Who Pays?

Ohio: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

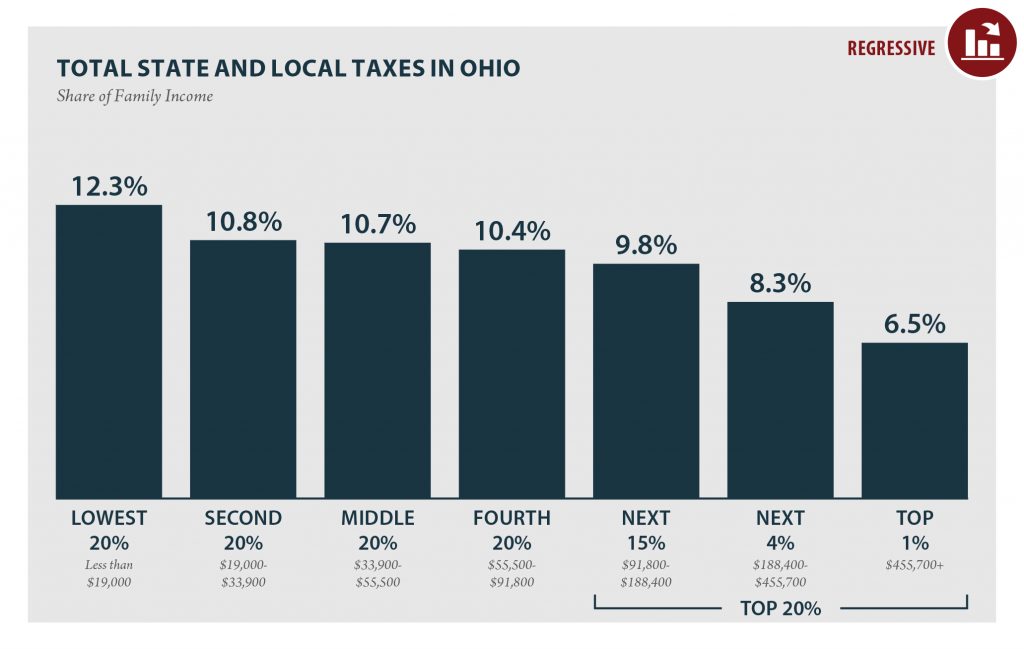

OHIO Read as PDF OHIO STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,000 $19,000 to $33,900 $33,900 to $55,500 $55,500 to $91,800 $91,800 to $188,400 $188,400 to $455,700 over $455,700 […]

Montana: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

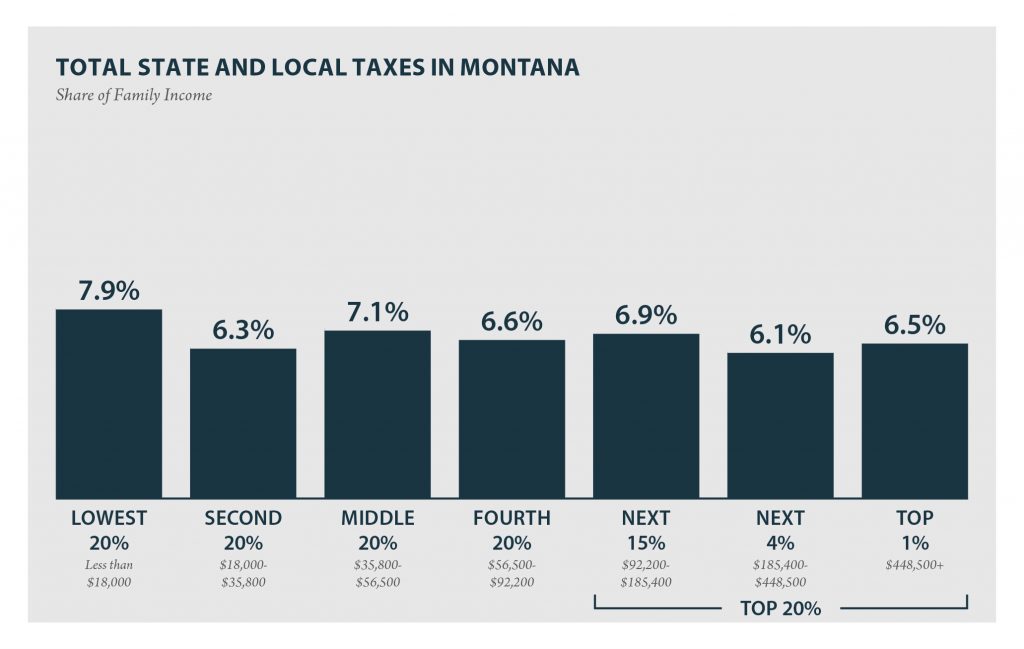

According to ITEP’s Tax Inequality Index, Montana’s state and local tax system does not worsen income inequality and ranks 43rd on the index. The large income gap between lower- and middle-income taxpayers, as compared to the wealthy, is somewhat narrower after state and local taxes than before.

Maine: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

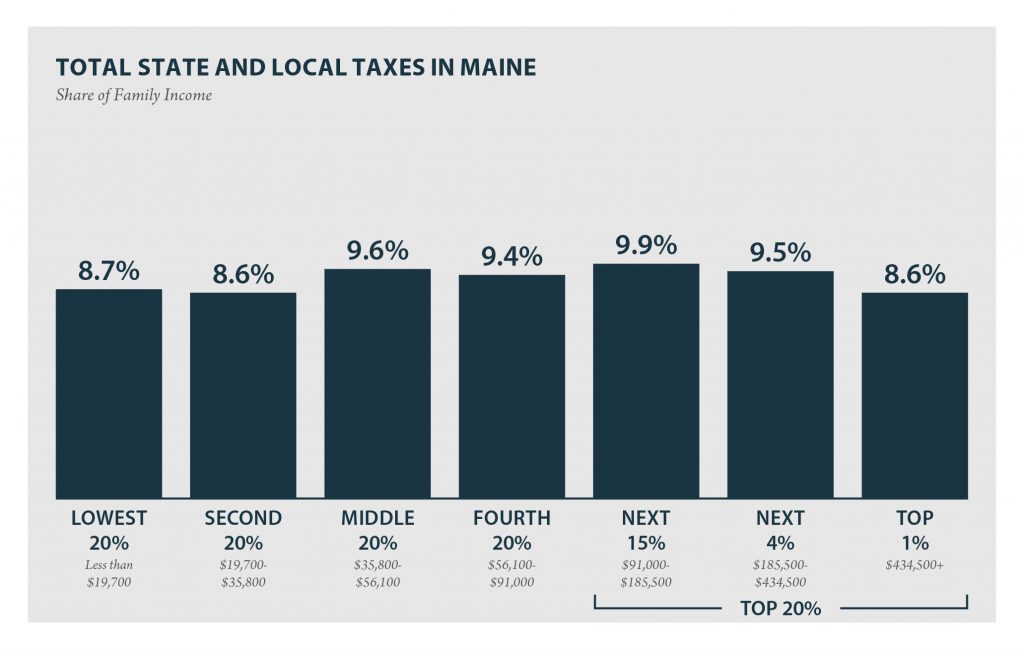

MAINE Read as PDF MAINE STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,700 $19,700 to $35,800 $35,800 to $56,100 $56,100 to $91,000 $91,000 to $185,500 $185,500 to $434,500 over $434,500 […]

South Carolina: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

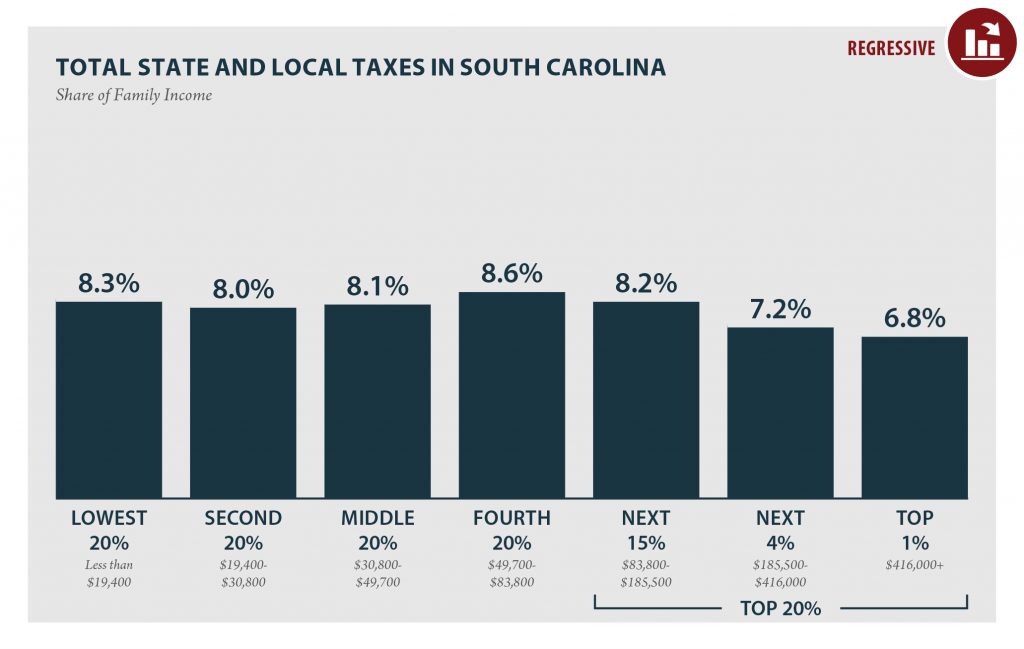

SOUTH CAROLINA Read as PDF SOUTH CAROLINA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,400 $19,400 to $30,800 $30,800 to $49,700 $49,700 to $83,800 $83,800 to $185,500 $185,500 to $416,000 […]

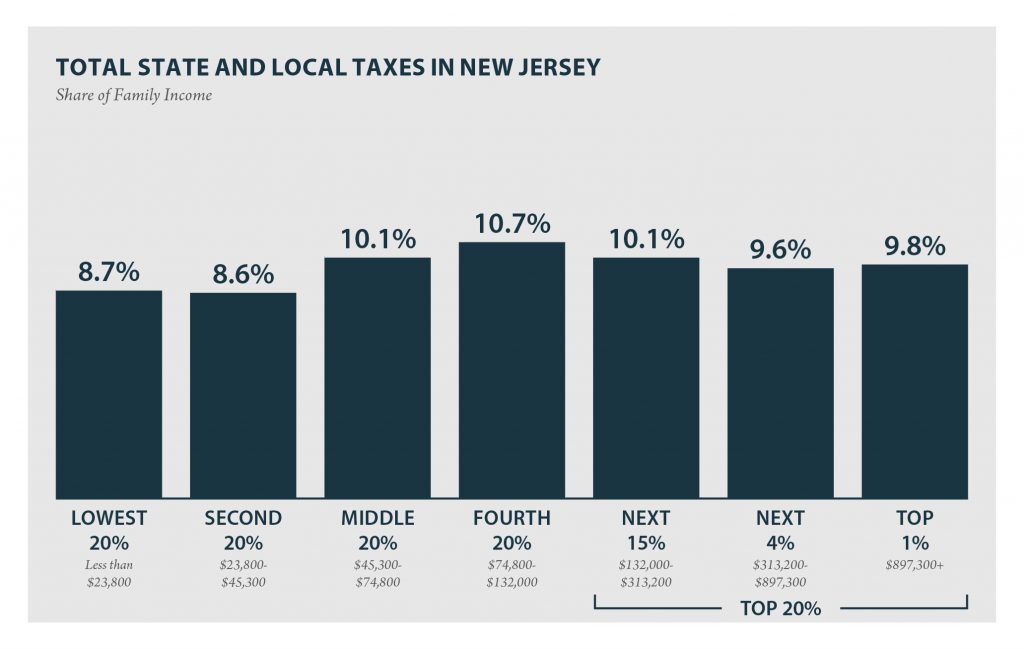

New Jersey: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, New Jersey’s state and local tax system does not worsen income inequality and ranks 46th on the index. The large income gap between lower- and middle-income taxpayers, as compared to the wealthy, is somewhat narrower after state and local taxes than before.

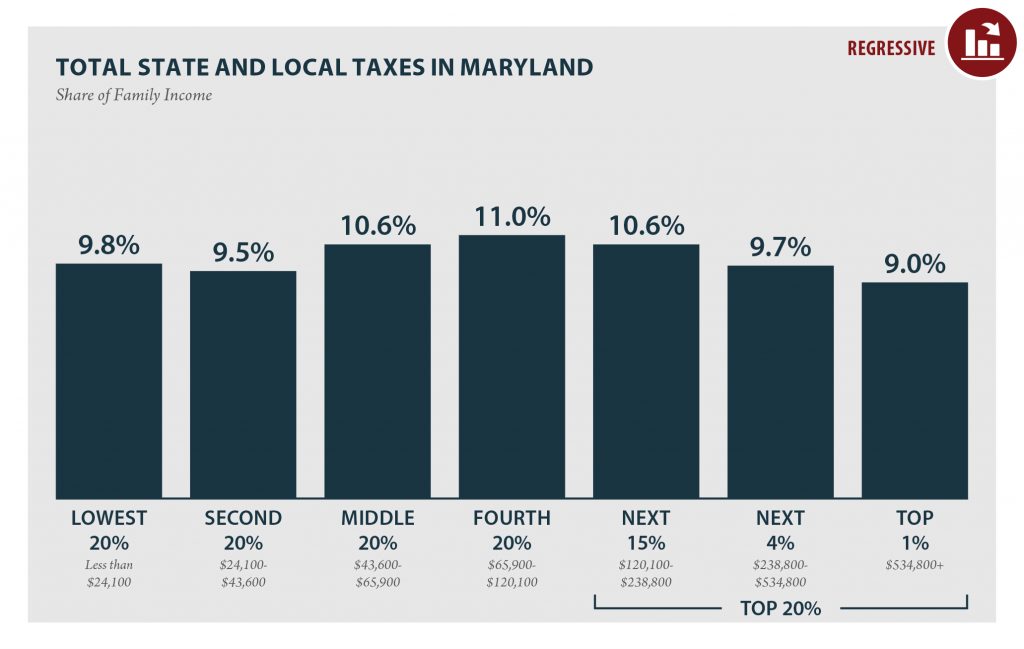

Maryland: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

MARYLAND Read as PDF MARYLAND STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $24,100 $24,100 to $43,600 $43,600 to $65,900 $65,900 to $120,100 $120,100 to $238,800 $238,800 to $534,800 over $534,800 […]

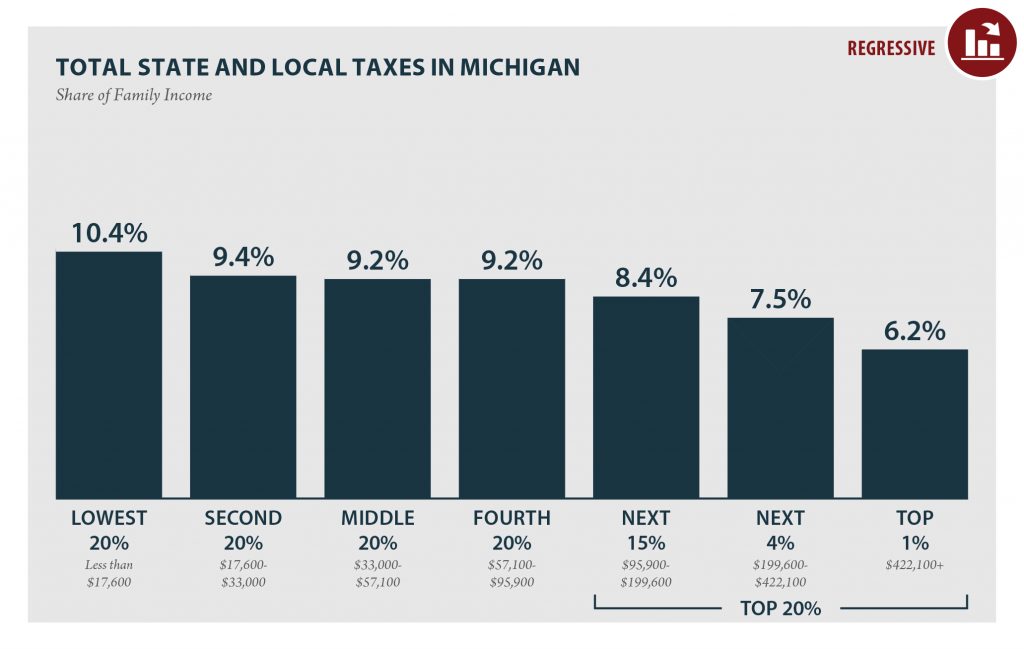

Michigan: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

MICHIGAN Read as PDF MICHIGAN STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $17,600 $17,600 to $33,000 $33,000 to $57,100 $57,100 to $95,900 $95,900 to $199,600 $199,600 to $422,100 over $422,100 […]

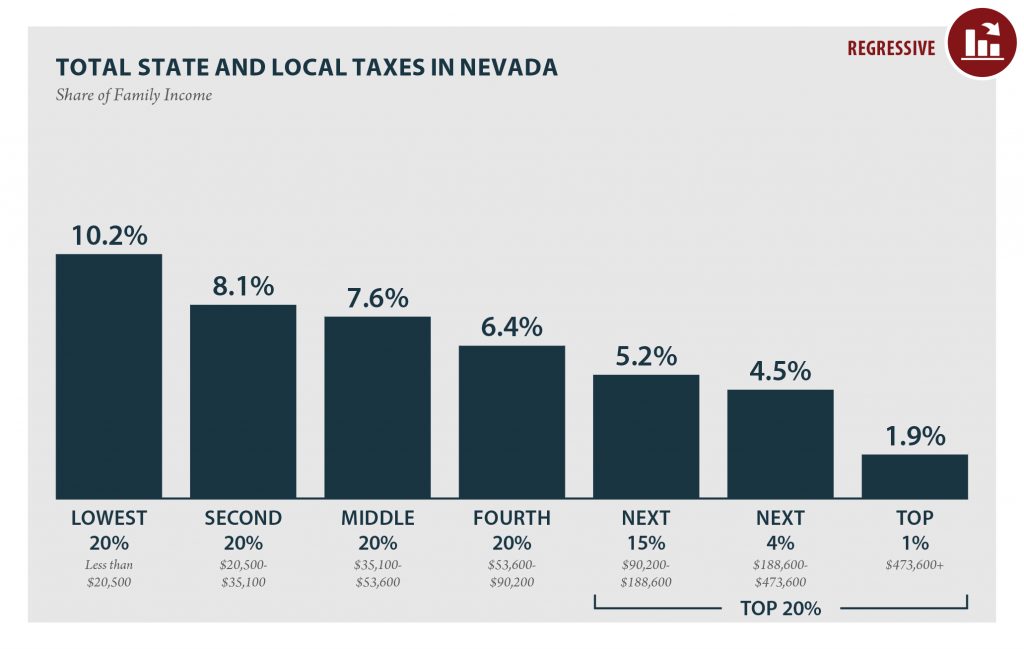

Nevada: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

NEVADA Read as PDF NEVADA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $20,500 $20,500 to $35,100 $35,100 to $53,600 $53,600 to $90,200 $90,200 to $188,600 $188,600 to $473,600 over $473,600 […]

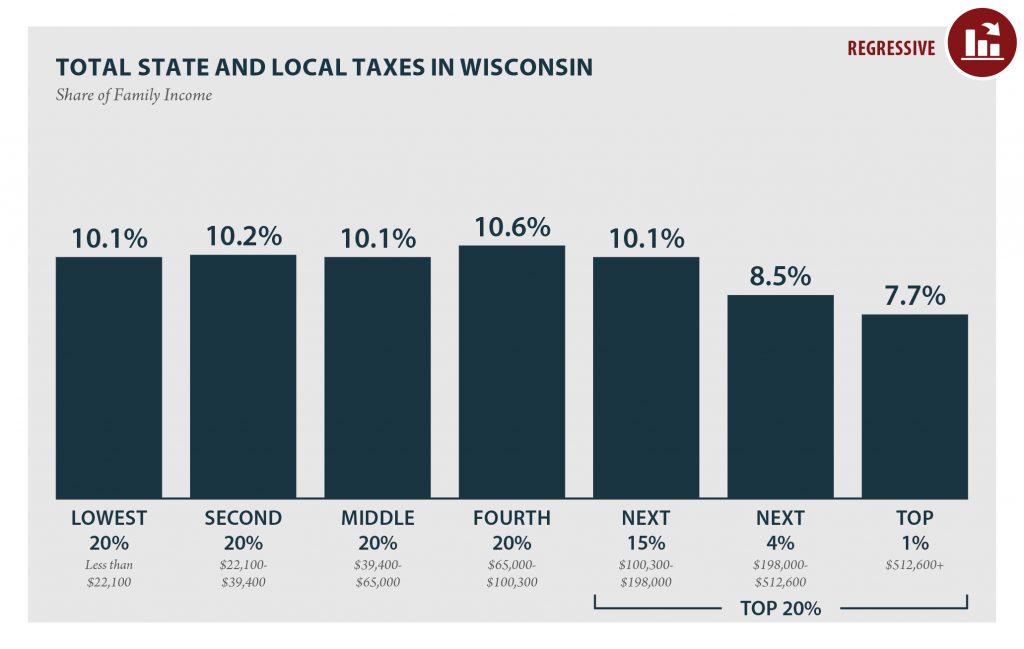

Wisconsin: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

WISCONSIN Read as PDF WISCONSIN STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $22,100 $22,100 to $39,400 $39,400 to $65,000 $65,000 to $100,300 $100,300 to $198,000 $198,000 to $512,600 over $512,600 […]

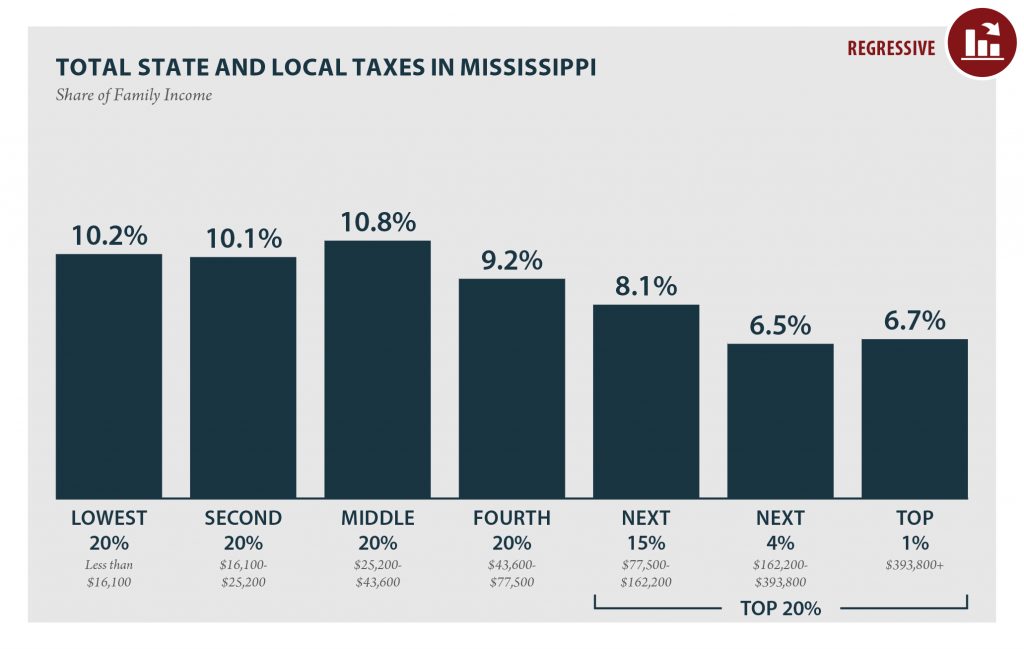

Mississippi: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

MISSISSIPPI Read as PDF MISSISSIPPI STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $16,100 $16,100 to $25,200 $25,200 to $43,600 $43,600 to $77,500 $77,500 to $162,200 $162,200 to $393,800 over $393,800 […]

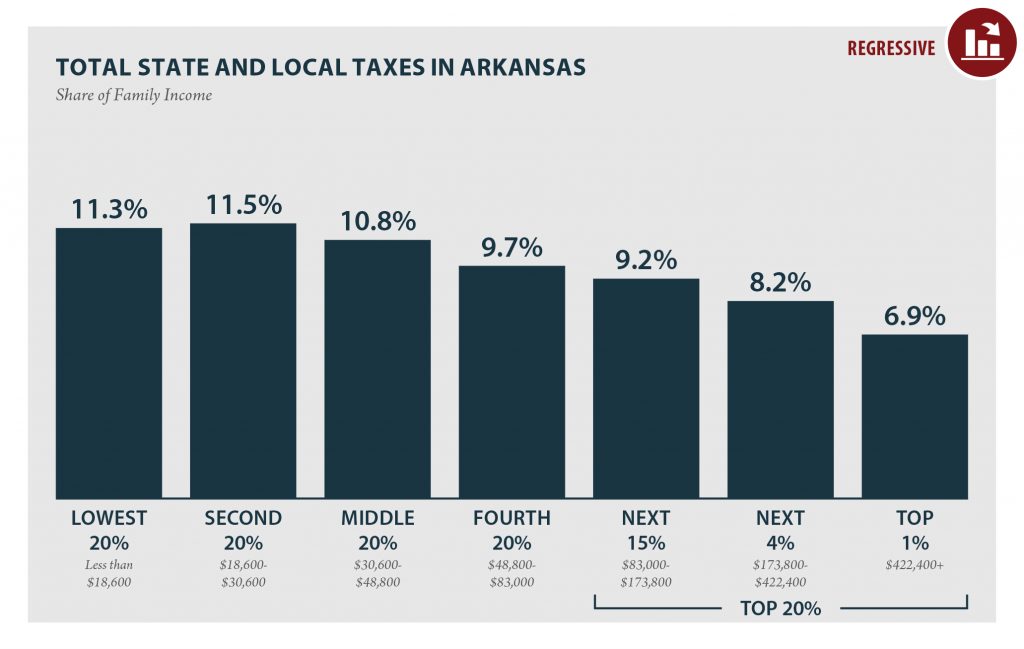

Arkansas: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

ARKANSAS Read as PDF ARKANSAS STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $18,600 $18,600 to $30,600 $30,600 to $48,800 $48,800 to $83,000 $83,000 to $173,800 $173,800 to $422,400 over $422,400 […]

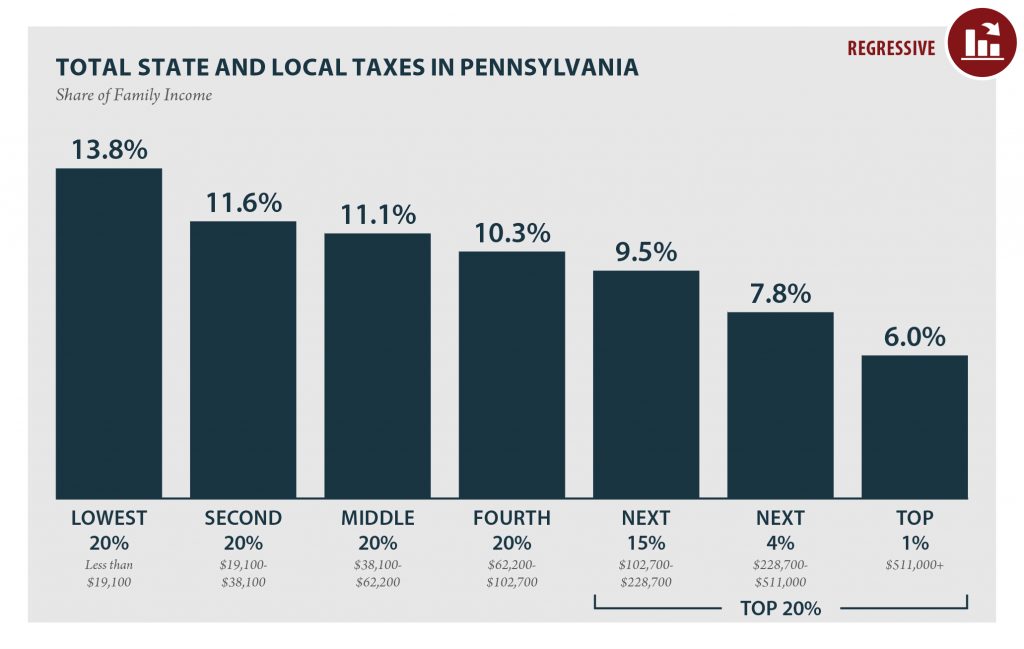

Pennsylvania: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

PENNSYLVANIA Read as PDF PENNSYLVANIA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,100 $19,100 to $38,100 $38,100 to $62,200 $62,200 to $102,700 $102,700 to $228,700 $228,700 to $511,000 over $511,000 […]

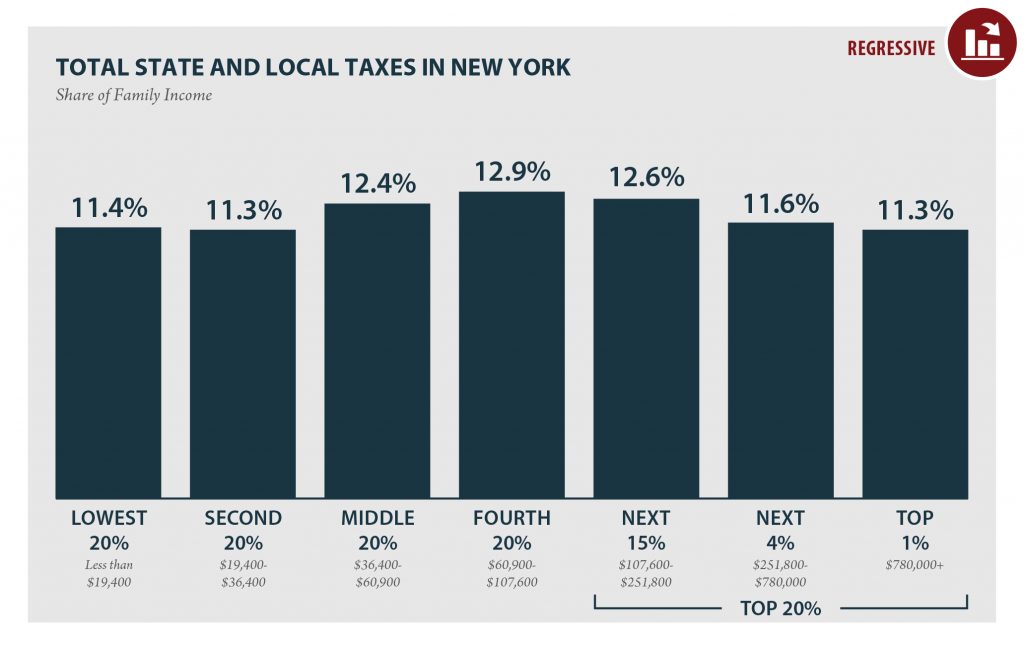

New York: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

NEW YORK Read as PDF NEW YORK STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,400 $19,400 to $36,400 $36,400 to $60,900 $60,900 to $107,600 $107,600 to $251,800 $251,800 to $780,000 […]

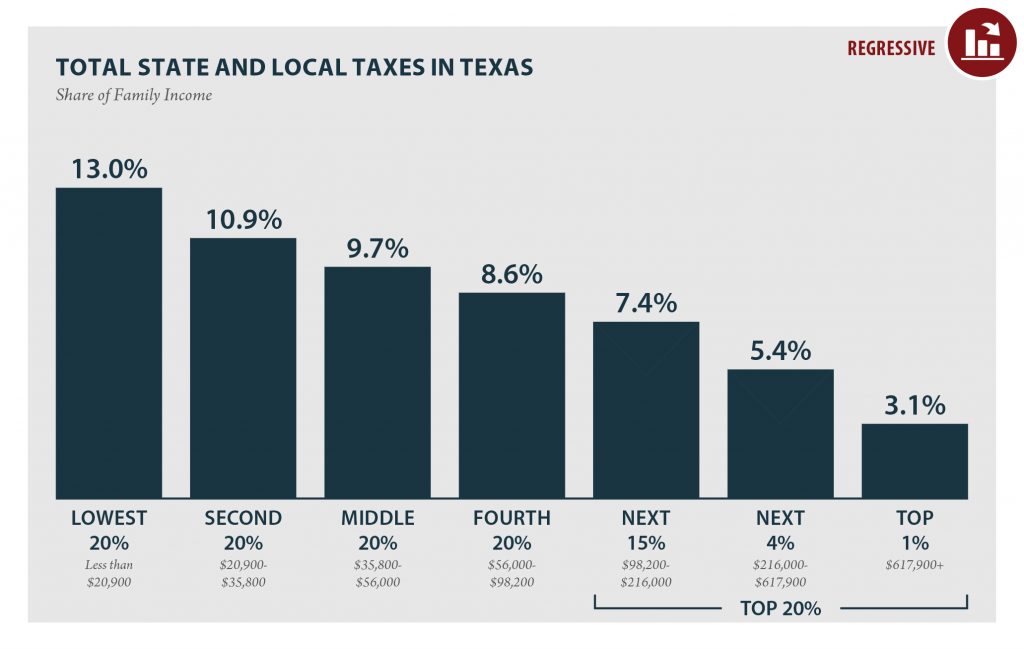

Texas: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

TEXAS Read as PDF TEXAS STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $20,900 $20,900 to $35,800 $35,800 to $56,000 $56,000 to $98,200 $98,200 to $216,000 $216,000 to $617,900 over $617,900 […]

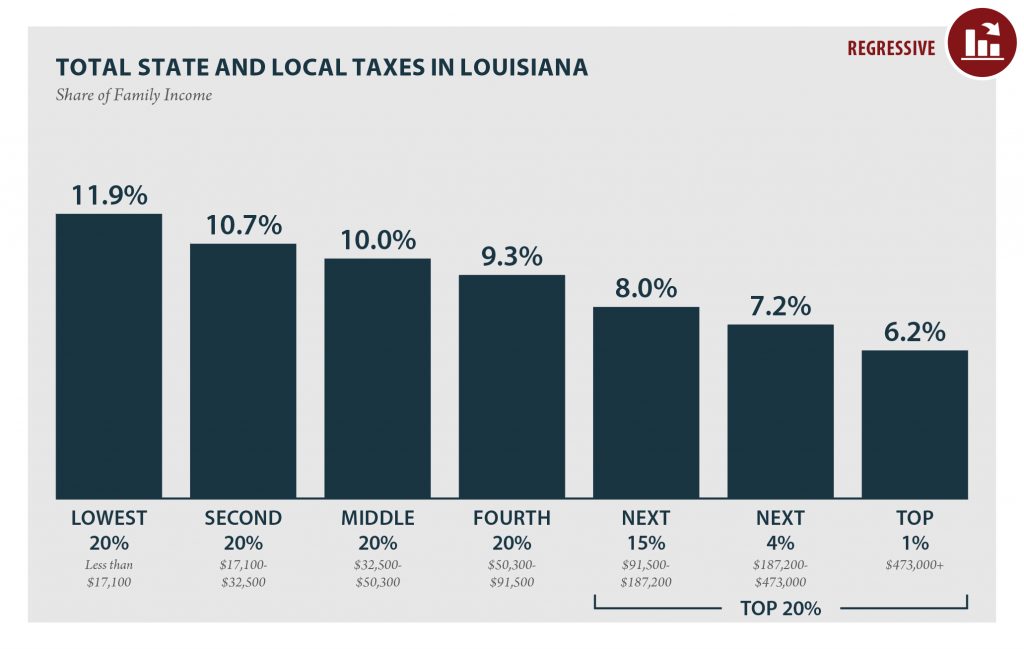

Louisiana: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

LOUISIANA Read as PDF LOUISIANA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $17,100 $17,100 to $32,500 $32,500 to $50,300 $50,300 to $91,500 $91,500 to $187,200 $187,200 to $473,000 over $473,000 […]

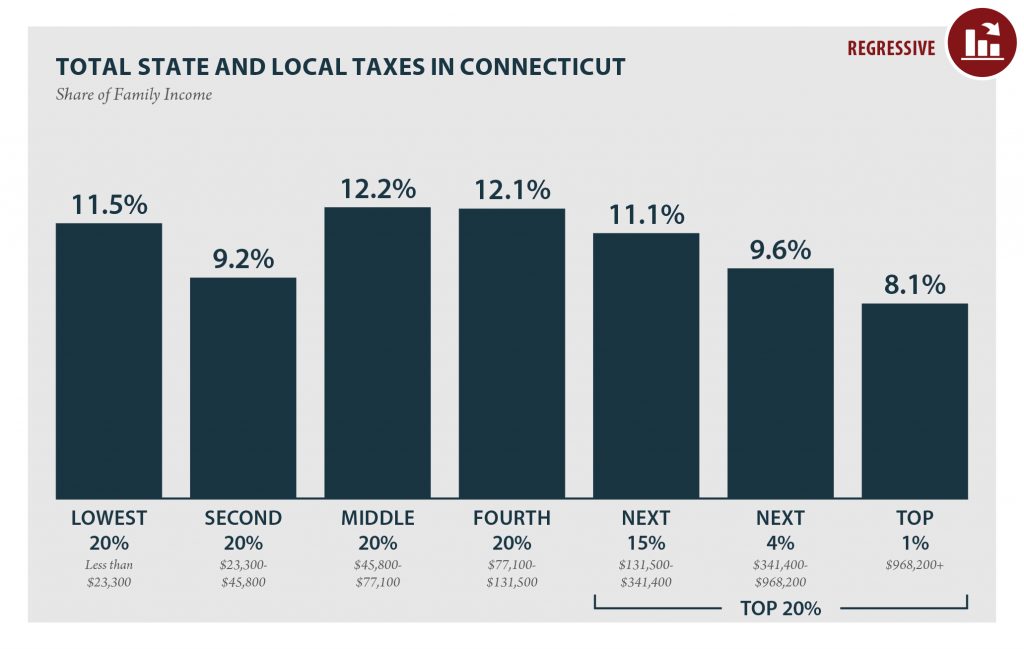

Connecticut: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

CONNECTICUT Read as PDF CONNECTICUT STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $23,300 $23,300 to $45,800 $45,800 to $77,100 $77,100 to $131,500 $131,500 to $341,400 $341,400 to $968,200 over $968,200 […]

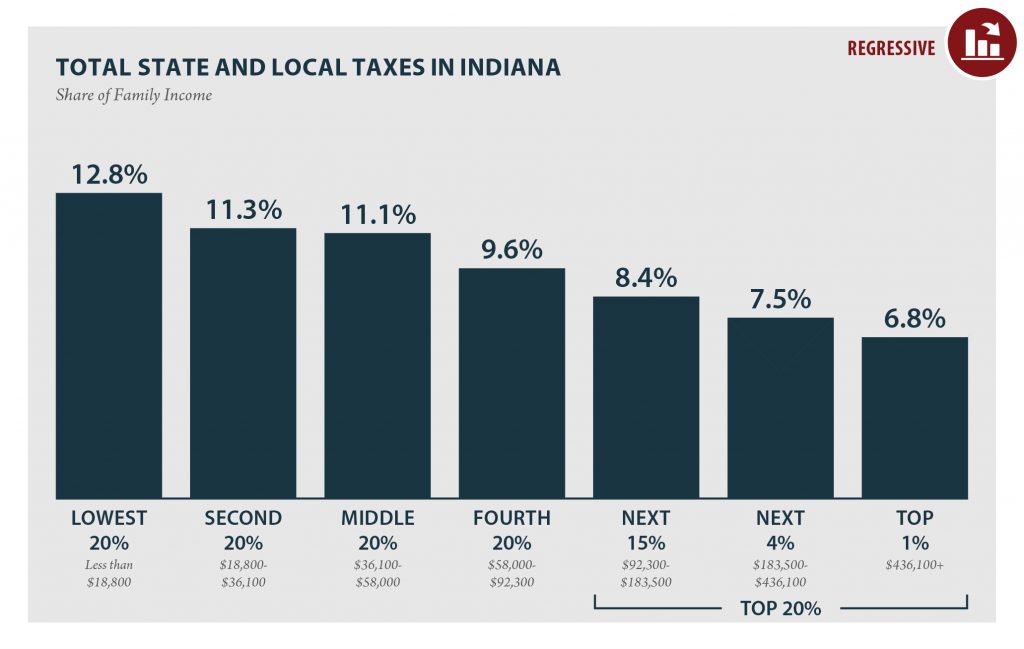

Indiana: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

INDIANA Read as PDF INDIANA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $18,800 $18,800 to $36,100 $36,100 to $58,000 $58,000 to $92,300 $92,300 to $183,500 $183,500 to $436,100 over $436,100 […]

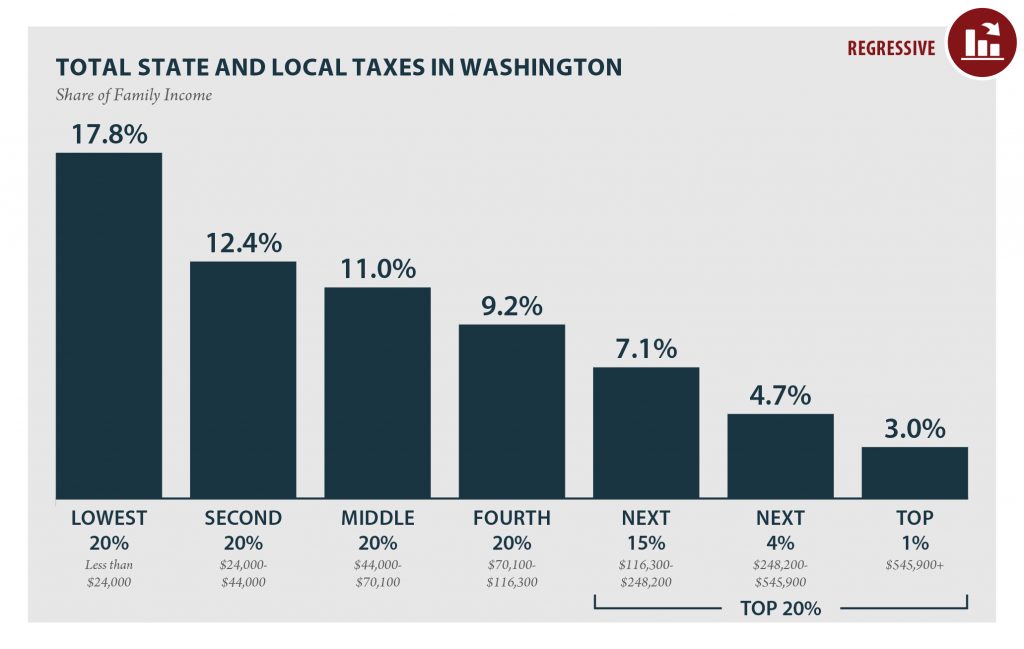

Washington: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

WASHINGTON Read as PDF WASHINGTON STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $24,000 $24,000 to $44,000 $44,000 to $70,100 $70,100 to $116,300 $116,300 to $248,200 $248,200 to $545,900 over $545,900 […]

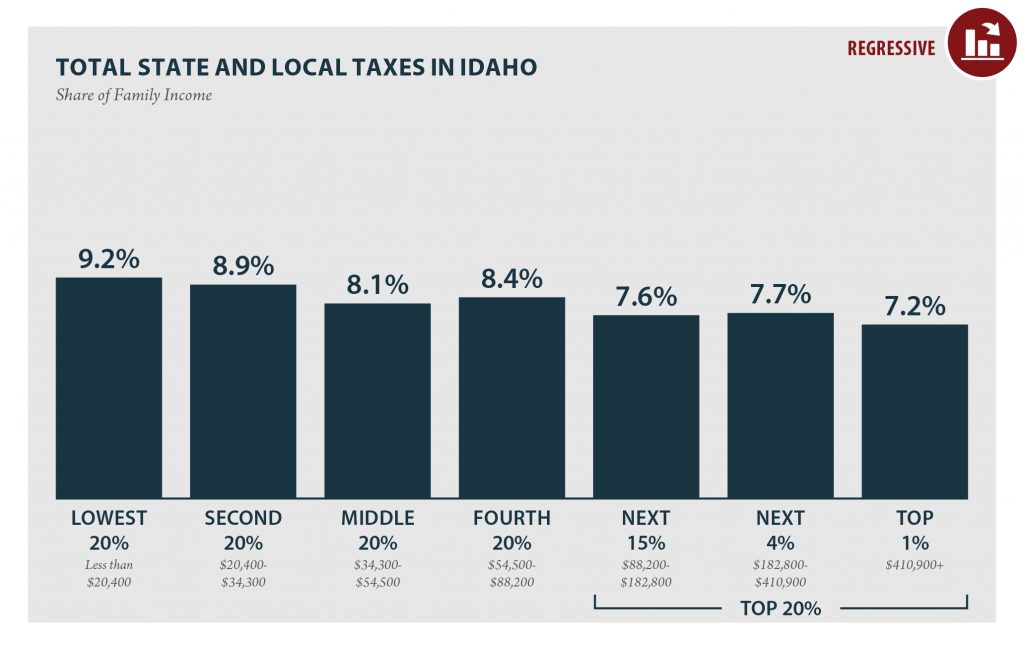

Idaho: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, which measures the impact of each state’s tax system on income inequality, Idaho has the 38th most unfair state and local tax system in the country. Incomes are more unequal in Idaho after state and local taxes are collected than before.

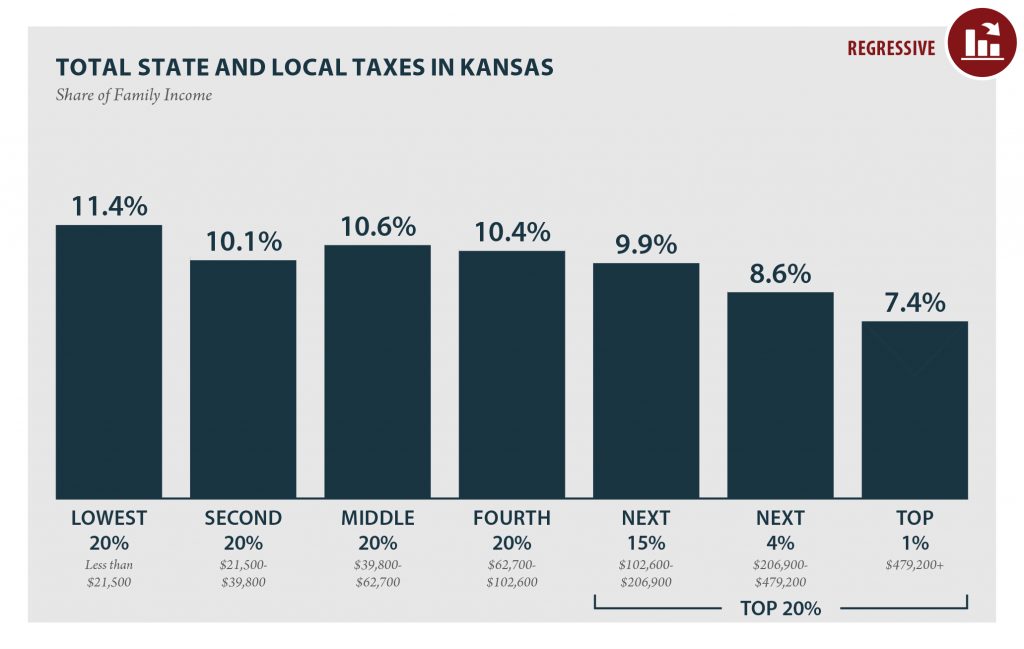

Kansas: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

KANSAS Read as PDF KANSAS STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $21,500 $21,500 to $39,800 $39,800 to $62,700 $62,700 to $102,600 $102,600 to $206,900 $206,900 to $479,200 over $479,200 […]

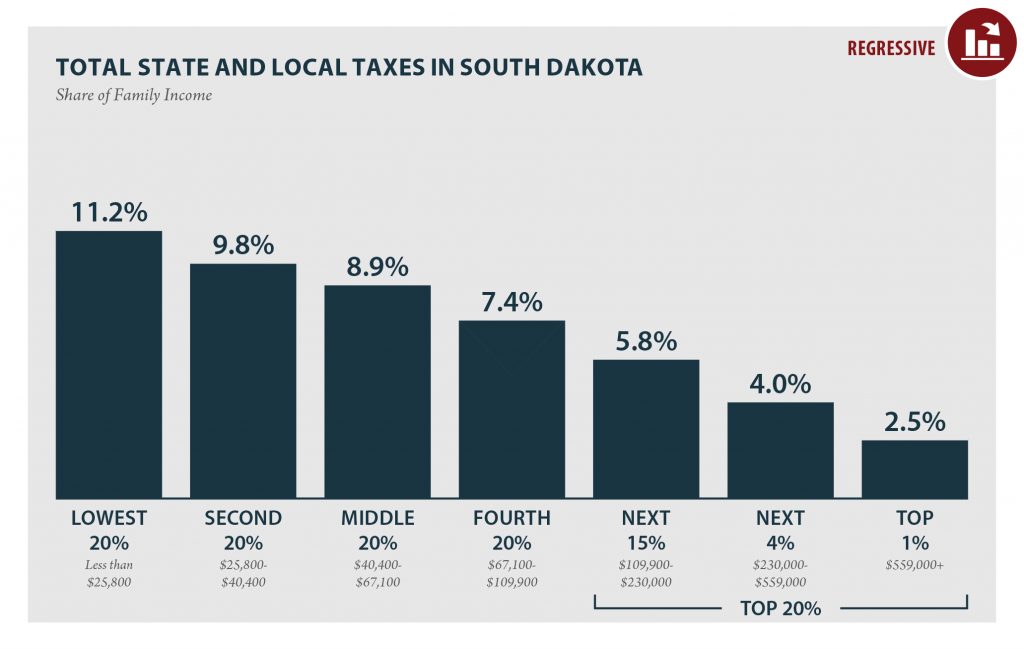

South Dakota: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

SOUTH DAKOTA Read as PDF SOUTH DAKOTA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $25,800 $25,800 to $40,400 $40,400 to $67,100 $67,100 to $109,900 $109,900 to $230,000 $230,000 to $559,000 […]

Low Tax for Whom?: Tennessee is a “Low Tax State” Overall, But Not for Families Living in Poverty

September 17, 2015 • By Meg Wiehe

Annual data from the U.S. Census Bureau appear to lend support to Tennessee's reputation as a "low tax state," ranking it 50th nationally in taxes collected as a share of personal income.1 But focusing on the state's overall tax revenues has led many observers to overlook the fact that different taxpayers experience Tennessee's tax system very differently. In particular, the poorest 20 percent of Tennessee residents pay significantly more of their income (10.9 percent) in state and local taxes than any other group in the state. For low-income families, Tennessee is far from being a low tax state.2 In fact,…

Read the Report in PDF The 2015 Who Pays: A Distributional Analysis of the Tax Systems in All Fifty States (the fifth edition of the report) assesses the fairness of state and local tax systems by measuring the state and local taxes that will be paid in 2015 by different income groups as a share […]

Who Pays? A Distributional Analysis of the Tax Systems in All 50 States is the Institute on Taxation and Economic Policy’s flagship report. First published in 1996, and updated most recently in 2024, Who Pays? shows the distributional impact by income level of all major state and local taxes in each state, as well as in the District of Columbia. This section highlights related Who Pays? resources, articles and information.