Corporate Tax Watch

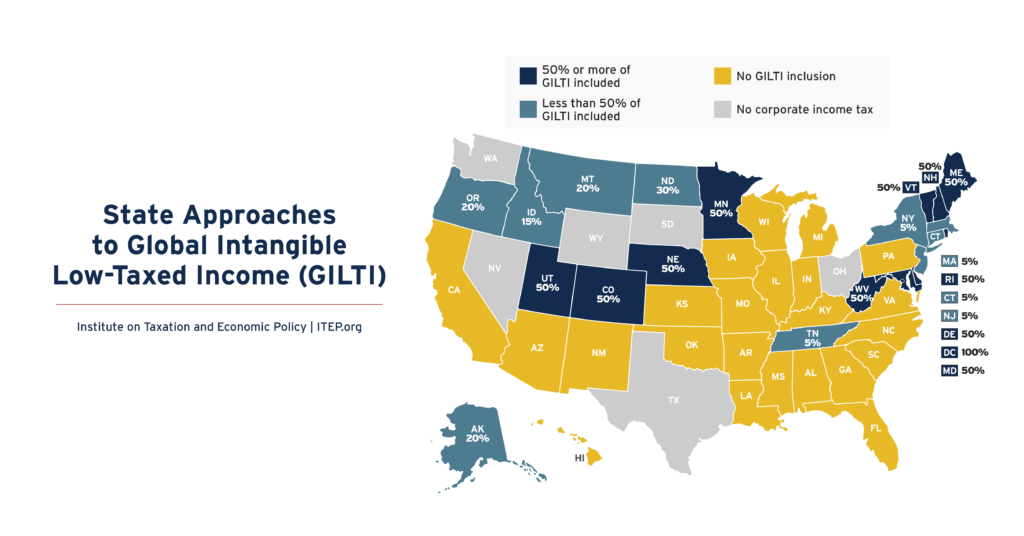

Many states with corporate income taxes include some amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases. Twenty-one states plus D.C. include some amount of GILTI in their tax calculations in 2025.

In last night’s address to Congress, President Trump spent more time insulting Americans, lying, and bragging than he did talking about taxes. But regardless of what President Trump and Elon Musk talk about most loudly and angrily, there is one clear policy that they and the corporations and billionaires that support them will try hardest […]

A Revenue Analysis of Worldwide Combined Reporting in the States

February 20, 2025 • By Carl Davis, Matthew Gardner, Michael Mazerov

Universal adoption of mandatory worldwide combined reporting would boost state corporate income tax revenues by roughly 14 percent. Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion.

The Five Biggest Corporations Represented at Trump’s Inauguration Could Save $75 Billion from One Tax Break Before Congress

February 11, 2025 • By Matthew Gardner, Spandan Marasini

New financial reports indicate five of America’s biggest corporations—Alphabet, Amazon, Apple, Meta, and Tesla—could win $75 billion in tax breaks if Congress and the President satisfy demands from corporate lobbyists to reinstate a provision repealed under the 2017 Trump tax law.

Tesla Reported Zero Federal Income Tax on $2 Billion of U.S. Income in 2024

January 30, 2025 • By Matthew Gardner

Tesla reported $2.3 billion of U.S. income in 2024 but paid zero federal income tax. Over the past three years, the Elon Musk-led company reports $10.8 billion of U.S. income on which its current federal tax was just $48 million.

As we close out 2024, we want to lift up the tax charts we published this year that received the most engagement from readers. Covering federal, state, and local tax work, here are our top charts of 2024.

Billionaires and businesses have too much power in Washington. Tax revenue is needed to pay for things we all need. If we want economic justice, racial justice and climate justice, we must have tax justice.

How Tax Decisions in 2025 Can Advance Racial Justice

October 30, 2024 • By Brakeyshia Samms, Jon Whiten

In the coming 14 months, federal lawmakers should address longstanding issues of racism in the tax code. With a presidential election this fall and many provisions of 2017’s Trump tax law expiring at the end of 2025, the debate over tax policy and economic fairness is in full swing.

The tax proposals from Vice President Kamala Harris would, on average, lead to a tax increase for the richest 1 percent of Americans and a tax cut for all other income groups.

Fifteen Companies Each Avoided More than $1 Billion in Taxes from a Single Trump Tax Cut

October 10, 2024 • By Joe Hughes, Spandan Marasini

The deduction for Foreign-Derived Intangible Income (FDII), one of the tax cuts included in former President Trump’s signature 2017 tax law, provides a lower effective tax rate on income earned from intangible assets, such as patents, trademarks, and other forms of intellectual property. Since the law went into effect in 2018, 15 corporations have separately reported more than $1 billion in tax benefits. Alphabet (the parent company of Google) reported the most, at more than $11 billion in tax breaks from 2018 to 2023. Other beneficiaries include large tech firms such as Meta, Microsoft, Intel, and Qualcomm.

A Distributional Analysis of Donald Trump’s Tax Plan

October 7, 2024 • By Carl Davis, Erika Frankel, Galen Hendricks, Joe Hughes, Matthew Gardner, Michael Ettlinger, Steve Wamhoff

Former President Donald Trump has proposed a wide variety of tax policy changes. Taken together, these proposals would, on average, lead to a tax cut for the richest 5 percent of Americans and a tax increase for all other income groups.

Major tax cuts were largely rejected this year, but states continue to chip away at income taxes. And while property tax cuts were a hot topic across the country, many states failed to deliver effective solutions to affordability issues.

Corporate Tax Breaks Contribute to Income and Racial Inequality and Shift Resources to Foreign Investors

July 16, 2024 • By Emma Sifre, Steve Wamhoff

Corporate tax cuts and corporate tax avoidance worsen income and racial inequality in our country. Most of the benefits flow to foreign investors and the richest 20% of Americans.

Who Benefits and Who Pays: How Corporate Tax Breaks Drive Inequality

June 27, 2024 • By Emma Sifre, Steve Wamhoff

Corporate tax breaks and corporate tax avoidance significantly contribute to income and racial inequality and largely benefit foreign investors.

SCOTUS Rejects Expansion of Trump’s Corporate Tax Cuts, Leaves Broader Tax Questions for Another Day

June 20, 2024 • By Steve Wamhoff

The Supreme Court matters, for tax fairness as for every other part of our lives. Whether or not we ever have a government that taxes billionaires as much as it taxes the rest of us will depend on how the Supreme Court rules in the future and who appoints justices to the Court.

Corporate Taxes Before and After the Trump Tax Law

May 2, 2024 • By Matthew Gardner, Michael Ettlinger, Spandan Marasini, Steve Wamhoff

The Trump tax law slashed taxes for America’s largest, consistently profitable corporations. These companies saw their effective tax rates fall from an average of 22.0 percent to an average of 12.8 percent after the Trump tax law went into effect in 2018.

Biden Is Right: Corporate Tax Avoidance Has Big Problems That We Can Fix

April 1, 2024 • By Jon Whiten

Sensible reforms to the corporate tax system can help both crack down on corporate tax avoidance and ensure companies that are flourishing are paying their share for the public infrastructure that forms the building blocks of their success.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2025 Budget Plan

March 12, 2024 • By Steve Wamhoff

President Biden’s most recent budget plan includes proposals that would raise more than $5 trillion from high-income individuals and corporations over a decade. Like the budget plan he submitted to Congress last year, it would partly reverse the Trump tax cuts for corporations and high-income individuals, clamp down on corporate tax avoidance, and require the wealthiest individuals to pay taxes on their capital gains income just as they are required to for other types of income, among other reforms.

President Biden discussed multiple tax proposals during the State of the Union address to Congress. Several of these proposals appeared in the budget plan he submitted to Congress last year, but at least two appear to be new proposals. Raise Corporate Tax Rate from 21 Percent to 28 Percent 10-Year Revenue Impact in President’s Previous […]

Corporate Tax Avoidance in the First Five Years of the Trump Tax Law

February 29, 2024 • By Matthew Gardner, Spandan Marasini, Steve Wamhoff

The Trump tax law overhaul cut the federal corporate income tax rate from 35 percent to 21 percent, but during the first five years it has been in effect, most profitable corporations paid considerably less than that.

NPR: A Tech Billionaire Is Quietly Buying Up Land in Hawaii. No One Knows Why

February 28, 2024

Over the last couple of years, a mystery has been brewing in this small mountain town. Someone has been quietly buying hundreds of acres of land — stirring worries about rising housing prices and speculation among locals about what exactly is going on.

Impacts of the Tax Relief for American Families and Workers Act

February 2, 2024 • By Joe Hughes, Steve Wamhoff

The Tax Relief for American Families and Workers Act passed by the House of Representatives on January 31 is a compromise between lawmakers who want to address child poverty and lawmakers who want to expand the Trump tax cuts for corporations and therefore includes provisions that do both. It also offsets the costs of those […]

Rep. Rosa DeLauro: Fact Sheets on Tax Deal

January 30, 2024

“The tax deal fails on equity,” said Congresswoman DeLauro. “It delivers huge tax cuts for giant corporations while denying middle class families the economic security they had under the expanded, monthly Child Tax Credit. It also leaves the poorest families behind because of a policy choice. At a time when a majority of American voters believe tax on big corporations should be increased, there is no reason we should be providing corporations a tax cut while only giving families pennies.”

Ongoing Use of Offshore Tax Havens Demonstrates the Need for the Global Minimum Tax

January 17, 2024 • By Steve Wamhoff

Key Findings To avoid taxation, American corporations use accounting gimmicks that make profits appear to be earned in foreign jurisdictions which tax corporate profits very lightly or not at all. In 2020, American corporations claimed profits in 15 of these jurisdictions that were often far too high to be possible. For example, in four jurisdictions […]

Proposed Tax Deal Would Help Millions of Kids with Child Tax Credit Expansion While Extending Damaging Corporate Tax Breaks

January 16, 2024 • By Joe Hughes

On January 16, Congressional tax writers officially announced the details of a tax policy agreement. The deal includes expansions of the Child Tax Credit (CTC) to improve access for low- and middle-income families as well as expansions of the 2017 Trump tax cuts for businesses. The agreement also includes bipartisan tax priorities tax provisions for […]