Recent Work by ITEP

Webinar: What’s Tax Got to Do With It?

September 17, 2020 • By ITEP Staff

Tax justice is necessary to achieve racial, social and economic justice. We need race-forward tax policies that create opportunity for everyone, demand corporations and the wealthy pay their fair share and raise enough revenue to respond to compounding climate, health and economic crises. Tax justice is justice. Sen. Sherrod Brown, joined by Dorian Warren (Community […]

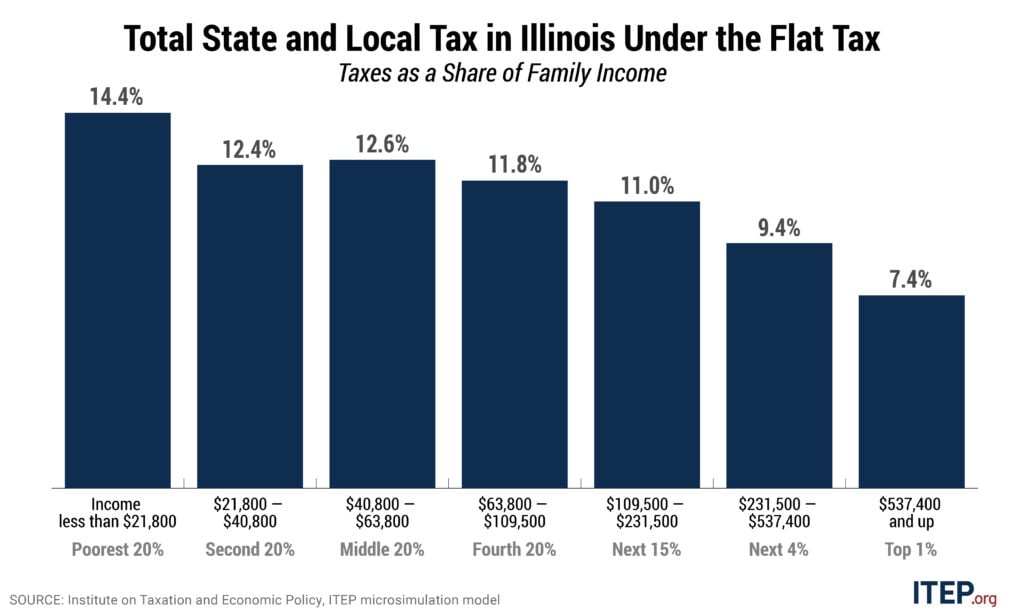

Illinois’s Flat Income Tax Amounts to a Tax Subsidy for the Wealthiest Illinoisans that Compounds Income and Wealth Inequalities

September 17, 2020 • By Lisa Christensen Gee

This November, Illinoisans will decide whether to amend the state constitution to allow a graduated income tax. A “yes” vote on the Illinois Fair Tax constitutional amendment will make effective legislation that will replace the current flat tax rate of 4.95 percent with graduated rates that cut taxes for those with taxable income less than $250,000 and institute higher marginal rates on taxable incomes greater than $250,000.

Illinois’s Flat Tax Exacerbates Income Inequality and Racial Wealth Gaps

September 17, 2020 • By Lisa Christensen Gee

Flat or graduated personal income taxes have varying effects on the annual individual tax liabilities of taxpayers at different income levels. Less examined is how tax structures affect income inequality and racial wealth gaps. This brief illustrates how Illinois’s historic flat income tax structure compares to the proposed Fair Tax through a multi-year retrospective analysis. It shows that Illinois’s flat income tax in lieu of a graduated rate tax used by most states amounts to a tax subsidy for the wealthiest Illinoisans that compounds income inequality and racial wealth gaps.

The Vital Role of Public Programs in Moving People and Families Out of Poverty

September 15, 2020 • By Aidan Davis

More families across our nation are struggling to meet their most basic needs. High unemployment, the struggle to put enough food on the table, and an inability to make rent or mortgage payments are widespread. Absent federal intervention, outcomes would have been worse. Over the past few months, federal and state relief measures have mitigated hardship. By putting cash in the hands of those who need it most, lawmakers were able to stabilize some families’ budgets and prop up our fragile economy. With time we will surely glean many lessons from 2020. But the sheer power of targeted assistance is already apparent.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2020

September 15, 2020 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been amplified as many states have enacted and expanded their own credits.

Racial justice requires tax justice. Economic justice requires tax justice. Climate and health justice require, yes, tax justice.

State Rundown 9/11: Benefits of Progressive Taxation Getting Well-Deserved Attention

September 11, 2020 • By ITEP Staff

Readers may want to start with our “What We’re Reading” section this week, which is full of good reading on how progressive taxation is needed to fund vital public services, helpful for state and local economic growth, and popular among voters as well. In that spirit, leaders in both New Jersey and New York are looking at small taxes on stock trades to help improve their budgets and tax codes. These last couple of weeks have also featured more state fiscal action than is typical this time of year, for example in North Carolina, where lawmakers decided to use federal…

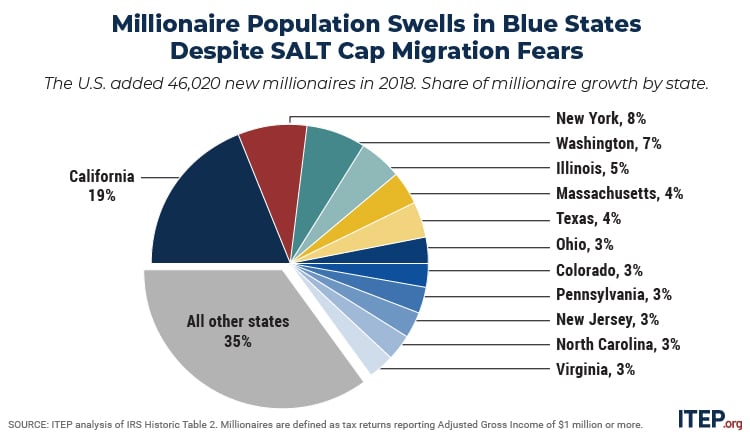

Millionaire Population Swells in Blue States Despite Migration Fearmongering

September 3, 2020 • By Carl Davis

Although the 2017 Tax Cuts and Jobs Act has created a slew of problems, it is now clear that a mass migration of top earners out of higher-tax blue states is not one of them.

The Rich Are Weathering the Pandemic Just Fine: Tax Them

September 3, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

Reductions in critical state and local investments, including health care and education, would only exacerbate the economic crisis brought on by COVID-19 and worsen racial and income inequality for years to come. Higher taxes on top earners are among the best options for addressing pandemic-related state revenue shortfalls in the coming months.

State Rundown 8/26: Progressive Revenue Ideas Featured in Many States’ Fiscal Debates

August 26, 2020 • By ITEP Staff

Voters could significantly change the tax landscape through ballot measures this November regarding oil taxes in Alaska and a high-income surcharge for education funding in Arizona. Legislators are doing their part to bring progressive tax ideas to the fore as well, including a possible wealth tax in California, a millionaires tax in New Jersey, and a pied-a-terre proposal in New York. And Nebraska lawmakers reached a property tax and business tax subsidy compromise before closing out their session, but did not identify progressive revenue sources to fund it and will likely be back at the bargaining table before long.