Pennsylvania

Amazon Maintains Sales Tax Advantage over Local Businesses

March 26, 2018 • By ITEP Staff

This report concludes that lack of consistent sales tax collection is contributing to an unlevel playing field for local businesses “because millions of shoppers are able to pay less tax if they choose to buy from out-of-state companies over the Internet rather than at local stores.” It recommends that states explore reforms to bring their sales tax policies into the digital age.

Amazon and Other E-Retailers Get a Free Pass from Some Local-Level Sales Taxes

March 26, 2018 • By Carl Davis

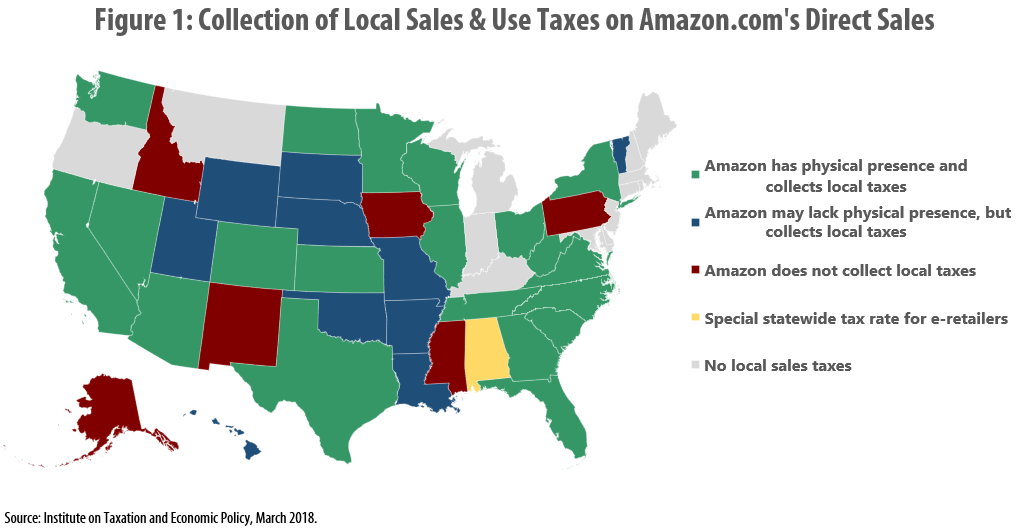

A new ITEP analysis reveals that in seven states (Alabama, Alaska, Idaho, Iowa, Mississippi, New Mexico, and Pennsylvania), the nation’s largest e-retailer, Amazon.com, is either not collecting local-level sales taxes or is charging a lower tax rate than local retailers. In other states, such as Colorado and Illinois, Amazon is collecting local tax because it has an in-state presence, but localities cannot collect taxes from other e-retailers based outside the state.

Many Localities Are Unprepared to Collect Taxes on Online Purchases: Amazon.com and other E-Retailers Receive Tax Advantage Over Local Businesses

March 26, 2018 • By Carl Davis

Online retailer Amazon.com made headlines last year when it began collecting every state-level sales tax on its direct sales. Savvy observers quickly noted that this change did not affect the company’s large and growing “marketplace” business, where it conducts sales in partnership with third-parties and rarely collects tax. But far fewer have noticed that even on its direct sales, Amazon is still not collecting some local-level taxes.

Philadelphia Inquirer: Philly’s proposed property-tax increase to fund schools is actually bad for city kids

March 22, 2018

Already throughout Pennsylvania, those making less than $20,000 are paying a much greater share in taxes (at 12 percent) than those making more than $426,000 (at just 4.2 percent), according to the Institute on Taxation and Economic Policy. City officials’ proposing to drive up property taxes as a way to finance new city largesse — […]

Trends We’re Watching in 2018, Part 2: State Revenue Shortfalls and the Impact on Education and Other Services

March 12, 2018 • By Aidan Davis

Many states struggle with a need for revenue, yet their lawmakers show little will to raise taxes to fund public services. Revenue shortfalls can prove to be a moving target. Some states with expected shortfalls are now seeing rosier forecasts. But as estimates come in above or below projections, states continue to grapple with how and whether to raise the revenue necessary to adequately fund key programs. Here are a few trends that are leading to less than cushy state coffers this year.

This week was very active for state tax debates. Georgia, Idaho, and Oregon passed bills reacting to the federal tax cut, as Maryland and other states made headway on their own responses. Florida lawmakers sent a harmful "supermajority" constitutional amendment to voters. New Jersey now has two progressive revenue raising proposals on the table (and a need for both). Louisiana ended one special session with talks of yet another. And online sales taxes continued to make news nationally and in Kansas, Nebraska, and Pennsylvania.

State Rundown 2/28: February a Long Month for State Tax Debates

February 28, 2018 • By ITEP Staff

February may be the shortest month but it has been a long one for state lawmakers. This week saw Arizona, Idaho, Oregon, and Utah seemingly approaching final decisions on how to respond to the federal tax-cut bill, while a bill that appeared cleared for take-off in Georgia hit some unexpected turbulence. Other states are still studying what the federal bill means for them, and many more continue to debate tax and budget proposals independently of the federal changes. And be sure to check our "What We're Reading" section for news on corporate tax credits from multiple states.

Preventing State Tax Subsidies for Private K-12 Education in the Wake of the New Federal 529 Law

February 23, 2018 • By Ronald Mak

This policy brief explains the federal and various state-level breaks for 529 plans and explores the potential impact that the change in federal treatment of 529 plans will have on state revenues.

This week, major tax packages relating to the federal tax-cut bill made news in Georgia, Iowa, and Louisiana, as Minnesota and Oregon lawmakers also continue to work out how their states will be affected. New Mexico's legislative session has finished without significant tax changes, while Idaho and Illinois's sessions are beginning to heat up, and Vermont's school funding system is under the microscope.

State Rundown 2/8: State Responses to Federal Bill Gaining Steam

February 8, 2018 • By ITEP Staff

Several states this week are looking at ways to revamp their tax codes in response to the federal tax cut bill, with Georgia, Idaho, Maryland, Nebraska, and Vermont all actively considering proposals. Meanwhile, Connecticut, Louisiana, and Pennsylvania are working on resolving their budget shortfalls. And transportation funding is getting needed attention in Mississippi, Utah, and Wisconsin.

Third and State: Fact Check: Undocumented Immigrants like the Dreamers are not a Drag on State and Local Governments

January 27, 2018

A recent study by the Institute on Tax and Economic Policy (ITEP) shows that the estimated 137,000 undocumented immigrants in Pennsylvania pay our state and local governments almost $135 million in taxes each year. (They pay $11.7 billion in state and local taxes nationwide.) Read more here

Pennsylvania Budget and Policy Center: The Pennsylvania Promise: Making College Affordable and Securing Pennsylvania’s Economic Future

January 22, 2018

Three recent briefs by the Keystone Research Center laid out the case for more affordable access to post-secondary education in Pennsylvania. The global race for raising incomes and increasing opportunity hinges critically on access to post-secondary education and training. If Pennsylvania does not expand access to higher education to more of its citizens, the Commonwealth’s economy will suffer and living standards will lag behind growth elsewhere. With a modest and smart investment, Pennsylvania can build a more prosperous future for its citizens and reinvigorate the American Dream in every corner of the keystone state. “The Pennsylvania Promise,” outlined below, shows…

Charleston Post-Courier: An Abuse of Charitable Giving?

January 14, 2018

Under the new law, some wealthy South Carolinians may actually make a 37 percent profit, risk-free, by making charitable contributions to Exceptional SC, a nonprofit fund created by the state Legislature to administer scholarships to students with disabilities attending private schools. That’s according to a recent report by the nonpartisan Institute on Taxation and Economic Policy. South Carolina has […]

Philadelphia Business Journal: New Federal Tax Loophole Could Stoke Interest in Private School Donations

January 2, 2018

Changes to the federal tax code could encourage more Pennsylvania businesses to pump money into K-12 private schools instead of paying state taxes. That’s according to an analysis by the nonprofit Institute on Taxation and Economic Policy (ITEP), which says it discovered an expanded loophole in the new law. By cross-referencing federal and state incentives, […]

NPR: This Tax Loophole for Wealthy Donors Just Got Bigger

December 29, 2017

One of the changes, according to the Institute on Taxation & Economic Policy, which advocates for a “fair and sustainable” tax system, allows far more wealthy donors in 10 states to turn a profit through “donations” to private school scholarships. Yes, you read that right. If your income is high enough, you can actually make […]

How the Final GOP-Trump Tax Bill Would Affect Pennsylvania Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

Private Schools Donors Likely to Win Big from Expanded Loophole in Tax Bill

December 14, 2017 • By Carl Davis

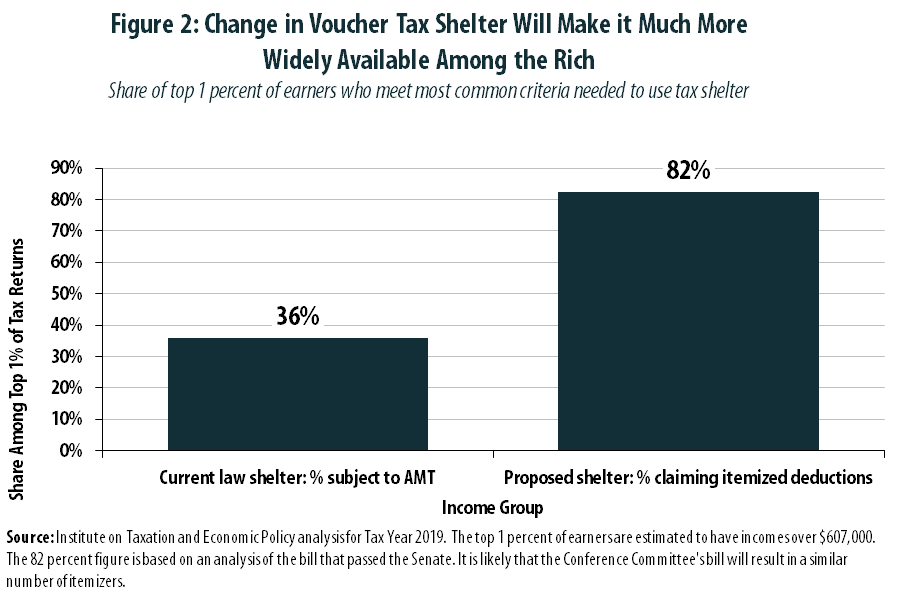

For years, private schools around the country have been making an unusual pitch to prospective donors: give us your money, and you’ll get so many state and federal tax breaks in return that you may end up turning a profit. Under tax legislation being considered in Congress right now, that pitch is about to become even more persuasive.

Tax Bill Would Increase Abuse of Charitable Giving Deduction, with Private K-12 Schools as the Biggest Winners

December 14, 2017 • By Carl Davis

In its rush to pass a major rewrite of the tax code before year’s end, Congress appears likely to enact a “tax reform” that creates, or expands, a significant number of tax loopholes.[1] One such loophole would reward some of the nation’s wealthiest individuals with a strategy for padding their own bank accounts by “donating” to support private K-12 schools. While a similar loophole exists under current law, its size and scope would be dramatically expanded by the legislation working its way through Congress.[2]

As 2017 draws to close, Congress has yet to take legislative action to protect Dreamers. The young undocumented immigrants who were brought to the United States as children, and are largely working or in school, were protected by President Obama’s 2012 executive action, Deferred Action for Childhood Arrivals (DACA). But in September, President Trump announced that he would end DACA in March 2018. Instead of honoring the work authorizations and protection from deportation that currently shields more than 685,000 young people, President Trump punted their lives and livelihood to a woefully divided Congress which is expected to take up legislation…

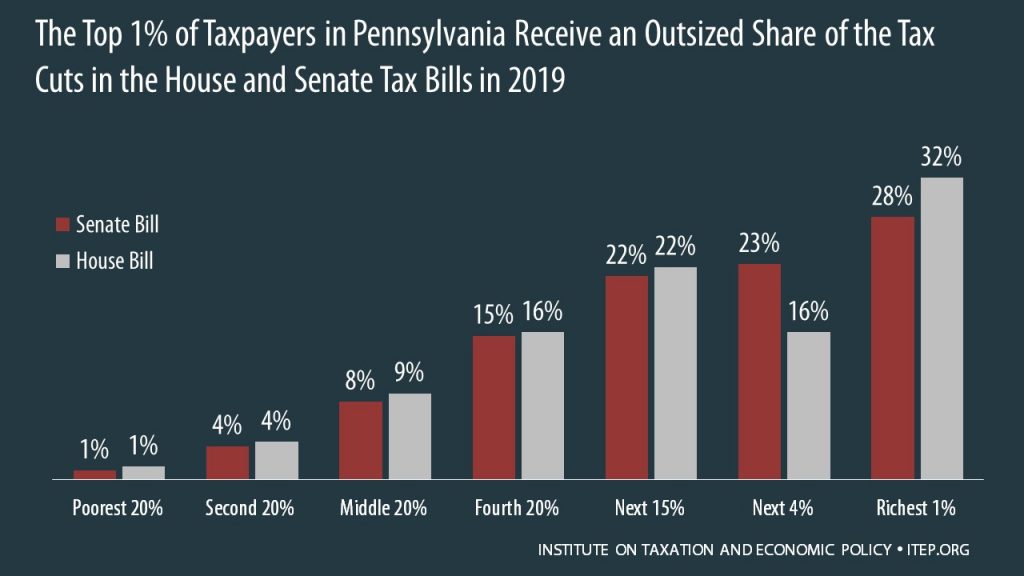

How the House and Senate Tax Bills Would Affect Pennsylvania Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Pennsylvania residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

How the Revised Senate Tax Bill Would Affect Pennsylvania Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Pennsylvania, 50 percent of the federal tax cuts would go to the richest 5 percent of residents, and 12 percent of households would face a tax increase, once the bill is fully implemented.

State Rundown 11/8: Online Sales Tax Fight and Tax Subsidy Absurdity Go National

November 8, 2017 • By ITEP Staff

Internet sales tax fairness efforts gained momentum this week as most states joined together to encourage the US Supreme Court to allow them to collect taxes on online sales. Meanwhile, Montana lawmakers will enter special session next week to plug their revenue shortfall, Mississippi's (self-inflicted) revenue crunch is reaching unprecedented severity, and misguided corporate tax subsidies got mainstream attention from HBO's John Oliver and Rolling Stone.