Pennsylvania

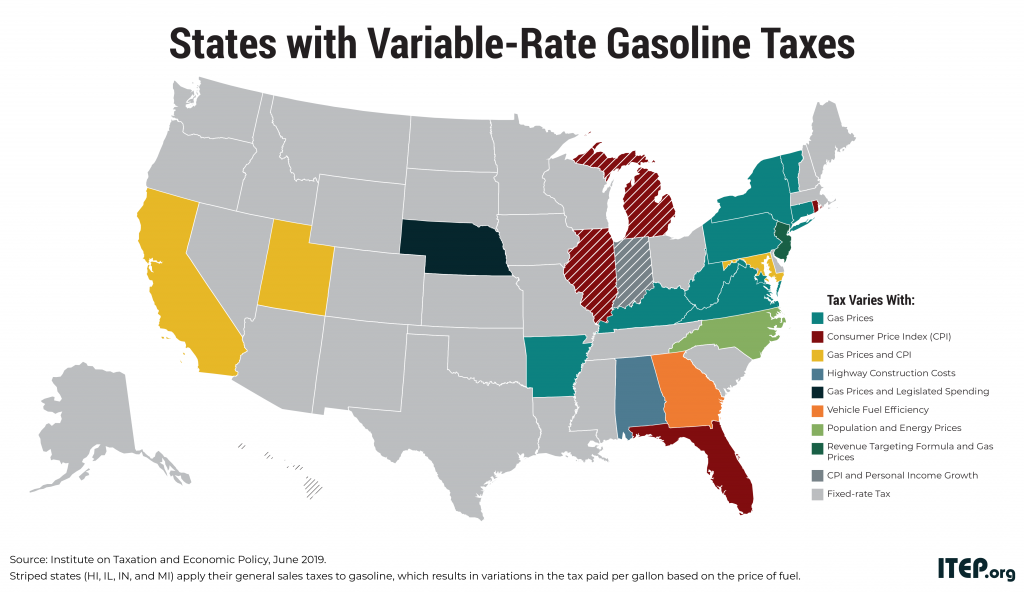

These States Abandoned Old Gas Tax Structures in Favor of More Sustainable Variable-Rate Gas Taxes

May 20, 2019 • By ITEP Staff

Because of these reforms, more than 193 million people (or 59 percent of the U.S. population) now live in places where the state gas tax rate automatically varies over time.

State Rundown 5/16: Tensions Remain High Over Budgets and School Finances in Several States

May 16, 2019 • By ITEP Staff

Tax and budget negotiations remain at standstills in Louisiana and Minnesota, as school funding debates and teacher protests again captured headlines in several states. Oregon lawmakers, for example, finally passed a mixed-bag tax package that won’t improve tax equity but will raise much-needed revenue for education. Meanwhile their counterparts in Nebraska continue to debate highly […]

Teachers in North Carolina and South Carolina are walking out and rallying this week for increased education funding, teacher and staff pay, and other improvements to benefit students—if you’re unsure why be sure to check out research on the teacher shortage and pay gap under “What We’re Reading” below. Meanwhile, budget debates have recently wrapped up in Indiana, Iowa, Massachusetts, New Hampshire, and Washington. And major tax debates are kicking into high gear in both Louisiana and Nebraska.

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

Pennsylvania Budget and Policy Center: A Fair Share Tax Plan for Pennsylvania — 2019 Update

April 15, 2019

This paper puts forward the Fair Share Tax plan, a major step toward fixing Pennsylvania’s broken tax system and raising the revenues we need to invest in the public goods that are critical to creating thriving communities and individual opportunity in our state: education, infrastructure, protection for our air and water, and human services. The […]

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

March 6, 2019 • By ITEP Staff

There is significant room for improvement in state and local tax codes. State tax codes are filled with top-heavy exemptions and deductions and often fail to tax higher incomes at higher rates. States and localities have come to rely too heavily on regressive sales taxes that fail to reflect the modern economy. And overall tax collections are often inadequate in the short-run and unsustainable in the long-run. These types of shortcomings provide compelling reason to pursue state and local tax reforms to make these systems more equitable, adequate, and sustainable.

Reuters: Illinois Budget Debate Raises Key Questions on Taxing Retirement Income

February 28, 2019

But the policies of various states are all over the map. Data provided by the Institute on Taxation and Economic Policy shows that 11 states tax some portion of Social Security benefits, usually mirroring the federal formula. Many others tax pensions and tax-deferred accounts, although some have exemptions that protect lower-income, public sector workers and […]

Trends We’re Watching in 2019: Attempting to Double Down on Failed Trickle-Down Regressive Tax Cuts

February 7, 2019 • By Lisa Christensen Gee

It’s always troubling for those concerned with adequate and fair public finance systems when states prioritize tax cuts at the cost of divesting in important public priorities and exacerbating underlying tax inequalities. But it’s even more nerve-racking when it happens on the eve of what many consider to be an inevitable economic downturn.

Trends We’re Watching in 2019: The Use of Targeted Tax Breaks to Help Address Poverty and Inequality

February 7, 2019 • By Aidan Davis

Continuing to build upon the momentum of previous years, states are taking steps to create and improve targeted tax breaks meant to lift their most in-need state residents up and out of poverty. Most notably, a range of states are exploring ways to restore, enhance or create state Earned Income Tax Credits (EITC). EITCs are an effective tool to help struggling families with low wages make ends meet and provide necessities for their children. The policy, designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, allows struggling families to move toward meaningful economic…

State policy toward cannabis is evolving rapidly. While much of the debate around legalization has rightly focused on potential health and criminal justice impacts, legalization also has revenue implications for state and local governments that choose to regulate and tax cannabis sales. This report describes the various options for structuring state and local taxes on cannabis and identifies approaches currently in use. It also undertakes an in-depth exploration of state cannabis tax revenue performance and offers a glimpse into what may lie ahead for these taxes.

State Rundown 1/18: Governors’ Speeches Kick Off State Fiscal Debates

January 18, 2019 • By ITEP Staff

Gubernatorial speeches and budget proposals dominated state fiscal news this week, as governors proposed a wide array of policies including positive reforms such as Earned Income Tax Credit (EITC) enhancements in CALIFORNIA, a capital gains tax on wealthy households in WASHINGTON, and investments in education in several states. Proposals to exempt more retirement income from tax, particularly for veterans, are a common theme so far this year, having been raised in multiple states including MARYLAND, MICHIGAN, and SOUTH CAROLINA. And NEW JERSEY became the fourth state with a $15 minimum hourly wage. Those wishing to better understand and influence important debates about equitable tax policy should mark their…

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.

Today Amazon announced major expansions in New York and Virginia, where it intends to hire up to 50,000 full-time employees. The announcement marks the culmination of a highly publicized search that lasted more than a year and involved aggressive courting of the company by cities across the nation. The following are three tax-related observations on the announcement.

Tuesday’s elections shook up statehouses, governors’ offices, and tax laws in many states, and in this week’s Rundown we bring you the top 3 election state tax policy stories to emerge. First, voters in Kansas and other states sent a message that regressive tax cuts and supply-side economics have not succeeded and are not welcome among their state fiscal policies. Meanwhile, residents of many other states, including most notably Illinois, voted for representatives who reflect their preference for equitable, sustainable policies to improve their state economies through smart public investments and improve the lives of all residents through progressive tax structures. Lastly, while some states missed…

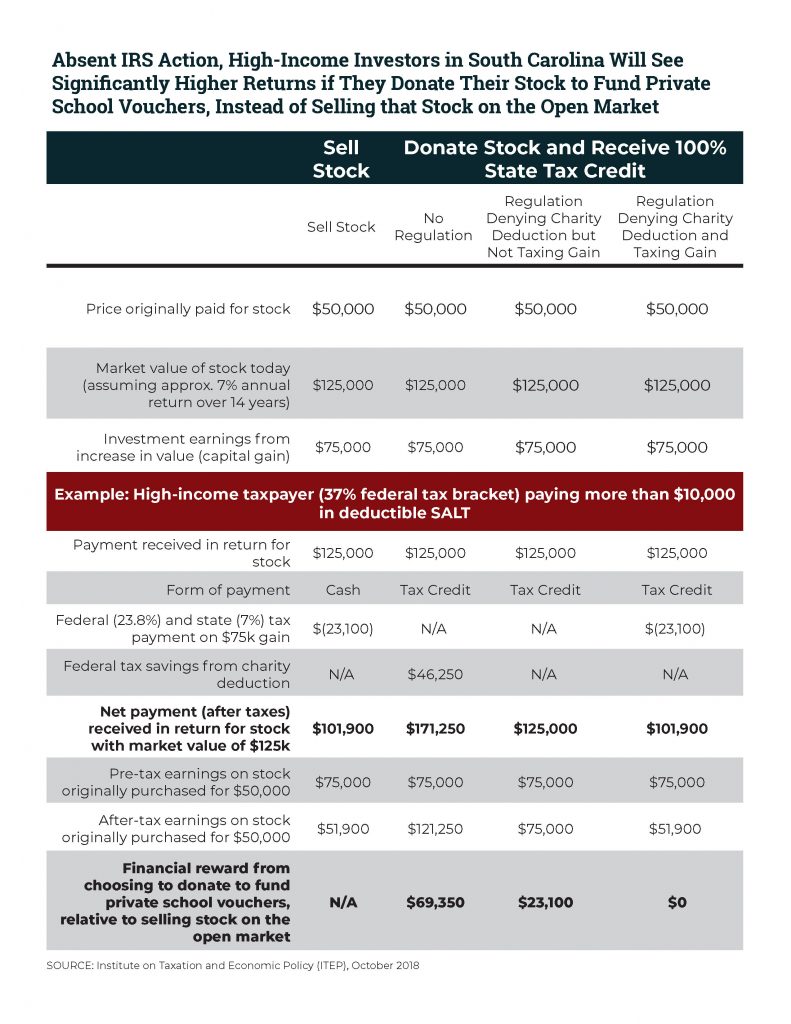

Comments to be delivered during IRS hearing on “Contributions in Exchange for State or Local Tax Credits” (REG-112176-18)

November 5, 2018 • By Carl Davis

ITEP views this proposal as a sensible improvement, and one that is actually overdue, to the way the charitable deduction is administered. At the end of my remarks I will discuss a few ways that the regulation could be improved. But the core point I want to emphasize is that the general approach taken here, where quid pro quo rules are applied in a broad-based fashion to all significant state and local tax credits, is the correct one.

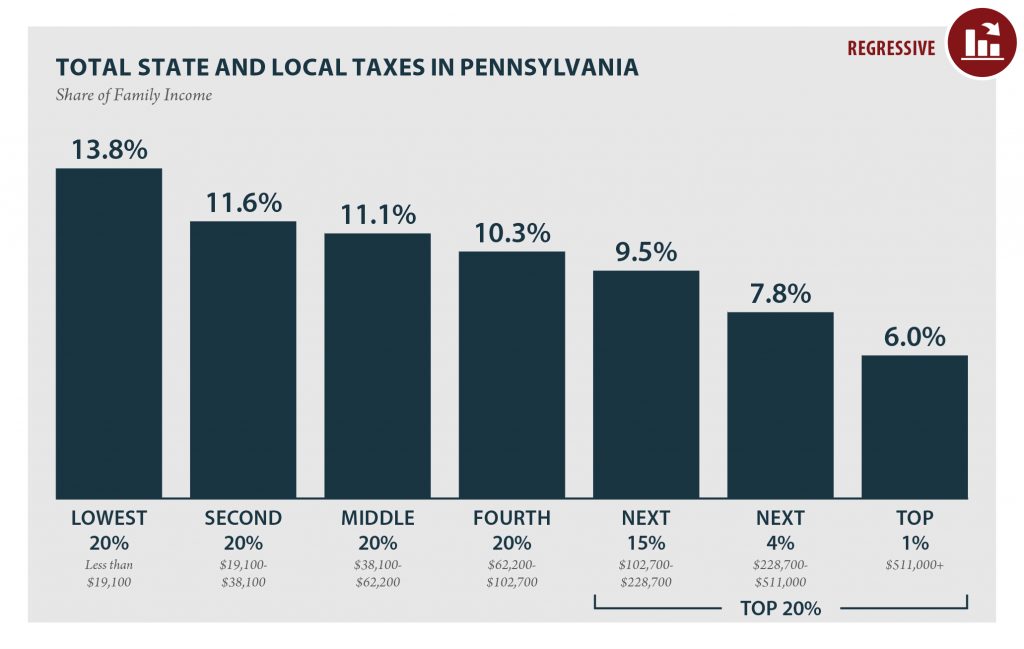

Third and State: Pennsylvania’s Terrible Tax Code Asks More of You as You Make Less: Hitting Community’s of Color Especially Hard

October 23, 2018

The Commonwealth once again claims its spot in the “Terrible 10” most unfair tax structures in the nation. The lowest 20% of income earners in the state pays more than double (2.3 times) their share of family income on state and local taxes than the top 1%.

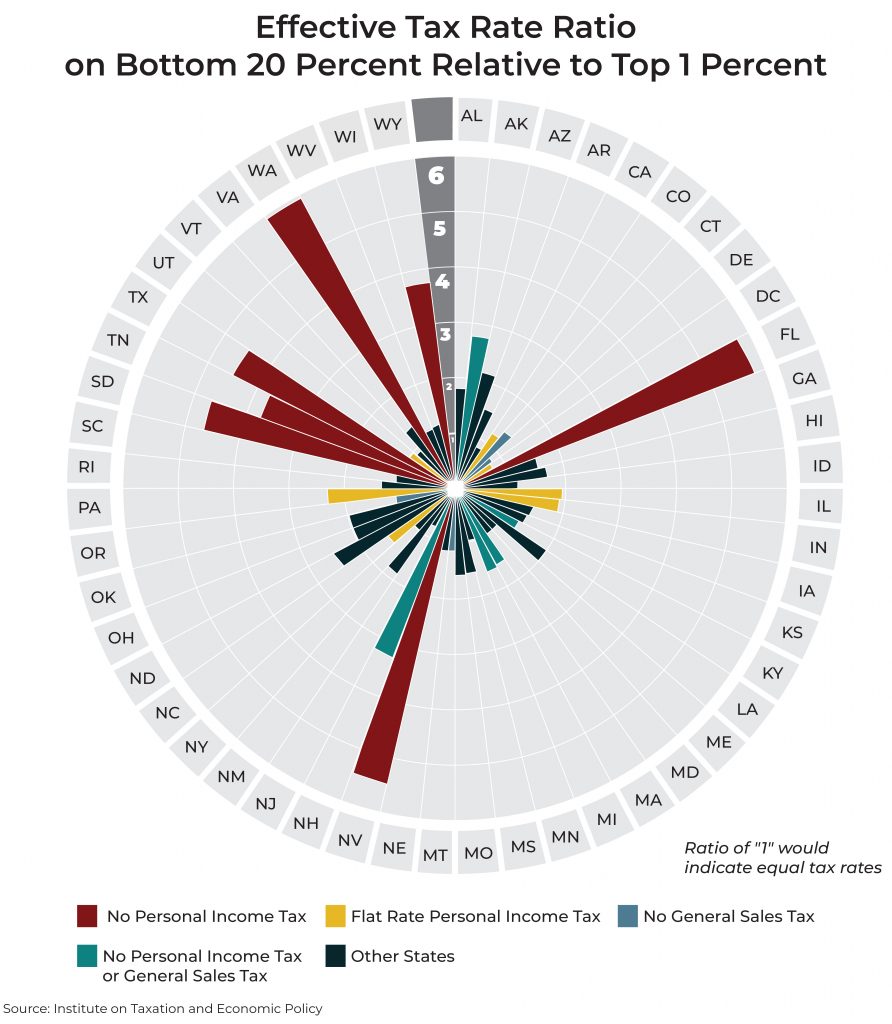

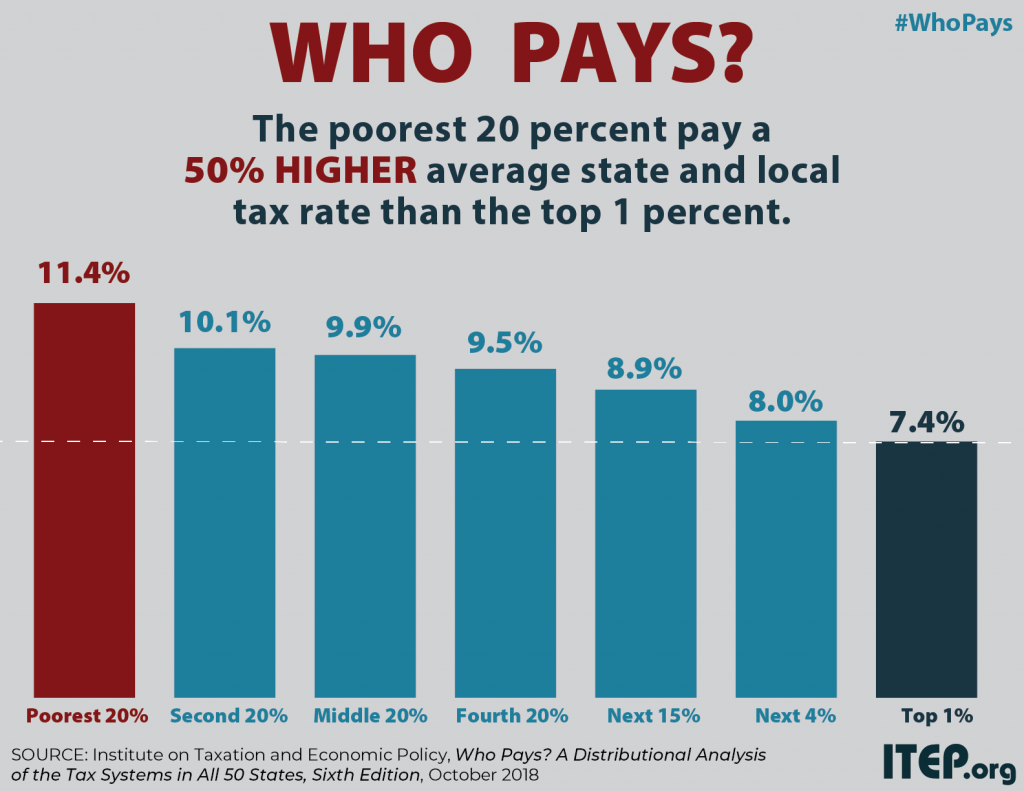

Poorest 20 Percent Pays a 50 Percent Higher Effective State and Local Tax Rate than the Top 1 Percent

October 17, 2018 • By ITEP Staff

A comprehensive 50-state study released today by the Institute on Taxation and Economic Policy (ITEP) finds that most state and local tax systems tax low- and middle-income households at significantly higher rates than wealthy taxpayers, with the lowest-income households paying an average of 50 percent more of their income in taxes than the very rich.

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

Pennsylvania: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

PENNSYLVANIA Read as PDF PENNSYLVANIA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,100 $19,100 to $38,100 $38,100 to $62,200 $62,200 to $102,700 $102,700 to $228,700 $228,700 to $511,000 over $511,000 […]

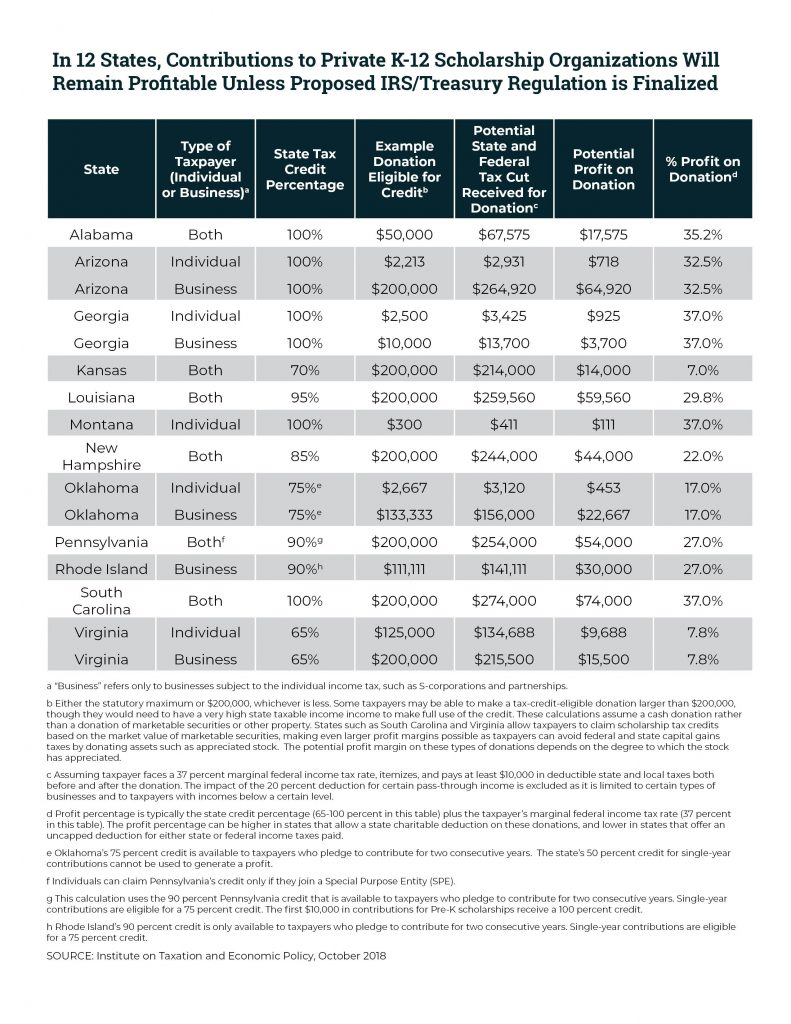

ITEP Comments and Recommendations on Proposed Section 170 Regulation (REG-112176-18)

October 11, 2018 • By Carl Davis

The IRS recently proposed a commonsense improvement to the federal charitable deduction. If finalized, the regulation would prevent not just the newest workarounds to the $10,000 deduction for state and local taxes (SALT), but also a longer-running tax shelter abused by wealthy donors to private K-12 school voucher programs. ITEP has submitted official comments outlining four key recommendations related to the proposed regulation.

Twelve States Offer Profitable Tax Shelter to Private School Voucher Donors; IRS Proposal Could Fix This

October 2, 2018 • By Carl Davis

A proposed IRS regulation would eliminate a tax shelter for private school donors in twelve states by making a commonsense improvement to the federal tax deduction for charitable gifts. For years, some affluent taxpayers who donate to private K-12 school voucher programs have managed to turn a profit by claiming state tax credits and federal tax deductions that, taken together, are worth more than the amount donated. This practice could soon come to an end under the IRS’s broader goal of ending misuse of the charitable deduction by people seeking to dodge the federal SALT deduction cap.

Tax Cuts 2.0 – Pennsylvania

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

IRS Reopens Tax Loophole Sought by Sen. Toomey, but it Won’t Work in Pennsylvania

September 20, 2018 • By Carl Davis

A recent IRS clarification, which appears to have been a pet project of Sen. Pat Toomey (R-PA), has been widely interpreted as reopening a loophole the agency had proposed closing just weeks earlier. But while the announcement creates an opening for aggressive tax avoidance in many states, Pennsylvania, ironically enough, isn’t one of them.

Keystone Research: The State of Working Pennsylvania 2018

August 30, 2018

“The State of Working Pennsylvania 2018,” Keystone Research Center’s 23rd annual review of the Pennsylvania economy and labor market finds that, nearly a decade into the current national economic expansion, many Pennsylvania workers are still waiting for a raise. The report points to three factors that help explain this.

Consumers’ growing interest in online shopping and “gig economy” services like Uber and Airbnb has forced states and localities to revisit their sales taxes, for instance. Meanwhile new evidence on the dangers and causes of obesity has led to rising interest in soda taxes, but the soda industry is fighting back. Carbon taxes are being discussed as a tool for combatting climate change. And changing attitudes toward cannabis use have spurred some states to move away from outright prohibition in favor of legalization, regulation and taxation.