From a new report comparing five major federal tax credit proposals to resources for continuing gas tax debates and the launch of ITEP’s interactive library On the Map, here’s a summary of ITEP news this month.

NO SHORTAGE OF TAX POLICY PROPOSALS TO TARGET WORKING FAMILIES

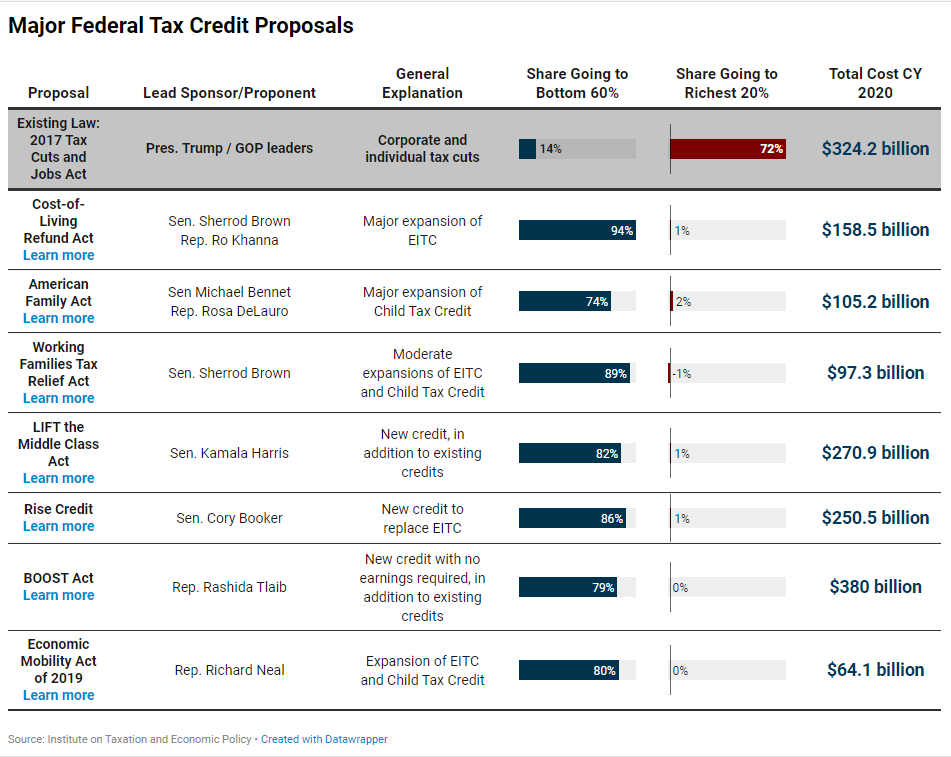

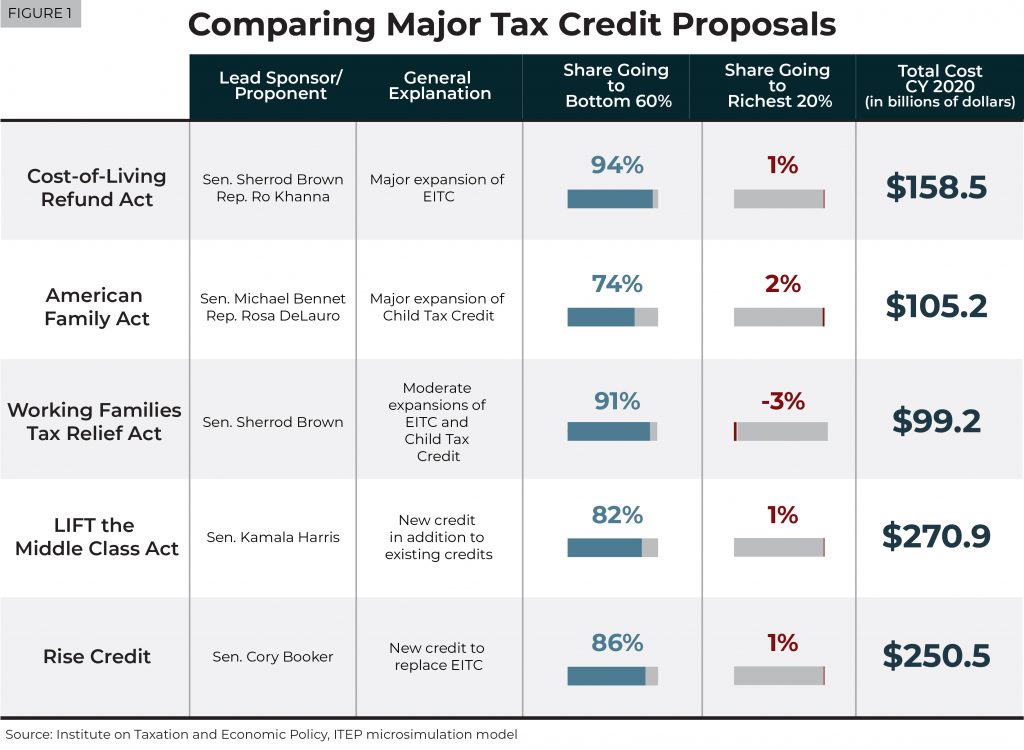

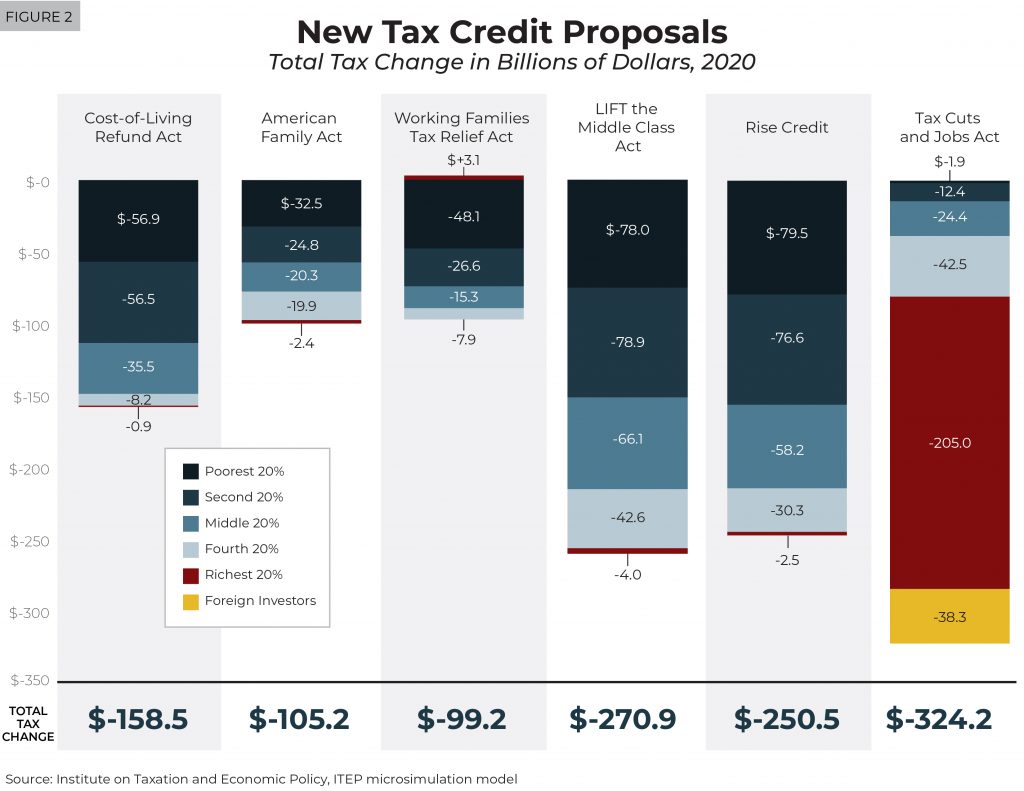

Five different tax credit proposals would do a better job boosting after-tax income for the bottom 60 percent of taxpayers than the Trump-GOP tax law, a new ITEP analysis finds.

Five different tax credit proposals would do a better job boosting after-tax income for the bottom 60 percent of taxpayers than the Trump-GOP tax law, a new ITEP analysis finds.

RELATED BLOG: Proposals for Refundable Tax Credits Are Light Years from Tax Policies Enacted in Recent Years

RELATED BLOG: Unlike Trump-GOP Tax Law, There Are Tax Plans That Would Actually Deliver on Promise to Help Working People

MINUTE:30: Jessica Schieder explains how these proposals could shift the tax code to address complex challenges, including economic inequality, stagnating wages and child poverty.

▶ Listen now.

CONGRESSIONAL RESEARCH SERVICE CALLS THREE STRIKES ON THE TRUMP TAX CUTS

A new report from the non-partisan Congressional Research Service finds the 2017 tax law failed to deliver on its promises of economic growth and boosting the middle class. The CRS evaluation should constrain—or end—outlandish claims about the so-called merits of the Trump-GOP tax cuts.

— MATTHEW GARDNER

UPDATED POLICY BRIEF ANSWERS HOW LONG IT’S BEEN SINCE YOUR STATE LAST RAISED ITS GAS TAX

State gas tax rates that have not been updated in many years, or even decades, have seen significant declines in their purchasing power. Fortunately, many states recently have made significant progress in updating their gas tax rates.

— CARL DAVIS

RELATED BLOG: Gas Taxes Have Gone Up in Most States, but Decades-Long Procrastinators Remain

INTERACTIVE MAPS LIBRARY

ON THE MAP

As part of our commitment to providing distributional analysis and state-specific data, ITEP has launched a maps library. Each week, it will highlight different tax policy information so that readers can better understand the national landscape of state tax policy.

FROM THE BLOG

BOOTSTRAPS REMAIN AN INEFFECTIVE TOOL FOR COMBATTING POVERTY

The White House recently issued a proposed regulation that could slow the rate at which the federal poverty threshold increases. If enacted, millions of people eventually could lose access to vital programs in which eligibility is determined based on household income.

— JENICE ROBINSON

PROPONENTS OF TRUMP TAX LAW CITE ITEP WITH OBVIOUS LACK OF CONTEXT

Sen. Chuck Grassley issued an op-ed earlier this month citing ITEP estimates to back up his point that most people in every income group have lower taxes because of the law. As Sen. Grassley and his staff know full well, this misses the point of our findings: the 2017 tax law was designed to shower most of its benefits on the wealthy.

— STEVE WAMHOFF

NOW ON INSTAGRAM

Follow us @_itep for charts, graphs and commentary on tax policy issues, including bonus behind-the-scenes photos and footage, giving you a glimpse into the work of ITEP analysts and researchers.

Follow us @_itep for charts, graphs and commentary on tax policy issues, including bonus behind-the-scenes photos and footage, giving you a glimpse into the work of ITEP analysts and researchers.