Tax Credits for Workers and Families

Minnesota’s House, Senate and Governor’s office have each proposed their own vision as to how the state should maximize its $17.5 billion surplus and raise new revenue, and these tax plans make one thing clear: Minnesota lawmakers are serious about using tax policy to advance tax equity and improve the lives of Minnesotans.

As Tax Day approaches, it’s worth thinking about not only the taxes that we individually pay but the overall condition of our tax code as well. State tax codes, while perhaps less discussed than the federal system, are critically important. Depending on how they are designed, state taxes can improve or worsen economic and racial […]

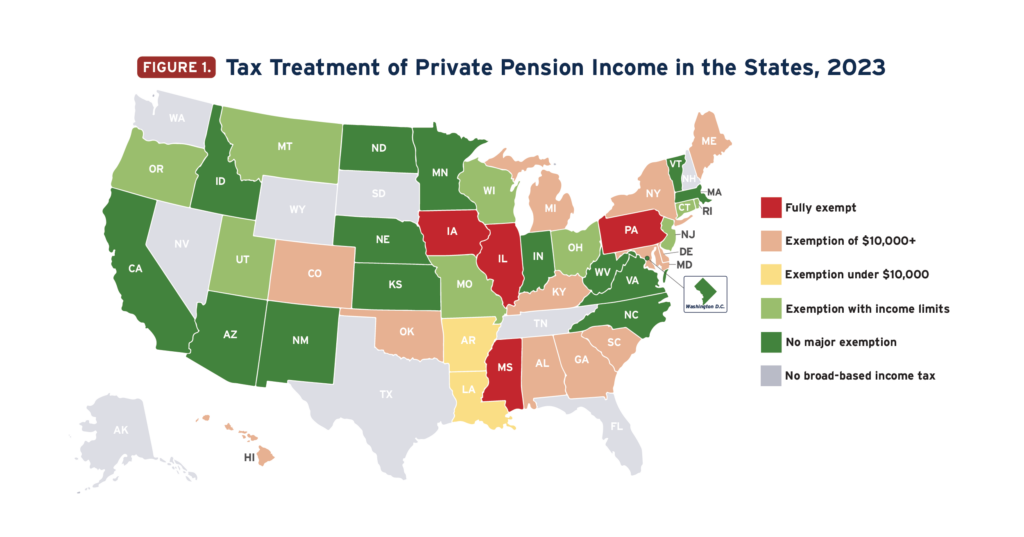

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

The word “tax” appears 97 times and counting in one recent summary of governors’ addresses to state legislators so far this year. The policy visions that governors are bringing, however, vary enormously. While there's good reason to worry about tax cuts for wealthy families and the flattening or elimination of income taxes, there are at least five great tax ideas coming directly out of governors’ offices this year.

Momentum Behind State Tax Credits for Workers and Families Continues in 2023

January 18, 2023 • By Miles Trinidad

Refundable tax credits are an important tool for improving family economic security and advancing racial equity, and there is incredible momentum heading into 2023 to boost two key state credits: the Child Tax Credit and the Earned Income Tax Credit.

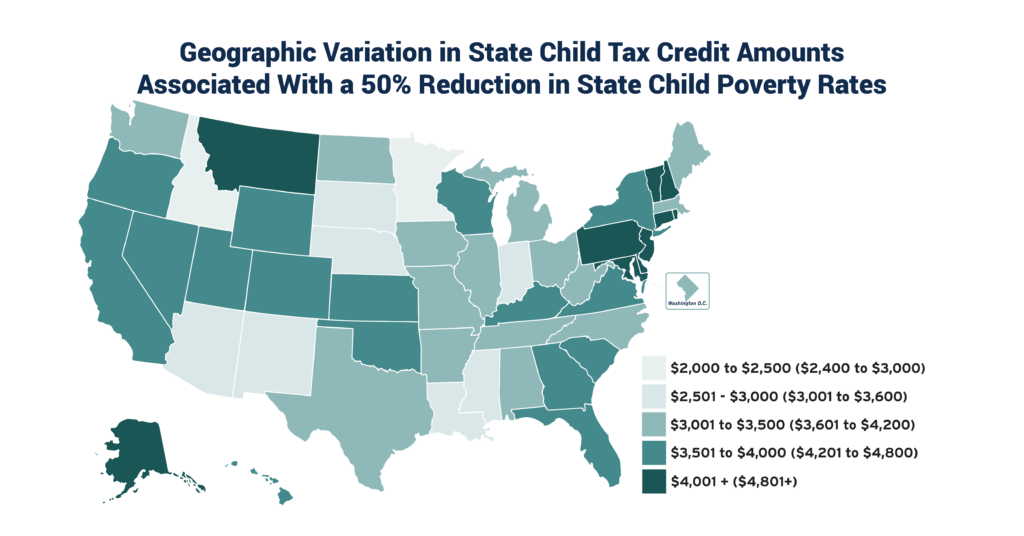

State policymakers have the tools they need to drastically reduce child poverty within their borders. A new ITEP report, coauthored with Columbia University’s Center on Poverty and Social Policy, explores state Child Tax Credit (CTC) options that would reduce child poverty by up to 50 percent. Temporary expansion of the federal CTC in 2021 reduced […]

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

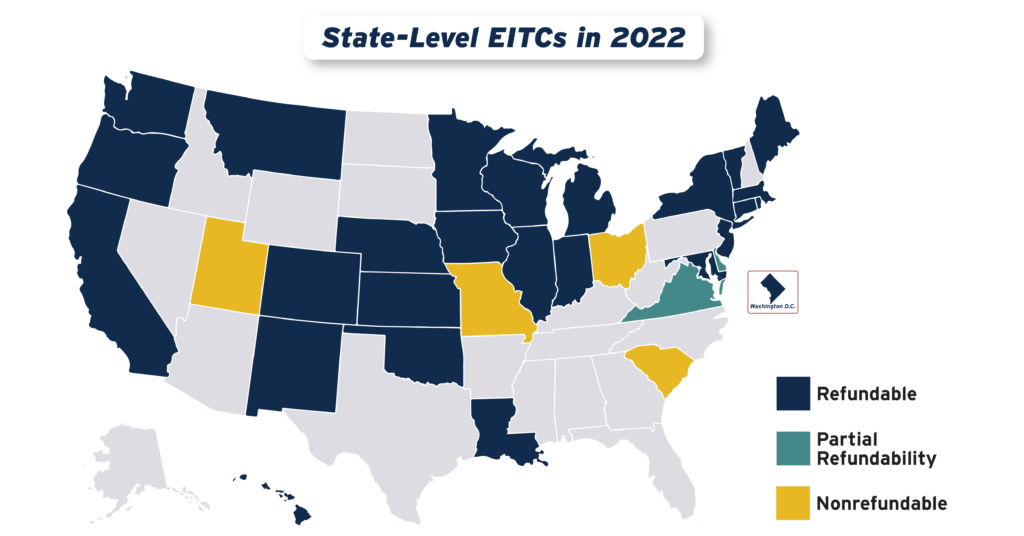

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

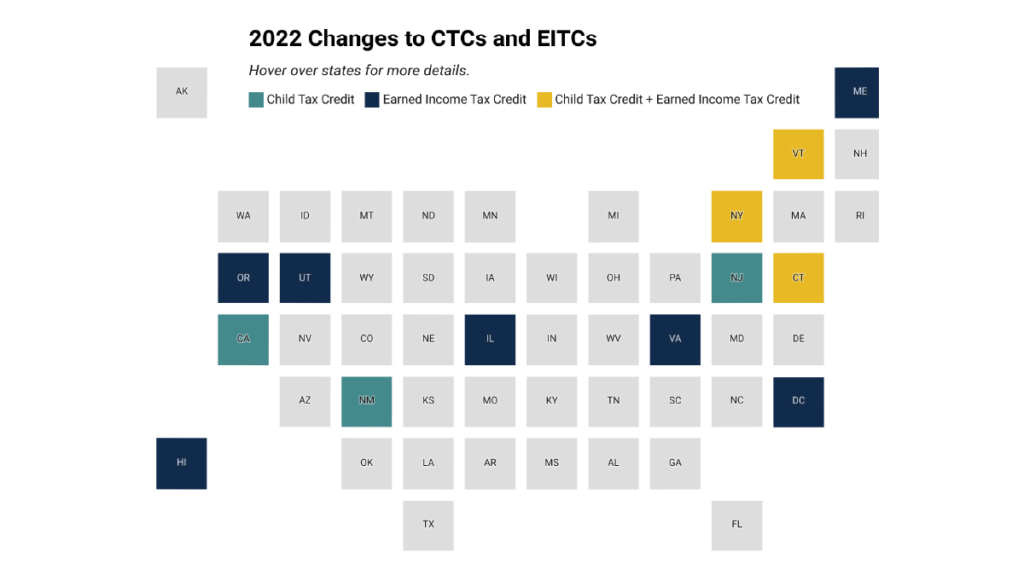

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

Abortion-Restricting States Do Least for Children

July 13, 2022 • By Amy Hanauer

Lawmakers have passed laws in 22 states that either immediately or soon will greatly restrict women’s rights to decide whether and when to have children. These states have some of the worst tax, spending and labor market policies for families in the U.S.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2021

October 21, 2021 • By Aidan Davis

The EITC benefits low-income people of all races and ethnicities. But it is particularly impactful in historically excluded Black and Hispanic communities where discrimination in the labor market, inequitable educational systems, and countless other inequities have relegated a disproportionate share of people to low-wage jobs.

New Census Data Highlight Need for Permanent Child Tax Credit Expansion

September 14, 2021 • By Neva Butkus

The status quo was a choice, but the Census data released today shows that different policy choices can create drastically different outcomes for children and families. It is time for our state and federal legislators to put people first when it comes to recovery.

DC Exemplifies Trend of Tax Justice Victories on the Ground Despite Distractions in the Sky

July 23, 2021 • By Dylan Grundman O'Neill

This month, we watched billionaire space-racers with skyrocketing fortunes literally rocket themselves into the sky to look down on us from the largest gap they could put between themselves and the people, communities, and institutions that made their fortunes possible. These events have put an exclamation point on one of the clearest lessons to come […]

The Child Tax Credit in Practice: What We Know About the Payoffs of Payments (Webinar)

July 7, 2021 • By ITEP Staff

Join us for a discussion on why tax credits like the Child Tax Credit (CTC) expansion are good economic policy. You’ll hear from anti-poverty experts on why Congress should extend the policy beyond 2021 and what we can learn from an initiative providing low-income mothers in Jackson, Miss., $1,000 cash on a monthly basis, no strings attached. From theory to practice and what it means for American families, this CTC webinar will provide a unique angle through which to view this transformative policy.

A growing group of state lawmakers are recognizing the extent to which low- and middle-income Americans are struggling and the ways in which their state and local tax systems can do more to ensure the economic security of their residents over the long run. To that end, lawmakers across the country have made strides in enacting, increasing, or expanding tax credits that benefit low- and middle-income families. Here is a summary of those changes and a celebration of those successes.

Nearly 20 Million Will Benefit if Congress Makes the EITC Enhancement Permanent

May 13, 2021 • By Aidan Davis

Overall, the EITC enhancement would provide a $12.4 billion boost in 2022 if made permanent, benefiting 19.5 million workers. It would have a particularly meaningful impact on the bottom 20 percent of eligible households who would receive more than three-fourths of the total benefit. Forty-one percent of households in the bottom 20 percent of earners would benefit, receiving an average income boost of 6.3 percent, or $740 dollars.

Young workers are confronting a harsh economic reality filled with student loan debt and far too few good-paying jobs. The pandemic reinforced this group’s long history of not receiving proper benefits, such as health insurance, from their employers. They also are often overlooked when it comes to policies that promote economic wellbeing. The federal Earned Income Tax Credit (EITC), for example, is a glowing success story. It lifted 5.8 million people out of poverty in 2018, including 3 million children. But a key shortcoming of the federal EITC: working adults without children in the home receive little to no benefit.

While the federal EITC provides a great deal of support for families with children, its impact is limited for those without children or who are not raising children in their homes. Childless workers under 25 and over 64 have for far too long received no benefit from the federal credit. And workers aged 25 to 64 have received very little value from the existing credit (the maximum credit is much smaller and the income limits more restrictive). The federal EITC’s meager benefits for just some childless adults lead to an inequitable outcome: the federal income tax system—which is ostensibly based…

Immediate Action State Lawmakers Can Take to Support Families and Children

February 2, 2021 • By Aidan Davis

If Congress does act and enact President Biden’s CTC expansion, states could simply couple to that federal change. The changes, while temporary, could become the foundation of a permanent state-level credit over the long-term. But state lawmakers need not wait for legislative action in DC. They can take immediate steps to ensure that their state’s most vulnerable children are positioned to succeed.

The Vital Role of Public Programs in Moving People and Families Out of Poverty

September 15, 2020 • By Aidan Davis

More families across our nation are struggling to meet their most basic needs. High unemployment, the struggle to put enough food on the table, and an inability to make rent or mortgage payments are widespread. Absent federal intervention, outcomes would have been worse. Over the past few months, federal and state relief measures have mitigated hardship. By putting cash in the hands of those who need it most, lawmakers were able to stabilize some families’ budgets and prop up our fragile economy. With time we will surely glean many lessons from 2020. But the sheer power of targeted assistance is already apparent.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2020

September 15, 2020 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been amplified as many states have enacted and expanded their own credits.

Temporarily modifying the structure of the EITC to reflect the realities of our current economy could provide a vital lifeline to low-income workers who have seen their incomes disappear during this crisis. What follows are a few such ideas which could be implemented at either the federal or state levels, or both.

Expanding State EITCs: Age Enhancements and a Credit Increase for Workers without Children in the Home

February 18, 2020 • By Aidan Davis

For 45 years, the federal Earned Income Tax Credit (EITC) has benefited low- and moderate-income workers. Yet, throughout its history, the EITC has provided little or no benefit to workers without children in the home—a group that includes noncustodial parents whose children live the majority of the year with another parent.

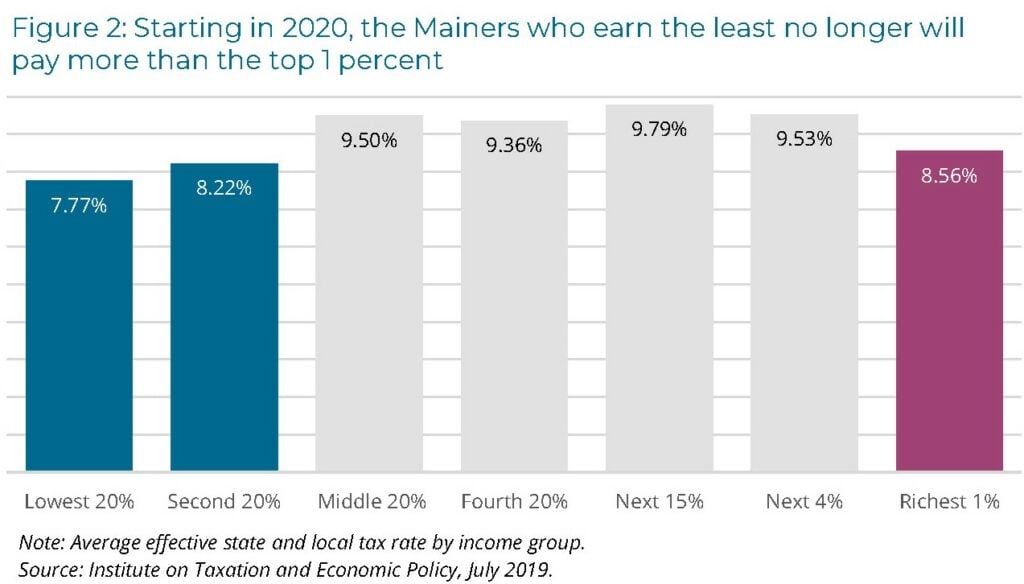

Lawmakers in Maine this year took bold steps toward making the state’s tax system fairer. Their actions demonstrate that political will can dramatically alter state tax policy landscape to improve economic well-being for low-income families while also ensuring the wealthy pay a fairer share.

State and local tax policies can often make it more difficult for low- and moderate-income individuals and families to make ends meet. Through the use of a variety of targeted tax credits, state lawmakers can help improve both the fairness of their tax systems as well as the standard of living for low- and moderate-income residents. ITEP resources on tax credits for workers and families provide general and state-specific information about the mechanics of these credits and options for reform including state Earned Income Tax Credits, property tax circuit breakers and child-related tax credits.