Recent Work by ITEP

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

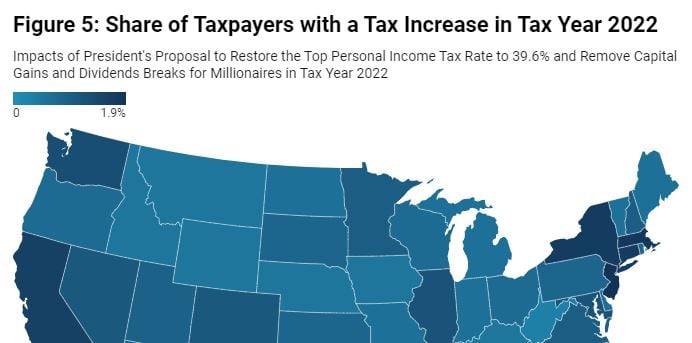

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

“Tax Day” was earlier this week but the debates, research, and advocacy that determine our taxes and how they are used take place every day of the year...

IRS Clock Runs Out, Saving 14 Large Companies $1.3 Billion

May 18, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Each year, corporations publicly state that some of the tax breaks they claim are unlikely to withstand scrutiny from tax authorities. And each year, corporations report that they will keep some of the dubious tax breaks they declared in previous years simply because the statute of limitations ran out before tax authorities made any conclusions. This suggests that, perhaps because of cuts to its enforcement budget, the IRS is not even investigating corporations that publicly announce they have claimed tax breaks that tax authorities would likely find illegal.

Take a minute on this Tax Day to reflect on all that you survived, accomplished, and contributed to the collective good this past year, and be proud. There is always more work to be done to build the communities we desire, and paying your share is what allows that work to continue.

Taxes not only provide revenue so we can have a functioning government, they also shape broader society. Currently economic inequality is one of the most pressing challenges of our time. ITEP has produced research over the years that shows the nation’s overall tax system (local, state and federal combined) is barely progressive. With real tax reform that centers ordinary people, tax policy can help create a more equitable society.

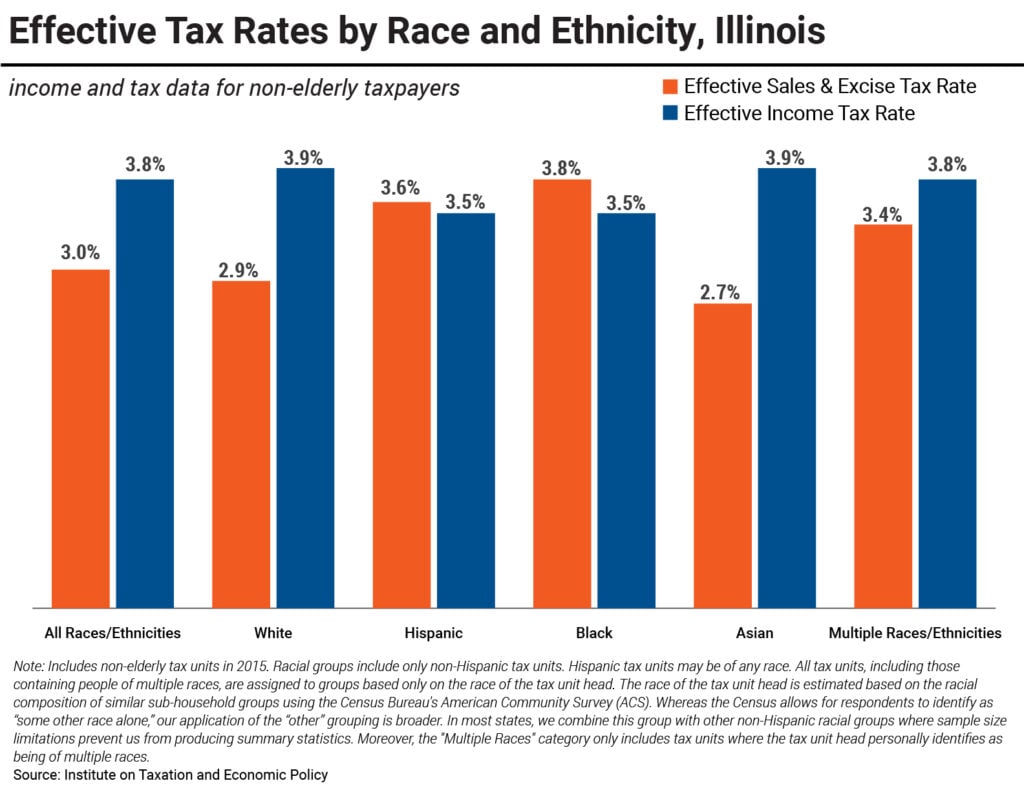

State Tax Codes & Racial Inequities: An Illinois Case Study

May 14, 2021 • By Lisa Christensen Gee

Earlier this year, ITEP released a report providing an overview of the impacts of state and local tax policies on race equity. Against a backdrop of vast racial disparities in income and wealth resulting from historical and current injustices both in public policy and in broader society, the report highlights that how states raise revenue to invest in disparity-reducing investments like education, health, and childcare has important implications for race equity.

State Rundown 5/13: States Get Federal Aid and Guidance as Many Sessions Wind Down

May 13, 2021 • By ITEP Staff

We had our noses buried in new American Rescue Plan guidance...when we heard the refreshing news that Missouri leaders are on the verge of modernizing their tax code, not only by becoming the final state to apply sales taxes to online purchases, but also by enacting an Earned Income Tax Credit (EITC)...Meanwhile, tax debates are also highly active in California, Colorado, Louisiana, Maine, and Nebraska. We also share some of our own reporting on recent efforts in Arizona and several other states to undermine voter-approved reforms and democratic institutions themselves.

Nearly 20 Million Will Benefit if Congress Makes the EITC Enhancement Permanent

May 13, 2021 • By Aidan Davis

Overall, the EITC enhancement would provide a $12.4 billion boost in 2022 if made permanent, benefiting 19.5 million workers. It would have a particularly meaningful impact on the bottom 20 percent of eligible households who would receive more than three-fourths of the total benefit. Forty-one percent of households in the bottom 20 percent of earners would benefit, receiving an average income boost of 6.3 percent, or $740 dollars.

Attacks on Voting Rights, Secret Tax-Cut Negotiations in Arizona Reflect Broader Trend to Undermine Democracy

May 13, 2021 • By Carl Davis, ITEP Staff, Jenice Robinson

The onslaught of news about multiple states introducing or passing legislation to make it harder to vote is a clear signal that our democracy is in crisis. Decades of policymaking and judicial rulings have created a system in which the voices of the wealthy and powerful have more weight, and some lawmakers are determined to further rig the system and keep it that way.

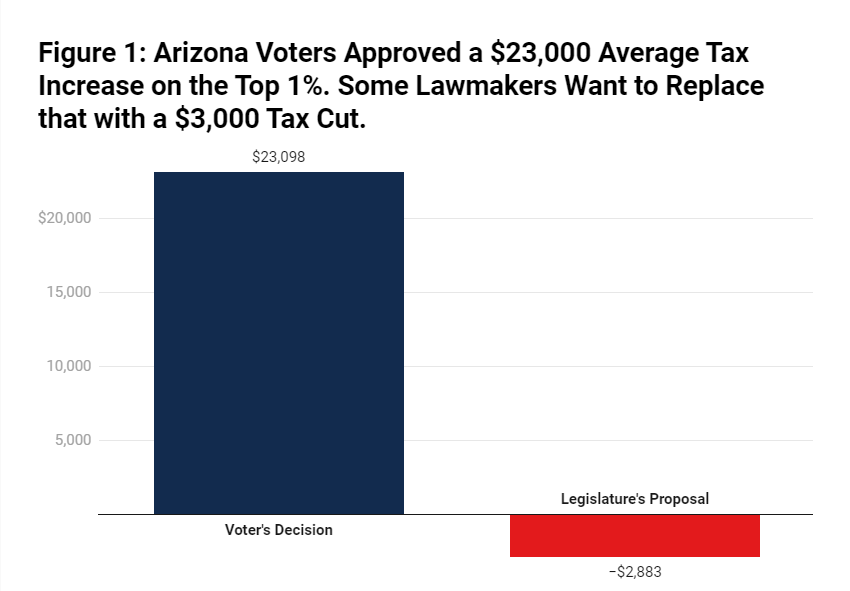

Arizonans Voted to Tax the Rich. Now Lawmakers Want to Undo Most of That.

May 12, 2021 • By Carl Davis

In 2018, Arizona teachers took part in a national wave of teacher walkouts, protesting inadequate education funding and some of the lowest teacher pay in the nation—direct results of the state’s penchant for deep tax cuts and its decision to levy some of the lowest tax rates in the country on high-income families.