This is the first in a retrospective series of blogs we will be posting over the coming weeks reviewing major trends in state tax policy in 2018. First, Dylan Grundman examines state responses to the federal tax bill. Stay tuned for more!

An Update on State Responses to the Federal Tax Bill

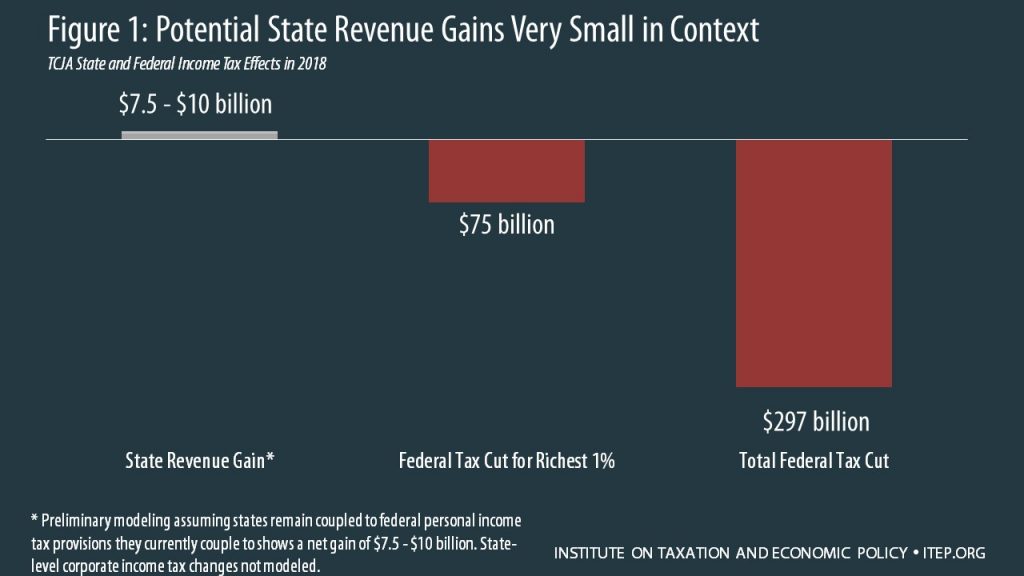

Earlier this year, ITEP produced two reports mapping out how the federal Tax Cuts and Jobs Act (TCJA) affects states and charting a responsible course of action for state policymakers to maintain adequate revenue, promote tax fairness, and ensure stability and sustainability in their tax codes. We offered four main points of advice for states to navigate this new terrain: 1) protect and enhance revenues to fund vital services, and reject any efforts to worsen budget outlooks through tax cuts; 2) mitigate – not exacerbate – the regressive nature of federal tax changes that overwhelmingly benefit the highest-income Americans; 3) remember that trickle-down economics and Kansas-style tax competition do not work; and 4) focus permanent responses on the long-term good, not short-sighted tax-cut temptations or political maneuvering.

With many state fiscal years beginning July 1, most states that will make decisions this year about federal tax conformity have now done so, making this a great time to take stock of how well state policymakers have kept to, or veered from, this path. Most states that have enacted laws in response to the federal changes have adhered to some, but not all, of the principles we laid out, with a few responding rather prudently and a handful charting a much more treacherous course of unfair, unsustainable policy based on unfounded promises of economic growth. The review below is not exhaustive but orients readers regarding which states are heading in the right (and wrong) direction.

Surefooted Trail Blazers

- Perhaps the most responsible approach taken so far was in Maryland where lawmakers were looking at a moderate revenue bump if they simply went along with the federal changes. They chose to invest much of that revenue in their K-12 education system, save another large chunk in their Rainy Day Fund and devote the remainder to tax cuts that will largely benefit low- and moderate-income families – such as an expansion of the state Earned Income Tax Credit (EITC) for workers without children in the home, an increase in the standard deduction and expanded tax benefits for retired veterans and public safety employees.

Baby Steps in The Right Direction

- Nebraska legislators had less at stake with fewer linkages to the federal tax code but reacted responsibly by preserving the personal exemption credit, slightly increasing the standard deduction and decoupling from the federal inflation change that would have decreased the value of such tax benefits over time.

- Similarly, Indiana lawmakers preserved the personal exemption for residents while allowing some of the base expansion changes in the TCJA to generate about $150 million for state needs, though they missed an opportunity to fully couple to the federal EITC while adopting the lower inflation measure that will shrink EITC benefits over time.

- Kentucky, too, has relatively limited conformity to the federal code, but smartly de-coupled from the new federal deduction for pass-through income that would have cost the state significant revenue and only benefitted a handful of upper-income Kentuckians who are already benefitting tremendously from the federal bill. (It should be noted, however, that Kentucky passed a misguided, upside down tax bill this year that is not applause-worthy.)

- Due to the large federal tax cut, Louisiana’s deduction for excess itemized deductions and unlimited deduction for federal income taxes resulted in a significant revenue bump for the state, which lawmakers happily assumed to help reduce a budget shortfall from more than $1 billion to around $500 million.

A Few Steps Forward, A Few Steps Back

Several states’ responses were mixed bags, adhering to some of the policy principles outlined above while eschewing others.

- Colorado opted to go along with the federal changes affecting residents which means some needed revenue for state priorities, but this is not an improvement in tax fairness as much of that revenue will come from middle-income families, and many of the wealthiest residents will see unnecessary state tax cuts on top of their federal tax cuts.

- Oregon, like Kentucky, wisely avoided adopting the new federal deduction for high-income recipients of pass-through income, but instead passed a smaller separate tax cut for pass-through income.

- After a contentious debate in which Vermont Gov. Phil Scott vetoed two earlier proposals, Scott ultimately allowed a bill to become law that broadly decouples the state’s tax code from the federal system and creates a Vermont-specific set of tax parameters including independent standard deduction and personal exemption amounts. The bill eliminates itemized deductions, creating a charitable credit, and increases the state EITC, but also cuts income tax rates across the board and forgoes revenue that could have been put toward public services.

Passive Stances

A few states adopted a more passive stance, choosing to either allow TCJA provisions to automatically take effect or punting the debate to a future legislative session.

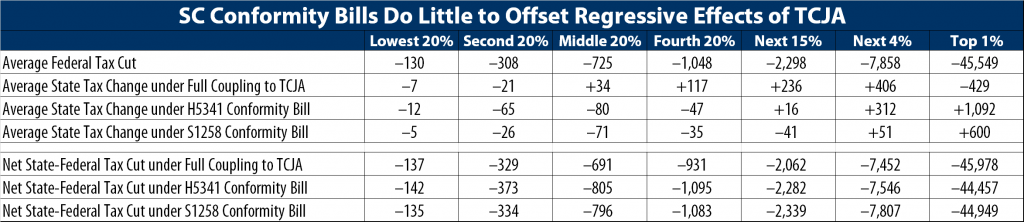

- South Carolina lawmakers, for example, considered some mixed-bag proposals that did not improve the state’s fiscal situation but did include some broadly positive and progressive elements, such as adopting the larger federal standard deduction and eschewing the new federal pass-through deduction. In the end, because none of these changes take effect automatically, lawmakers opted to maintain existing tax code and revisit the question next year.

- The federal conformity bill in Minnesota was vetoed by the governor and not scheduled for a comeback. The bill passed by the legislature would have avoided the regressive effects of the new pass-through income deduction by coupling to federal adjusted gross income rather than taxable income, but also would have cut personal and corporate income tax rates, adopted the lower inflation measure that will shrink tax benefits over time and drawn down the state’s Rainy Day Fund rather than finding sustainable revenue for school funding.

- Despite being heavily debated throughout the legislative session, the final tax conformity and cut bill considered in Kansas failed to garner enough support to pass due to concerns about budgetary implications and the adequacy of education funding. In addition to holding harmless state taxpayers who previously itemized their deductions, the bill would have given a tax cut to multinational corporations.

- New Mexico lawmakers adjourned without addressing the question, allowing the TCJA changes to take effect for now but planning to take another look at decoupling or passing offsetting tax cuts next year.

- North Dakota’s income tax is closely linked to the federal code, but the legislature only convenes in odd-numbered years. The state will generally automatically conform to the TCJA’s changes this year, with a chance of changes coming next year.

The Low Road

A handful of states have done considerably worse for residents. Each of the states below stood to gain some revenue by going along with the TCJA changes affecting them, but none chose to save that money to help cushion the blow of inevitable federal funding cuts to shared priorities like health care, education and infrastructure, or even to focus on improving the fairness of their tax codes through targeted benefits to low- and middle-income families. Instead, policymakers in each of these states took the low road, invoking debunked trickle-down economics and counterproductive tax competition to score easy political points while worsening their states’ tax codes and compromising their futures.

- In Missouri, where the potential revenue gain was partly due to being one of the few states with a state deduction for federal income taxes, legislators tried to gut their revenue system even further (even proposing to phase out the personal income tax altogether) but ultimately ended up with a package that shifts taxes around in order to look like a tax cut, reducing the federal income tax deduction and the state’s own pass-through income deduction to pay for a cut to the top income tax rate.

- While Idaho lawmakers enacted a nonrefundable child tax credit to counter some of the tax increases from the elimination of the federal personal exemption, they also enacted deep and permanent rate cuts to personal and corporate income taxes that are twice the size of the revenue gains the state faced from simply adopting the federal changes.

- In Georgia, where Gov. Nathan Deal had originally proposed a relatively responsible path of waiting a year to find out the full effects of the TCJA, political pressures to cut taxes won out. The state enacted a bill that will forgo up to $1 billion of revenue gain and reduce state revenues instead. The one bright side in Georgia is that the rate cuts are temporary, scheduled to expire when the bulk of the TCJA expires.

- Iowa lawmakers must have been reading our policy map backward, as the changes enacted there are costly, regressive and based on junk economics. Lawmakers enacted a package that will guarantee large and immediate tax rate cuts for the state’s wealthiest residents while basing the pieces most likely to benefit lower-income families on an uncertain revenue trigger not likely to be met for several years.

- Utah, like Colorado, passively accepted the federal changes affecting residents, but then used the revenue to reduce the state’s income tax rate, which will neither help its economy nor target tax cuts to the families who could most use them.

Dancing Around the TCJA

A few states have focused on politically driven gimmicks designed to circumvent the TCJA. Lawmakers in California, Connecticut, New Jersey and New York have tried converting tax payments into “charitable contributions” in order to maintain federal deductions for residents’ state and local taxes beyond the new $10,000 cap on such deductions in the TCJA. New York even went so far as to create an optional employer payroll tax and offsetting credit so residents can effectively continue to deduct income taxes beyond the cap. The IRS and Treasury Department have announced intentions to put a stop to these workarounds. Connecticut, Maryland, New Jersey and New York also plan to sue the federal government over the bill. States are right, for many reasons, to dislike the TCJA, but these workaround proposals generally amount to misplaced ire that would be better spent on crafting thoughtful policy solutions.

Still Studying the Map

Finally, some states have yet to seriously debate these decisions. Maine, for example, kept their tax code coupled to pre-TCJA federal law for now but has yet to revisit the question. In Virginia, where a similar quirk to Georgia’s could generate some significant revenue, lawmakers will have the opportunity either next year or in a special summer session to respond to that potential revenue gain in a more responsible manner.

These states have a tremendous opportunity to learn from the successes and mistakes of their neighbors by enacting responses to the TCJA that follow the contours of the map laid out above to promote adequacy and fairness while avoiding debunked economic myths and specious workaround gimmicks. And in fact, every state can and should work toward those goals, which transcend current fiscal debates and the TCJA itself.