Oklahoma

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

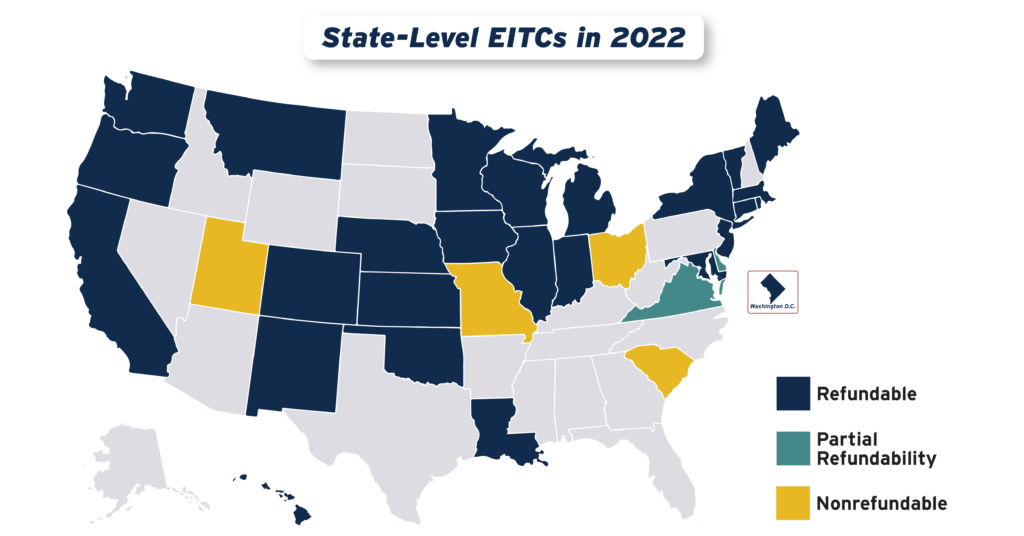

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.

National and State-by-State Estimates of Two Approaches to Expanding the Child Tax Credit

September 7, 2022 • By Emma Sifre, Joe Hughes, Steve Wamhoff

The Romney Child Tax Credit plan would leave a quarter of children worse off compared to current law and help half as many low-income children as the 2021 expansion of the credit.

State Rundown 8/10: States Still Talking Taxes as IRA Dominates Headlines

August 10, 2022 • By ITEP Staff

While federal tax policy has dominated the headlines with the Senate’s recent approval of the Inflation Reduction Act, lawmakers in statehouses across the country...

From the Bay State to the Golden State, lawmakers across the nation are making deals and negotiating budgets with major tax implications...

With many state legislative sessions wrapped or wrapping up, we at ITEP want to take a moment to direct your attention south, and specifically, to the American South...

Creating Racially and Economically Equitable Tax Policy in the South

June 21, 2022 • By Kamolika Das

The South's negative outcomes on measures of wellbeing are the result of a century and a half of policy choices. Lawmakers have many options available to make concrete improvements to tax policy that would raise more revenue, do so equitably, and generate resources that could improve schools, healthcare, social services, infrastructure, and other public resources.

With inflation dominating headlines both nationally and locally, state lawmakers around the U.S. are searching for ways to put their revenues to good use, and not surprisingly, some options are better than others...

Bloomberg Tax: Flat Income Tax Revival Draws Sharply Mixed Reviews (Podcast)

June 14, 2022

With cash cushions plump with federal pandemic relief dollars and a surge in tax revenues, state legislatures across the country have cut taxes aggressively this year. But several states went further, converting their tiered income tax structures to flat-rate systems. Arizona, Georgia, Iowa, and Mississippi have committed to the flat tax in recent weeks, and […]

State Rundown 6/8: Tax Policy Features Prominently During Budget and Primary Season

June 8, 2022 • By ITEP Staff

As voters head to the polls to weigh in on their state’s primary elections and legislators convene to hash out budget deals, tax policy remains atop the agenda...

While the temperature ticks up outside, the temperature in state legislatures around the country has fallen slightly. But with several states still dealing with ongoing tax and budget issues, this summer could be a hot one...

State Rundown 5/11: Mid-Year Special Elections and Primary Season Kicks Off with Taxes in the Spotlight

May 11, 2022 • By ITEP Staff

As 2022 inches closer to its midpoint, important tax policy decisions are being put in the hands of voters, as special elections and the primary season begin...

While tax discussions among federal lawmakers continue in fits and starts, major tax news continues to make waves across the nation...

Some Lawmakers Continue to Mythologize Income Tax Elimination Despite Widespread Opposition

April 19, 2022 • By Kamolika Das

One of the most surprising trends this legislative session is that conservative leaders and the business community joined with progressive advocates to oppose income tax repeal plans. There is a general consensus that income tax repeal is a step too far.

State Rundown 4/13: Recent State Budgets Prove Not All Tax Cuts are the Same

April 13, 2022 • By ITEP Staff

Two prominent blue states made headlines this past week when they passed budget agreements that include relief for taxpayers, and fortunately, the budget plans don’t include costly tax cuts that primarily benefit the wealthy...

Last week we highlighted how several states were pushing through regressive tax cuts as their legislative sessions are coming to a close. Well, this week many of those same states took further actions on those bills and it’s safe to say we’re even less impressed than before...

Bloomberg: Did You Pay Your ‘Fair Share’ of Federal Income Tax This Year?

March 31, 2022

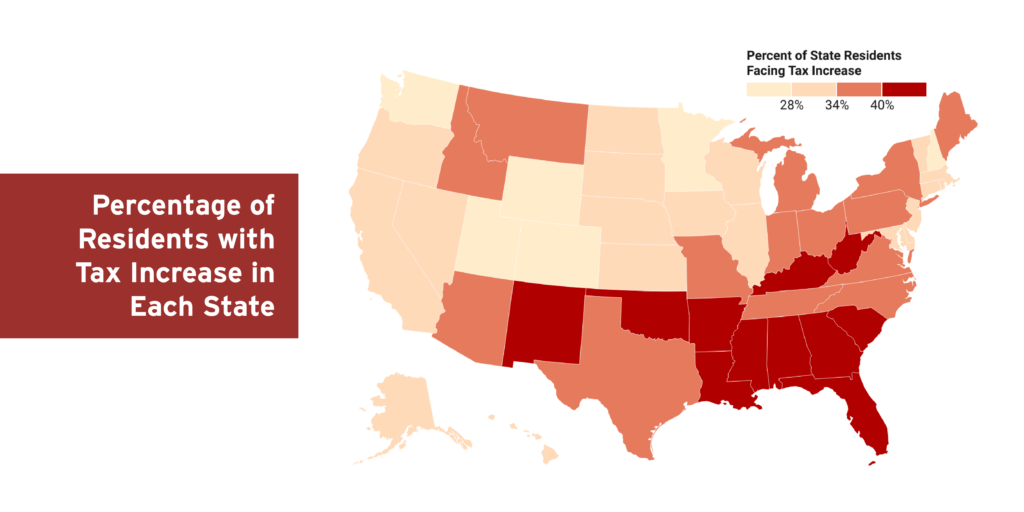

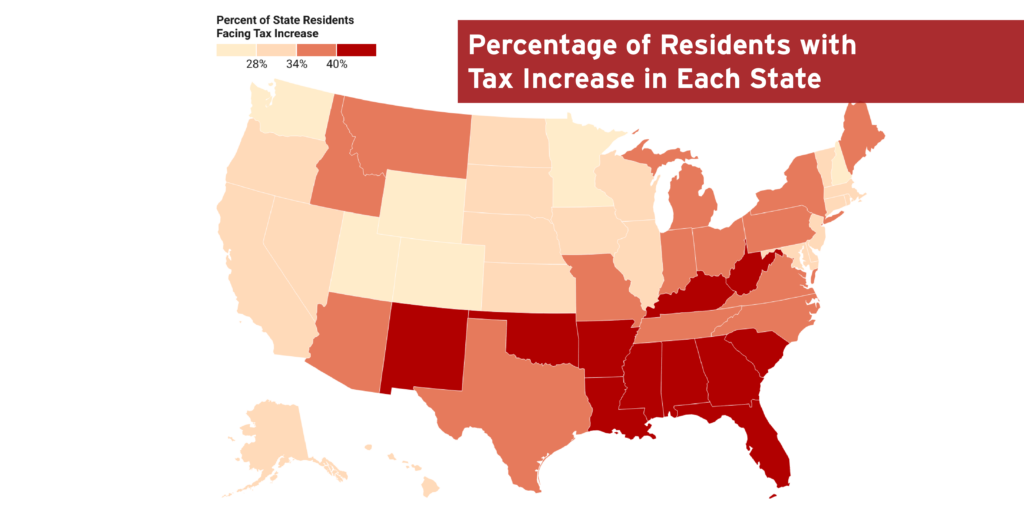

And according to the Institute on Taxation and Economic Policy, the impact would have a definite geographic tilt. The states where more than 40% of residents would face tax increases are largely in the South, including Mississippi, West Virginia, Arkansas, Louisiana, Alabama, Kentucky, Oklahoma, Georgia, New Mexico, South Carolina, and Florida. read more

Several states have dropped a few late-session surprises, and from the looks of it, they’re not the good kind...

Spring is around the corner and like those pesky allergies that come along with it, equally pesky tax proposals continue to pop up in states across the U.S....

State Rundown 3/16: The Scramble to Curb Rising Gas Prices is On

March 16, 2022 • By ITEP Staff

Rising gas prices have lawmakers around the country searching for ways to ease the pressure on consumers and almost half the states are considering reducing or temporarily repealing their gas tax, but another idea is taking hold...

State Rundown 3/9: One State Stands Out Amid the Avalanche of Tax Cuts

March 9, 2022 • By ITEP Staff

The avalanche of regressive tax-cut proposals coming out of state legislatures has not slowed over the course of the winter months, but one state has provided a shot of hope to advocates of tax equity...

New 50-State Analysis: Poorest Two-Fifths Would Bear the Brunt of Sen. Rick Scott’s Proposed Tax Increase

March 7, 2022 • By ITEP Staff

“Billionaires are getting richer, and some of them are altogether avoiding taxes or paying a tiny percentage relative to their income and wealth. The 2017 tax law further worsened inequality by giving huge tax breaks to the rich. It’s inconceivable that a lawmaker would propose to single out the most vulnerable households for higher taxes.” --Steve Wamhoff

State-by-State Estimates of Sen. Rick Scott’s “Skin in the Game” Proposal

March 7, 2022 • By Steve Wamhoff

A proposal from Sen. Rick Scott would increase taxes for more than 35% of Americans, with the poorest fifth of Americans paying 34% of the tax increase.

Several state legislatures are continuing to push ahead this year with significant tax cut packages that are regressive and would dramatically reduce revenues and leave states in a bad position should they experience another unexpected economic shock...

State Rundown 2/16: Spending Priorities Emerge as the Votes Are Counted

February 16, 2022 • By ITEP Staff

State lawmakers have been busy working out deals and negotiating how best to use excess revenues, and as the votes are beginning to come in, spending priorities are becoming clearer...