Recent Work by ITEP

Donald Trump and Taxes: Fast and Loose with Loopholes or Fraud?

September 30, 2020 • By Matthew Gardner

The president’s apparent abuse of everything from hair-care deductions to consulting fees for family members raises questions about whether Trump was fast and loose with tax loopholes or whether the IRS simply wasn’t enforcing the law. Either way, Trump successfully flouting or pushing the limits of the law shouldn’t come as a surprise: Congress has cut IRS funding, in real terms in each of the last 10 years.

A 2017 Tax Provision Could Have Restrained Trump’s Tax Dodging, But Congress Just Weakened It

September 29, 2020 • By Steve Wamhoff

President Trump and Republicans in Congress passed up almost every opportunity to shut down special tax breaks and loopholes for real estate investors when they enacted their 2017 tax law. They did, however, include some welcome provisions to limit how business owners use losses to avoid taxes, and these provisions could potentially limit the sort of tax dodging perfected by Trump. Unfortunately, Congress temporarily reversed these limits with some provisions tucked into the CARES Act that was enacted in March, and this may help Trump and others like him to continue avoiding taxes.

Congress is certainly to blame both for providing a ridiculously lenient tax code for the super-wealthy and for preventing the IRS from enforcing even the existing weak limits in the law on tax avoidance. But make no mistake, one person is primarily responsible for the farce that is Donald Trump’s tax dodging, and that is Donald Trump. For years, he has actively and loudly supported special tax breaks and tax shelters, making him anything but a passive bystander to their creation.

It’s Time to Change the Tax Laws to Make Donald Trump and Corporate Giants Pay Up

September 29, 2020 • By Amy Hanauer

It’s time for a new approach. Trump’s egregious tax avoidance further exposes a system that preserves an enormous and growing economic divide. Congress has gutted IRS funding so that we don’t have the resources to audit wealthy tax avoiders. And lobbyists continue to secure giveaways for corporate clients that do nothing for our communities.

It’s No Secret—To Save State Budgets End Preferential Treatment of Capital Gains

September 25, 2020 • By Marco Guzman

In an updated policy brief, ITEP explores the flaws in state capital gains tax breaks and highlights how ending special tax breaks provides one of the simplest ways to raise additional revenue and increase equity in the tax system.

State Taxation of Capital Gains: The Folly of Tax Cuts & Case for Proactive Reforms

September 25, 2020 • By Marco Guzman

The federal tax system and every state treat income from capital gains more favorably than income from work. Preferential capital gains tax treatment includes exclusions and seldom-discussed provisions like deferral and stepped-up basis, as well as more direct tax subsidies for profits realized from local investments and, in some instances, from investments around the world. This policy brief explains state capital gains taxation, examines the flaws in state capital gains tax breaks, and proposes reform options that will help make state tax systems more progressive and more equitable.

While the moneyed elite were dangling shiny objects, scapegoating Black and brown people, denigrating immigrants, and financing studies to convince us that poor people are the problem, they were concurrently securing policies that cut taxes primarily for the rich and profitable corporations, deregulated industry, weakened unions and attacked voting rights. This and more allowed the rich to amass even more wealth and power.

State Rundown 9/23: Tax Justice Advanced in New Jersey, On the Ballot in Illinois

September 23, 2020 • By ITEP Staff

New Jersey leaders grabbed the biggest headlines of the week by finally agreeing to implement a much-needed and long-discussed millionaires tax to shore up the budget and improve tax fairness. And Illinois residents can begin voting tomorrow to enact a graduated income tax there. Relatedly, ITEP Research Director Carl Davis updated our research debunking the myth that progressive taxes interfere with economic growth. Cannabis legalization and taxation was a hot topic as well, as lawmakers in Vermont reached an agreement to move forward on the matter and others in Connecticut, Kansas, and New Hampshire worked toward the same.

Another Reason to Tax the Rich? States with High Top Tax Rates Doing as Well, if Not Better, than States Without Income Taxes

September 23, 2020 • By Carl Davis

ITEP updated a 2017 study that examined the economic performance of the nine states with the highest top marginal tax rates compared to the nine states with no state income tax. Economies in states with the highest top marginal rates grew faster. States facing budget shortfalls should first look at raising taxes on those most able to pay (incomes at the top have grown during this economic crisis) before considering harmful budget cuts.

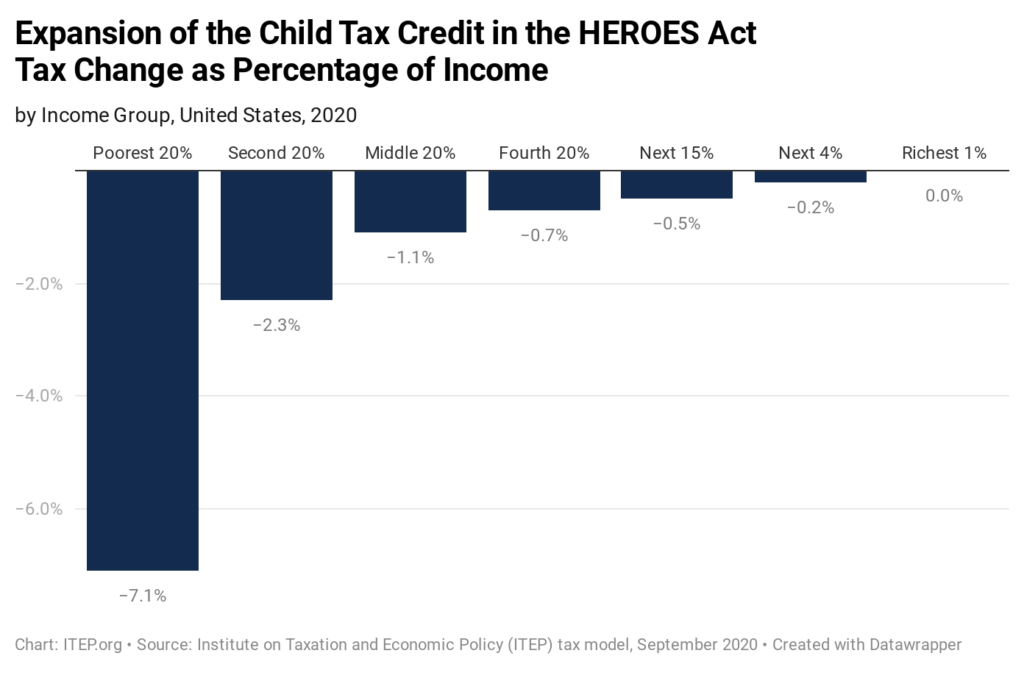

New ITEP Estimates on Biden’s Proposal to Expand the Child Tax Credit

September 18, 2020 • By Steve Wamhoff

On Thursday, former Vice President Joe Biden announced that his tax plan would include a provision passed by House Democrats to temporarily expand the Child Tax Credit (CTC), potentially lifting millions of children out of poverty. Estimates from ITEP show that this change would benefit most families with children—more than 83 million children live in households that would benefit if this was in effect in 2020—but the most dramatic boost would go to low-income families.