Ohio

While tax discussions among federal lawmakers continue in fits and starts, major tax news continues to make waves across the nation...

Model Development Intern Summer 2022

April 21, 2022 • By ITEP Staff

The Institute on Taxation and Economic Policy, the country’s premier progressive tax policy research organization, seeks a model development intern for 28 hours a week for 10 weeks between June and August 2022, with flexibility on precise dates. Preference given to those available for on-site work in Northeast Ohio but remote applicants may apply.

Several states have dropped a few late-session surprises, and from the looks of it, they’re not the good kind...

ITEP is happy to announce the launch of our new State Tax Watch page, where you can find out about the most up-to-date tax proposals and permanent legislative changes happening across the country...

State Rundown 2/16: Spending Priorities Emerge as the Votes Are Counted

February 16, 2022 • By ITEP Staff

State lawmakers have been busy working out deals and negotiating how best to use excess revenues, and as the votes are beginning to come in, spending priorities are becoming clearer...

The New Trend: Short-Sighted Tax Cuts for the Rich Will Not Grow State Economies

January 10, 2022 • By Neva Butkus

The same legislators who touted tax cuts for the rich as solution to our problems before the pandemic are also saying tax cuts for the rich are a solution during the pandemic. Tax cuts cannot be a solution to everything, especially at a time when the richest Americans are amassing more wealth than ever.

Rather than resorting to tax cuts, which can eventually create revenue shortfalls, lawmakers should determine whether they have adequately invested in people and communities. There are better ways to leverage tax systems to help those who need it most.

Bloomberg: SALT Debate Forces Rich Americans to Confront Widening Tax Gap

December 10, 2021

Lawmakers in Arizona, Arkansas, Idaho, Iowa, Louisiana, Missouri, Montana, North Carolina, Ohio and Oklahoma have also approved cuts to their top personal income tax going into effect either this year or in future years. “There are states moving in different directions,” said Carl Davis, research director at the left-leaning Institute on Taxation and Economic Policy. […]

Here at ITEP we want to give thanks and say we’re grateful for all of the hard work that advocates in states across the country are doing to secure progressive tax policy victories...

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2021

October 21, 2021 • By Aidan Davis

The EITC benefits low-income people of all races and ethnicities. But it is particularly impactful in historically excluded Black and Hispanic communities where discrimination in the labor market, inequitable educational systems, and countless other inequities have relegated a disproportionate share of people to low-wage jobs.

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

Labor Day is around the corner and in the spirit of celebrating the achievements of workers around the country, we here at ITEP want to call attention to the states (and territories) that are using tax policy to support workers and residents alike...

The One Thing Missing From the Qualified Business Income Deduction Conversation: Racial Equity

August 25, 2021 • By Marco Guzman

When crafting tax policy, lawmakers and bill authors often work backward, using a patchwork of changes to help achieve their stated goal. One important consideration that is routinely left out is what impact the change will have on racial equity. Such is the case with the qualified business income deduction, which is helping to further enrich wealthy business owners, the overwhelming majority of whom are white. At present, white Americans own 88 percent of private business wealth despite making up only 60 percent of the population. Meanwhile, Black and Hispanic families confronting much higher barriers to entrepreneurship each own less…

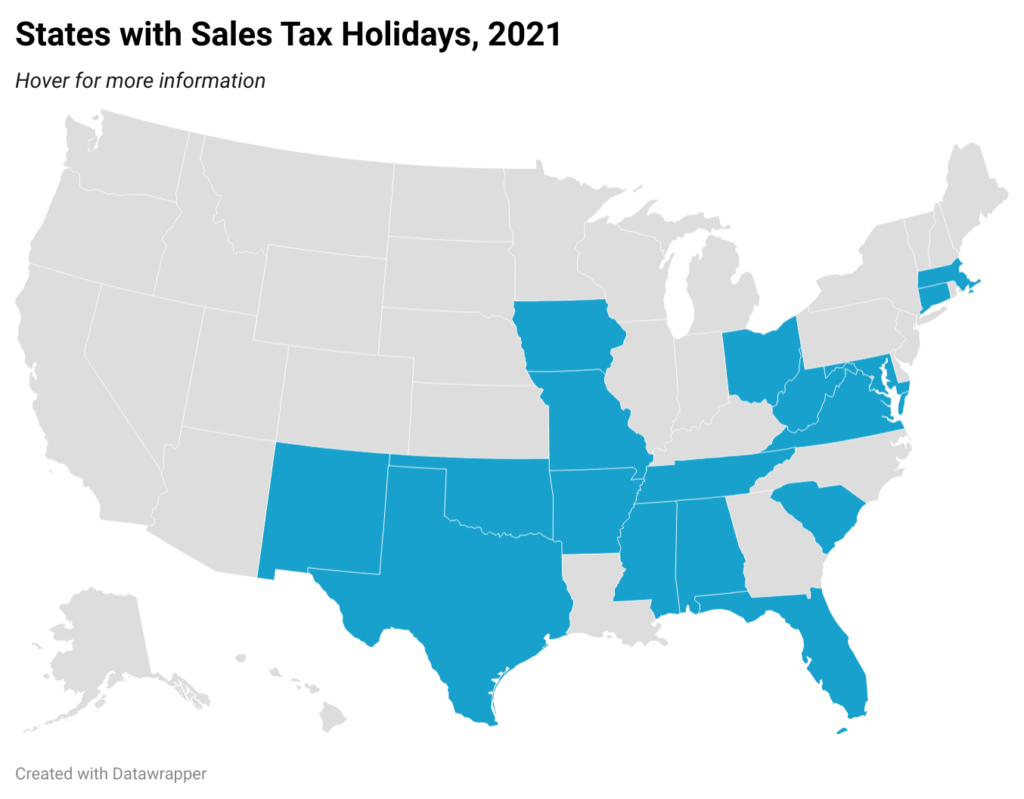

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

Why Local Governments Need an Anti-Racist Approach to Property Assessments

August 5, 2021 • By Ambika Sinha

Property taxes are among the oldest and most relied upon form of local taxes. Revenue raised from these taxes funds education, firefighting, law enforcement, street and infrastructure maintenance, and other essential services. Though all members of the community enjoy these public goods, homeowners of color, especially Black families, pay more as a share of home value in property taxes than their white counterparts.

State Rundown 7/7: The New Fiscal Year Starts off With a Bang, And Not Just Fireworks

July 7, 2021 • By ITEP Staff

States were busy over the past week despite the Fourth of July holiday. Many are gearing up for upcoming tax and budget clashes that could shape their futures for some time...

In Drive to Cut Taxes, States Blow an Opportunity to Invest in Underfunded Services

July 7, 2021 • By Marco Guzman

Many states find themselves in a peculiar fiscal situation right now: federal pandemic relief money has been dispersed to states and revenue projections have exceeded expectations set during the pandemic. Meanwhile, more and more workers are returning to jobs as vaccines roll out and typical economic activity resumes. Some states, however, have decided to squander their unexpected fiscal strength on tax cuts.

CNN.com: States are so flush with funds, many are cutting taxes

July 1, 2021

This means that the state’s wealthiest 5% of taxpayers will receive nearly 60% of the benefits, while the bottom 80% will get only 23%, according to an analysis for Policy Matters Ohio by the left-leaning Institute on Taxation and Economic Policy. Read more

State Rundown 6/30: Resolutions Are in Order for the New Fiscal Year

June 30, 2021 • By ITEP Staff

Today is the last day of the fiscal year in many states, and some lawmakers might want to take the opportunity to make some new fiscal year resolutions. Legislators in Arizona, New Hampshire, Ohio, North Carolina, and Wisconsin, for example, should really cut back on the trickle-down tax-cut Kool-Aid, which may make parties with rich donors more fun but tends to be both harmful and habit-forming...

Policy Matters Ohio: Ohio Tax Cuts Would Go Mostly to the Very Affluent

June 29, 2021

Instead of using Ohio’s public resources to build strong, resilient communities, the General Assembly approved income-tax cuts that would favor the very wealthiest Ohioans, while providing only modest benefits for moderate-income Ohioans and nothing at all to the state’s poorest. Benefiting especially from the elimination of the top bracket of the tax, the most affluent […]

Policy Matters Ohio: Ohio Income-tax Cuts Would Reward the Wealthiest

June 29, 2021

Income-tax cuts approved by the General Assembly in the budget bill would favor the very wealthiest Ohioans, while providing only modest benefits for moderate-income Ohioans and nothing at all to the state’s poorest. Benefiting especially from the elimination of the top bracket of the tax, the most affluent 1% of Ohioans would see an average […]

State Rundown 6/7: Remaining State Legislative Sessions Are Heating up as Budget Deadlines Loom

June 7, 2021 • By ITEP Staff

Just as an early summer heatwave brought soaring temperatures this past weekend through much of the lower 48 states, several state legislative sessions are heating up as legislators scramble to make tough budget decisions. Massachusetts lawmakers are voting on a fiery new "millionaires' tax" that would support transportation and education revenue needs, and Connecticut will likely restore its state Earned Income Tax Credit (EITC) back to 30 percent. Illinois’s decision to cut back corporate tax breaks also provided a breath of fresh air. Unfortunately, we'd give other state tax proposals a more lukewarm reception: New Hampshire, North Carolina, and Ohio…

Toledo Blade: Ohio urged to spend surplus on children, pregnant women

May 11, 2021

A study by the Institute on Taxation and Economic Policy for Policy Matters estimates that those making between $40,000 and $61,000 a year would on average see a $7 reduction in their annual tax bills from the latest proposal. Those earning at least $490,000 would average a $612 break. Through April, with just two months […]

North Carolina lawmakers may have approved a massive tax subsidy giveaway to Apple, but we won’t let that news spoil our barrel this week. Nor will we be discouraged by Connecticut Gov. Ned Lamont’s threats to upset the apple cart full of positive progressive tax reforms state lawmakers recently came together to approve...Why all the optimism? Because the apple of our eye this week is Washington State, where advocates and lawmakers succeeded in a decade-long fight...

Sometimes a good idea takes a while. Alvin Schorr, who would have turned 100 this month, helped draft a 1972 bill “to provide for a system of children’s allowances.” He continued to push (in a 1977 congressional testimony and in a 1983 New York Times op-ed) for a refundable tax credit for all families and a children’s allowance, among other laudable ideas. A half-century later, these ideas—which many others have championed—are becoming reality.