Colorado

State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug […]

State Rundown 1/8: States Need Clear Tax and Budget Policy Vision in 2020

January 8, 2020 • By ITEP Staff

Happy New Year readers! The Rundown is back to our usual weekly schedule as state legislative sessions and governors’ budgets and State of the State Addresses begin in earnest. Here’s to clear-eyed 20-20 vision guiding state tax and budget decisions in 2020! So far this year, the harm of Colorado’s TABOR policy and Alaska’s lack of an income tax are coming into focus in big ways. Utah advocates are hoping the benefit of hindsight will help convince voters to overturn a recently enacted tax overhaul. Lawmakers in states including Iowa, Maryland, and Virginia can clearly see a need for revenues,…

In the last few weeks, Florida Gov. Ron DeSantis has served up his budget proposal, which advocates are eager to dig into and hoping to contribute to with a delectable Earned Income Tax Credit proposal of their own. Utah lawmakers have been cooking up tax ideas as well, but haven’t yet decided when to come to the table to debate them. And Maryland leaders finalized their menu of needed education reforms, now moving on to assigning responsibilities for funding them. With respect to dividing up the pie, our “What We’re Reading” section below includes reporting on evidence that corporate tax…

State Rundown 11/6: State Voters Show Readiness to Fix Broken Tax Codes

November 6, 2019 • By ITEP Staff

Many of yesterday’s Election Day votes came down to questions of whether or not to improve on upside-down and often inadequate state and local tax systems. The status quo was maintained in Colorado, where voters failed to approve a proposition to allow the state to invest tax revenue in education and other needs, and in Texas, where a constitutional amendment was approved to prohibit the state from creating an income tax. But voters supported important reforms in other states by approving needed funding for schools in Idaho, opting to legalize and tax recreational cannabis in California. And for more on…

State Rundown 10/24: State Tax Talk Makes Like a Tree and Gets Colorful

October 24, 2019 • By ITEP Staff

As autumn brings a colorful display of foliage to many states, so too are tax proposals taking on interesting hues as states move from the summer off-season toward 2020 legislative sessions. Ohio lawmakers are blue in the face from debating and re-debating tax and budget issues there. Maryland residents again showed they can’t be called yellow-bellied when it comes to footing the bill for needed education improvements, showing their broad support for higher taxes to fund those needs even despite a hefty price tag. Alaska, Michigan, and other states are giving the green light to laws implementing their new ability…

State Rundown 10/10: Always Something Old, Something New in State Tax Debates

October 10, 2019 • By ITEP Staff

Creative thinking from Pennsylvania lawmakers has helped them discover that the Wayfair ruling allowing states to collect sales tax from online retailers can also help them identify and tax corporate profits earned in their borders. Similarly, New York leaders had the vision to put bold environmental goals in place and identify a carbon price as a potential pay-for. Gubernatorial candidates in Mississippi and Kentucky showed less ingenuity, proposing tax cuts even though Mississippi is still phasing in a massive tax cut from a few years ago and Kentucky’s next election isn’t until 2020. Meanwhile, the old idea of eliminating income…

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

State Rundown 9/12: Work Continues to Flip the Script on Backwards Tax Codes

September 12, 2019 • By ITEP Staff

Residents of several states are spending their palindrome week reading ballot initiatives forwards and backwards to decide whether or not to support them, including measures to improve education funding in California and Idaho, allow Alaska and Colorado to invest more in public services, and constitutionally prohibit income taxation in Texas. New Jersey lawmakers are giving the same thorough treatment to the state’s corporate tax subsidies. And advocates in Chicago, Illinois, have a bold proposal to flip the script on upside-down taxes there. But devotees of good policy and honest government in North Carolina won’t want to re-read yesterday’s news in…

The hottest, stickiest month of the year has left a grimy feeling on several state tax debates, as Idaho lawmakers find themselves unable to fund the state’s priorities after years of cutting taxes, Alaskans express their support for public investments to their governor’s polling office and then watch the governor slash them anyway, New Jersey lawmakers go to bat for ineffective and corrupt business tax subsidies, and residents of North Carolina watch their representatives pursue cheap political points over sound investments and thoughtful policy. Nonetheless, residents and advocates on the other side of these and other debates have fought long…

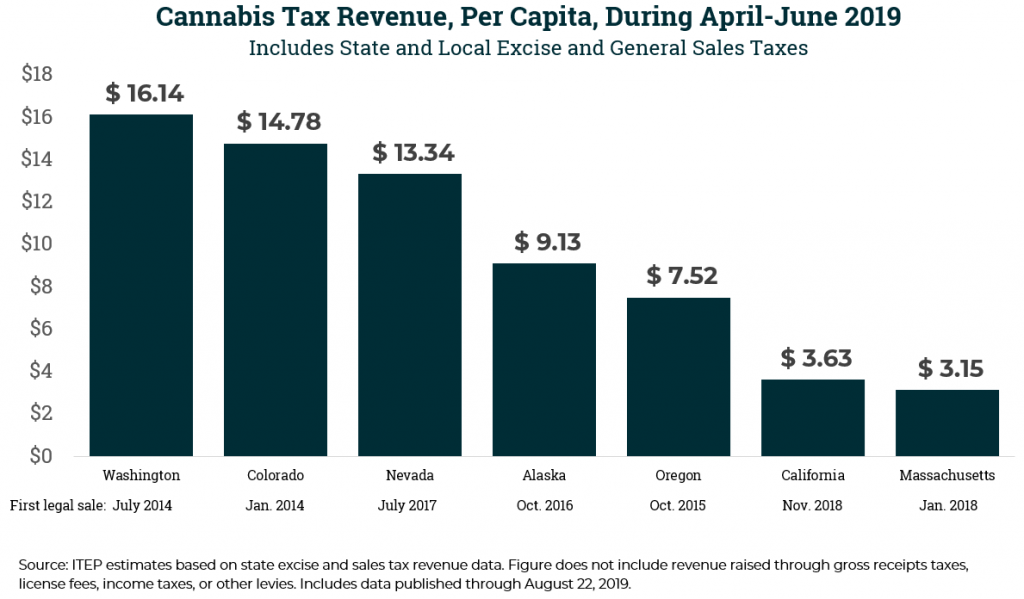

NPR: California Says Its Cannabis Revenue Has Fallen Short Of Estimates, Despite Gains

August 23, 2019

“After adjusting for population, the Golden State raised the second-least amount of revenue from cannabis taxes during the second quarter among states with legal sales, ahead of only Massachusetts,” according to the Institute on Taxation and Economic Policy. The result was a departure from the spikes seen in states such as Colorado, Washington and Oregon […]

Why California’s Cannabis Market May Not Tell You Much about Legalization in Your State

August 22, 2019 • By Carl Davis

New tax data out of California, the world’s largest market for legal cannabis, tell a complicated story about the cannabis industry and its tax revenue potential. Legal cannabis markets take time to establish, and depending on local market conditions, the revenue states raise can vary significantly.

Governing: High on Pot Taxes

August 20, 2019

But even with maximized revenue, pot taxes will likely only account for about 1 percent of overall state budgets, according to the Institute on Taxation and Economic Policy. The $266 million Colorado collected in 2018, for instance, pales next to the state’s $15 billion in total revenues and $32 billion budget. Read more

State Rundown 8/15: A Tax-Subsidy Cease-Fire in Kansas and Missouri

August 15, 2019 • By ITEP Staff

Over the last couple of weeks, leaders in Kansas and Missouri reached a historic agreement to stop giving away tax subsidies just to entice companies a couple of miles across their shared state line. Meanwhile, policymakers in Alaska resolved a stand-off over education funding...by cutting education funding slightly less. And California voters may be voting in 2020 on a stronger reform to the notoriously inequitable property tax effects of “Proposition 13.”

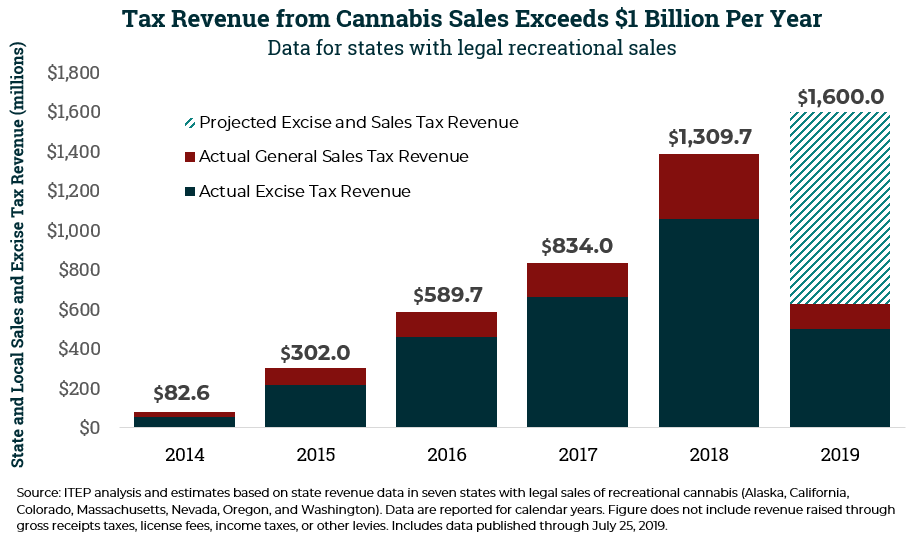

State and Local Cannabis Tax Revenue on Pace for $1.6 Billion in 2019

August 7, 2019 • By Carl Davis

Cannabis tax revenue is becoming more significant as legal sales grow. The tax is far from a budgetary panacea, but an ITEP analysis of revenue data reported by the seven states with legal cannabis sales underway suggests that excise and sales tax revenues from the sale of the drug could reach $1.6 billion this year.

OHIO legislators passed a budget with unfortunate income tax cuts for high-income households. Other states turned their attention to unconventional ideas during their legislative off-seasons, for better and for worse. And there are many gems to be found in our “What We’re Reading” section below, including new research on the racial inequities that continue to pervade our communities and schools.

We've said it before, and we'll say it again: states don't have to wait for federal lawmakers to make moves toward progressive tax policy. And so far, 2019 has been a good year for equitable and sustainable tax policy in the states. With July 1 marking the start of a new fiscal year for most states, this special edition of the Rundown looks at how discussions in 2019 have been dominated by plans to raise revenue for vital investments, tax the rich and corporations fairly, use the tax code to help workers and families and advance racial equity, and shore…

State Rundown 6/27: States Look at Raising Incomes at the Bottom, Taxes at the Top

June 27, 2019 • By ITEP Staff

Low-income working families got good news and bad news this week, as Earned Income Tax Credit (EITC) enhancements passed in California and advanced in Oregon, while minimum wage increases failed in Pennsylvania, Rhode Island, and Wisconsin. Meanwhile, the momentum for taxing wealth and the very rich continued to grow, as more one-percenters called for enacting progressive taxes, and Inequality.org held a star-studded conference on why and how to do so.

State Rundown 6/19: Juneteenth Highlights Role of State Policy in Racial Equity Fight

June 19, 2019 • By ITEP Staff

As Americans observe Juneteenth today–the day two years after the Emancipation Proclamation on which news of the end of the Civil War and slavery reached some of the last slaves in Texas—most people’s attention should be on celebrating victories, remembering losses, gathering strength to continue the fight for racial justice, and the accompanying Congressional reparations hearings. In comparison, state tax debates over matters such as reluctance to invest in infrastructure in Michigan and Missouri, approval of income tax cuts in Wisconsin, and a budget standoff in New Jersey may seem unimportant and irrelevant. But we encourage our readers to think about how state policies often serve to enrich and empower white and wealthy households, and…

KEYE TV: Colorado made $1B in marijuana tax revenue: What could this mean for federal legalization?

June 13, 2019

Tax experts explained that government revenue from cannabis is not a panacea for solving the country’s budget issues, but it could certainly help. According to a study by Carl Davis, the research director at the Institute on Taxation and Economic Policy, a federal push to legalize marijuana and regulate commercial sales could potentially generate nearly […]

Illinois made big news in several tax and budget areas recently, including sending a graduated income tax amendment to voters in 2020, as well as legalizing and taxing cannabis and updating gas and cigarette taxes for infrastructure improvements. Connecticut made smaller waves with sales tax reforms, a plastic bag tax, and a progressive mansion tax. Property tax credits were proposed in both Maine and New Jersey. And Nevada extended a business tax to give teachers a raise. And our What We’re Reading section is brimming with good reads on how states are doing with recovering from the Great Recession, funding…

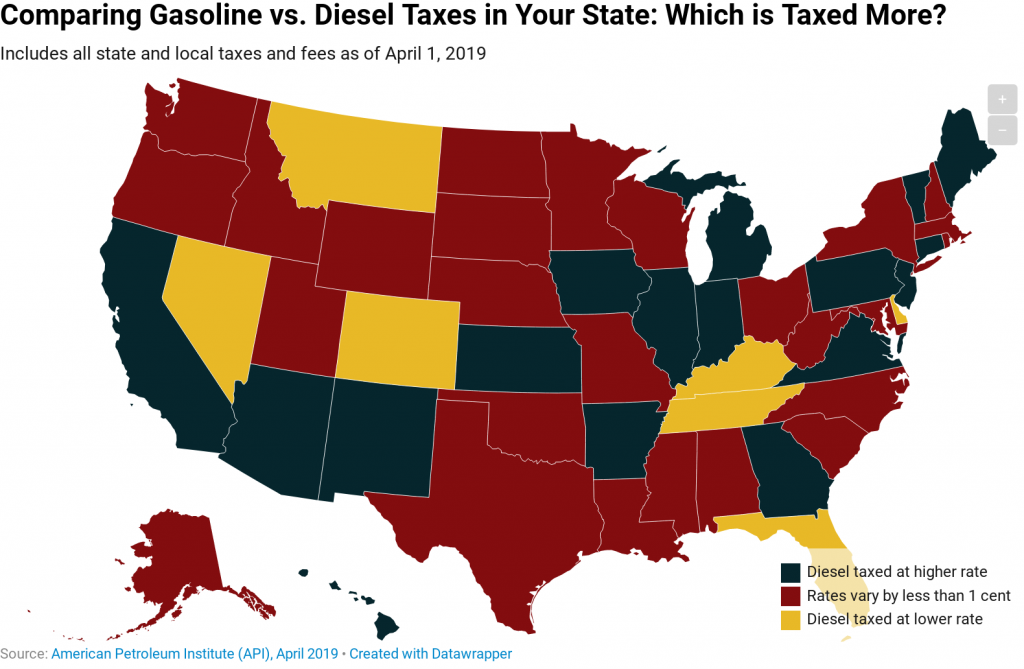

Twenty-six states and the District of Columbia tax these two fuel types at the same rate or very similar rates, as of April 2019, according to data from the American Petroleum Institute.

State Rundown 5/9: Illinois Moves Closer to a Progressive Income Tax

May 9, 2019 • By ITEP Staff

Lawmakers in Illinois and Ohio have advanced major tax proposals but cannot rest just yet, as they must still get past the other legislative chamber. Their counterparts in Michigan, Minnesota, Nebraska, and Oregon, meanwhile, are all at impasses over education funding, as those in Texas left their school funding disagreement unresolved at least until they reconvene...in 2021. And in an era of many states pre-empting smaller jurisdictions by revoking local decision-making powers, leaders in Colorado and Delaware made moves in the opposite direction, entrusting cities and school districts with more local control.

Teachers in North Carolina and South Carolina are walking out and rallying this week for increased education funding, teacher and staff pay, and other improvements to benefit students—if you’re unsure why be sure to check out research on the teacher shortage and pay gap under “What We’re Reading” below. Meanwhile, budget debates have recently wrapped up in Indiana, Iowa, Massachusetts, New Hampshire, and Washington. And major tax debates are kicking into high gear in both Louisiana and Nebraska.

Tax and budget debates are now mostly complete in Alabama, Arkansas, and Colorado, but just starting or just getting interesting in several other states. Delaware and Massachusetts lawmakers, for example, are looking at progressive income tax increases on wealthy households, and New Hampshire may use a progressive tax on capital gains to simultaneously improve its upside-down tax code and invest in education. Nebraska and Texas, on the other hand, are also looking to improve school funding but plan to do so on the backs of low- and middle-income families through regressive sales tax increases. Fiscal debates are heating up in…

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…