Recent Work by ITEP

A month ago, the Seattle City Council passed an income tax measure, which has garnered a lot of attention as well as volumes of supportive and opposition commentary. Haven’t had a chance to dive into the details yet? We’ve got you covered. What is the new income tax law and who does it impact? The […]

This week, Rhode Island lawmakers agreed on a budget, leaving only three states – Connecticut, Pennsylvania, and Wisconsin – without complete budgets. Texas, however, remains in special session and West Virginia could go back into another special session over tax issues. And in New York City, the mayor proposes a tax on the wealthy to […]

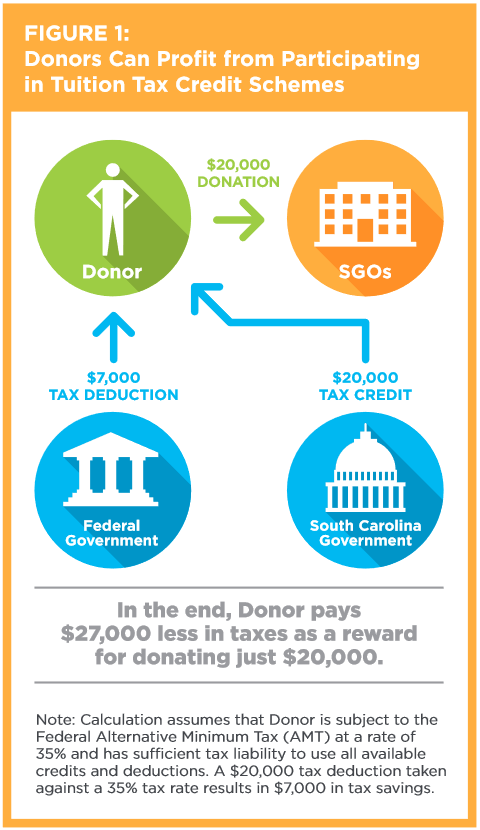

It’s a Fact: Voucher Tax Credits Offer Profits for Some “Donors”

August 9, 2017 • By Carl Davis

In nine states, tax rewards gained by donating to fund private K-12 vouchers are so oversized that “donors” can turn a profit. This is the shocking but true finding of a pair of studies released by ITEP over the last year.

How to Think About the Problem of Corporate Offshore Cash: Lessons from Microsoft

August 4, 2017 • By Matthew Gardner

For a corporation with deeply American roots, Microsoft seems remarkably unable to turn a profit here. Against all odds, the Redmond, Washington-based company continues to claim that virtually all its earnings are in foreign countries. Microsoft’s latest annual report, released earlier this week, shows that over the past two years, the company enjoyed worldwide income of almost $43 billion. It claims to have earned just 0.3 percent of that—$128 million—in the United States.

Trump Administration May Make Corporate Inversions Great Again

August 4, 2017 • By Richard Phillips

During the presidential campaign, Donald Trump called out companies engaging in corporate inversions saying that one proposed inversion was “disgusting” and that “politicians should be ashamed” for allowing it to happen. Despite this rhetoric, the Trump Administration is considering rolling back critical anti-inversion rules as part of its broad regulatory review of recently issued Treasury Department regulations.

Comment Letter to Treasury on Earnings Stripping Regulations

August 4, 2017 • By ITEP Staff

The following letter was submitted to U.S. Treasury as per their request for comment in Notice 2017–38 on Section 385 regulations.

State Rundown 8/2: Legislative Tax Debates Wind Down as Ballot Initiative Efforts Ramp Up

August 2, 2017 • By ITEP Staff

Budget deliberations continue in earnest this week in Alaska, Connecticut, Pennsylvania, and Rhode Island. In South Dakota and Utah, the focus is on gearing up for ballot initiative efforts to raise needed revenue, though be sure to read about legislators nullifying voter-approved initiatives in Maine and elsewhere in our "what we're reading" section.

The Problems with the Multi-Million-Dollar Effort to Secure Millionaire and Corporate Tax Cuts

July 31, 2017 • By Alan Essig

Until GOP leaders put forth a detailed tax proposal, we will not know for certain whether the plan will focus on the middle-class and create jobs. But what we do know is that unless the plan is a radical departure from the principles outlined by President Trump earlier this year or laid out by Paul Ryan last year in his “Better Way,” plan, GOP-led tax “reform” efforts will be a tax break bonanza for the wealthiest Americans while delivering a pittance to working people.

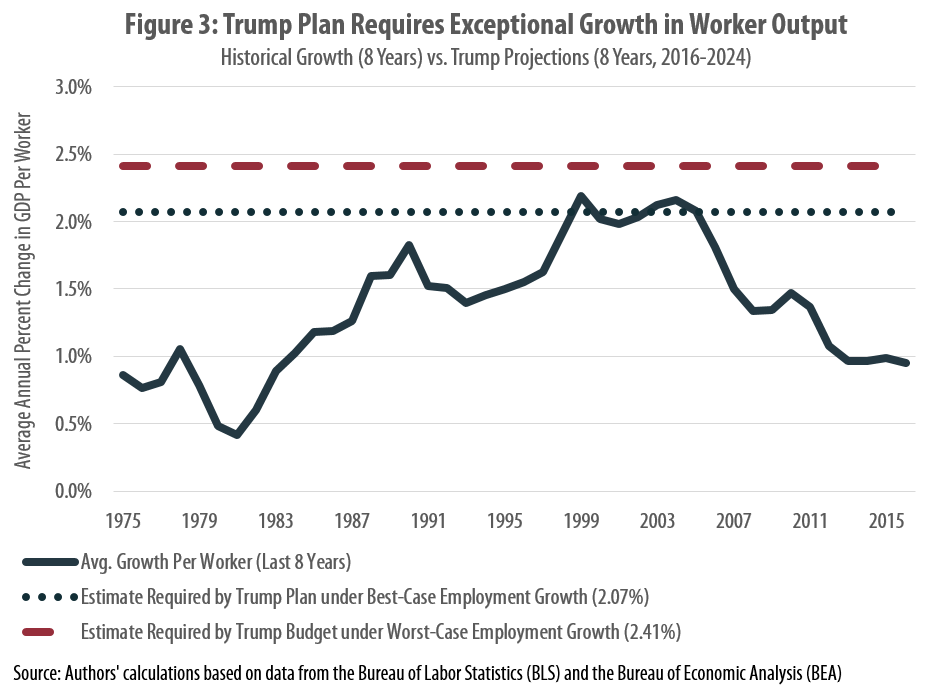

Art Laffer and Stephen Moore’s Misleading Case for the Trump Tax Cuts

July 28, 2017 • By Nick Buffie

Art Laffer and Stephen Moore recently penned an op-ed in the Wall Street Journal in which they called on state and local policymakers to support the Trump tax cuts. They claimed that the Trump plan would provide a significant boost to state and local tax revenues, thereby allowing states with large budget deficits to “regain fiscal health.” State and local lawmakers should not be fooled by these claims. The reality is that Trump’s tax cuts are more likely to worsen state and local fiscal health than improve it.

State Rundown 7/27: State Legislative Debates Winding Down but Tax Talk Continues

July 27, 2017 • By ITEP Staff

While only a few states still remain mired in overtime budget debates, there is plenty of budget and tax news from around the country this week. Efforts are underway to repeal gas tax increases in California and challenge a local income tax in Seattle, Washington. And New Jersey legislators' law to modernize its tax code to tax Airbnb rentals has been vetoed for now.