In last night’s address to Congress, President Trump spent more time insulting Americans, lying, and bragging than he did talking about taxes. But regardless of what President Trump and Elon Musk talk about most loudly and angrily, there is one clear policy that they and the corporations and billionaires that support them will try hardest to impose on the American people: enormous tax cuts that supercharge inequality, enrich those who least need it, and make it harder to fund the health care, education and infrastructure that keep our communities functioning.

We at the Institute on Taxation and Economic Policy have the resources to help you follow what they are trying to do and what it means for you. Here’s the lowdown.

Slashing corporate taxes

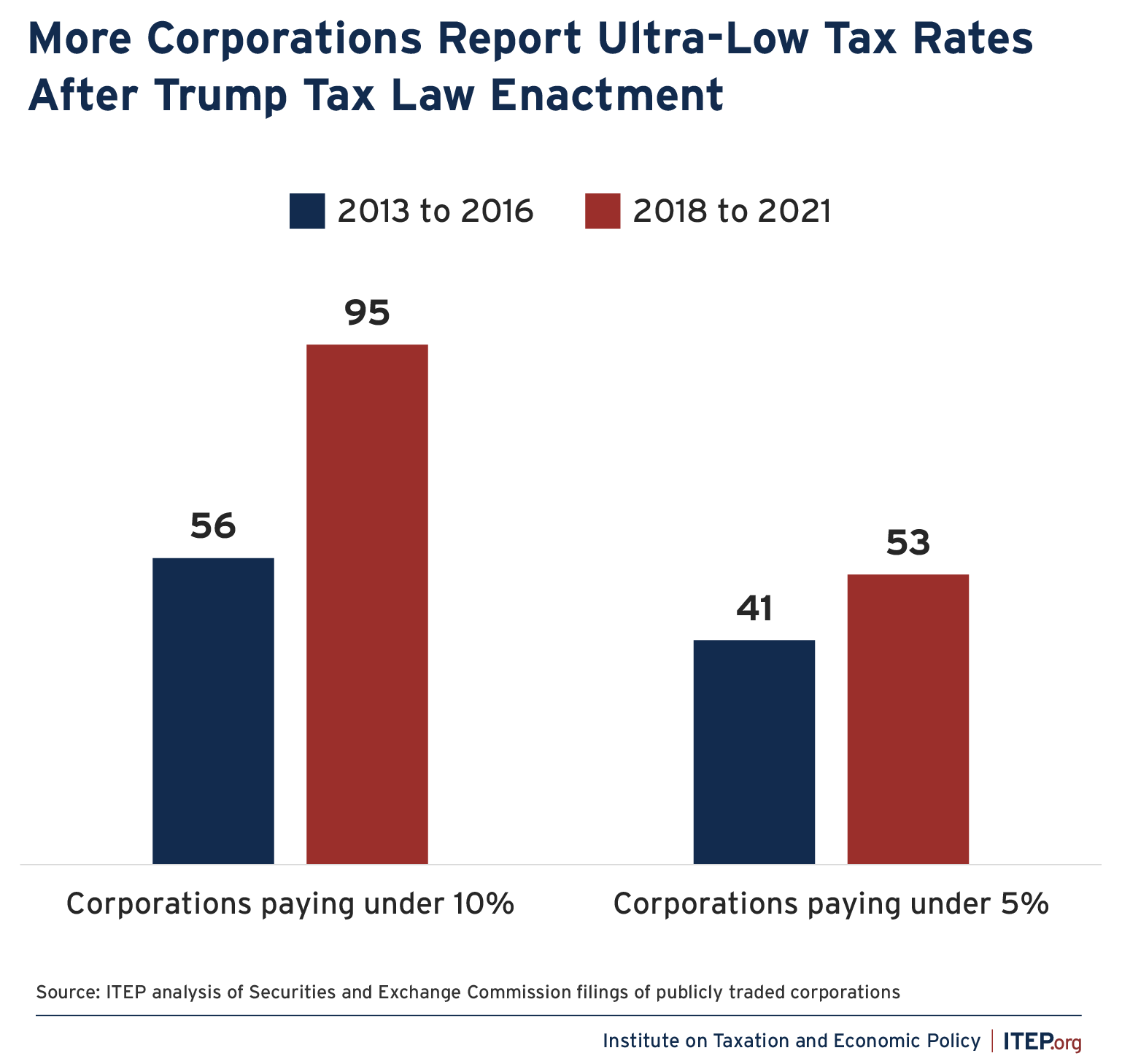

In President Trump’s first term, the only major thing he successfully got through Congress was a tax cut that was heavily skewed to corporations and the wealthiest. America’s largest, most profitable corporations slashed their effective tax rate (what they paid as a share of profits) from 22 percent on average to 12.8 percent on average after this law passed.

It’s because of big problems in our tax laws that corporations like Tesla, the most valuable automaker in the world valued at over $1 trillion, got away with paying zero taxes last year.

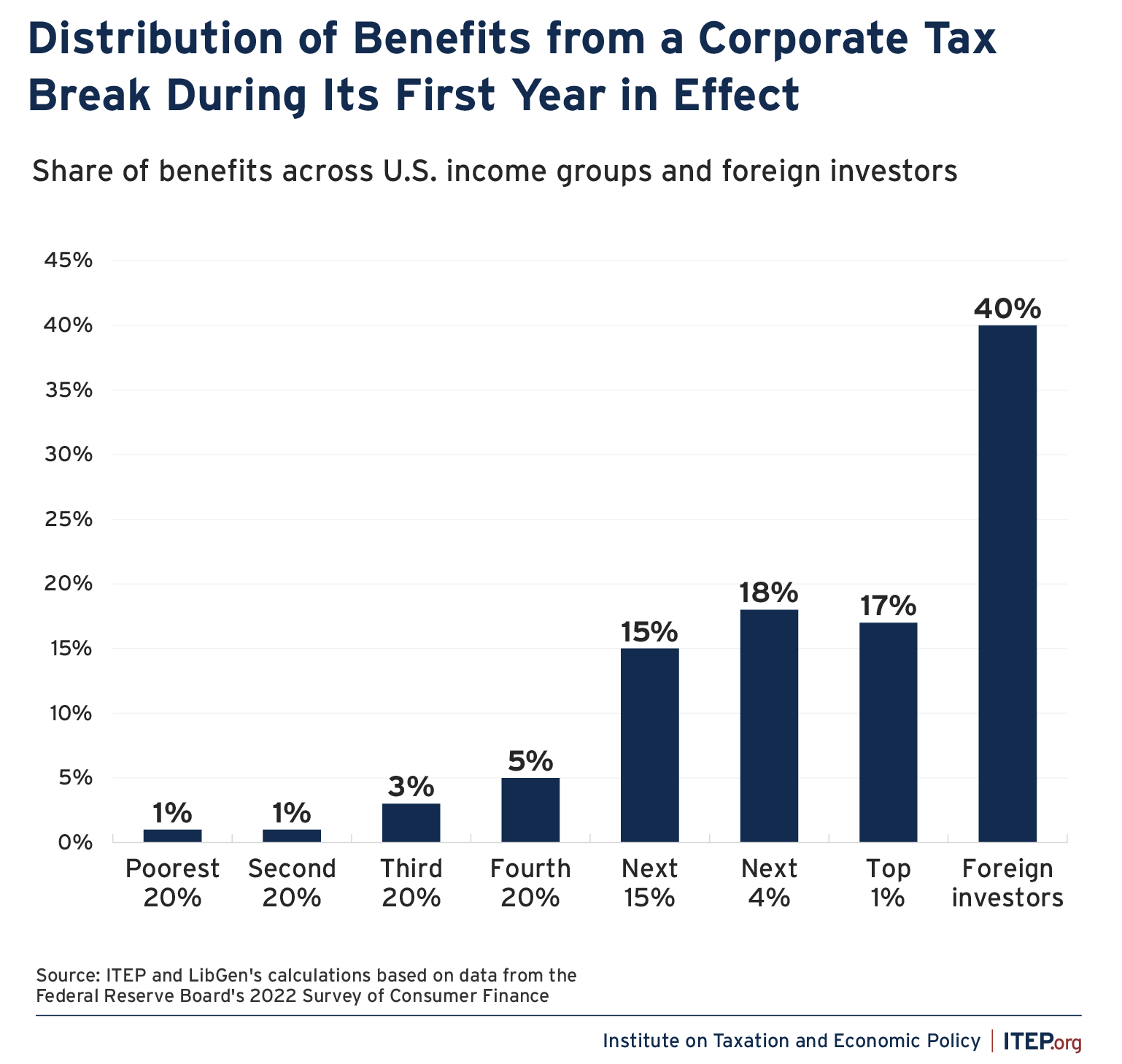

All of this increased the deficit, reduced resources for public needs, and deepened economic and racial wealth divides. Plus, 40 cents of every dollar in corporate tax cuts goes straight out of the country to foreign investors.

Cutting taxes for the wealthy

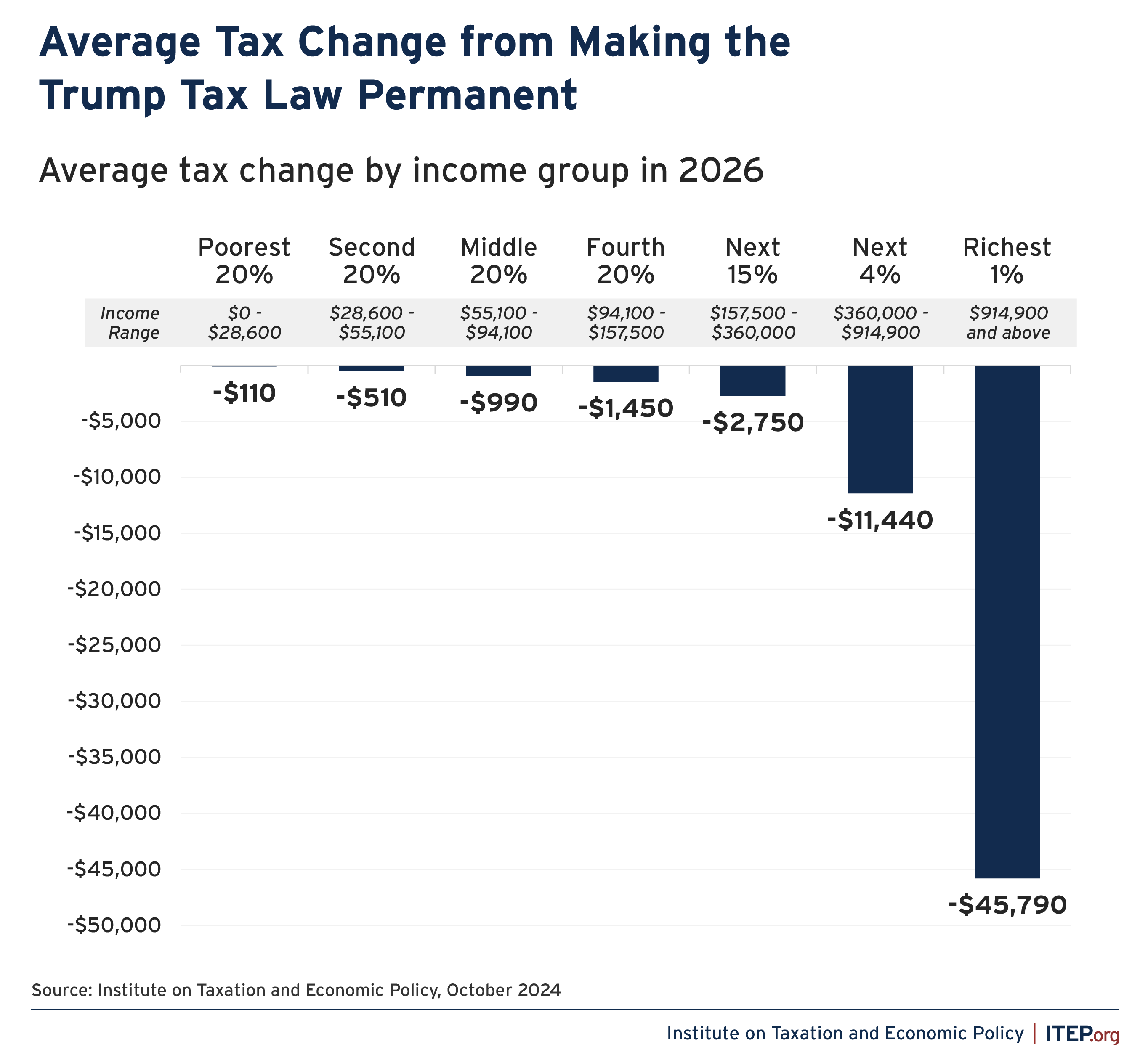

That 2017 tax law also cut individual income taxes in ways that gave much more to the wealthiest, blew up the national debt, and further slashed what was available for public needs. Not only that: to hide the true cost of these unpopular tax cuts, the first Trump administration made the individual tax cuts temporary. They now want to make them permanent. Doing so would give the richest one percent, with income exceeding $914,000 a year, an average tax cut of $45,790 next year.

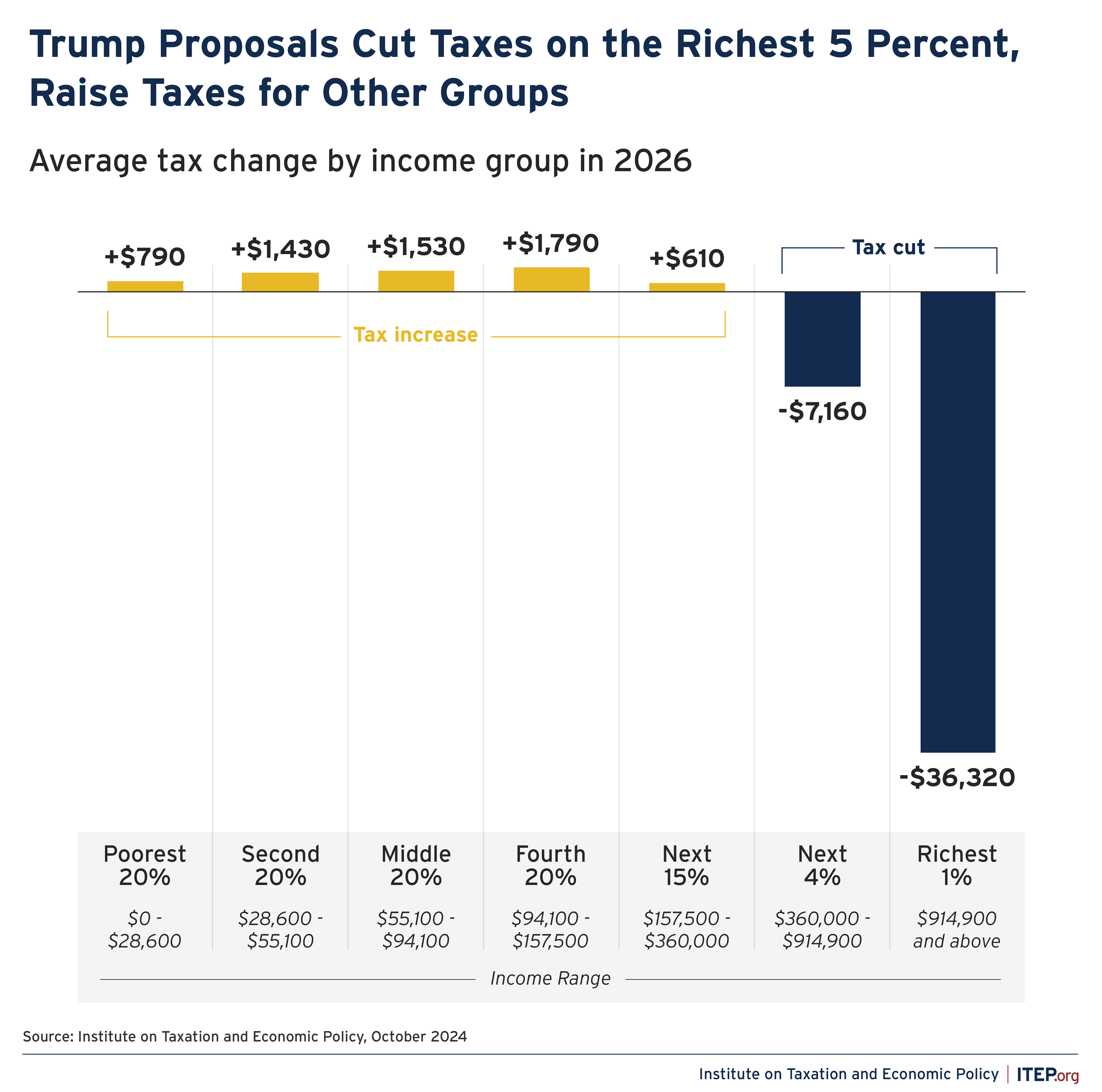

Tariffs that disproportionately hurt regular families

Trump also promised on the campaign trail to impose across-the-board tariffs on all imported goods, with a higher 60 percent tariff on goods imported from China. It’s now unclear exactly how the tariffs will be implemented (and impossible to model a constantly-shifting strategy that seems designed to exact retribution on any international leader who Trump perceives as having insulted him). But the original proposal, including both his proposed tax cuts and tariffs, would have increased costs by over $1,500 a year for middle-income Americans – households earning between $55,000 and $94,000 a year while cutting taxes by over $36,000 for the richest one percent, with income over $914,000.

Extra giveaways and gimmicks

Trump and Musk also want to provide extra giveaways to wealthy people and corporations – we can’t say what would make it into this grab-bag, but last night Trump mentioned allowing immediate deductions for capital investments, which would worsen timing games in the tax code that already costs the public billions. Another possibility is immediate deductions for research and development: Buddies who attended Trump’s inauguration, like Tesla’s Elon Musk, Meta’s Mark Zuckerberg, Amazon’s Jeff Bezos, Apple’s Tim Cook, and Alphabet’s Sundar Pichai could collectively win over $75 billion in tax breaks immediately with this move. This is just one of the special provisions in the offing for those who sufficiently endear themselves to Trump and Musk.

Trump also mentioned a few gimmicky proposals: eliminating taxes on tips, overtime and Social Security. All are far more problematic than they sound. The tip proposal would encourage reclassification of other types of income as tips, introduce big inequities between income from – say – waiting tables and income from nursing or teaching, and shift costs from employers to consumers. The Social Security proposal would reduce the solvency of the program while not being well targeted. And the overtime proposal is a fake-out, designed to distract from the fact that the Project 2025 playbook calls for stripping overtime protection entirely from 8 million workers.

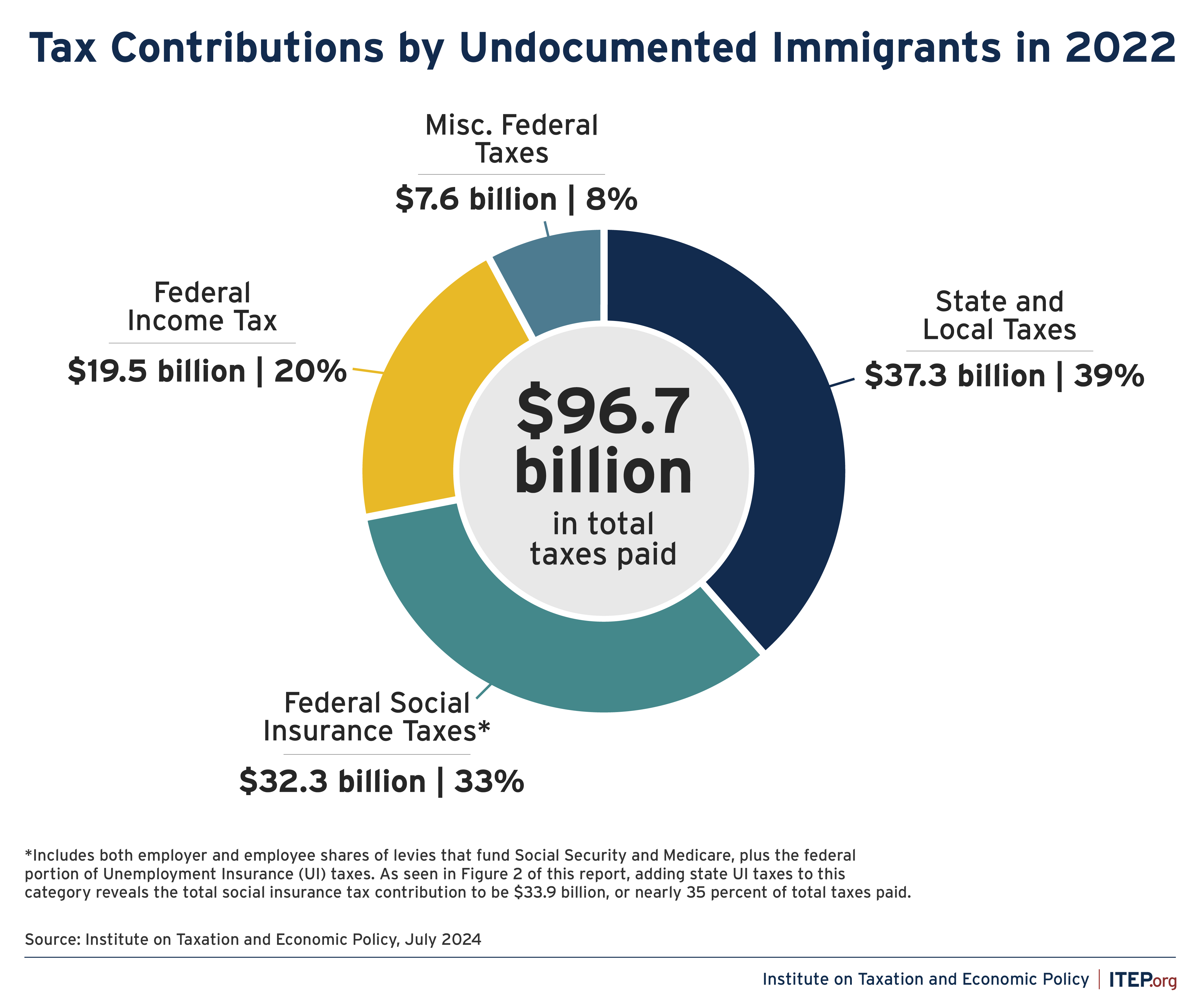

Eroding immigrants’ tax payments

Undocumented immigrants paid nearly $100 billion in taxes in 2022. One crucial part of that was federal payroll taxes, which support Social Security and Medicare, which some undocumented immigrants pay even though they are never able to benefit from those programs. The other part is state and local taxes, especially sales and property taxes. Trump has talked about deporting undocumented immigrants, removing Deferred Action for Childhood Arrivals (DACA) status for adults who came to the U.S. as children, and forcing IRS agents to report undocumented immigrants who pay taxes. We should oppose these moves because they’ll hurt our economy, remove needed workers, and because people will inevitably die as these cruel policies are carried out. But from a tax perspective, which is our unique lens, these actions will suppress tax payments, make Social Security less solvent, and take revenue from state budgets.

Trump likes to keep people focused on culture wars, on dividing people by race, ethnicity, or immigration status. But the truth is he is waging economic war on the vast majority of Americans, pushing to further slash taxes on the wealthiest and corporations, while sapping the public services that keep our communities strong. He wants to distract you into spending your energy hating your neighbor while he gives corporate shareholders and international corporations money that should go to your health care, young people’s education, and all our communities. Don’t fall for it.