Washington

State Rundown 10/18: Ballot Initiative Efforts Being Finalized

October 18, 2017 • By ITEP Staff

Ballot initiatives relating to taxes made news around the country this week, with Oregon voters to consider reversing new health care taxes, Washingtonians to vote on improving education funding, and Nebraskans to potentially vote on a state tax credit for school property taxes. Meanwhile, multiple states are finalizing their proposals to lure Amazon to build a new headquarters in their state, often through the use of massive tax subsidies. And in our "What We're Reading" section we have sobering news from Moody's Investors Service on states' struggles to fund their infrastructure and save for the next recession.

Washington Examiner: Indiana’s Tax Cuts Haven’t Led to Higher Paychecks

October 17, 2017

Carl Davis for the Institute on Taxation and Economic Policy: In announcing a tax cut framework in Indianapolis that was negotiated with House and Senate leaders, President Trump said, “Indiana is a tremendous example of the prosperity that is unleashed when we cut taxes and set free the dreams of our citizens … In Indiana, […]

This study explores how in 2016 Fortune 500 companies used tax haven subsidiaries to avoid paying taxes on much of their income. It reveals that tax haven use is now standard practice among the Fortune 500 and that a handful of the country’s biggest corporations benefit the most from offshore tax avoidance schemes.

Washington Post: How Much Will Trump Tax Plan Cost You and Your Wealthiest Neighbors

October 5, 2017 • By ITEP Staff

https://www.washingtonpost.com/news/politics/wp/2017/10/05/how-the-trump-tax-plan-could-affect-someone-in-your-state-with-your-income/?utm_term=.819c02760361

State Rundown 10/4: Wildfires in Montana and Tax Cuts in Kansas Wreak Budget Havoc

October 4, 2017 • By ITEP Staff

This week, Kansas's school funding was again ruled unconstitutionally low and unfair, while Montana lawmakers indicated they'd rather let historic wildfires burn a hole through their budget than raise revenues to meet their funding needs. Meanwhile, a struggling agricultural sector continues to cause problems for Iowa and Nebraska, but legalized recreational marijuana is bringing good economic news to both California and Nevada.

The Washington Monthly: The Republican Tax Cut Framework Is Already in Trouble

October 4, 2017

The tax cut framework suggests that Republicans will eventually define some corporate tax loopholes to close. They haven’t done so yet because that will unleash a host of corporate lobbyists to fight against them, which is all the proof we should need that the statutory tax rate, as it exists today, is meaningless. The real […]

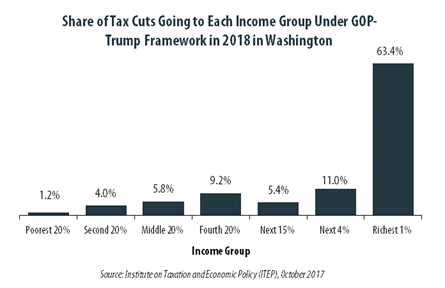

GOP-Trump Tax Framework Would Provide Richest One Percent in Washington with 63.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Washington equally. The richest one percent of Washington residents would receive 63.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $624,100 next year. The framework would provide them an average tax cut of $103,120 in 2018, which would increase their income by an average of 5.2 percent.

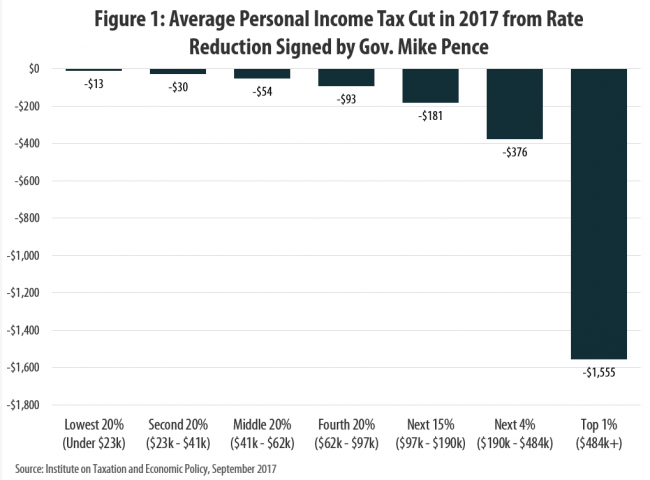

Indiana’s Tax Cuts Under Mike Pence Are Not a Model for the Nation

September 29, 2017 • By Carl Davis

In announcing a new tax cut framework this week in Indianapolis that was negotiated with House and Senate leaders, President Trump claimed that “Indiana is a tremendous example of the prosperity that is unleashed when we cut taxes and set free the dreams of our citizens …. In Indiana, you have seen firsthand that cutting taxes on businesses makes your state more competitive and leads to more jobs and higher paychecks for your workers.”

State Rundown 9/13: The Year of Unprecedented State Budget Impasses Continues

September 13, 2017 • By ITEP Staff

This week, Pennsylvania lawmakers risk defaulting on payments due to their extremely overdue budget and Illinois legislators will borrow billions to start paying their backlog of unpaid bills. Governing delves into why there were more such budget impasses this year than in any year in recent memory. And Oklahoma got closure from its Supreme Court on whether closing special tax exemptions counts as "raising taxes" (it doesn't).

Fox Business: Trump gives assurances on tax reform,

September 13, 2017

According to an April 2017 report by the Institute on Taxation and Economic Policy, a Washington research organization, the top 1% of income earners in the United States pays an estimated 23.8% share of total taxes. Read more

State Rundown 9/6: Most Statehouses Quiet, Many Pondering Harvey’s Impacts

September 7, 2017 • By ITEP Staff

It's been a quiet week for tax policy in most states, though lawmakers are still making noise in Pennsylvania, where a budget agreement is still needed, and in Wisconsin, where legislators are searching for the will to raise revenue for the state's ailing transportation infrastructure. In our "What We're Reading" section you'll find interesting reading on the fiscal fallout of Hurricane Harvey, as well as an in-depth series on how states' disaster response needs are likely to continue to increase.

The New York Times: Trump Tax Plan May Free Up Corporate Dollars, but Then What?

August 30, 2017

But skeptics worry that making the system airtight is impossible. “It’s an endless cat-and-mouse game,” said Matthew Gardner, senior fellow at the Institute on Taxation and Economic Policy, a research group based in Washington. “What’s driving companies to engage in paper transactions is not our 35 percent tax rate,” he said, but other countries’ willingness […]

The Washington Post: Trump Says a Corporate Tax Cut Would Create More Jobs. Economists Aren’t So Sure.

August 30, 2017

IPS used data from company filings — analyzed by the Institute on Taxation and Economic Policy, a left-leaning research organization — to make a list of publicly held firms that made a profit every year from 2008 to 2015 and that also paid less than 20 percent of their earnings in federal corporate income tax. Ninety-two companies fit that description, including […]

Washington Post: Ahead of regional summit, left-leaning policy groups say ‘No’ to a sales tax for Metro

August 28, 2017

A regionwide one-cent sales tax to fund Metro would have a disproportionate impact on poor families, taking five times the share of income from the bottom 20 percent of earners when compared with those in the top 1 percent, according to a new analysis from a trio of left-leaning think tanks representing the District, Maryland and Virginia.

The American Prospect: Paul Ryan Is Lying About High Corporate Tax Rates

August 24, 2017

Republicans are taking their corporate tax-cut campaign on the road. House Speaker Paul Ryan visited airplane manufacturer Boeing on Thursday in Washington state, where he lamented how the company is quivering underneath the weight of a 35 percent tax rate. Meanwhile, Ways & Means Chair Kevin Brady sang the same song at telecom giant AT&T’s […]

State Rundown 8/23: Few Lingering Budget Debates Cannot Linger Much Longer

August 23, 2017 • By ITEP Staff

This week, Oklahoma lawmakers learned they'll need to enter a special session to balance their budget and that they'll likely face a lawsuit over their low funding of public education. Pennsylvania's budget stalemate is also coming to a head as the state literally runs out of funds to pay its bills. And Amazon's tax practices are in the news again as the company has been sued in South Carolina.

GOP Leaders Tout Corporate Tax Cuts at Boeing and AT&T, Companies that Already Have Single-Digit Tax Rates

August 23, 2017 • By Matthew Gardner

House Speaker Paul Ryan plans to visit a Boeing factory in Washington State tomorrow to promote the GOP’s ideas for tax reform, which include a deep cut in the corporate tax rate, while House Ways and Means Chairman Kevin Brady is bringing the same message today to employees of AT&T in Dallas. What is unclear is how much lower taxes for these companies can possibly go.

The Epoch Times: Trump Targets Amazon Over Sales Tax and Retail Jobs

August 23, 2017

More than half of items sold on Amazon are coming through third-party retailers, according to a CNBC report. These retailers can benefit from Amazon’s facilities or payment system, but they are not required to collect sales tax. It is still a pending issue and a meaningful revenue loss for states, said Carl Davis, research director […]

Associated Press: Tense Days for Business Owners without Legal Status in US

August 17, 2017

Those selling often see no choice but to take a loss. Under Trump, detentions of immigrants in the country illegally rose 37 percent over the first six months of the year compared with the same period in 2016. The administration says it is focused on those with criminal records, but the number of detainees who […]

In Washington 43.7 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Washington population (0.5 percent) earns more than $1 million annually. But this elite group would receive 43.7 percent of the tax cuts that go to Washington residents under the tax proposals from the Trump administration. A much larger group, 38.5 percent of the state, earns less than $45,000, but would receive just 4.0 percent of the tax cuts.

Washington Examiner: Mitch McConnell Faces Dug-in Democrats on Tax Reform

August 13, 2017

“There’s been more and more awareness that actually C-corporations are not paying 35 percent in taxes,” said Steven Wamhoff, a tax expert at the Institute on Taxation and Economic Policy, a left-of-center think tank. His group has highlighted that corporations as a group pay much lower than 35 percent of their profits in taxes, thanks […]

New York Times: Questions Emerge Over What Wisconsin Must Give for Foxconn Plant

August 11, 2017

Mr. Walker, who has made promises of job creation a centerpiece of his two terms in office, has pushed lawmakers to move quickly in approving the bill, which would offer Foxconn, a producer of flat-panel display screens for televisions and other consumer electronics, close to $3 billion in state tax credits. The subsidies for the […]

AP: School Voucher Programs Raise Questions about Transparency and Accountability

August 11, 2017

The AAA Scholarship Foundation Inc. which runs programs in Nevada and five other states, says it doesn’t give tax advice but has, when asked, shared an IRS memo on the matter. The Institute on Taxation and Economic Policy say loopholes in the tax code would allow contributors to both eliminate their state tax bill and […]

A month ago, the Seattle City Council passed an income tax measure, which has garnered a lot of attention as well as volumes of supportive and opposition commentary. Haven’t had a chance to dive into the details yet? We’ve got you covered. What is the new income tax law and who does it impact? The […]

How to Think About the Problem of Corporate Offshore Cash: Lessons from Microsoft

August 4, 2017 • By Matthew Gardner

For a corporation with deeply American roots, Microsoft seems remarkably unable to turn a profit here. Against all odds, the Redmond, Washington-based company continues to claim that virtually all its earnings are in foreign countries. Microsoft’s latest annual report, released earlier this week, shows that over the past two years, the company enjoyed worldwide income of almost $43 billion. It claims to have earned just 0.3 percent of that—$128 million—in the United States.