Oklahoma

It’s that time of year again. Members of Congress and the White House are negotiating the federal budget. Winter temperatures are unpredictable due to climate change. And news outlets, organizations and others are releasing end-of-year lists and the tax wonks at ITEP are joining the chorus. If you’re lucky enough to have some time off over the next couple of weeks or find yourself curling up on the couch this winter in need of a way to pass the time, the tax policy wonks at ITEP have compiled a winter reading/listening list that will appeal to wonks and non-wonks alike.

State Rundown 12/5: Familiar Questions Returning to Fore as 2019 Approaches

December 5, 2018 • By ITEP Staff

State lawmakers are preparing their agendas for 2019 and looking at all sorts of tax and budget policies in the process, raising many familiar questions. Oregon legislators, for example, will try to fill in the blanks in a proposal to boost investments in education that left out detail on how to fund them, while their counterparts in Texas face the inverse problem of a proposed property tax cut that fails to clarify how schools could be protected from cuts. Similar school finance debates will play out in many other states. Alabama, Kansas, and Louisiana will look at gas tax updates,…

Wyo File: Why Are We Footing the Bill for Billionaires?

November 16, 2018

he question, then, will be: Who pays? That question — “Who pays?” — is also at the center of a report released last month by the Washington, D.C.-based Institute on Taxation and Economic Policy. The report, Who Pays? A Distributional Analysis of the Tax Systems in All 50 States, looks at the different tax rates […]

Today Amazon announced major expansions in New York and Virginia, where it intends to hire up to 50,000 full-time employees. The announcement marks the culmination of a highly publicized search that lasted more than a year and involved aggressive courting of the company by cities across the nation. The following are three tax-related observations on the announcement.

State Rundown 10/31: Trick or Treat Advice to Savor for Tonight

October 31, 2018 • By ITEP Staff

Look out for potholes if you’re out trick-or-treating in Alabama tonight, where crumbling infrastructure figures to be a dominant debate in the coming legislative session. And be prepared to share the streets with disgruntled teachers if you‘re in Louisiana, where teachers are walking out to protest regressive tax policies that are sucking the lifeblood from the state’s schools. Meanwhile, Wisconsin residents are sharing scary stories of grotesquely large business tax subsidies and the “dark store” tax loophole they’ll be voting on next week. And you better expect the unexpected if you’re in Delaware, where Gov. John Carney shocked everyone by vetoing two broadly supported tax bills last week.

The Journal Record: Prosperity Policy: An Upside-down Tax System

October 24, 2018

A modestly progressive income tax slightly offsets our regressive sales taxes. But Oklahoma lawmakers cut our top income tax rate by nearly 25 percent since 2004, further tipping the scales to the wealthiest households. Then while grappling with massive budget shortfalls caused in part by these tax cuts, lawmakers took aim at measures that primarily benefit low- and middle-income working families by making the state Earned Income Tax Credit non-refundable and freezing the state standard deduction, while leaving cuts to the top income tax rate in place.

Enid News & Eagle: A Low Tax State for Only Some Oklahomans

October 23, 2018

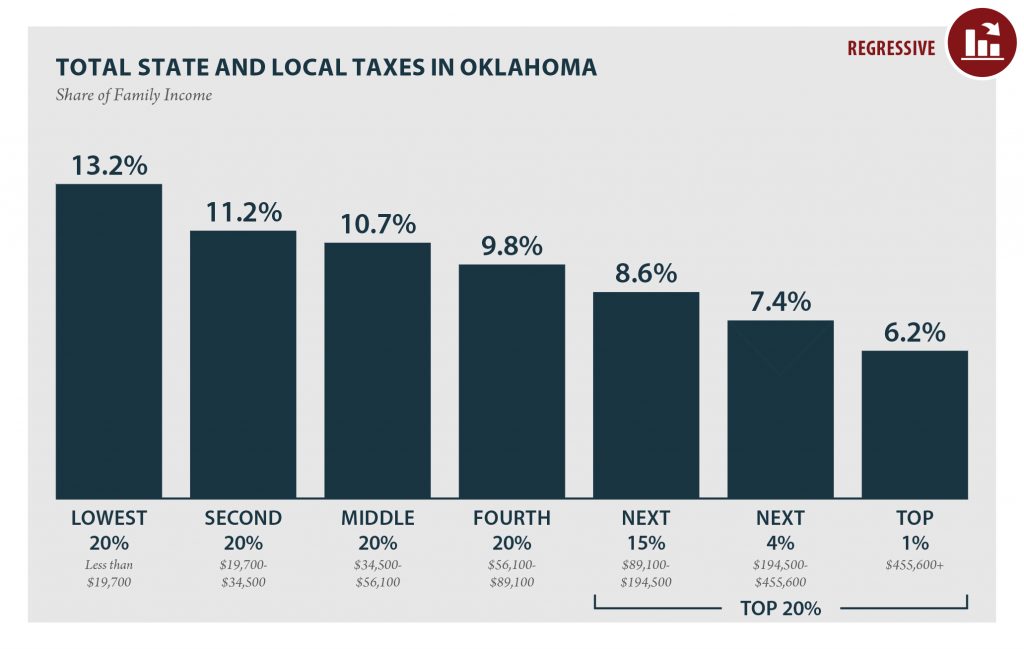

While Oklahoma has a reputation as a low tax state, poor and middle-income Oklahomans are actually paying a greater share of their income in taxes than the national average, while the richest 5 percent of households — with annual incomes of $194,500 or more — pay less.

Tulsa World: Political Notebook: Report Says Oklahoma’s State and Local Taxes Among the Most Regressive in the Nation

October 21, 2018

Oklahoma’s state and local taxes are among the most regressive in the country, according to a report released last week by the Institute on Taxation and Policy.

Oklahoma Policy Institute: New Analysis: Low-income Taxpayers in Oklahoma Pay More than Twice the Tax Rate Paid by the Richest Oklahomans

October 17, 2018

While Oklahoma has a reputation as a low tax state, poor and middle-income Oklahomans are actually paying a greater share of their income in taxes than the national average, while the richest 5 percent of households — with annual incomes of $194,500 or more — pay less.

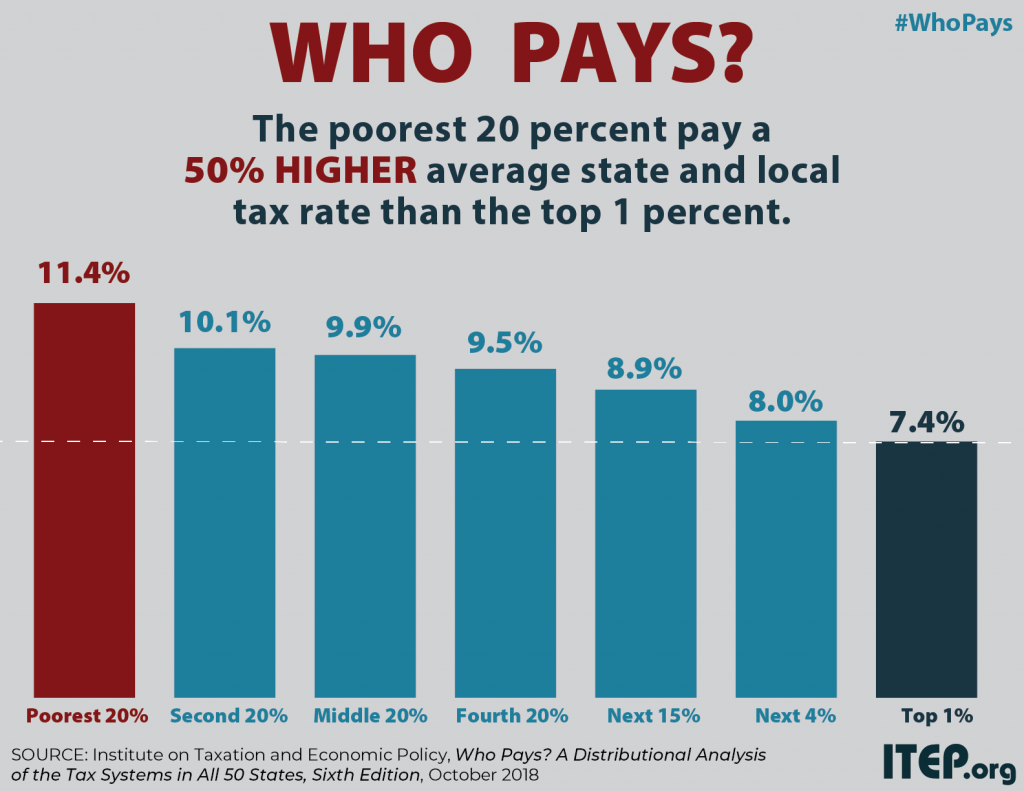

Poorest 20 Percent Pays a 50 Percent Higher Effective State and Local Tax Rate than the Top 1 Percent

October 17, 2018 • By ITEP Staff

A comprehensive 50-state study released today by the Institute on Taxation and Economic Policy (ITEP) finds that most state and local tax systems tax low- and middle-income households at significantly higher rates than wealthy taxpayers, with the lowest-income households paying an average of 50 percent more of their income in taxes than the very rich.

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

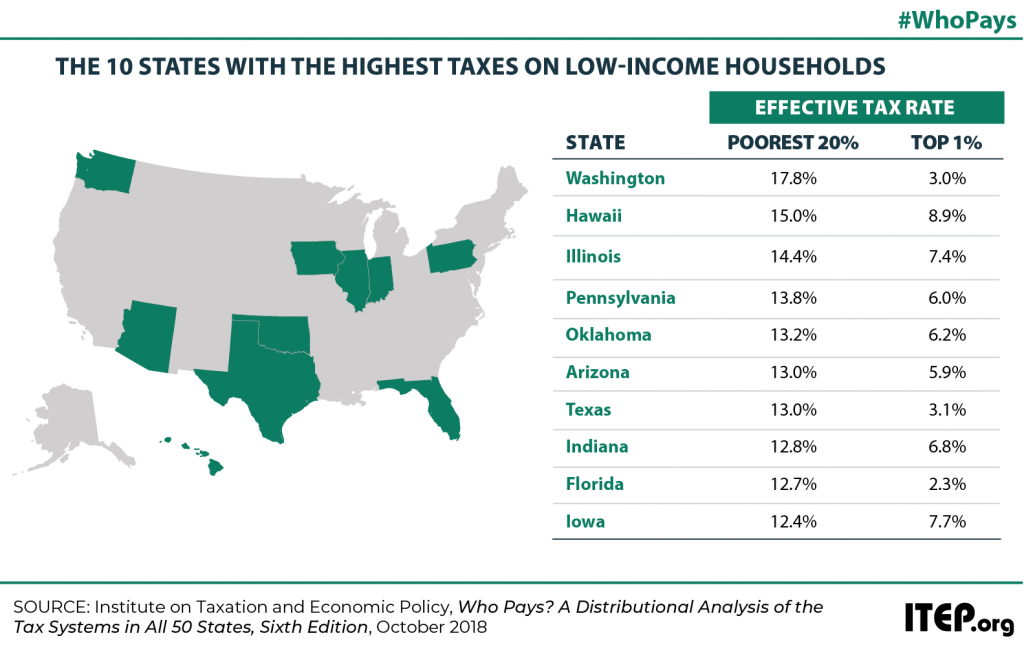

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

ITEP analysis reveals that many states traditionally considered to be “low-tax states” are actually high-tax for their poorest residents. The “low tax” label is typically assigned to states that either lack a personal income tax or that collect a comparatively low amount of tax revenue overall. But a focus on these measures can cause lawmakers to overlook the fact that state tax systems impact different taxpayers in very different ways, and that low-income taxpayers often do not experience these states as being even remotely “low tax.”

Low Tax for Whom? Oklahoma is a “Low Tax State” Overall, But Not for Families Living in Poverty

October 17, 2018 • By ITEP Staff

Oklahoma’s tax system has vastly different impacts on taxpayers at different income levels. For instance, the lowest-income 20 percent of Oklahomans contribute 13.2 percent of their income in state and local taxes — considerably more than any other income group in the state. For low-income families, Oklahoma is far from being a low tax state; in fact, it is the fifth highest-tax state in the country for low-income families.

Oklahoma: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, which measures the impact of each state’s tax system on income inequality, Oklahoma has the 9th most unfair state and local tax system in the country. Incomes are more unequal in Oklahoma after state and local taxes are collected than before.

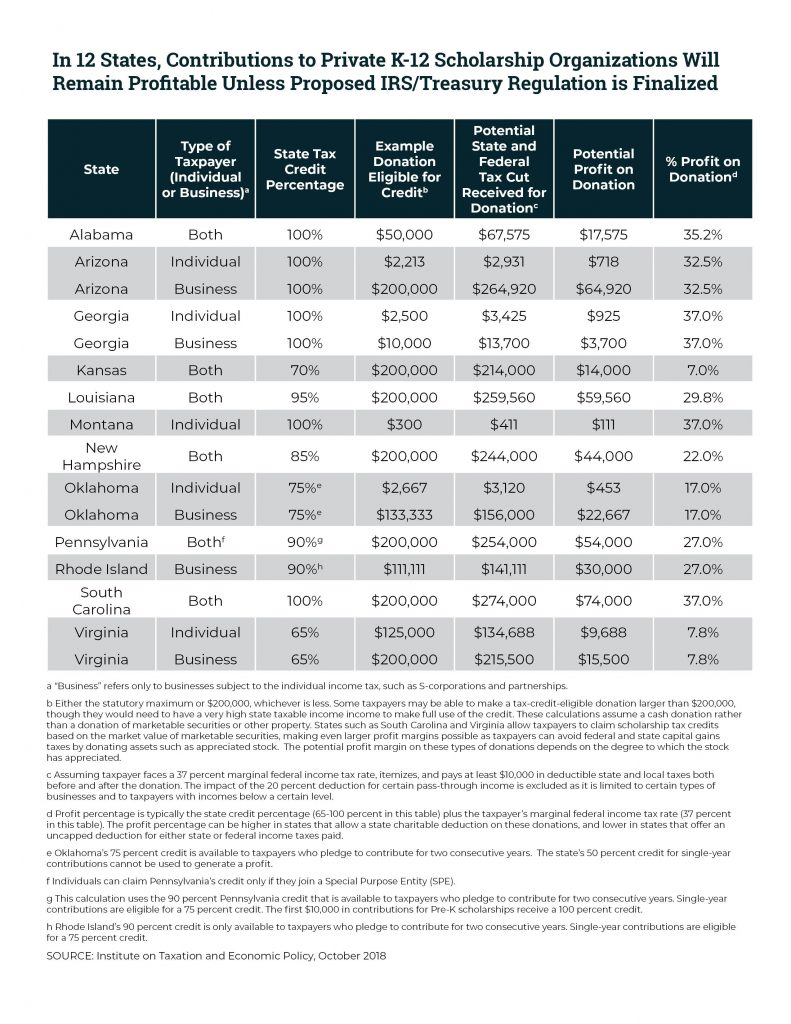

Twelve States Offer Profitable Tax Shelter to Private School Voucher Donors; IRS Proposal Could Fix This

October 2, 2018 • By Carl Davis

A proposed IRS regulation would eliminate a tax shelter for private school donors in twelve states by making a commonsense improvement to the federal tax deduction for charitable gifts. For years, some affluent taxpayers who donate to private K-12 school voucher programs have managed to turn a profit by claiming state tax credits and federal tax deductions that, taken together, are worth more than the amount donated. This practice could soon come to an end under the IRS’s broader goal of ending misuse of the charitable deduction by people seeking to dodge the federal SALT deduction cap.

Tax Cuts 2.0 – Oklahoma

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Rewarding Work Through State Earned Income Tax Credits in 2018

September 17, 2018 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits. The effectiveness of the EITC as an anti-poverty policy can be increased by expanding the credit at…

Reducing the Cost of Child Care Through State Tax Codes in 2018

September 17, 2018 • By Aidan Davis

Families in poverty contribute over 30 percent of their income to child care compared to about 6 percent for families at or above 200 percent of poverty. Most families with children need one or more incomes to make ends meet which means child care expenses are an increasingly unavoidable and unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

Consumers’ growing interest in online shopping and “gig economy” services like Uber and Airbnb has forced states and localities to revisit their sales taxes, for instance. Meanwhile new evidence on the dangers and causes of obesity has led to rising interest in soda taxes, but the soda industry is fighting back. Carbon taxes are being discussed as a tool for combatting climate change. And changing attitudes toward cannabis use have spurred some states to move away from outright prohibition in favor of legalization, regulation and taxation.

The Fight for Education Funding: State Revenue Needs and Responses in 2018

July 24, 2018 • By Aidan Davis

States’ need for revenue and increased investment in key public services is not unique to this legislative session. But the extent of disinvestment—particularly in education—has been a driving force behind policy discussion and state legislative action this year. In many cases ill-advised tax cuts coupled with persistent school funding cuts led states to this common fate, initiating a powerful and growing trend. Here’s how lawmakers in a handful of state responded:

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2018 • By Dylan Grundman O'Neill

An updated version of this brief for 2019 is available here. Read this report in PDF. Overview Sales taxes are an important revenue source, composing close to half of all state tax revenues.[1] But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and […]

New Jersey avoided a second consecutive shutdown and proved that even against staunch opposition, progressive solutions to states' fiscal issues are attainable, and Arizona voters will likely have a chance to solve their education funding crisis in a similar way. Budget and tax debates remain to be resolved, however, in Maine and Massachusetts. Meanwhile, voters are gaining a clearer picture of what questions they will be asked on ballots this fall as signature drives conclude in several states.

Fox Business: Higher State Taxes, Not OPEC, Boosting Gas Prices

July 5, 2018

In July, Oklahoma, South Carolina and Tennessee were among seven states that raised their gas taxes Opens a New Window. . At least 27 states have raised or updated their gas taxes since 2013, according to a report from the Institute on Taxation and Economic Policy Opens a New Window. . California – where drivers pay some […]

The Nation: Will Red-State Protests Spark Electoral Change?

July 5, 2018

State lawmakers came “out of the gate in 2011 with a pretty regressive, large-scale tax-cut plan,” said Meg Wiehe, deputy director of the Institute on Taxation and Economic Policy (ITEP), a nonprofit, tax-focused research group. Led by Governor Fallin, the Oklahoma GOP wanted to scrap the income tax entirely—a plan that was the brainchild of […]