Connecticut

State Rundown 5/11: Mid-Year Special Elections and Primary Season Kicks Off with Taxes in the Spotlight

May 11, 2022 • By ITEP Staff

As 2022 inches closer to its midpoint, important tax policy decisions are being put in the hands of voters, as special elections and the primary season begin...

While tax discussions among federal lawmakers continue in fits and starts, major tax news continues to make waves across the nation...

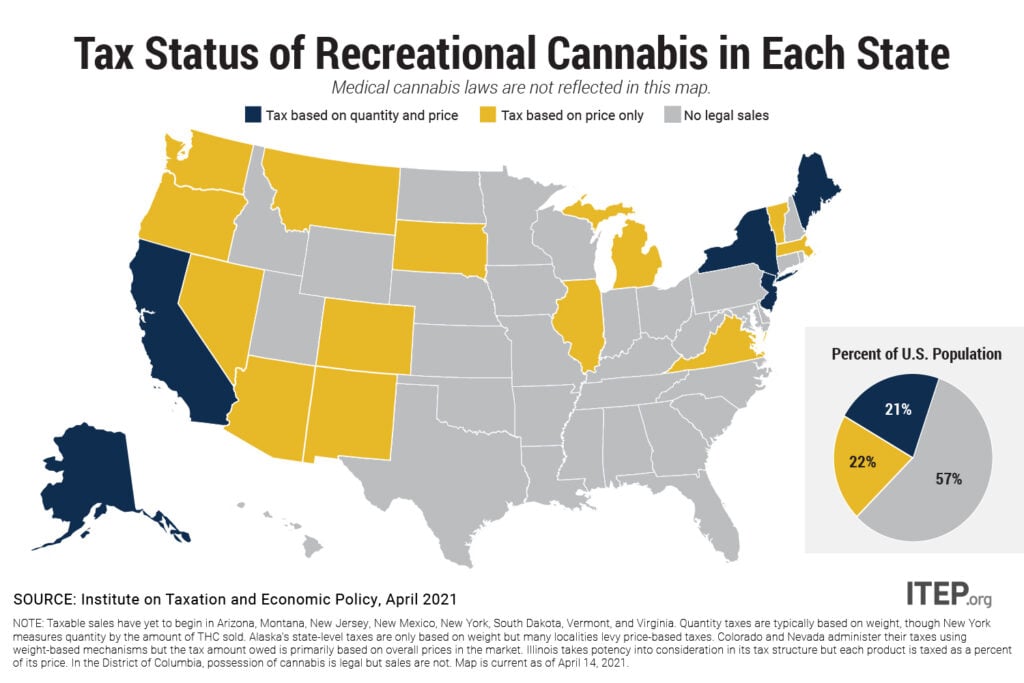

Eighteen states have legalized the sale of cannabis for general adult use and sales are already underway in 10 of those states. Every state allowing legal sales applies an excise tax to cannabis based on the product’s quantity, its price, or both. Quantity taxes are typically based on weight, though New York measures quantity by the amount of THC sold. ITEP research indicates that taxes based on quantity will be more sustainable over time because prices are widely expected to fall as the cannabis industry matures. Most states allowing for legal cannabis sales apply their general sales taxes to the…

State Rundown 4/13: Recent State Budgets Prove Not All Tax Cuts are the Same

April 13, 2022 • By ITEP Staff

Two prominent blue states made headlines this past week when they passed budget agreements that include relief for taxpayers, and fortunately, the budget plans don’t include costly tax cuts that primarily benefit the wealthy...

Last week we highlighted how several states were pushing through regressive tax cuts as their legislative sessions are coming to a close. Well, this week many of those same states took further actions on those bills and it’s safe to say we’re even less impressed than before...

Several states have dropped a few late-session surprises, and from the looks of it, they’re not the good kind...

Spring is around the corner and like those pesky allergies that come along with it, equally pesky tax proposals continue to pop up in states across the U.S....

State Rundown 3/9: One State Stands Out Amid the Avalanche of Tax Cuts

March 9, 2022 • By ITEP Staff

The avalanche of regressive tax-cut proposals coming out of state legislatures has not slowed over the course of the winter months, but one state has provided a shot of hope to advocates of tax equity...

ITEP is happy to announce the launch of our new State Tax Watch page, where you can find out about the most up-to-date tax proposals and permanent legislative changes happening across the country...

While record state revenue surpluses have led to big pushes in red states to make unnecessary permanent income and corporate tax cuts, Democrats are also getting in on the tax-cut mania...

One-time payments have become a common theme around the country, as Idaho is one of roughly eleven states with plans to provide tax relief in a similar fashion...

Connecticut Voices for Children: Steps to a Fairer Tax System

February 1, 2022

Although Connecticut has the second highest level of per capita personal income in the US, making it exceptionally wealthy overall, many families consistently struggle because Connecticut also has the second highest level of income inequality and a substantial racial income gap, meaning a small, disproportionately white portion of the population primarily benefits from the state’s […]

State Rundown 1/26: States Offering Preview of Tax Themes and Trends for 2022

January 26, 2022 • By ITEP Staff

Governors and legislators are beginning to settle on and advance tax bills that could drastically shape the future of their states and several trends and themes are beginning to emerge...

State Rundown 1/13: The Tax Cuts Cometh, But There Is a Better Way

January 13, 2022 • By ITEP Staff

As expected, with the start of many new legislative sessions around the country, lawmakers have introduced a slew of tax cut plans following better-than-expected budget outlooks that have, so far, weathered the impact of the pandemic...

The new year often brings with it a reinvigorated commitment to new goals and a fresh perspective on how to accomplish them, but it seems like lawmakers in states around the country are giving up already...

State Rundown 12/15: Making Our State Tax Naughty or Nice List & Checking it Twice

December 15, 2021 • By ITEP Staff

As the holiday season kicks into full gear, we’re putting the finishing touches on our State Tax Naughty or Nice list, and it looks like some late entrants are making a good case to be included...

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2021

October 21, 2021 • By Aidan Davis

The EITC benefits low-income people of all races and ethnicities. But it is particularly impactful in historically excluded Black and Hispanic communities where discrimination in the labor market, inequitable educational systems, and countless other inequities have relegated a disproportionate share of people to low-wage jobs.

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

New Census Data Highlight Need for Permanent Child Tax Credit Expansion

September 14, 2021 • By Neva Butkus

The status quo was a choice, but the Census data released today shows that different policy choices can create drastically different outcomes for children and families. It is time for our state and federal legislators to put people first when it comes to recovery.

Labor Day is around the corner and in the spirit of celebrating the achievements of workers around the country, we here at ITEP want to call attention to the states (and territories) that are using tax policy to support workers and residents alike...

Options to Reduce the Revenue Loss from Adjusting the SALT Cap

August 26, 2021 • By Carl Davis, ITEP Staff, Matthew Gardner, Steve Wamhoff

If lawmakers are unwilling to replace the SALT cap with a new limit on tax breaks that raises revenue, then any modification they make to the cap in the current environment will lose revenue and make the federal tax code less progressive. Given this, lawmakers should choose a policy option that loses as little revenue as possible and that does the smallest amount of damage possible to the progressivity of the federal tax code.

Summer is quickly (and sadly) coming to an end and if you’ve been away enjoying the great outdoors or off the grid, we’re here to help keep you up to date on what’s been happening on the tax front around the country...

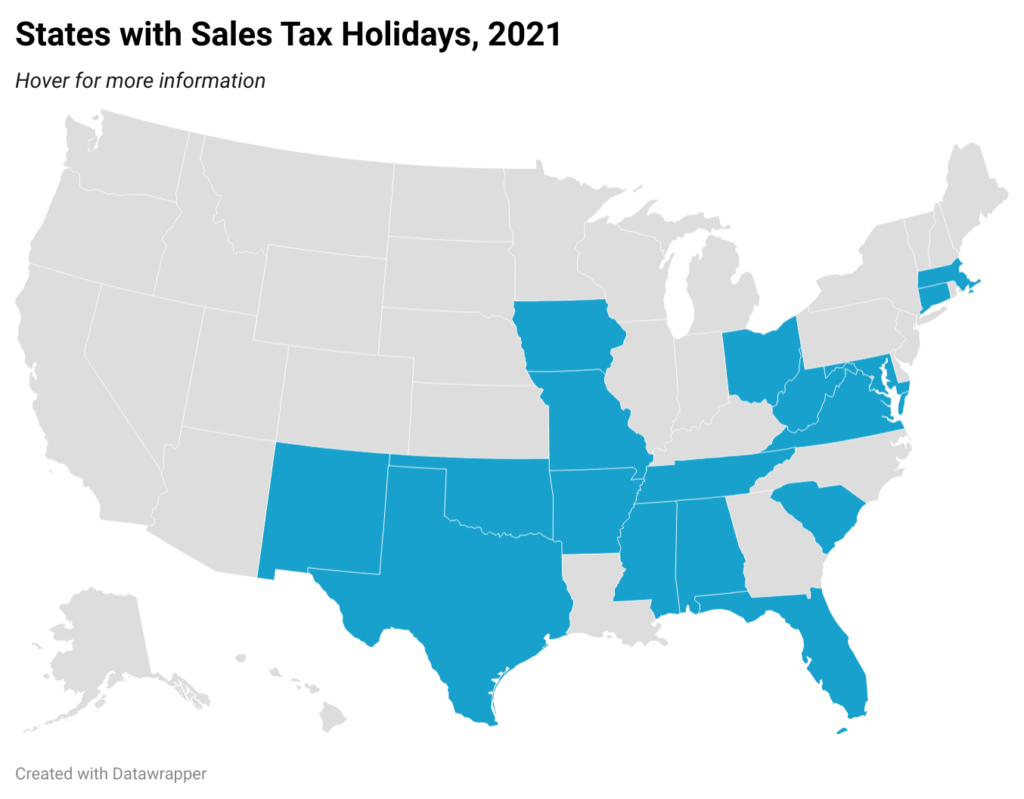

State Experimentation with Sales Tax Holidays Magnifies Their Flaws

August 6, 2021 • By Dylan Grundman O'Neill

It’s back-to-school shopping season, so…everyone who buys a cell phone in Arkansas this weekend will do so sales-tax-free. For this whole week in Connecticut, and for the entire spring in New Mexico, the corporate owners of highly profitable multinational restaurant chains had the option to pocket their customers’ taxes rather than remit them to the state to fund vital public services, pass along those savings to their customers, or give a much-needed boost to their employees. And all told, about $550 million of state and local revenue will be forgone in 17 states this year through wasteful and poorly targeted…

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

State Rundown 8/4: Tis the Season…for Unnecessary Sales Tax Holidays

August 4, 2021 • By ITEP Staff

It’s beginning to look a lot like that time of year again. That’s right, it’s sales tax holiday season and states across the country are doing their best to induce spending that would probably occur regardless...