Recent Work by ITEP

State Rundown 2/1: February Brings New (and Some Old) Tax Policy Conversations

February 1, 2023 • By ITEP Staff

Tax bills across the U.S. are winding their way through state legislatures and governors continue to set the tone for this year’s legislative sessions...

By Fighting Audit Bias, Funding for Tax Enforcement Can Advance Racial Equity

February 1, 2023 • By Jon Whiten

Black households are between 2.9 and 4.7 times more likely to be audited by the Internal Revenue Service than non-Black households. This disparity is driven in part but not wholly by a lack of resources at the IRS, which itself is driven by years of budget cuts the agency has faced.

State Rundown 1/26: Tax Season Brings With it Reminder of EITC’s Impact

January 26, 2023 • By ITEP Staff

Tax season has officially kicked off and with Earned Income Tax Credit (EITC) Awareness Day right around the corner, it serves as another reminder for how important the EITC is...

State Rundown 1/19: ITEP Provides a Roadmap for Equitable Tax Goals in 2023

January 19, 2023 • By ITEP Staff

State legislatures are buzzing as leaders and lawmakers jockey to advance their 2023 goals...

Lawmakers in seven states will introduce legislation this week to tax wealth in a new coordinated effort to combat ever-increasing income and wealth inequality. The bills couldn’t come at a better time, as those at the very top continue to pull apart from the rest of us and far too many states contemplate piling on to this runaway inequality with seemingly endless tax cuts for those at the top.

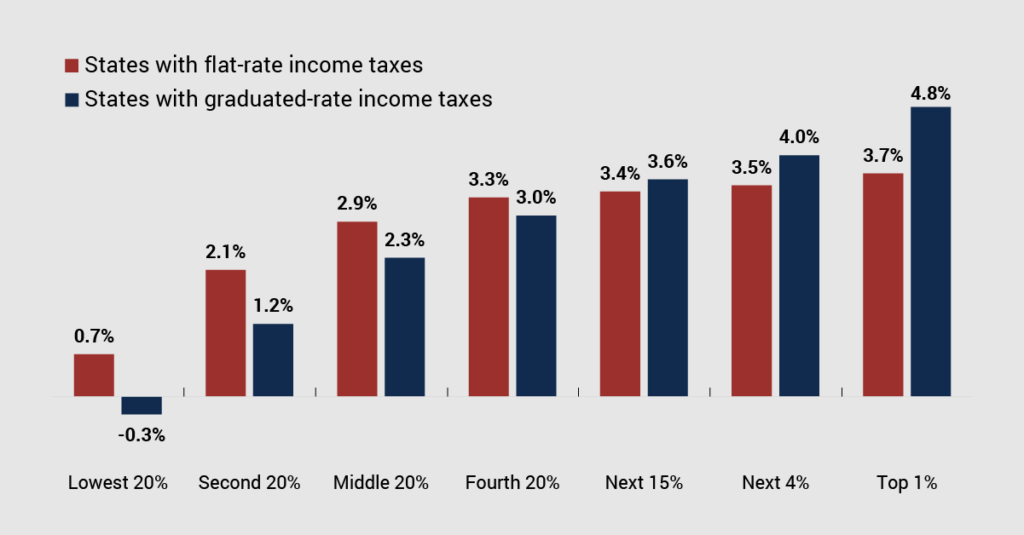

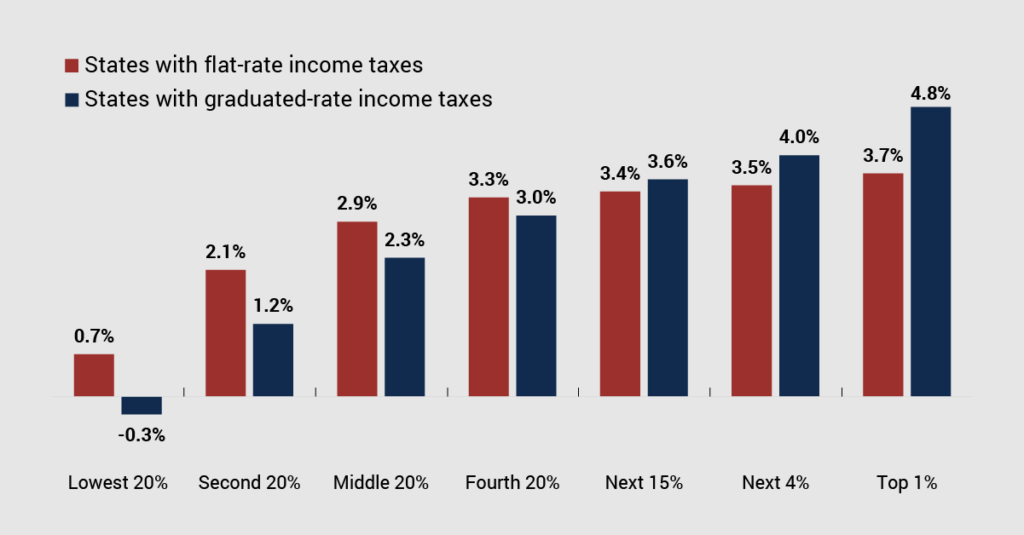

Two-thirds of states with broad-based personal income tax structures have a graduated rate, while one-third have flat taxes.

State Lawmakers Should Break the 2023 Tax Cut Fever Before It’s Too Late

January 18, 2023 • By Miles Trinidad

Despite mixed economic signals for 2023, including a possible recession, many state lawmakers plan to use temporary budget surpluses to forge ahead with permanent, regressive tax cuts that would disproportionately benefit the wealthy at the expense of low- and middle-income households. These cuts would put state finances in a precarious position and further erode public investments in education, transportation and health, all of which are crucial for creating inclusive, vibrant communities where everyone, not just the rich, can achieve economic security and thrive. In the event of an economic downturn, these results would be accelerated and amplified.

Momentum Behind State Tax Credits for Workers and Families Continues in 2023

January 18, 2023 • By Miles Trinidad

Refundable tax credits are an important tool for improving family economic security and advancing racial equity, and there is incredible momentum heading into 2023 to boost two key state credits: the Child Tax Credit and the Earned Income Tax Credit.

National Taxpayer Advocate: Infusion of New IRS Funding a ‘Gamechanger’ for Taxpayers

January 17, 2023 • By Jon Whiten

A new report from the National Taxpayer Advocate – part of an independent oversight arm inside the IRS – found that the agency struggled in 2022 with timely processing of tax returns and refunds, responding to taxpayer correspondence quickly, and answering phone calls. It expects these issues to improve in 2023, thanks in part to the influx of $80 billion in new funding from last year’s Inflation Reduction Act, which the Advocate’s office calls a “gamechanger” for Americans.

Flat taxes have some surface appeal but come with significant disadvantages. Critically, a flat tax guarantees that wealthy families’ total state and local tax bill will be a lower share of their income than that paid by families of more modest means.