Minnesota

We've said it before, and we'll say it again: states don't have to wait for federal lawmakers to make moves toward progressive tax policy. And so far, 2019 has been a good year for equitable and sustainable tax policy in the states. With July 1 marking the start of a new fiscal year for most states, this special edition of the Rundown looks at how discussions in 2019 have been dominated by plans to raise revenue for vital investments, tax the rich and corporations fairly, use the tax code to help workers and families and advance racial equity, and shore…

State Rundown 6/19: Juneteenth Highlights Role of State Policy in Racial Equity Fight

June 19, 2019 • By ITEP Staff

As Americans observe Juneteenth today–the day two years after the Emancipation Proclamation on which news of the end of the Civil War and slavery reached some of the last slaves in Texas—most people’s attention should be on celebrating victories, remembering losses, gathering strength to continue the fight for racial justice, and the accompanying Congressional reparations hearings. In comparison, state tax debates over matters such as reluctance to invest in infrastructure in Michigan and Missouri, approval of income tax cuts in Wisconsin, and a budget standoff in New Jersey may seem unimportant and irrelevant. But we encourage our readers to think about how state policies often serve to enrich and empower white and wealthy households, and…

States are putting evidence into practice with multiple efforts to improve services and tax codes through more progressive taxes on the wealthy. Clear evidence has spread widely this year, informing a national conversation about progressive taxation and leading lawmakers in multiple states to eschew supply-side superstition and act on real evidence instead. Taxing the rich works, and in this Just Taxes blog we review state-level efforts to put these proven findings into effect.

Income inequality continues to be an undercurrent in public discourse about our economy and how working families are faring. It drove the national debate over the 2017 Tax Cuts and Jobs Act, which, mounds of data reveal has exacerbated the problem. Some elected federal officials have responded to this step backward with calls for higher […]

Like certain recent controversially concluded television shows, tax and budget debates can end in many ways and often receive mixed reviews. Illinois leaders, for example, ended on a cliffhanger by approving a historic constitutional amendment to create a graduated income tax in the state, whose ultimate conclusion will be crowdsourced by voters next November. Arizona’s fiscal finale fell flat with many observers due to corner-cutting on needed investments and a heavy focus on tax cuts. Texas legislators went for crowd-pleasing property tax cuts and school funding increases but left a gigantic “but how will we pay for this” plot hole…

State Rundown 5/22: (Some) State Lawmakers Can (Partly) Relax This Weekend

May 22, 2019 • By ITEP Staff

Lawmakers and advocates can enjoy their barbeques with only one eye on their work email this weekend in states that have essentially finished their budget debates such as Alaska, Minnesota, Nebraska, and Oklahoma, though both Alaska and Minnesota require special sessions to wrap things up. Getting to those barbeques may be a bumpy ride in Louisiana, Michigan, and other states still working to modernize outdated and inadequate gas taxes.

State Rundown 5/16: Tensions Remain High Over Budgets and School Finances in Several States

May 16, 2019 • By ITEP Staff

Tax and budget negotiations remain at standstills in Louisiana and Minnesota, as school funding debates and teacher protests again captured headlines in several states. Oregon lawmakers, for example, finally passed a mixed-bag tax package that won’t improve tax equity but will raise much-needed revenue for education. Meanwhile their counterparts in Nebraska continue to debate highly […]

State Rundown 5/9: Illinois Moves Closer to a Progressive Income Tax

May 9, 2019 • By ITEP Staff

Lawmakers in Illinois and Ohio have advanced major tax proposals but cannot rest just yet, as they must still get past the other legislative chamber. Their counterparts in Michigan, Minnesota, Nebraska, and Oregon, meanwhile, are all at impasses over education funding, as those in Texas left their school funding disagreement unresolved at least until they reconvene...in 2021. And in an era of many states pre-empting smaller jurisdictions by revoking local decision-making powers, leaders in Colorado and Delaware made moves in the opposite direction, entrusting cities and school districts with more local control.

Teachers in North Carolina and South Carolina are walking out and rallying this week for increased education funding, teacher and staff pay, and other improvements to benefit students—if you’re unsure why be sure to check out research on the teacher shortage and pay gap under “What We’re Reading” below. Meanwhile, budget debates have recently wrapped up in Indiana, Iowa, Massachusetts, New Hampshire, and Washington. And major tax debates are kicking into high gear in both Louisiana and Nebraska.

MinnPost: Legislative Tax Plans: Equitable, Inspirational or Destructive?

April 30, 2019

Minnesota’s current tax system is considered one of the nation’s most progressive. The Institute on Taxation and Economic Policy, a nonpartisan think tank that assesses state and federal tax policies, ranks the state the fourth most-equitable in the way it taxes lower-income residents. It’s the provider tax and that proposed gas tax hike — two inherently regressive taxes — that drag down the overall progressivity of the plans.

State Rundown 4/26: Capital Gains Taxes Make Gains and Regressive Proposals Regress

April 26, 2019 • By ITEP Staff

Progressive capital gains tax proposals made news this week in Connecticut and Massachusetts, while Nebraskans came out in force to oppose a regressive tax shift, and North Carolina teachers prepare to rally over their legislature’s proclivity to cut taxes on wealthy households while underfunding schools.

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

Minnesota Public Radio: Are Minnesotans Happy with President Trump’s Tax Cuts?

April 15, 2019

Carl Davis, ITEP’s research director, participated in this half-hour segment on how the public feels about the 2017 Trump-GOP tax cuts. Listen here or get more info here: https://www.mprnews.org/listen?name=/minnesota/podcasts/kerri-miller/2019/04/15tax_day_20190415_64.mp3

State Rundown 3/27: Spring Bringing Smart State Tax Policy So Far

March 27, 2019 • By ITEP Staff

Though a long winter and a rough start to spring weather have wreaked havoc in much of the country, lawmakers are off to a good start in the world of state fiscal policy so far. In the last week, a progressive revenue package was passed in the nick of time in NEW MEXICO, a service-sapping tax cut was vetoed in KANSAS, and a regressive and unsustainable tax shift was soundly defeated in NORTH DAKOTA. Meanwhile, gas tax updates are on the table in MAINE, MINNESOTA, and OHIO. And exemptions for feminine hygiene products and diapers were enacted in VIRGINIA and introduced in MISSOURI.

More than three billion dollars could be raised under a major progressive tax plan proposed by Illinois Gov. J.B. Pritzker this week, the point being to simultaneously improve the state’s upside-down tax code and address its notorious budget gap issues. One state, Utah, may already be looking at a special session to revisit the sales tax reform debate that ended this week without resolution, in contrast to Alabama and Arkansas, where leaders finally resolved years-long debates over gas taxes and infrastructure funding. And lawmakers in four states – California, Florida, Minnesota, and North Carolina – introduced legislation to expand or…

GQ: Local and State Taxes Are Making the Wealthy More Rich Now Too

March 12, 2019

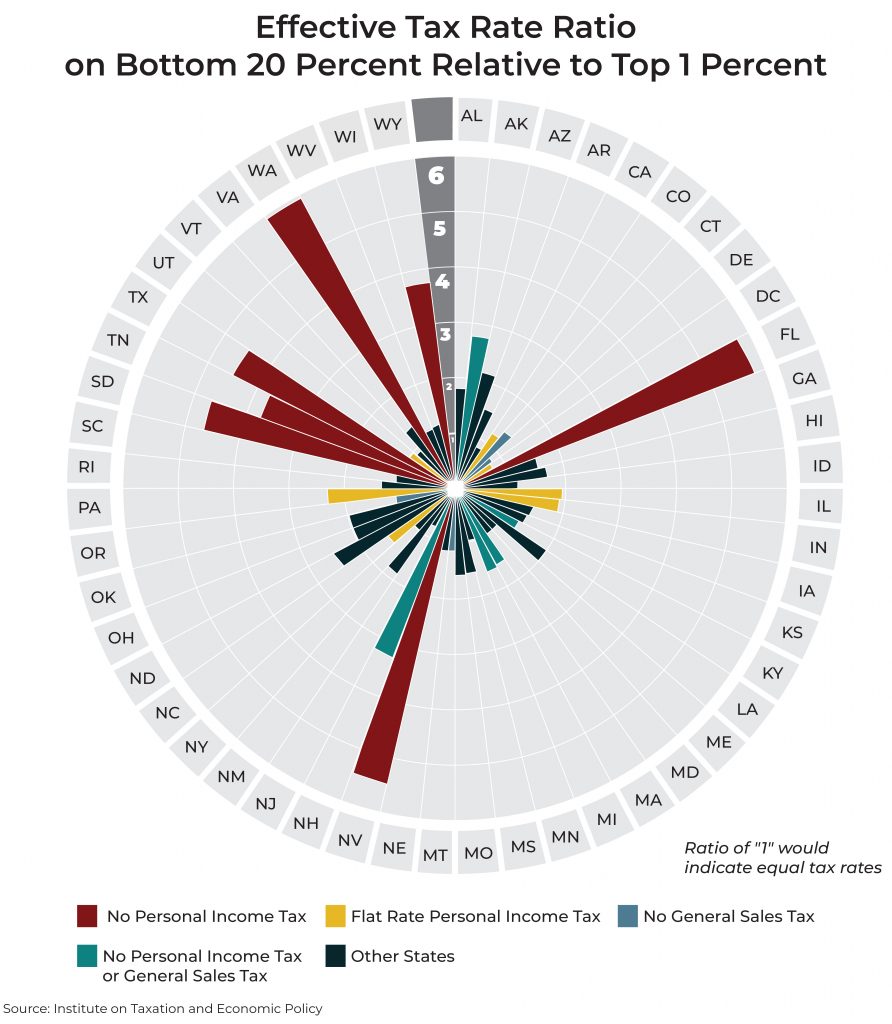

According to a new report by the progressive think tank Institute on Taxation and Economic Policy (ITEP), as relayed in the Washington Post, state and local governments that are heavily reliant on sales and excise taxes, rather than income taxes, shift the economic burden onto low- and moderate-income taxpayers. At every level, those who work […]

State Rundown 3/6: March Tax Debates Contain Sanity Amid Usual Madness

March 6, 2019 • By ITEP Staff

State policymakers around the nation this week served up a handful of harmful and upside-down tax proposals, but these were refreshingly outnumbered by sound tax and budget policy proposals in several other states. NEW JERSEY Gov. Phil Murphy made tax fairness an explicit priority in his budget address, the NEW MEXICO House passed progressive reforms to improve the state’s schools and tax code, states such as VERMONT are looking to raise funds from legalized cannabis and put it to good use, and many states, including ALABAMA, ARKANSAS, OHIO, and WISCONSIN, are seriously considering much-needed gas tax updates to improve their…

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

March 6, 2019 • By ITEP Staff

There is significant room for improvement in state and local tax codes. State tax codes are filled with top-heavy exemptions and deductions and often fail to tax higher incomes at higher rates. States and localities have come to rely too heavily on regressive sales taxes that fail to reflect the modern economy. And overall tax collections are often inadequate in the short-run and unsustainable in the long-run. These types of shortcomings provide compelling reason to pursue state and local tax reforms to make these systems more equitable, adequate, and sustainable.

Minneapolis Star-Tribune: Tax Avoidance Might Make Financial Sense, but Is It Fair?

March 1, 2019

One feature of sales taxes is that they cost lower-income people a bigger chunk of what they take in than is the case for more affluent people. In Minnesota the bottom 20 percent of taxpayers by family income only pay about 8.7 percent of their income in state and local taxes. In Florida the poorest […]

State tax policy can be a contentious topic, but one issue on which lawmakers largely agree is that higher gas tax rates are necessary to keep our nation’s infrastructure operating safely and efficiently. Lawmakers in 27 states have approved gas tax increases since 2013.

State Rundown 2/20: February and Regressive Tax Cuts, The “Meanest Moons of Winter”

February 20, 2019 • By ITEP Staff

Tom Robbins called February “the meanest moon of winter, all the more cruel because it will masquerade as spring, occasionally for hours at a time, only to rip off its mask with a sadistic laugh and spit icicles into every gullible face, behavior that grows quickly old.” Observers of state fiscal debates might think he was writing about similarly tiresome regressive tax cut proposals, which recently succeeded in Arkansas and advanced in North Dakota despite improved public understanding of the upside-down nature state tax systems, ineffectiveness of supply-side trickle-down tax cuts, and importance of investing in education. But like February…

Trends We’re Watching in 2019: Attempting to Double Down on Failed Trickle-Down Regressive Tax Cuts

February 7, 2019 • By Lisa Christensen Gee

It’s always troubling for those concerned with adequate and fair public finance systems when states prioritize tax cuts at the cost of divesting in important public priorities and exacerbating underlying tax inequalities. But it’s even more nerve-racking when it happens on the eve of what many consider to be an inevitable economic downturn.

Trends We’re Watching in 2019: Cannabis Tax Implementation and Reform

February 7, 2019 • By Carl Davis

Few areas of state tax policy have evolved as rapidly as cannabis taxation over the last few years. The first legal, taxable sale of recreational cannabis in modern U.S. history did not occur until 2014. Now, just five years later, a new ITEP report estimates that recreational cannabis is generating more than $1 billion annually in excise tax revenues and $300 million more in general sales tax dollars.

Trends We’re Watching in 2019: Consumption Taxes: the Good, Bad and the Ugly

February 7, 2019 • By ITEP Staff

Consumption taxes are a significant source of state and local revenue, and we expect that lawmakers will continue to adjust state consumption tax levies to adapt to budget needs and a changing economy.

Trends We’re Watching in 2019: Addressing Lingering Federal Conformity Questions and Opportunities

February 7, 2019 • By Dylan Grundman O'Neill

In our last update on state responses to the federal tax cut (Tax Cuts and Jobs Act, or TCJA), we noted that several states were waiting until 2019 to make their final decisions, giving them additional time to (hopefully) respond in ways that improve their fiscal situations and upside-down tax codes. The TCJA is affecting the 2018 federal taxes people are filing now, in some cases adding urgency and/or confusion to these debates.