California

ITEP Testimony Regarding Connecticut Senate Bill 16, An Act Concerning the Adult Use of Cannabis

March 4, 2020 • By Carl Davis

This testimony explains the advantages of the cannabis tax structure proposed in Connecticut’s Senate Bill 16 and offers additional background information as well as ideas for potential changes to the bill.

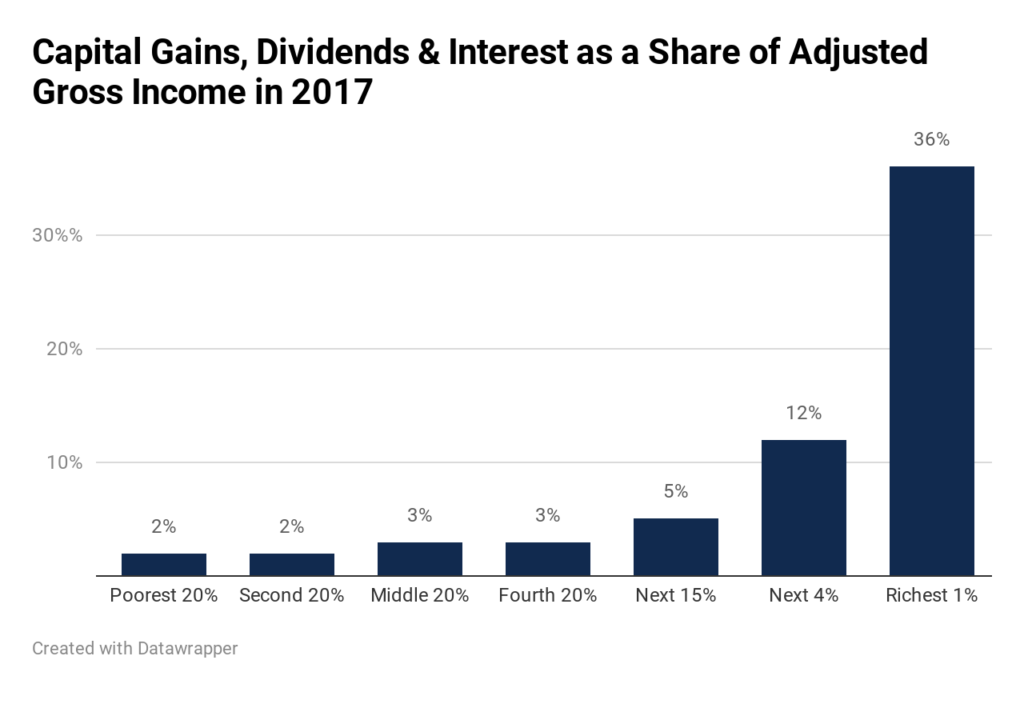

Anti-tax activists’ convoluted claims that the rich pay too much in taxes broke new ground with an op-ed published last week in the Wall Street Journal. Penned by former Texas Sen. Phil Gramm and John Early, a former official of the Bureau of Labor Statistics, the piece is particularly misleading. The so-called evidence in support of their argument against raising taxes on the rich fails to correctly calculate effective tax rates.

State Rundown 2/20: Property Taxes and School Finance Take Center Stage

February 20, 2020 • By ITEP Staff

Property taxes and education funding are a major focus in state fiscal debates this week. California voters will soon vote on borrowing billions of dollars to fill just part of the funding hole created in large part by 1978’s anti-property-tax Proposition 13. Nebraska lawmakers are debating major school finance changes that some fear will create similar long-term fiscal issues. And Idaho and South Dakota leaders are looking to avoid that fate by reducing property taxes in ways that will target the families who most need the help. Meanwhile, Arkansas, Nevada, and New Hampshire are taking close looks at their transportation…

States Can Lead on Making the EITC Benefit More Young and Older Workers

February 18, 2020 • By Aidan Davis

The federal Earned Income Tax Credit (or EITC) lifts millions out of poverty each year, but it is not created equal for everyone. Childless workers under 25 and over 64 receive no benefit from the existing federal credit. In the absence of immediate federal action, states have led–and continue to lead–the way.

Expanding State EITCs: Age Enhancements and a Credit Increase for Workers without Children in the Home

February 18, 2020 • By Aidan Davis

For 45 years, the federal Earned Income Tax Credit (EITC) has benefited low- and moderate-income workers. Yet, throughout its history, the EITC has provided little or no benefit to workers without children in the home—a group that includes noncustodial parents whose children live the majority of the year with another parent.

State lawmakers have plenty to keep them busy on the tax policy front in 2020. Encouraging trends we’re watching this year include opportunities to enact and enhance refundable tax credits and increase the tax contributions of high-income households, each of which would improve tax equity and help to reduce income inequality.

State Itemized Deductions: Surveying the Landscape, Exploring Reforms

February 5, 2020 • By Carl Davis

State itemized deductions are generally patterned after federal law, though nearly every state makes significant changes to the menu of deductions available or the extent to which those deductions are allowed. This report summarizes the key details of each state’s itemized deduction policies and discusses various options for reforming those deductions with a focus on lessening their regressive impact and reducing their cost to state budgets.

This week as Americans celebrate Martin Luther King Jr.’s messages of resisting oppression and fighting for progress, state policymakers can look to some bright spots where tax and budget debates are bending toward justice. Among those highlights, Hawaii leaders are considering improvements to minimum wage policy, early childhood education, and affordable housing; Kansas Gov. Laura Kelly is seeking to reduce sales taxes applied to food and restore the state’s grocery tax credit; and advocates in Connecticut and Maryland are pushing for meaningful progressive tax reforms.

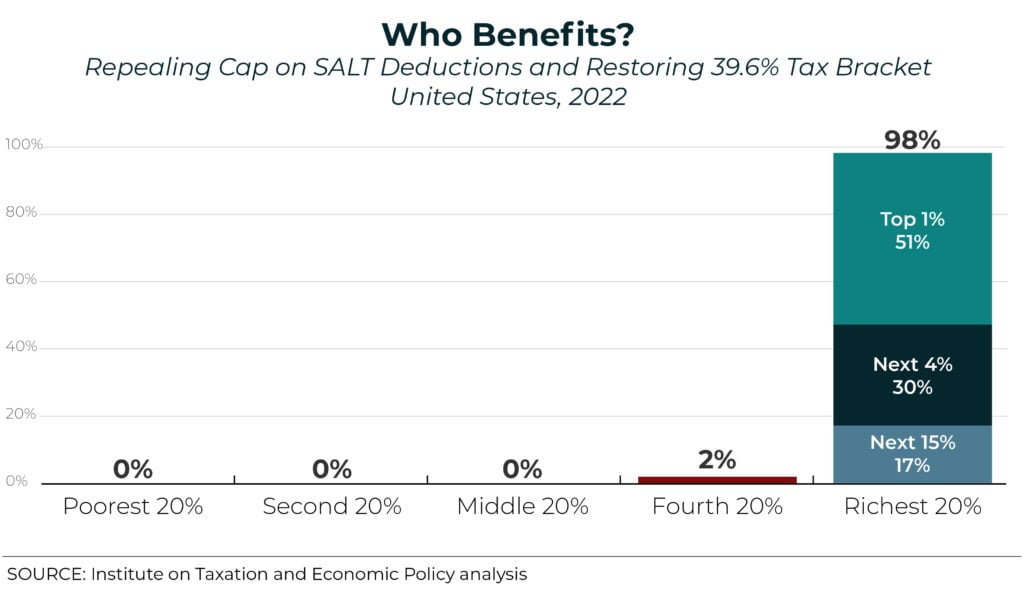

McClatchy: Lifting the Cap on This Tax Break Would Benefit California’s Rich

January 17, 2020

The figures were developed by the nonpartisan Institute on Taxation and Economic Policy. to project the likely effects if the Democrats’ proposal went into effect in 2022. That’s likely the earliest year when Democrats could have their policies go into full effect if the party takes control of the White House and Congress in 2021. […]

The Colorado Sun: Colorado progressives have a new target in their pursuit of a tax overhaul: the rich. Here’s why.

January 16, 2020

More progressive taxes aren’t a panacea for income inequality, either. With a top rate of 12.3%, plus a 1% millionaire tax, California has the most progressive tax code in the country, according to the left-leaning Institute on Taxation and Economic Policy. It is also the seventh most unequal, with the wealthiest 1% making 30 times […]

State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug […]

State Rundown 1/8: States Need Clear Tax and Budget Policy Vision in 2020

January 8, 2020 • By ITEP Staff

Happy New Year readers! The Rundown is back to our usual weekly schedule as state legislative sessions and governors’ budgets and State of the State Addresses begin in earnest. Here’s to clear-eyed 20-20 vision guiding state tax and budget decisions in 2020! So far this year, the harm of Colorado’s TABOR policy and Alaska’s lack of an income tax are coming into focus in big ways. Utah advocates are hoping the benefit of hindsight will help convince voters to overturn a recently enacted tax overhaul. Lawmakers in states including Iowa, Maryland, and Virginia can clearly see a need for revenues,…

Corporate Tax Avoidance Is Mostly Legal—and That’s the Problem

December 19, 2019 • By Steve Wamhoff

As usual, corporate spokespersons and their allies are trying to push back against ITEP’s latest study showing that many corporations pay little or nothing in federal income taxes. One way they respond is by stating that everything they do is perfectly legal. This is an attempt by the corporate world to change the subject. The entire point of ITEP’s study is that Congress has allowed corporations to avoid paying taxes, and that this must change.

State Rundown 12/18: Utah’s Tax Fight Wraps Up As Other States’ Ramp Up

December 18, 2019 • By ITEP Staff

With the new year and many state legislative sessions just around the corner, most state tax and budget debates are just getting started. Arkansas will be among the states working to improve their roads and other infrastructure. Massachusetts will have to deal with revenue losses due to a misguided tax-cut trigger put in place in prior years. Maryland and South Dakota will be two of many states facing teacher pay shortages and other education funding needs. And debates over the legalization and taxation of cannabis will likely continue in California, Kentucky, New Jersey, and beyond. Utah lawmakers, on the other…

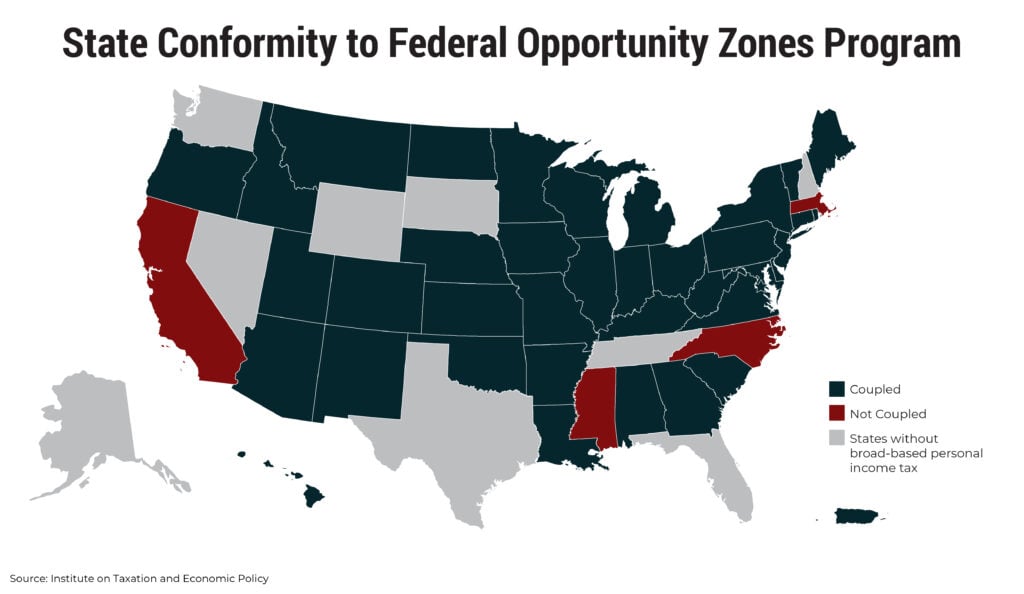

States Should Decouple from Costly Federal Opportunity Zones and Reject Look-Alike Programs

December 12, 2019 • By ITEP Staff

Post enactment of TCJA, lawmakers in most states needed to decide how to respond to the creation of this new program. Given the shortcomings of the federal Opportunity Zones program and its added potential costs to states, the most prudent course of action is three-pronged: States should move quickly to decouple; states should reject look-alike programs; and lawmakers should make investments directly into economically distressed areas.

House Democrats’ Latest Bill on SALT Deductions Would Mean Bigger Tax Cuts for the Rich

December 11, 2019 • By Steve Wamhoff

ITEP estimates show that if the House Democrats' proposal was in effect in 2022, it would have a net cost of $81 billion in that year alone. The estimates also show that 51 percent of the benefits would go to the richest 1 percent of taxpayers in the U.S. Clearly, lawmakers concerned about the SALT cap need to go back to the drawing board.

Understanding the full tax consequences of cannabis legalization requires evaluating not only the excise taxes proposed in most legalization bills, but also the effects on the federal income tax liability of cannabis businesses.

In the last few weeks, Florida Gov. Ron DeSantis has served up his budget proposal, which advocates are eager to dig into and hoping to contribute to with a delectable Earned Income Tax Credit proposal of their own. Utah lawmakers have been cooking up tax ideas as well, but haven’t yet decided when to come to the table to debate them. And Maryland leaders finalized their menu of needed education reforms, now moving on to assigning responsibilities for funding them. With respect to dividing up the pie, our “What We’re Reading” section below includes reporting on evidence that corporate tax…

State Rundown 11/6: State Voters Show Readiness to Fix Broken Tax Codes

November 6, 2019 • By ITEP Staff

Many of yesterday’s Election Day votes came down to questions of whether or not to improve on upside-down and often inadequate state and local tax systems. The status quo was maintained in Colorado, where voters failed to approve a proposition to allow the state to invest tax revenue in education and other needs, and in Texas, where a constitutional amendment was approved to prohibit the state from creating an income tax. But voters supported important reforms in other states by approving needed funding for schools in Idaho, opting to legalize and tax recreational cannabis in California. And for more on…

The Sacramento Bee: California Democrat Wants to Make PG&E Pay a Penalty if it Gives Executive Bonuses

October 28, 2019

Harder’s bill would revive a tax called the alternative minimum tax for utilities that offer executive bonuses but have failed to invest in climate-resilient infrastructure. The bill is written to specifically target PG&E, which has not paid federal income taxes in the past decade due to tax loopholes on depreciation, according to the Institute on Taxation […]

State Rundown 10/24: State Tax Talk Makes Like a Tree and Gets Colorful

October 24, 2019 • By ITEP Staff

As autumn brings a colorful display of foliage to many states, so too are tax proposals taking on interesting hues as states move from the summer off-season toward 2020 legislative sessions. Ohio lawmakers are blue in the face from debating and re-debating tax and budget issues there. Maryland residents again showed they can’t be called yellow-bellied when it comes to footing the bill for needed education improvements, showing their broad support for higher taxes to fund those needs even despite a hefty price tag. Alaska, Michigan, and other states are giving the green light to laws implementing their new ability…

Wall Street Journal: Rising California Gasoline Prices Highlight Growing Divide in U.S.

October 23, 2019

A dozen states raised gas taxes earlier this year, including Illinois, Ohio, California, Maryland and Michigan, according to the Institute on Taxation and Economic Policy, a state and federal tax-policy think tank. Read more

State Rundown 9/26: Shady State Business Tax Subsidies Coming to Light

September 26, 2019 • By ITEP Staff

Lawmakers in Michigan and New Hampshire made progress toward enacting their state budgets, though Michigan may yet end up in a government shutdown. Leaders in Wyoming advanced a proposal to create a limited tax on large corporations to raise some revenue and add a progressive element to their state’s tax code. Georgia agencies are forced to recommend their own funding cuts amid state income tax cuts. And business tax subsidies are looking particularly bad in Maryland, where subsidy money has been handed out without verification that companies were creating jobs, and New Jersey, where a false threat to leave the…

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Reducing the Cost of Child Care Through State Tax Codes in 2019

September 26, 2019 • By Aidan Davis

The high cost of quality child care is a budget constraint for many working families and particularly daunting for parents who are working but earning low wages. Most families with children need one or more incomes to make ends meet which means child care expenses are an increasingly unavoidable and unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.