Washington

Under Pressure, Trump Organization Abandons Risky Sales Tax Avoidance Strategy in New York. Will It Face Penalties for Taxes it Did Not Collect?

May 3, 2018 • By Carl Davis

While President Trump was busy publicly shaming Amazon for failing to collect some state and local sales taxes, his own business’s online store was not only failing to collect the same taxes, but was arguably more aggressive than Amazon in refusing to do so. As of last month, TrumpStore.com was not even collecting sales tax in New York State despite having a “flagship retail store” inside Trump Tower, in Manhattan. As ITEP pointed out at that time: “It seems likely that the presence of a New York location should be enough to put TrumpStore.com within reach of New York’s sales…

Washington Post: Democrats’ Tax Plan Looks an Awful Lot Like a Big Giveaway to the Wealthy

April 26, 2018

Some Democratic-led states are also moving forward with plans that would offset the tax benefits for the rich, with New Jersey Gov. Phil Murphy (D) acting swiftly to enact a millionaire’s tax, according to Meg Wiehe, deputy director of ITEP, who noted Murphy has acknowledged the workaround may help the rich. Cuomo has rebuffed similar […]

Newark Star-Ledger: The 15 Mostly Red States That Mooch off NJ the Most

April 15, 2018

Under the Republican tax bill, New Jersey and five other states, four of which now pay more to Washington than they receive in services, will contribute a greater share of federal income taxes than they do now, according to the Institute on Taxation and Economic Policy, a progressive research group. Read more

Washington Post: Kentucky’s Tax Cut for the Top 5 Percent Survives Despite Governor’s Veto

April 13, 2018

Republicans in Kentucky's state legislature overturned Gov. Matt Bevin's (R) vetoes of their tax overhaul and budget plan Friday, capping a dramatic confrontation between members of the same party that has also seen thousands of teachers descend on the state Capitol in protests for better pay.

Washington Post: Behind Oklahoma’s Teacher Strike: Years of Tax Cuts and an Energy Slump

April 12, 2018

Some states that have also recently pushed through big income tax cuts, including North Carolina and Ohio, did so while also broadening their tax base, according to Meg Wiehe of the Institute on Taxation and Economic Policy. But until this year, Oklahoma did very little to balance rate reductions with increases in the tax base. Oklahoma raised […]

Washington State Budget & Policy Center: Five Essential Truths About Our State Tax Code

April 12, 2018

Unfortunately, many myths permeate the public discourse about our state tax code. At the Washington State Budget & Policy Center, we are committed to making sure you know the truth about that tax code – and the real solutions that must be enacted in Olympia to make it work for everyone. Because it is a tax code that doesn’t live up to our values. It isn’t set up to invest in our communities in the short and long term. And it is set up to favor corporations, special interests, and the ultra-wealthy over everyday Washingtonians. As a result, the tax…

What to Expect if the Supreme Court Allows for Online Sales Tax Collection

April 11, 2018 • By Carl Davis

Online shopping is hardly a new phenomenon. And yet states and localities still lack the authority to require many Internet retailers to collect the sales taxes that their locally based, brick and mortar competitors have been collecting for decades.

Courier Journal: Kentucky Tax Reform Bill is a Break for the Rich but a Hike for Everybody Else, Study Says

April 6, 2018

The tax bill that zipped through the General Assembly on Monday will amount to a tax break for millionaires but a tax increase for 95 percent of Kentuckians, according to an analysis by the Washington-based Institute for Taxation and Economic Policy.

Washington Times: Andrew Cuomo complains about tax breaks for wealthy — then signs off on N.Y. loopholes

April 5, 2018 • By Matthew Gardner

Matthew Gardner, a senior fellow at the left-leaning Institute on Taxation and Economic Policy, said this appears to be another example of wealthy Americans “gaming” the tax system through special loopholes. “The whole point is to help New Yorkers to avoid a tax hike, and in particular to help wealthy New Yorkers avoid a tax […]

Washington Post: Kentucky Legislators Send Tax Cuts for Wealthy, Tax Hikes for the Other 95 Percent to Governor’s Desk

April 5, 2018

The Kentucky legislature passed a sweeping tax overhaul this week, and now lawmakers are asking Gov. Matt Bevin to sign a bill that would slash taxes for some corporations and wealthy individuals while raising them on 95 percent of state residents, according to a new analysis.

Washington Post: If Trump Wants to Go After Amazon, He Has Options

April 4, 2018

Despite Trump’s complaints, Amazon started paying sales taxes in 2017 in most states after setting up warehouses across the country to expedite its delivery times. But Amazon does not collect sales taxes on goods sold by third-party vendors, and several big cities in seven states still are not collecting sales taxes at the same level as from local […]

President Trump’s latest Twitter target, the Amazon Corporation, is now under the microscope for its state and local tax avoidance. In a Thursday tweet, the President claimed that “[u]nlike others, they pay little or no taxes to state & local governments.” Such a statement is a startling reversal for a president who previously said his own ability to avoid paying income taxes “makes me smart.”

State Rundown 3/30: Several Major Tax Debates Will March on into April

March 30, 2018 • By ITEP Staff

This week, after the recent teacher strike in West Virginia, teacher pay crises brought on by years of irresponsible tax cuts also made headlines in Arizona and Oklahoma. Maine and New York lawmakers continue to hash out how they will respond to the federal tax bill. And their counterparts in Missouri and Nebraska attempt to push forward their tax cutting agendas.

New York Times: Still Angry at The Washington Post’s Coverage, Trump Bashes Jeff Bezos’ Amazon

March 30, 2018

There was also some irony in the criticism coming from Trump, who has boasted about his dexterity in avoiding paying taxes. “This is the guy who said that not paying taxes ‘makes me smart,’” said Matt Gardner, senior fellow at the Institute on Taxation and Economic Policy, a nonpartisan research organization. Read more

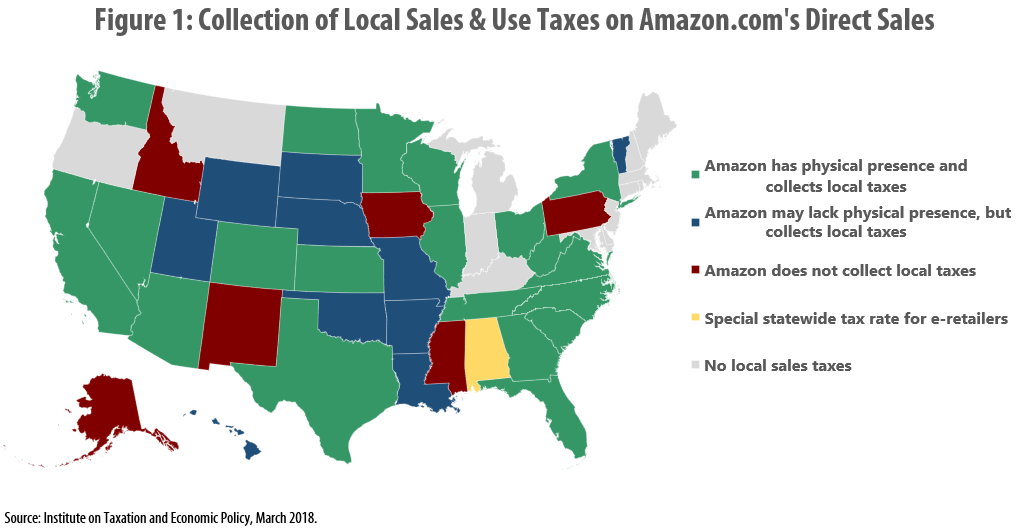

Many Localities Are Unprepared to Collect Taxes on Online Purchases: Amazon.com and other E-Retailers Receive Tax Advantage Over Local Businesses

March 26, 2018 • By Carl Davis

Online retailer Amazon.com made headlines last year when it began collecting every state-level sales tax on its direct sales. Savvy observers quickly noted that this change did not affect the company’s large and growing “marketplace” business, where it conducts sales in partnership with third-parties and rarely collects tax. But far fewer have noticed that even on its direct sales, Amazon is still not collecting some local-level taxes.

With many state legislative sessions about halfway through, the ripple effects of the federal tax-cut bill took a back seat this week as states focused their energies on their own tax and budget issues. Major proposals were released in Nebraska and New Jersey, one advanced in Missouri, and debates wrapped up in Florida, Utah, and Washington. Oklahoma and Vermont are considering ways to improve education funding, while California, New York, and Vermont look to require more of their most fortunate residents. And check in on "what we're reading" for resources on the online sales tax debate, the role of property…

CNN.com: Washington, Save Partisan Fighting for Actual Partisan Issues

March 10, 2018

DACA-eligible immigrants pay $2 billion each year in state and local taxes, according to a report from the Institute on Taxation and Economic Policy. One study indicates that 97% of DACA recipients are in school or employed. Read more

This week was very active for state tax debates. Georgia, Idaho, and Oregon passed bills reacting to the federal tax cut, as Maryland and other states made headway on their own responses. Florida lawmakers sent a harmful "supermajority" constitutional amendment to voters. New Jersey now has two progressive revenue raising proposals on the table (and a need for both). Louisiana ended one special session with talks of yet another. And online sales taxes continued to make news nationally and in Kansas, Nebraska, and Pennsylvania.

Trends We’re Watching in 2018, Part 1: State Responses to Federal Tax Cut Bill

March 5, 2018 • By Dylan Grundman O'Neill

Over the next few weeks we will be blogging about what we’re watching in state tax policy during 2018 legislative sessions. And there is no trend more pervasive in states this year than the need to sort through and react to the state-level impact of federal tax changes enacted late last year.

State Rundown 2/28: February a Long Month for State Tax Debates

February 28, 2018 • By ITEP Staff

February may be the shortest month but it has been a long one for state lawmakers. This week saw Arizona, Idaho, Oregon, and Utah seemingly approaching final decisions on how to respond to the federal tax-cut bill, while a bill that appeared cleared for take-off in Georgia hit some unexpected turbulence. Other states are still studying what the federal bill means for them, and many more continue to debate tax and budget proposals independently of the federal changes. And be sure to check our "What We're Reading" section for news on corporate tax credits from multiple states.

New York Times: When Calling an Uber Can Pay off for Cities and States

February 20, 2018

The new fees and taxes are often part of broader regulatory measures as states and localities scramble to update tax codes and laws that have not kept up with the proliferation of app-based ride services. For instance, a Georgia state tax applies to rides in taxis but not ride-hailing cars even though they essentially do […]

Concord Monitor: NH School Choice Bill Could Create a Tax Shelter for the Rich

February 18, 2018

Carl Davis, the research director at the Washington-based Institute on Taxation and Economic Policy, has written extensively about ETCs as tax shelters. Nationwide, about $1 billion in potential tax dollars is diverted each year into these scholarship organizations, according to a 2016 ITEP report by Davis. What kinds of tax credits states allow under ETC […]

The Augusta Chronicle: Georgia Governor Nathan Deal wants to slash state tax windfall

February 15, 2018

It is difficult to quantify how much the average taxpayer would be affected under current law. A middle income family in Georgia — making between $40,000 and $62,000 annually — could see its federal tax burden decrease by about $600 annually, according to an analysis from the left-leaning Institute on Taxation and Economic Policy in […]

State Rundown 2/8: State Responses to Federal Bill Gaining Steam

February 8, 2018 • By ITEP Staff

Several states this week are looking at ways to revamp their tax codes in response to the federal tax cut bill, with Georgia, Idaho, Maryland, Nebraska, and Vermont all actively considering proposals. Meanwhile, Connecticut, Louisiana, and Pennsylvania are working on resolving their budget shortfalls. And transportation funding is getting needed attention in Mississippi, Utah, and Wisconsin.

Dallas Morning News: Look out N.Y., L.A. and Chicago: The New Tax Law Makes Dallas even stronger

February 2, 2018

Most of the individual and family savings from tax reform are going to high earners. In Texas, three-quarters of the upside will be claimed by taxpayers earning over $106,000, according to the Institute on Taxation and Economic Policy, a “nonprofit, nonpartisan” research firm in Washington. To offset those gains — and the hit on the […]