Recent Work by ITEP

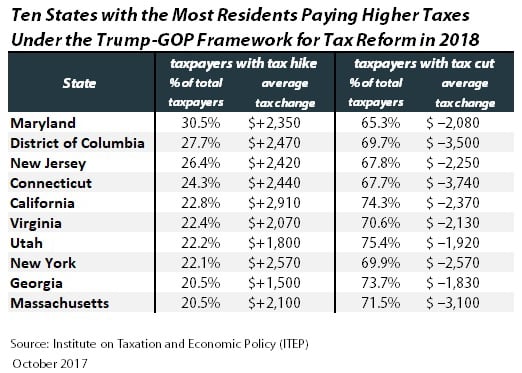

As our report on the Trump-GOP tax framework explained, in nine states plus the District of Columbia, more than a fifth of households would pay higher taxes under the framework.

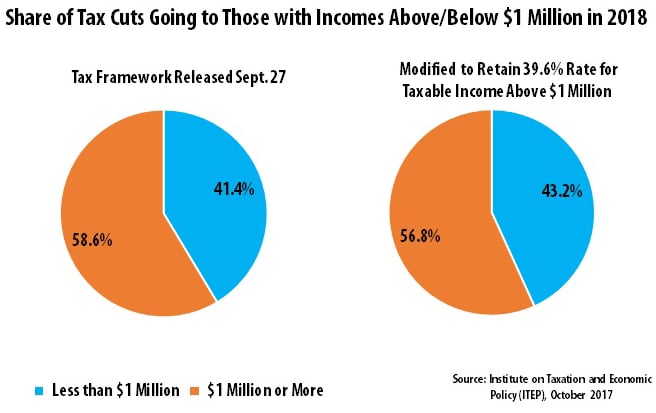

GOP Tax Plan Will Mainly Benefit Millionaires Even If Top Rate Remains 39.6 Percent

October 24, 2017 • By Steve Wamhoff

The Trump-GOP taxframework would reduce the top personal income tax rate from 39.6 percent to 35 percent, but now lawmakers are discussing keeping the top personal income tax rate at 39.6 percent for those with taxable income of more than $1 million. This modification would barely change the proposal’s overall impact.

The Jig Is Up: Republican Budget Resolution Finally Admits That Deficit Will Soar Under GOP Tax Plan

October 20, 2017 • By Alan Essig

For some lawmakers, annual deficits matter a lot—unless the nation is paying for tax cuts for the wealthy via deficit spending. Last night, Republican lawmakers demonstrated that previous grandstanding about the nation’s debt is much ado about nothing. The Senate approved a budget resolution on a party-line vote that would 1. fast-track legislation adding $1.5 trillion to the deficit over 10 years by cutting taxes, and 2. make it easy to enact this measure without a single Democratic vote.

Real tax reform would mean raising more revenue to make public investments and increasing the progressivity of the tax code. Many conservatives strongly disagree with this and insist that a substantial tax cut for the wealthiest Americans will grow the economy. Rather than engage in this policy debate based on policy ideals and principles, President Trump, other White House officials and GOP leaders have peppered their sales pitch for tax cuts with false claims about the amount of taxes that Americans pay and the effect the current GOP tax proposal would have on the tax system.

The Corporate Tax Code is in Dire Shape, But Trump-GOP Plan Would Make It Worse

October 18, 2017 • By Richard Phillips

Just how bad has the corporate tax code gotten? The newest edition of Offshore Shell Games, a joint report by the Institute on Taxation and Economic Policy (ITEP) and U.S. PIRG, outlines the massive scale of the offshore tax avoidance undertaken by U.S. multinationals. It’s well known that Fortune 500 companies have accumulated a stash of $2.6 trillion in earnings offshore, which has allowed them to avoid an estimated $752 billion in taxes.

State Rundown 10/18: Ballot Initiative Efforts Being Finalized

October 18, 2017 • By ITEP Staff

Ballot initiatives relating to taxes made news around the country this week, with Oregon voters to consider reversing new health care taxes, Washingtonians to vote on improving education funding, and Nebraskans to potentially vote on a state tax credit for school property taxes. Meanwhile, multiple states are finalizing their proposals to lure Amazon to build a new headquarters in their state, often through the use of massive tax subsidies. And in our "What We're Reading" section we have sobering news from Moody's Investors Service on states' struggles to fund their infrastructure and save for the next recession.

Tax Foundation Updates Its Problematic Wishlist for State Tax Policy

October 18, 2017 • By Carl Davis

This week the Tax Foundation published its 2018 State Business Tax Climate Index, or as University of Iowa economist Peter Fisher has nicknamed it, the “Waste of Time Index.”

This study explores how in 2016 Fortune 500 companies used tax haven subsidiaries to avoid paying taxes on much of their income. It reveals that tax haven use is now standard practice among the Fortune 500 and that a handful of the country’s biggest corporations benefit the most from offshore tax avoidance schemes.

State Rundown 10/13: Soda Taxes, Business Subsidies, and Gas Taxes Considered in Several States

October 13, 2017 • By ITEP Staff

A comprehensive tax study is underway in Arkansas this week as other states hone in on more specific issues. Soda taxes hit setbacks in Illinois and Michigan, business tax subsidies faced scrutiny in Iowa and Missouri, and gas tax update efforts are underway in Mississippi and North Dakota.

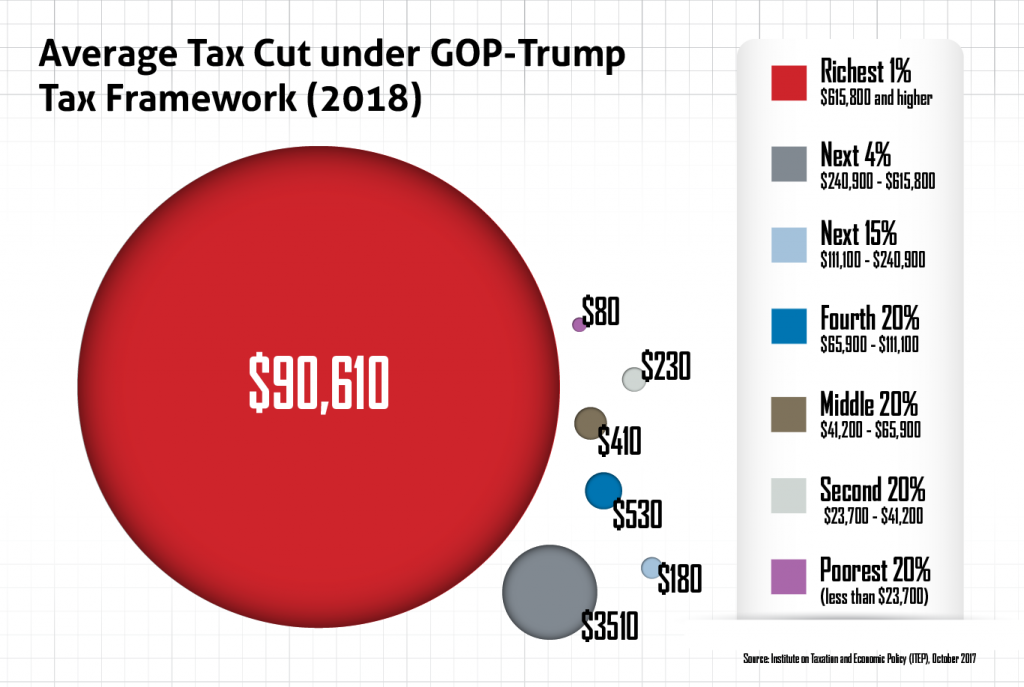

Middle-Income More Likely Than the Rich to Pay More Under Trump-GOP Tax Plan

October 11, 2017 • By Jenice Robinson

The Trump Administration and GOP leaders continue to wrap their multi-trillion tax cut gift to the wealthy in easily refutable rhetoric about boosting the nation’s middle class. Later today, trucks and truck drivers will serve as a backdrop for a Pennsylvania speech in which Trump is anticipated to talk about how proposed tax changes that […]