Recent Work by ITEP

Charitable, Property Tax, and Mortgage Interest Deductions Would Be Wiped Out for Two-Thirds of Current Claimants Under Congressional Tax Plans

December 7, 2017 • By Carl Davis

In the ongoing debate over major federal tax legislation, there is significant focus on how House and Senate bills would eliminate the deduction for state income tax payments and cap the deduction for property taxes at $10,000 per year. At the same time, tax writers have retained deductions for charitable gifts and mortgage interest with what appear to be comparatively minor changes, at least at first glance.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

They Can’t Help Themselves: GOP Leaders Reveal True Intent Behind Tax Overhaul

December 4, 2017 • By Jenice Robinson

The hand-written scrawls in the margins of the hastily written 500-page Senate tax bill had barely dried when lawmakers began to reveal the true motivation behind their rush to fundamentally overhaul the nation’s tax code.

Senate “Pass-Through” Deduction Threatens to Undermine State Tax Systems

December 1, 2017 • By Carl Davis

The U.S. Senate will soon be voting on a bill that would, among other things, allow so-called “pass-through” businesses to pay significantly lower taxes than their employees...If the Senate “pass-through” deduction is enacted into law, dozens of states will be forced to confront the possibility of reduced revenue collections, more regressive tax codes, and increased tax avoidance.

New ITEP Report Explains How Tax Reform Should Eliminate Breaks for Real Estate Investors Like Trump

December 1, 2017 • By Steve Wamhoff

A new report from ITEP provides more details on the many breaks and loopholes for wealthy real estate investors like Trump and what a true tax reform would do to close them.

How True Tax Reform Would Eliminate Breaks for Real Estate Investors Like Donald Trump

December 1, 2017 • By ITEP Staff

The federal tax code includes several loopholes and special breaks that advantage wealthy real estate investors like President Donald Trump. Under current law, real estate investors can claim losses much more quickly and easily than other taxpayers, but they also have several methods to delay or avoid reporting any profits to the IRS.

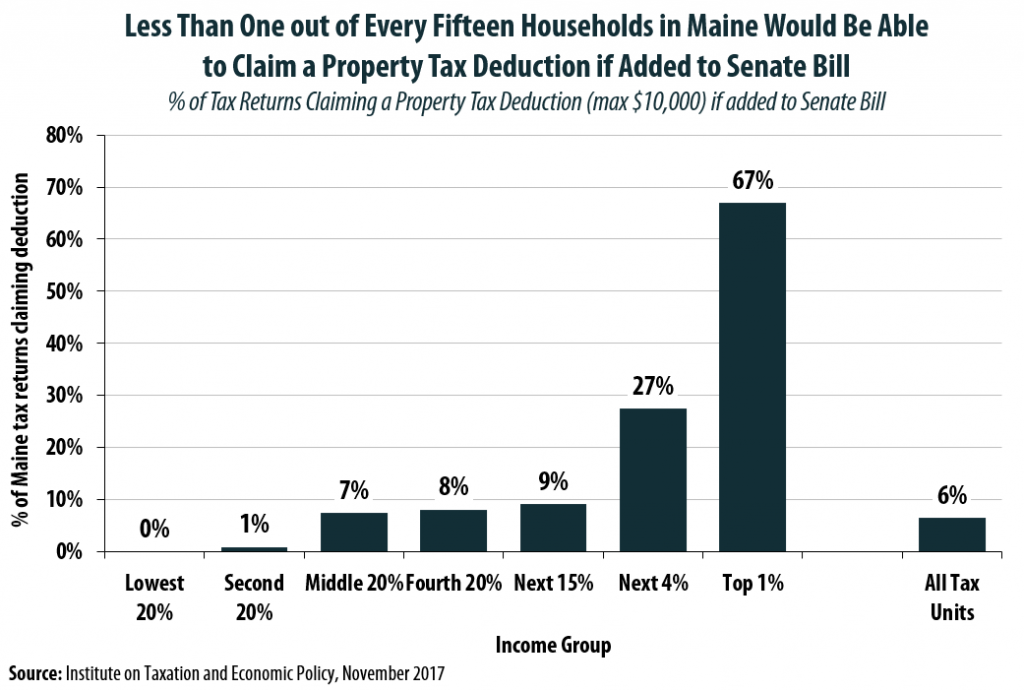

Senator Collins Pushes Hard for a Property Tax Deduction that Very Few of Her Constituents Will Be Able to Claim

December 1, 2017 • By Carl Davis

Adding a property tax deduction back into the Senate bill may sound like a compromise, but a new analysis performed using the ITEP Microsimulation Tax Model reveals that the amount of state and local taxes deducted by Maine residents would plummet by 90 percent under this change, from $2.58 billion to just $262 million in 2019. In short, this change is much more symbolic than substantive.

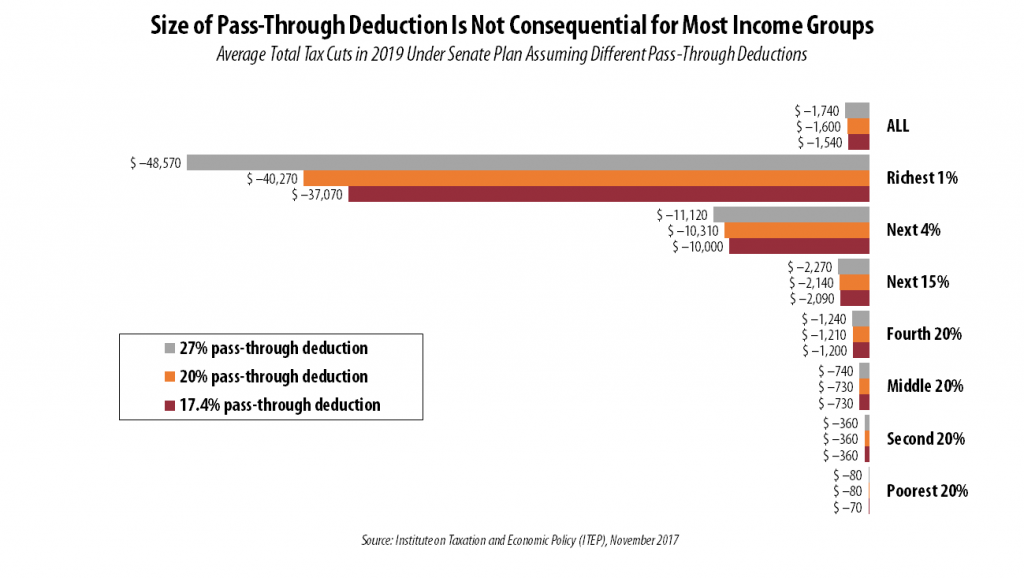

Republican Senators Debate Size of “Pass-Through” Break, But Proposed Compromises Will Make No Difference to Anyone Who Is Not Well-Off

November 30, 2017 • By Steve Wamhoff

Senators Ron Johnson of Wisconsin and Steve Daines of Montana want the tax bill on the Senate floor to be amended to offer a more generous tax break for “pass-through” businesses. We have estimated how all the provisions in the tax bill would impact each income group under three possible scenarios. The only thing different in each scenario is the size of the deduction for pass-through income: 17.4 percent (the deduction in the bill as this is written), 20 percent and 27 percent. We find that the size of the pass-through break makes no difference for anyone who is not…

A Corporate Tax Cut Would Benefit Coastal Investors, Not the Heartland

November 30, 2017 • By Carl Davis

The centerpiece of the House and Senate tax plans is a major tax cut for profitable corporations that the American public does not want, and that will overwhelmingly benefit a small number of wealthy investors living in traditionally “blue” states. New ITEP research shows that poorer states such as West Virginia, Oklahoma, Alabama, and Tennessee would be largely left behind by a corporate tax cut, while the lion’s share of the benefits would remain with a relatively small number of wealthy investors who tend to be concentrated in larger cities near the nation’s coasts.

Lawmakers Are Allowing Monied Interests to Trump the Voices of Their Constituents

November 30, 2017 • By Alan Essig

George Washington is said to have described the U.S. Senate as the body that cools the passions of an impulsive House of Representatives just as a saucer cools tea. But current Senate leaders appear to think of themselves as more of a Bunsen burner.