Blog

1303 posts

The Trump Megabill Hands the Rich a Gift — and Sends the Bill to Young Americans

August 21, 2025 • By ITEP Staff

Trump's megabill directs most benefits to the wealthy, while leaving younger generations with higher taxes, more debt, and fewer opportunities. For Millennials and Gen Z, it means reduced public investment and an economy less likely to work in their favor.

SALT in the Wound: New Tax Law’s Limit on State Tax Deductions Exempts Some of the Very Wealthiest

August 21, 2025 • By ITEP Staff

The new tax law enacted last month found a temporary compromise on the level of the cap, boosting it to $40,000 through 2029, but failed to fix a loophole that allows some rich taxpayers with good accountants to completely avoid the cap

State Rundown 8/20: States to Face Serious Conformity, Revenue Issues as Summer Ends

August 20, 2025 • By ITEP Staff

While tax news has slowed as summer comes to an end, there are rumblings beneath the surface that could be an inauspicious sign of the times ahead for states and state budgets.

Trump Administration’s English-Only IRS Would Undermine Public Trust and Boost Budget Deficits

August 19, 2025 • By Matthew Gardner

The Trump administration’s push to make English the official U.S. language threatens decades of progress in taxpayer services for non-English speakers, risking cuts to IRS multilingual support, harder tax filing, lower compliance, and an undermined agency mission.

Trump’s Tax Law Clobbers State Budgets. Now’s the Time to Prepare.

August 13, 2025 • By ITEP Staff

The Trump megabill hands the richest 1% a trillion-dollar windfall while gutting funding for health care, education, and disaster relief — leaving communities to pick up the pieces. State and local leaders must step up, tax the wealthiest fairly, and safeguard the essentials that keep America healthy, educated, and safe.

Mississippi’s Path to Income Tax Elimination Hinders Racial and Economic Equity

August 7, 2025 • By Vanessa Woods

Mississippi policymakers this year took a big step to worsen the state’s racial income and wealth divides by passing a radical plan to eventually eliminate the state’s income tax.

How Maryland’s Tax Reforms Advance Racial and Economic Equity

August 7, 2025 • By Vanessa Woods

Maryland is taking aim at income and racial disparities through a revised personal income tax. By raising taxes on high earners and cutting them for most households across racial and ethnic lines, the state is proving that progressive tax policy can drive both equity and revenue.

Trump’s Firing of BLS Commissioner is Part of Larger Erosion of Federal Data Infrastructure

August 7, 2025 • By Emma Sifre

Last week, President Trump fired the Commissioner of the Bureau of Labor Statistics in apparent retaliation for weak jobs numbers. The move drew sharp criticism for spooking investors and weakening trust in official data. But it also reflects a deeper problem: the ongoing erosion of the federal data infrastructure.

As states prepare for the revenue loss and disruption resulting from the federal tax bill, tax policy is being considered in legislatures across the country.

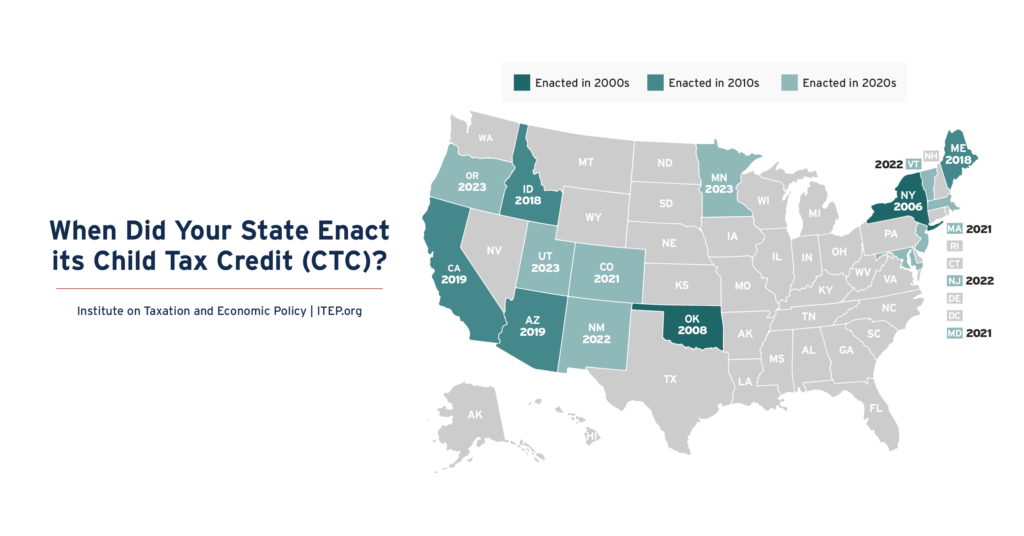

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.

Excessive CEO Pay Makes Inequality Worse. Shareholders and the Public Deserve to Know About Compensation Disparities

July 30, 2025 • By Matthew Gardner

Huge executive pay packages are a prime driver of income inequality. Shareholders and the public deserve to know about how CEOs are compensated, but new SEC leadership seems to think otherwise.

State Tax Action in 2025: Amid Uncertainty, Tax Cuts and New Revenue

July 28, 2025 • By Aidan Davis, Neva Butkus, Marco Guzman

Federal policy choices on tariffs, taxes, and spending cuts will be deeply felt by all states, which will have less money available to fund key priorities. This year some states raised revenue to ensure that their coffers were well-funded, some proceeded with warranted caution, and many others passed large regressive tax cuts that pile on to the massive tax cuts the wealthiest just received under the federal megabill.

Refundable tax credits were a big part of state tax policy conversations this year. In 2025, nine states improved or created Child Tax Credits or Earned Income Tax Credits.

State Rundown 7/24: States Begin Preparing for Federal Megabill Fallout

July 24, 2025 • By ITEP Staff

All eyes in statehouses in recent weeks have been on federal budget negotiations, and now that the “megabill” has passed, they are focused in on their own budgets in search of ways to cope with the enormous consequences coming their way. All states will see fewer federal dollars flowing through their coffers, higher needs due […]

Americans Want to Know Which Corporations Aren’t Paying Taxes, but House Republicans Want to Keep this Information Secret

July 23, 2025 • By Matthew Gardner

The appropriations plan released by House Republicans this weekend threatens to withhold funding for an obscure but vital financial oversight board because that board now requires corporations to disclose basic information about their income tax payments (or lack thereof).

Nobody should be too excited and think this means our country is headed toward lower deficits - especially when the administration recently signed one of the most expensive budget reconciliation bills in history.

How Much Would Every Family in Every State Get if the Megabill’s Tax Cuts Given to the Rich Had Instead Been Evenly Divided?

July 14, 2025 • By Michael Ettlinger

If instead of giving $117 billion to the richest 1 percent, that money had been evenly divided among all Americans, we'd each get $343 - or nearly $1,400 for a family of four.

This country’s biggest historical challenge has been delivering this progress to all Americans, but Republicans have cut it back for everyone, retreating from many 20th century achievements in ways that will slam doors, rather than opening them, for the next generation.

10 Crazy Comparisons Showing How Much Trump and Congress Just Cut Taxes for the Rich

July 10, 2025 • By ITEP Staff

$117 billion is a big number, so we thought it could use a little context.

State Rundown 7/8: State Tax Cuts Continue Despite Federal Megabill Passing

July 8, 2025 • By ITEP Staff

The last states are wrapping up legislative sessions, and some are crossing the finish line with major income tax cuts.

Top 1% to Receive $1 Trillion Tax Cut from Trump Megabill Over the Next Decade

July 3, 2025 • By Carl Davis

The Trump megabill will give the top 1 percent tax cuts totaling $1.02 trillion over the next decade. For comparison, the bill’s cuts to the Medicaid health care program will total $930 billion over the same period.

The endlessly debated cap on deductions for state and local taxes (SALT) has emerged in the GOP megabill largely unscathed—despite the efforts of Republican lawmakers from “blue” states. Those lawmakers are correct that the cap reduces the bill’s tax cuts for their wealthy constituents more than for those in other states. The megabill, however, is so loaded up with other provisions that result in a dramatic tax cut for the richest 1 percent in every state.

Megabill Takes Cap Off Unprecedented Private School Voucher Tax Credit, Potentially Raising Cost by Tens of Billions Relative to Earlier Version

July 2, 2025 • By Carl Davis

It is clear that this tax credit has the potential to come with an enormous cost if private school groups are successful in convincing their supporters to participate. In these times of very high debt and deficits, this is reason for all of us to be uneasy.

As federal aid ends and economic uncertainty grows, local governments face tough budget choices. Now is the time for localities to protect vulnerable residents and build stronger, more equitable fiscal foundations.

Trump Megabill Will Give $117 Billion in Tax Cuts to the Top 1% in 2026. How Much In Your State?

June 30, 2025 • By Michael Ettlinger

The predominant feature of the tax and spending bill working its way through Congress is a massive tax cut for the richest 1 percent — a $114 billion benefit to the wealthiest people in the country in 2026 alone.