Corporate Tax Watch

The Latest Convoluted Arguments in Favor of Rich People Not Paying Taxes

November 13, 2023 • By Steve Wamhoff

Two Senate hearings last week focused on how the richest Americans are avoiding and evading taxes in ways that ordinary Americans could hardly imagine. All the experts brought in to testify seemed to agree that the House GOP’s recent tactic of “paying for” a spending proposal by cutting IRS funding makes no sense because it […]

Year-End Tax Package Must Prioritize Children and Families Over Corporations and Private Equity

November 8, 2023 • By Joe Hughes

While Congress considers extending expired tax provisions, it should first and foremost focus on expanding the Child Tax Credit, a policy with a proven track record of helping families and children.

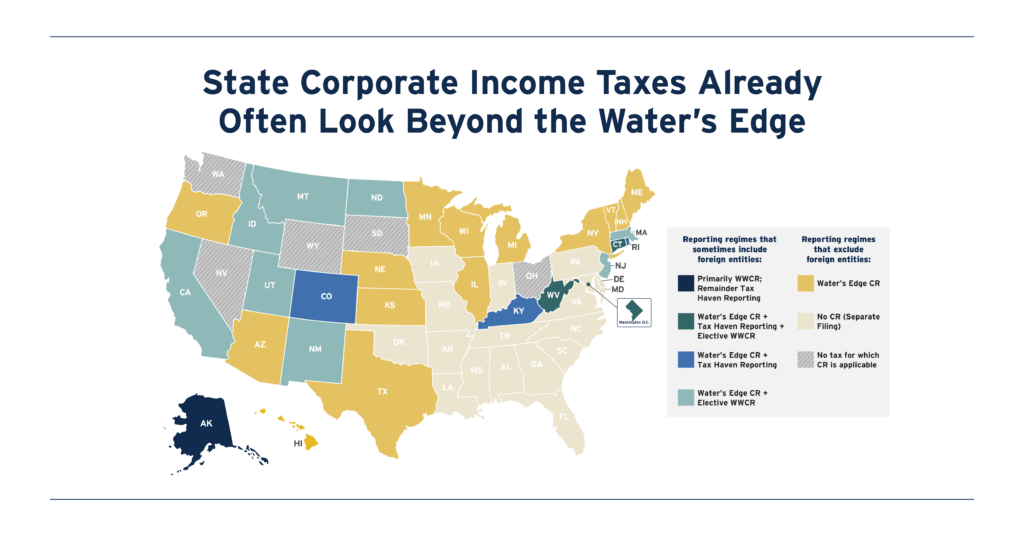

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

Intuit Receives Millions in Federal Subsidies While Arguing IRS Direct File Would Be Too Costly

October 24, 2023 • By Joe Hughes, Spandan Marasini

The tax preparation industry has for years lobbied to prevent the IRS from providing a tool that would allow Americans to file their taxes online for free. Recent public disclosures from Intuit, the maker of TurboTax and the leader of the pack, show that tax breaks the company claims for doing “research” might be larger […]

The Campaign by Democratic Former Officials to Stop Taxes on the Wealthy

October 6, 2023 • By Steve Wamhoff

One of the most attention-grabbing anti-tax campaigns at work today is called SAFE, which stands for Saving America’s Family Enterprises. But it might as well mean Saving Aristocrats From Everything given the outfit’s knack for opposing any national proposal to limit special tax advantages that only the wealthy enjoy. The basic approach of SAFE is […]

Moore Case Could Enrich Tax-Avoiding Multinational Corporations – and the SCOTUS Justices Who Own Their Stock

September 27, 2023 • By Matthew Gardner

The Moore v. United States case that will soon be heard by the U.S. Supreme Court could jeopardize at least $270 billion if SCOTUS finds the entire transition tax to be unconstitutional. The decision could also invalidate other important parts of the current tax system while preempting progressive wealth tax proposals. Such an outcome would represent one of the costliest—and most ethically questionable - Supreme Court decisions in U.S. history.

Supreme Corporate Tax Giveaway: Who Would Benefit from the Roberts Court Striking Down the Mandatory Repatriation Tax?

September 27, 2023 • By Matthew Gardner, Spandan Marasini

The Supreme Court is set to hear what could become one of the most important tax cases in a century. If decided broadly—with a ruling that strikes down the Mandatory Repatriation Tax for corporations, effectively making it unconstitutional to tax unrealized income—the Roberts Court’s decision in Moore v. US could stretch far beyond the plaintiffs themselves and would put in legal jeopardy many laws that prevent corporations and individuals from avoiding taxes and level the economic playing field.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

Minnesota’s Tax Battle of 2023 Signals a Turning of the Tide Against Corporate Tax Avoidance

July 7, 2023 • By Matthew Gardner

The qualified success of Minnesota’s GILTI conformity—to say nothing of the state’s serious dalliance with the game-changing worldwide combined reporting--sends a clear signal that the days may be coming to an end when big multinationals can scare state lawmakers into allowing them to game the tax system.

Corporations Reap Billions in Tax Breaks Under ‘Bonus Depreciation’

June 29, 2023 • By Matthew Gardner, Steve Wamhoff

Since TCJA expanded tax breaks for “accelerated depreciation” starting in 2018, it has reduced taxes by nearly $67 billion for the 25 profitable corporations that benefited the most. Congress is now looking at extending this policy.

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While Doing Little for Americans Who Most Need Help

June 11, 2023 • By Steve Wamhoff

The trio of tax bills that cleared the House Ways and Means Committee in June include tax cuts that would mostly benefit the richest one percent of Americans and foreign investors.

Congress Should Raise Taxes on the Rich, But That’s a Totally Separate Issue from the Debt Ceiling

May 9, 2023 • By Steve Wamhoff

Congress absolutely should raise taxes on the rich and on corporations to generate revenue and improve the fairness of our tax code. President Biden has several proposals to do exactly that. But this is an entirely separate question from whether we should raise the debt ceiling to honor the debts the nation has already incurred and avoid an economic apocalypse.

Minnesota Poised to Enact Landmark Loophole-Closing Corporate Tax Reforms

May 7, 2023 • By Matthew Gardner

With Minnesota poised to enact worldwide combined reporting of corporate income taxes, business lobbyists are pulling out all the stops to make state lawmakers believe the apocalypse is upon them.

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2024 Budget Plan

March 10, 2023 • By Steve Wamhoff

President Biden’s latest budget proposal includes trillions of dollars of new revenue that would be paid by the richest Americans, both directly through increases in personal income, Medicare and estate taxes, and indirectly through increases in corporate income taxes.

ITEP Statement: President Biden Lays Out a Bold Vision for Tax Justice in Proposed Budget

March 9, 2023 • By ITEP Staff

President Biden’s budget proposal presents a bold vision for what tax justice should look like in America. The provisions would raise substantial revenue, fund important priorities and increase tax fairness.

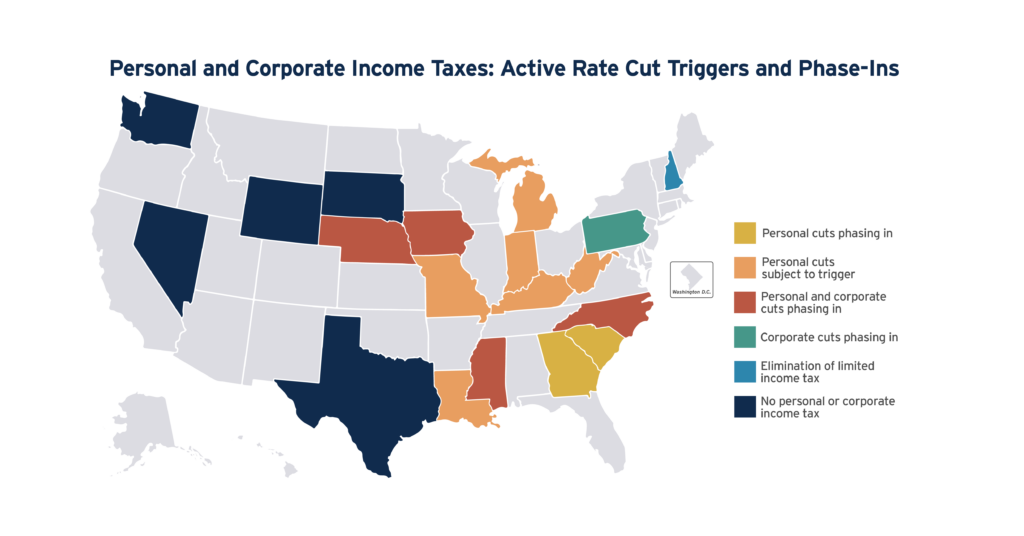

In recent years, lawmakers have been quick to push for phased-in tax cuts or cuts attached to trigger mechanisms. These policy tools push the implementation of tax cuts outside of the current budget window with a predetermined phase-in schedule or a mathematical formula tied to state revenue trends.

The No Tax Breaks for Outsourcing Act Is Needed More than Ever

February 14, 2023 • By Steve Wamhoff

The new corporate minimum tax enacted as part of last year’s Inflation Reduction Act will address some of the worst corporate tax dodging, but what else is needed? A group of Democrats have answered this question with the No Tax Breaks for Outsourcing Act.

Biden Says the Stock Buyback Tax Should Be Higher. Here are Three Reasons Why He’s Right.

February 13, 2023 • By Joe Hughes

A higher tax on stock buybacks would reduce the tax disparity between dividends and buybacks, raise more revenue for productive public investments, and recoup some of Trump's corporate tax cuts that went to wealthy shareholders.

Higher Stock Buyback Tax Would Raise Billions by Tightening Loophole for the Wealthy

February 13, 2023 • By Joe Hughes

A higher excise tax rate on buybacks is completely reasonable. Quadrupling the rate, as the President proposes, would raise more revenue and cut into the tax advantage buybacks have over dividends. When a company uses their cash holdings to repurchase their own stock, it is an admission that they have few productive investment opportunities. The public does have productive uses for the tax revenue like infrastructure and schools that create value for the entire economy.

GAO Report Confirms: Trump Tax Law Cut Corporate Taxes to Rock Bottom

January 13, 2023 • By Steve Wamhoff

A new report from the Government Accountability Office finds the average effective federal income tax rate paid by large, profitable corporations fell to 9 percent in the first year the Trump tax law was in effect, and the share of such companies paying nothing at all rose to 34 percent that year.

The European Union Moves Forward on Global Minimum Tax. Time for the U.S. to Follow.

December 21, 2022 • By Joe Hughes

The European Union has reached unanimous agreement to implement a global minimum tax beginning in 2024. With the EU and UK fully on board, it's time for Congress to follow suit and implement the plan negotiated by the Biden administration. Doing so would improve the corporate tax system here and around the world while making the United States economy stronger and more competitive.

The Tax Deal That Wasn’t: Congress Decides Corporate Tax Cuts Are Too Expensive if it Means Also Helping Children

December 20, 2022 • By Joe Hughes

Congressional leaders announced their long-awaited omnibus spending package which will fund the government through September 2023. The good news: the bill does not include needless corporate tax giveaways. The bad news: it also leaves out any expansion of the child tax credit.

Covering federal, state, and corporate tax work, here are our top 5 charts of 2022. It’s worth noting that the biggest tax news of 2022 – the adoption of a federal 15 percent corporate minimum tax in the Inflation Reduction Act – should make some of these charts look much better after the new law is implemented.

Lawmakers Seek to Extend Tax Break for “Research” that Corporations Use to Develop Frozen Foods, New Beer Flavors, Casino Games and Tax Avoidance

December 8, 2022 • By Steve Wamhoff

If Congress creates a tax break to encourage businesses to conduct research that benefits society, should Netflix be eligible for it? There is no shame in binge-watching Stranger Things or Bridgerton or The Crown, but how many of us really think Netflix deserves a tax break for whatever “research” the company did to provide this […]