Pennsylvania

Scripps News Service: Money Diverted from Public Schools?

June 26, 2017

All the programs basically work this way: Individuals and businesses make cash or stock donations to scholarship granting organizations. The organizations award scholarships to qualifying families with K-12 students, primarily children in failing public schools or whose families’ income meets the state’s poverty threshold. Students can then attend a private or religious school of their […]

State Rundown 6/21: Crunch Time for Many States with New Fiscal Year on Horizon

June 21, 2017 • By Meg Wiehe

This week several states rush to finalize their budget and tax debates before the start of most state fiscal years on July 1. West Virginia lawmakers considered tax increases as part of a balanced approach to closing the state’s budget gap but took a funding-cuts-only approach in the end. Delaware legislators face a similar choice, […]

State Rundown 6/14: Some States Wrapping Up Tax Debates, Others Looking Ahead to Next Round

June 14, 2017 • By ITEP Staff

This week lawmakers in California and Nevada resolved significant tax debates, while budget and tax wrangling continued in West Virginia, and structural revenue shortfalls were revealed in Iowa and Pennsylvania. Airbnb increased the number of states in which it collects state-level taxes to 21. We also share interesting reads on state fiscal uncertainty, the tax experiences of Alaska and Wyoming, the future of taxing robots, and more!

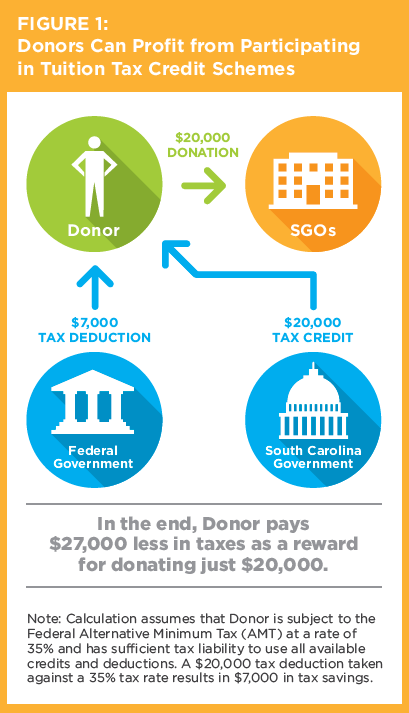

Investors and Corporations Would Profit from a Federal Private School Voucher Tax Credit

May 17, 2017 • By Carl Davis

A new report by the Institute on Taxation and Economic Policy (ITEP) and AASA, the School Superintendents Association, details how tax subsidies that funnel money toward private schools are being used as profitable tax shelters by high-income taxpayers. By exploiting interactions between federal and state tax law, high-income taxpayers in nine states are currently able […]

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

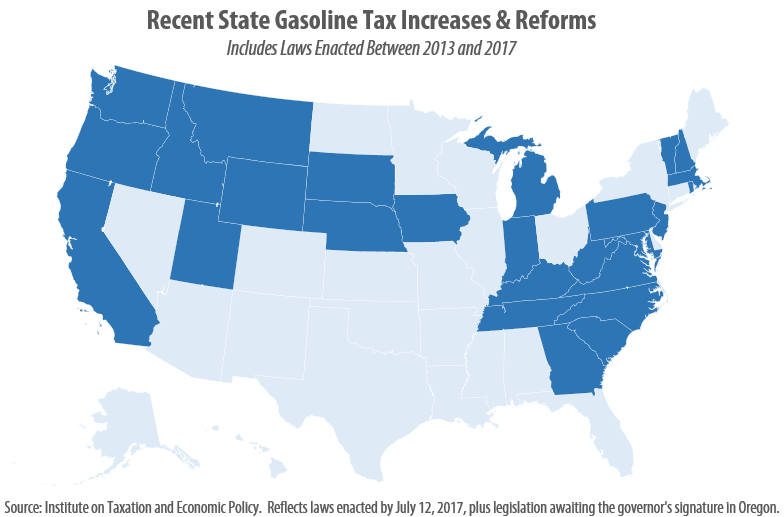

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.

State Rundown 4/12: Season in Transition as Some States Close, Others Open Tax Debates

April 12, 2017 • By ITEP Staff

This week in state tax news we see Louisiana‘s session getting started, budgets passed in New York and West Virginia, Kansas lawmakers taking a rest after defeating a harmful flat tax proposal, and Nebraska legislators preparing for full debate on major tax cuts. Nevada lawmakers may make tax decisions related to tampons, diapers, marijuana, and […]

Keystone Research Center: Who Pays for Property Tax Elimination?

April 6, 2017

Across all Pennsylvania families, property tax elimination would increase taxes by $334 per family. While property taxes would fall by an average of $1,685 per family, sales and income taxes would rise by over $2,000 on average per family. Moderate-income families (earning between $22,000 and $63,000), many of who live in rural areas, would see […]

This week in state tax news we saw a destructive tax cut effort defeated in Georgia, a state shutdown avoided in New York, and lawmakers hone in on major tax debates in Massachusetts, Nebraska, South Carolina, and WestVirginia. State efforts to collect taxes owed on online purchases continue to heat up as well. — Meg […]

Philadelphia Inquirer: BAT Bad News for Pennsylvania

March 31, 2017

Furthermore, any attempt to tax imports will likely be retaliated against in other countries by enacting similar trade measures that boost their own exports and penalize U.S. imports. In a recent interview, Matt Gardner, a senior fellow at the Institute on Taxation and Economic Policy said, “The question is whether that would just mean a […]

Pennsylvania Budget and Policy Center: The Fair Share Tax to Support Public Investment in Pennsylvania

March 23, 2017

This paper puts forward a plan, which we call the Fair Share Tax, that would take a major step toward fixing Pennsylvania’s broken tax system and raise the revenues we need to invest in the public goods that are critical to creating thriving communities and individual opportunity in our state: education, infrastructure, protection for our […]

A growing number of Americans are getting rides or booking short-term accommodations through online platforms such as Uber and Airbnb. This is nothing new in concept; brokers have operated for hundreds of years as go-betweens for producers and consumers. The ease with which this can be done through the Internet, however, has led to millions of people using these services, and to some of the nation's fastest-growing, high-profile businesses. The rise of this on-demand sector, sometimes referred to as the "gig economy" or, by its promoters, the "sharing economy," has raised a host of questions. For state and local governments,…

Tax Justice Digest: New Eight-Year Data Reveals Corporations Aren’t Paying Their Fair Share

March 9, 2017 • By ITEP Staff

In the Tax Justice Digest we recap the latest reports, blog posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy. Here’s a rundown of what we’ve been working on lately. New Study Explores the 35 Percent Corporate Tax Myth A comprehensive, eight-year study of profitable Fortune 500 corporations […]

This week brings more news of states considering reforms to their consumption taxes, on everything from gasoline in South Carolina and Tennessee, to marijuana in Pennsylvania, to groceries in Idaho and Utah, and to practically everything in West Virginia. Meanwhile, the fiscal fallout of Kansas’s failed ‘tax experiment’ has new consequences as the state’s Supreme […]

American Prospect: How States Turn K-12 Scholarships Into Money-Laundering Schemes

March 3, 2017

This article was originally published in The American Prospect. By Carl Davis Politicians have long had a knack for framing policy proposals, however controversial, in terms that make them more palatable to voters. This is why unpopular tax cuts for the wealthy are often sold as plans to “invest” in America or to stimulate “growth.” […]

Undocumented Immigrants’ State & Local Tax Contributions

March 1, 2017 • By Lisa Christensen Gee, Meg Wiehe, Misha Hill

Public debates over federal immigration reform, specifically around undocumented immigrants, often suffer from insufficient and inaccurate information about the tax contributions of undocumented immigrants, particularly at the state level. The truth is that undocumented immigrants living in the United States paybillions of dollars each year in state and local taxes. Further, these tax contributions would increase significantly if all undocumented immigrants currently living in the United States were granted a pathway to citizenship as part of comprehensive immigration reform. Or put in the reverse, if undocumented immigrants are deported in high numbers, state and local revenues could take a substantial…

States Should Require Combined Reporting of Corporate Income

February 27, 2017 • By Dylan Grundman O'Neill

An important aspect of a 21st century tax code is ensuring that corporate income taxes are easy for corporations to follow, but not easy for them to avoid. As our newly updated policy brief on Combined Reporting of State Corporate Income Taxes explains, “combined reporting” remains an essential tool for states to achieve these goals. […]

What to Watch in the States: Modernizing Sales Taxes for a 21st Century Economy

February 15, 2017 • By Misha Hill

This is the fourth installment of our six-part series on 2017 state tax trends. The introduction to this series is available here. State lawmakers often find themselves looking for ways to raise revenue to fund vital public services, fill budget gaps, or pay for the elimination or weakening of progressive taxes. Lately, that search has […]

This week we are following a number of significant proposals being debated or introduced including reinstating the income tax in Alaska and eliminating the tax in West Virginia, establishing a regressive tax-cut trigger in Nebraska, restructuring the Illinois sales tax, moving New Mexico to a flat income tax and broader gross receipts tax, and updating […]

State Rundown 2/8: Lessons of Kansas Tax-Cut Disaster Taking Hold in Kansas, Still Lost on Some in Other States

February 8, 2017 • By ITEP Staff

This week we bring news of Kansas lawmakers attempting to fix ill-advised tax cuts that have wreaked havoc on the state’s budget and schools, while their counterparts in Nebraska and Idaho debate bills that would create similar problems for their own states, as well as tax cuts in Arkansas that were proven unaffordable within one […]

This week’s Rundown brings news of tax cuts passed in Arkansas and advanced in Idaho, proposals to exempt feminine hygiene products from sales taxes in Nevada and Michigan, revenue shortfalls forcing tough choices in Louisiana and Maine, and more governors’ state of the state addresses and budget proposals setting the stage for yet more tax […]

Below is a list of notable resources for information on state taxes and revenues: Alabama Alabama Department of Revenue Alabama Department of Finance – Executive Budget Office Alabama Department of Revenue – Tax Incentives for Industry Alabama Legislative Fiscal Office Alaska Alaska Department of Revenue – Tax Division Alaska Office of Management & Budget Alaska […]

Over the next few weeks we will be blogging about what we’re watching in state tax policy during 2017 legislative sessions. In this “What to Watch in the States” series, we will look at the following: State responses to short- and long-term revenue deficits Boosting funding for infrastructure, though sometimes at the expense of other […]

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

January 26, 2017 • By Carl Davis, Meg Wiehe

When states shy away from personal income taxes in favor of higher sales and excise taxes, high-income taxpayers benefit at the expense of low- and moderate-income families who often face above-average tax rates to pick up the slack. This chart book demonstrates this basic reality by examining the distribution of taxes in states that have pursued these types of policies. Given the detrimental impact that regressive tax policies have on economic opportunity, income inequality, revenue adequacy, and long-run revenue sustainability, tax reform proponents should look to the least regressive, rather than most regressive, states in crafting their proposals.

The federal government and many states are unable to adequately maintain the nation's transportation infrastructure in part because the gasoline taxes intended to fund infrastructure projects are often poorly designed. Thirty states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers transition toward more fuel-efficient vehicles and pay less in gas tax. The federal government's 18.4 cent gas tax, for example, has not increased in over twenty-three years. Likewise, more than twenty states have waited a decade or more since last raising their…