Recent Work by ITEP

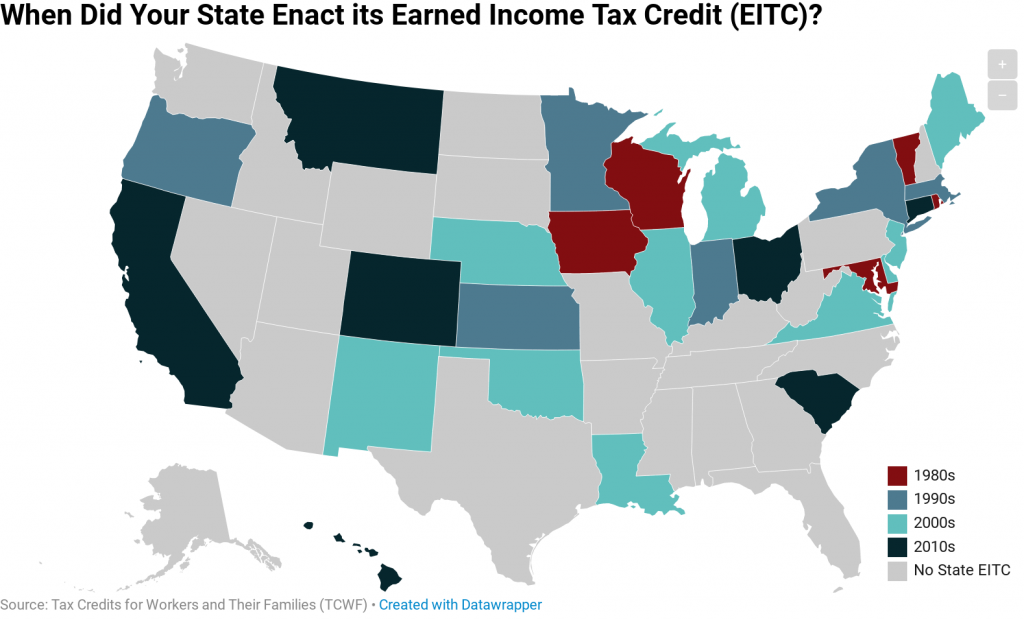

In 1986, Rhode Island became the first state to enact a tax credit patterned after the federal Earned Income Tax Credit (EITC). Since then, EITCs have become increasingly widespread at the state level with 28 states and the District of Columbia now offering them. These credits are designed to improve family economic security by bolstering […]

Unlike Trump-GOP Tax Law, There Are Tax Plans That Would Actually Deliver on Promise to Help Working People

May 24, 2019 • By Alan Essig

Using the tax code to boost the economic security of low- and moderate-income families is a proven strategy. These bold proposals would go much further than any policy currently on the books, and their approach directly contrasts with longstanding supply-side theories that call for continual tax cuts to those who are already economically faring far better than everyone else.

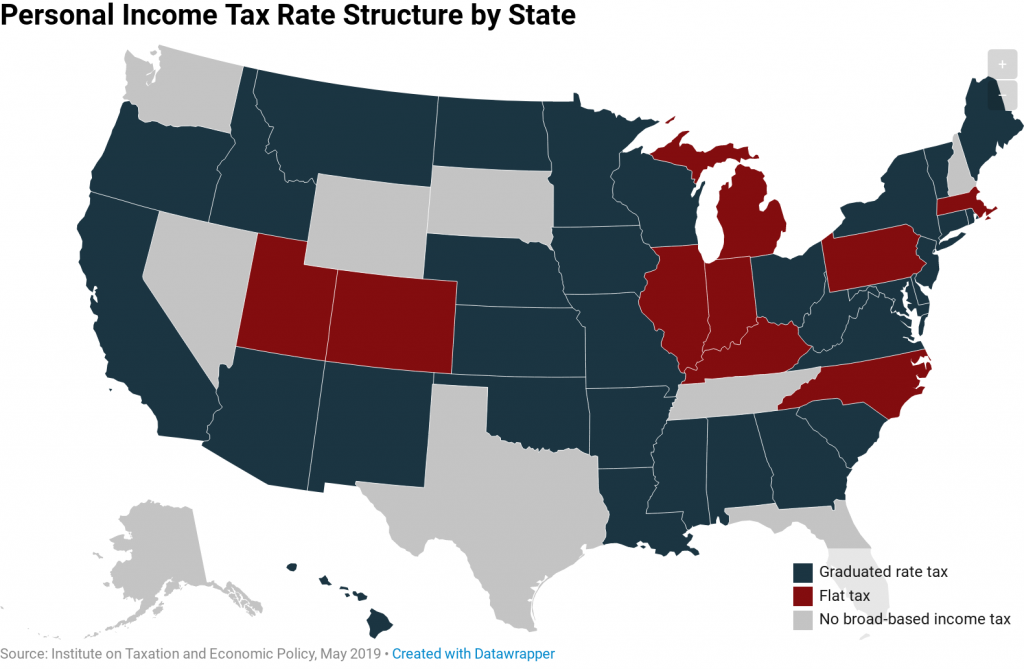

One of the most important decisions that must be made when designing a state personal income tax is whether to charge taxpayers a single flat rate on all their taxable income, or whether to levy a series of graduated rates that ask more of high-income taxpayers

State Rundown 5/22: (Some) State Lawmakers Can (Partly) Relax This Weekend

May 22, 2019 • By ITEP Staff

Lawmakers and advocates can enjoy their barbeques with only one eye on their work email this weekend in states that have essentially finished their budget debates such as Alaska, Minnesota, Nebraska, and Oklahoma, though both Alaska and Minnesota require special sessions to wrap things up. Getting to those barbeques may be a bumpy ride in Louisiana, Michigan, and other states still working to modernize outdated and inadequate gas taxes.

Proposals for Refundable Tax Credits Are Light Years from Tax Policies Enacted in Recent Years

May 22, 2019 • By Steve Wamhoff

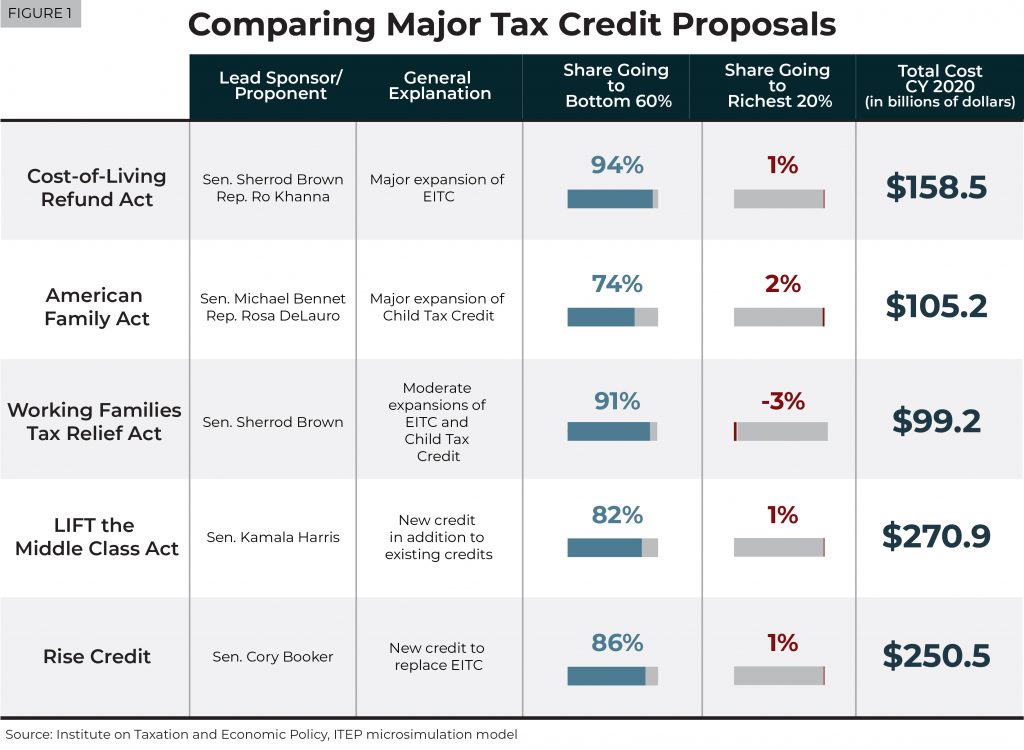

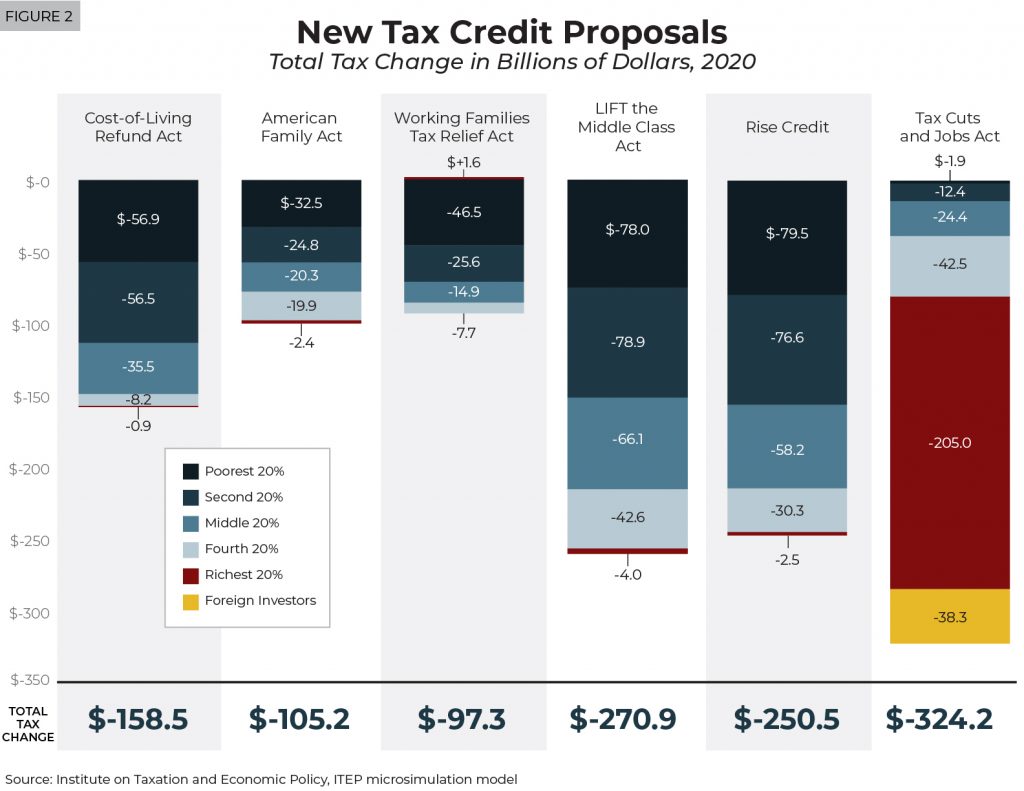

A new ITEP report examines five big proposals that have been announced this year to create or expand tax credits to address inequality and help low- and middle-income households.

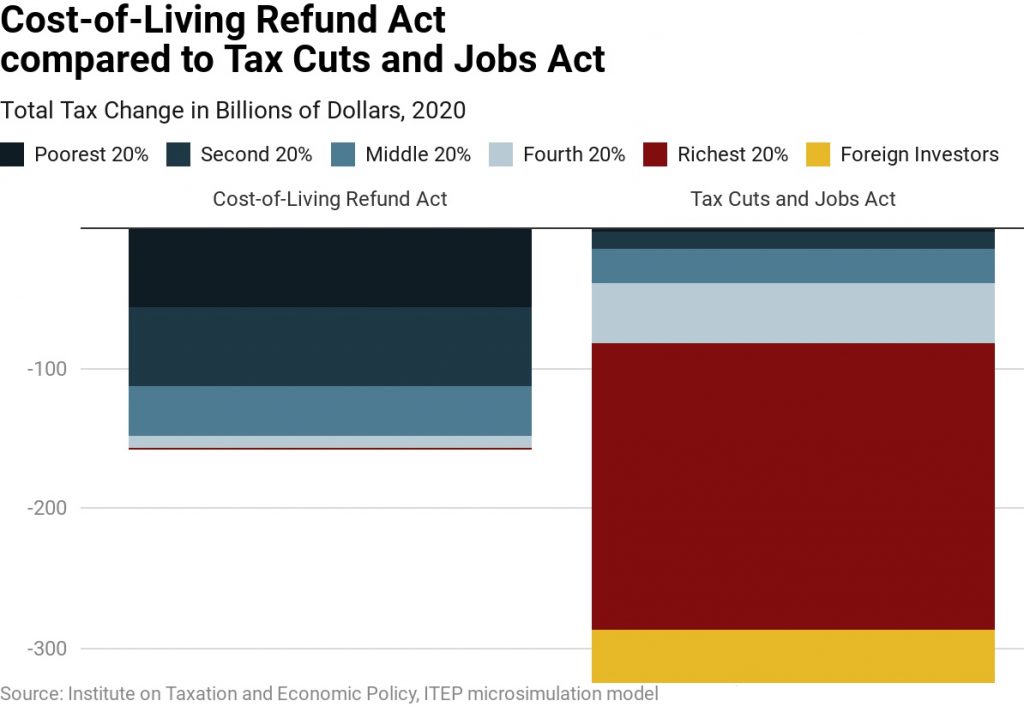

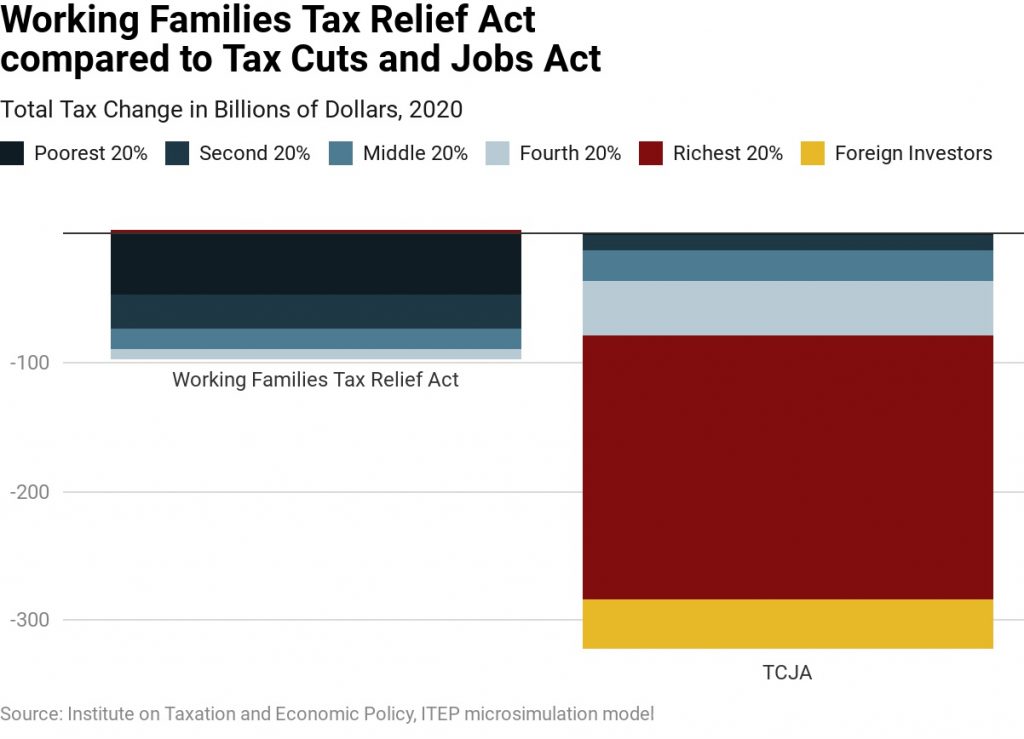

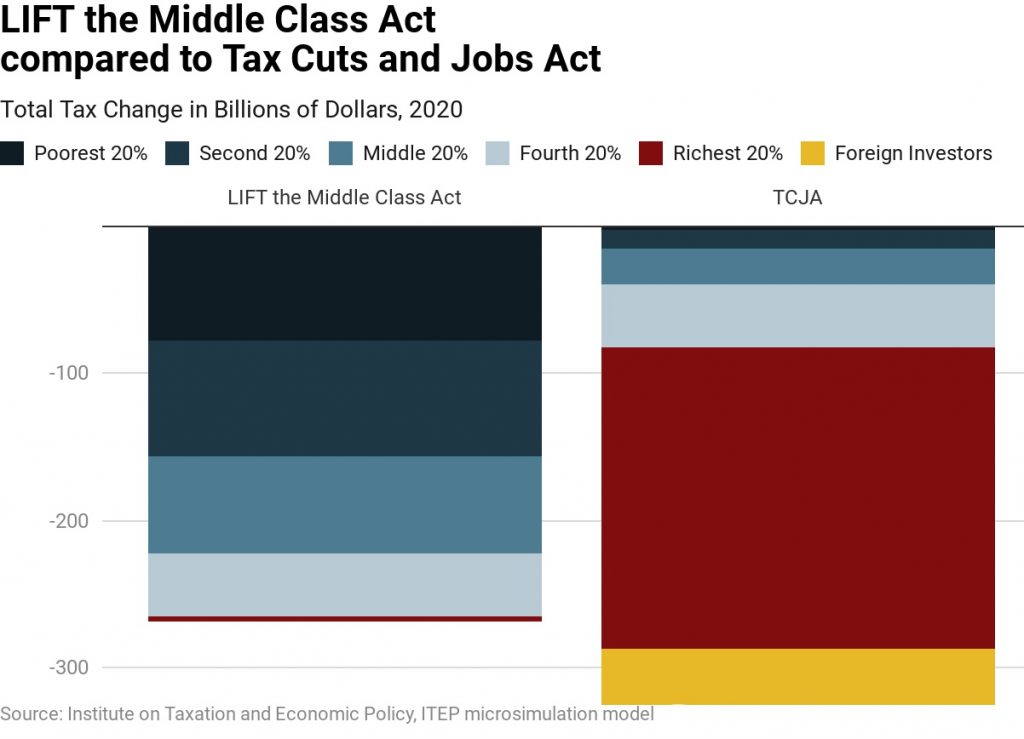

Federal lawmakers have recently announced at least five proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all would primarily benefit taxpayers who received only a small share of benefits from the Tax Cuts and Jobs Act.

The Cost-of-Living Refund Act would expand the Earned Income Tax Credit (EITC) for low- and moderate-income working people. The maximum EITC would nearly double for working families with children. Working people without children would receive an EITC that is nearly six times the size of the small EITC that they are allowed under current law.

The American Family Act would expand the Child Tax Credit (CTC) for low- and middle-income families. The CTC would increase from $2,000 under current law to $3,000 for each child age six and older and to $3,600 for each child younger than age six. The proposal removes limits on the refundable part of the credit so that low- and moderate-income families with children could receive the entire credit.

The Working Families Tax Relief Act would expand the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) for low- and middle-income families.

The LIFT (Livable Incomes for Families Today) the Middle Class Act would create a new tax credit of up to $3,000 for single people and up to $6,000 for married couples, which would be an addition to existing tax credits. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less. Income limits would prevent well-off households from receiving the credit.