ITEP's Research Priorities

Forbes: Would A Second Stimulus Check Or Payroll Tax Cut Be More Effective?

July 22, 2020

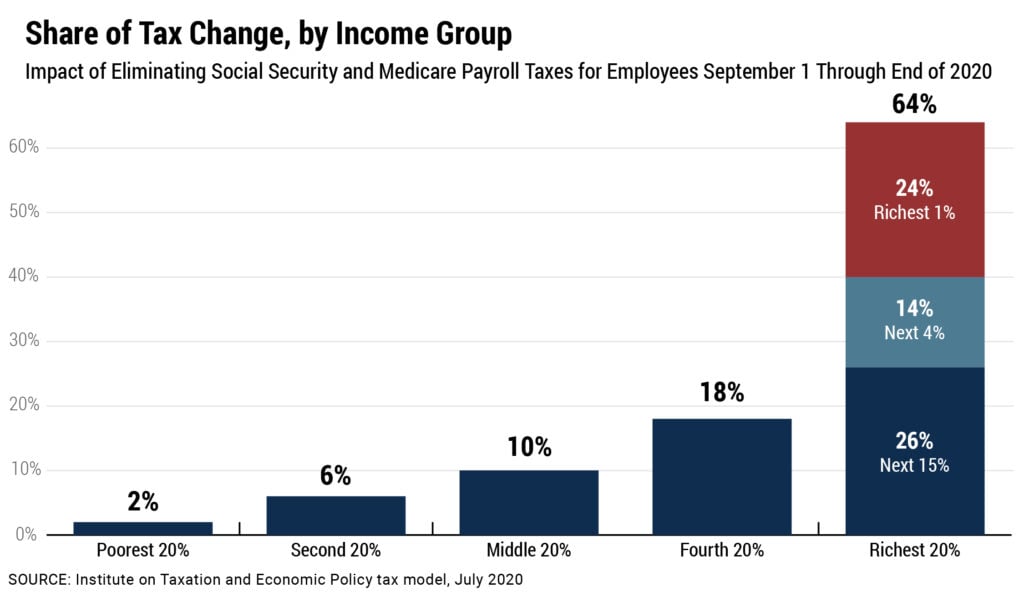

The left-leaning Institute on Taxation and Economic Policy (ITEP), calculated that eliminating the 7.65 levy on employees between April 1 and December 31, 2020 would distribute 47 percent of the benefits to the richest 20 percent of taxpayers. Conversely, “another round of stimulus payments would give proportionally larger benefits to low-income households, because a flat $1,200 represents […]

Newark Star-Ledger: Murphy plea for federal aid blocked by McConnell as some in GOP don’t want to help blue states

July 22, 2020

Trump has championed a payroll tax cut, which would not help those currently without jobs under the pandemic-induced recession nor assist states in balancing their budgets. Almost two-thirds of the benefits of a payroll tax cut, 64%, would go to the richest 20% of Americans, according to the Institute on Taxation and Economic Policy, a […]

Biden Proposes to Fund Child Care and Elder Care by Shutting Down Tax Breaks for Real Estate Investors

July 21, 2020 • By Steve Wamhoff

On Tuesday, Democratic presidential candidate Joe Biden announced a $775 billion proposal to expand care options for children and elderly people, suggesting that the cost would be at least partly offset by paring back tax breaks for real estate investors. Bigtime real estate investors are simply unaccustomed to operating without government subsidies provided through the tax code.

While the White House hasn’t clarified what it is proposing, we know that a payroll tax cut would not be well-targeted. In a new report, ITEP estimates the effects of suspending Social Security and Medicare payroll taxes for employees and employers from September 1 through the end of the year. We find that 64 percent of the benefits would go to the richest 20 percent of Americans while 24 percent of the benefits would go to the richest 1 percent.

New Analysis: Payroll Tax Cut Would Cost $336 Billion, Benefit Top 1 Percent Most

July 21, 2020 • By Steve Wamhoff

Media contact Temporarily eliminating all federal payroll taxes through the end of the year would cost $336 billion, deliver 64 percent of its benefits to the richest 20 percent of households and fail to provide help to unemployed workers who are struggling most due to the economic downturn, the Institute on Taxation and Economic Policy […]

An Updated Analysis of a Potential Payroll Tax Holiday

July 21, 2020 • By Jessica Schieder, Matthew Gardner, Steve Wamhoff

ITEP estimates that if Congress and the president eliminated all Social Security and Medicare payroll taxes paid by employers and employees from Sept. 1 through the end of the year, 64 percent of the benefits would go the richest 20 percent of taxpayers and 24 percent of the benefits would go to the richest 1 percent of taxpayers, as illustrated in the table below. The total cost of this hypothetical proposal would be $336 billion.

Business Insider: Trump is doubling down on a payroll tax cut which has slim GOP support and would do virtually nothing to help jobless Americans

July 20, 2020

A disproportionate share of the aid would go toward the wealthier segment of Americans. The Institute on Taxation and Economic Policy found that 65% of the benefits would be drawn by the richest 20% of taxpayers. Read more

Forbes: Is Trump Using Next Stimulus Package To Undermine Funding Of Social Security And Medicare?

July 20, 2020

In 2011, when President Obama and a Republican Congress compromised on a temporary 2 percent payroll tax holiday, the left-leaning Institute on Taxation and Economic Policy (ITEP), calculated that 48 percent of the benefits went to the richest 20 percent of taxpayers, which is problematic if you are trying to help low- and middle-income households. […]

Bloomberg: Virus Surge Hits Budgets of States Most Vulnerable to Shutdowns

July 17, 2020

As the two states have each surpassed nearly 600,000 confirmed cases combined, with daily new cases in the tens of thousands, governors in Florida and Texas are considering scaling back their economies amid enormous pressure. Their initial hesitancy to shut down may have fueled the recent surges according to some reports. Yet, experts say that […]

SALT Cap Repeal Has No Place in COVID-19 Legislation: National and State-by-State Data

July 17, 2020 • By Steve Wamhoff

The Trump-GOP tax law enacted at the end of 2017 includes a $10,000 cap on the amount of state and local taxes (SALT) that people can deduct on their federal tax returns, and this is one of the few limits the law places on tax breaks for high-income people. Unfortunately, it is also the provision that some Democrats are most determined to remove.

Trade Deals Aren’t Enough: Fixing the Tax Code to Bring American Jobs Back

July 16, 2020 • By Amy Hanauer

We all need the public sector to protect public health, keep us safe, educate our children, and much more. Companies, particularly multinational corporations, could not function without the legal, infrastructure, financial, regulatory, health, and transportation resources that the government provides.

KPFA: Death and taxes! or, why the rich get richer

July 16, 2020

Why and how the wealth of the very rich has grown, while all other public and private wealth has shrunk during COVID 19. Detailed analysis from the Institute on Taxation and Economic Policy. With host Kris Welch.

With tax day finally coming at the federal level and in many states this week, policymakers in Nevada and New Jersey began to talk about revenue solutions to their revenue shortfalls, even if they fell well short of wholeheartedly backing needed reforms. Like their counterparts in most states, they remain primarily focused on temporary solutions to their short-term emergencies. Still, advocates in these and other states continue to push for more fundamental fixes to their inadequate and upside-down tax codes, including a new campaign for better tax policy in Massachusetts and efforts to rein in tax subsidies and loopholes in…

New Prosperity Now Report Identifies Upside-Down Tax Incentives

July 15, 2020 • By Jessica Schieder

Ahead of this year’s delayed Tax Day, our partners at Prosperity Now released a powerful report providing a comprehensive overview of many of the ways our federal tax system privileges wealth over work, while also lifting up several provisions which could serve as a template for improving progressivity within the tax code. The report makes […]

Salon: “Stunningly Tone-Deaf”: Ivanka Trump Criticized for Urging Jobless Americans to “Find Something New”

July 14, 2020

Roughly two-thirds of the temporary payroll tax cut would flow to the richest 20% of Americans, while the poorest 40% would get only 6% of the benefit, according to the Institute for Taxation and Economic Policy. Such tax breaks are “insufficiently targeted and largely meaningless to those who’ve lost their jobs and are no longer […]

The Epoch Times: Biden’s Progressive Tax Proposal Raises Rates on Wealthy and Corporations

July 14, 2020

“It’s probably one of the most progressive tax plans we’ve seen from a presidential nominee from one of the two major parties in many, many years,” Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy told the Epoch Times. Unlike Sens. Bernie Sanders and Elizabeth Warren, Biden has not advocated for […]

Law 360: State And Local Tax Policy To Watch In The 2nd Half Of 2020

July 14, 2020

As states grapple with refilling their coffers in response to the COVID-19 pandemic, tax policy debates in the second half of 2020 could center on revisiting conformity to the federal code and a consideration of broad-based tax proposals. Additionally, some states are contemplating wading into untested legal waters by taxing digital advertising, while practitioners are […]

Urban Milwaukee: Labor Leaders Slam Trump for Betraying Working People

July 14, 2020

By Democratic Party of Wisconsin The tax law Trump pushed through was a boon for large corporations, including those in Wisconsin like Kimberly Clark, that used the handout to shutter their facilities, issue stock buybacks, and lay off workers instead of creating jobs and increasing wages. Read more

The Moneyist: ‘I’m Having a Hard Time Understanding How Earning Over $200K/year Is Too Much to Qualify for a Decent Stimulus Check’

July 14, 2020

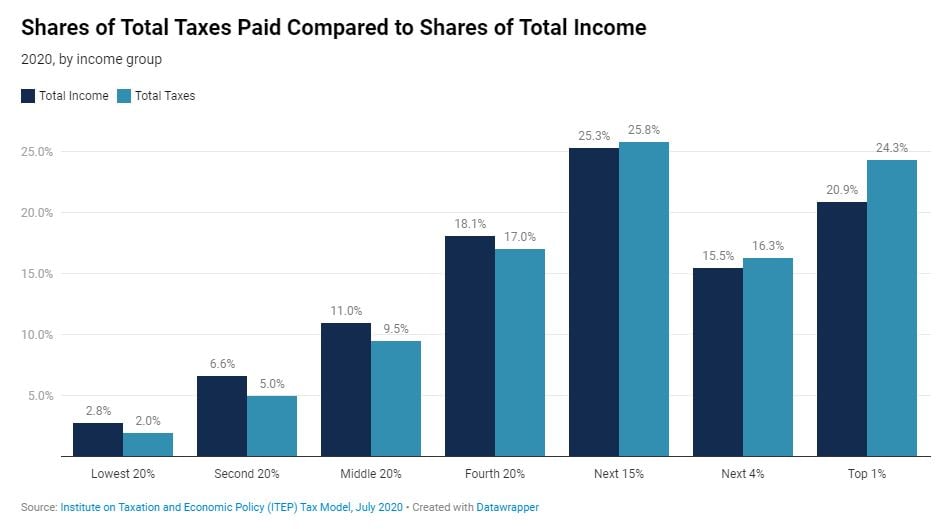

According to the Institute on Taxation and Economic Policy, the majority of state tax systems are regressive. “Those in the highest-income quintile pay a smaller share of all state and local taxes than their share of all income while the bottom 80% pay more. In other words, not only do the rich, on average, pay […]

Who Pays Taxes in America in 2020?

July 14, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Having a sound understanding of who pays taxes and how much is a particularly relevant question now as the nation grapples with a health and economic crisis that is devastating lower-income families and requiring all levels of government to invest more in keeping individuals, families and communities afloat. This year, the share of all taxes paid by the richest 1 percent of Americans (24.3 percent) will be just a bit higher than the share of all income going to this group (20.9 percent). The share of all taxes paid by the poorest fifth of Americans (2 percent) will be just…

ITEP: Tax Cuts for the Rich Will Exacerbate Inequality, Fail to Address Current Economic Crisis

July 13, 2020 • By Amy Hanauer

Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding White House Advisor Larry Kudlow’s statement on priorities for the next economic relief package.

Adequately Funding the IRS Would Be One Small Step Toward Racial Equity in the Tax Code

July 10, 2020 • By Jenice Robinson

IRS Commissioner Charles Rettig vowed to work with Congress to explore how the federal tax system contributes to the racial wealth gap. There are at least two ways this can happen: tax policies enacted by Congress and IRS enforcement of these policies.

Wall Street Journal Opinion: Payroll-Tax Cuts Mostly Go to the Well Off

July 9, 2020

Contrary to the authors’ claim, a payroll tax cut wouldn’t “disproportionately benefit” lower-income workers. According to the Institute on Taxation and Economic Policy, nearly half of the benefit from a payroll-tax cut would go to the richest 20% of taxpayers, and would be a boon to big corporations that are under no obligation to rehire […]

Jacobin: The 1 Percent Are Cheating Us Out of a Quarter-Trillion Dollars in Taxes Every Year

July 9, 2020

On the international front, Trump’s 2017 tax cut bill included several provisions that “encourage American-based corporations to shift profits offshore,” according to the Institute for Taxation and Economic Policy. The administration has also recently moved to roll back rules designed to crack down on so-called corporate inversions, whereby companies incorporate offshore in order to avoid […]

Yahoo Finance: This GOP Proposal May Slash Taxes for Big Tech: ITEP

July 9, 2020

Matthew Gardner, Senior Fellow at the Institute on Taxation and Economic Policy, joins Yahoo Finance’s Zack Guzman to discuss how a possible Republican tax credit proposal could provide new breaks to tax avoiders like Netflix and ITEP. Watch here (video)