Recent Work

2146 items

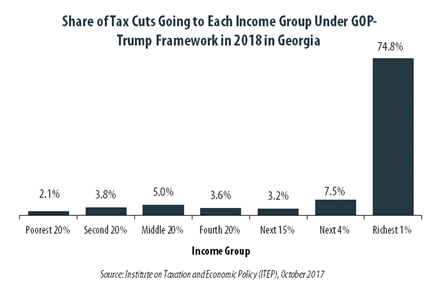

GOP-Trump Tax Framework Would Provide Richest One Percent in Georgia with 74.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Georgia equally. The richest one percent of Georgia residents would receive 74.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $552,200 next year. The framework would provide them an average tax cut of $83,070 in 2018, which would increase their income by an average of 4.0 percent.

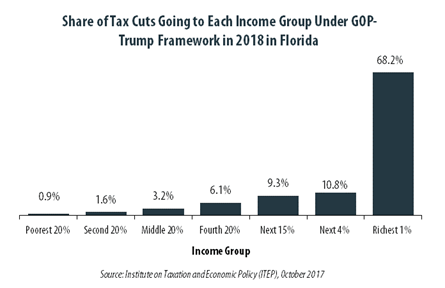

GOP-Trump Tax Framework Would Provide Richest One Percent in Florida with 68.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Florida equally. The richest one percent of Florida residents would receive 68.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $620,400 next year. The framework would provide them an average tax cut of $130,300 in 2018, which would increase their income by an average of 4.7 percent.

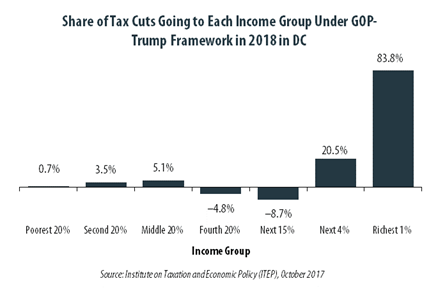

GOP-Trump Tax Framework Would Provide Richest One Percent in The District of Columbia with 83.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in the District equally. The richest one percent of District of Columbia residents would receive 83.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $1,022,000 next year. The framework would provide them an average tax cut of $147,500 in 2018, which would increase their income by an average of 4.9 percent.

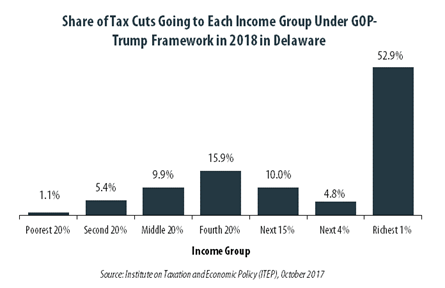

GOP-Trump Tax Framework Would Provide Richest One Percent in Delaware with 52.9 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Delaware equally. The richest one percent of Delaware residents would receive 52.9 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $497,100 next year. The framework would provide them an average tax cut of $49,370 in 2018, which would increase their income by an average of 2.7 percent.

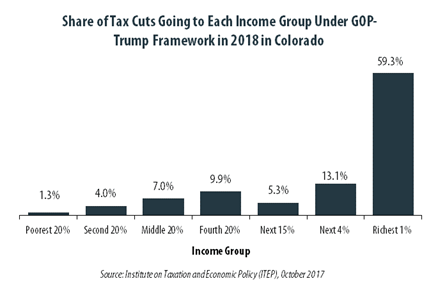

GOP-Trump Tax Framework Would Provide Richest One Percent in Colorado with 59.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Colorado equally. The richest one percent of Colorado residents would receive 59.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $637,800 next year. The framework would provide them an average tax cut of $86,480 in 2018, which would increase their income by an average of 4.7 percent.

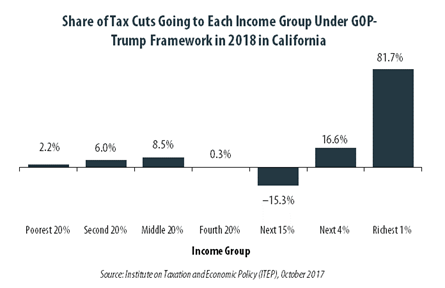

GOP-Trump Tax Framework Would Provide Richest One Percent in California with 81.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in California equally. The richest one percent of California residents would receive 81.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $864,900 next year. The framework would provide them an average tax cut of $90,160 in 2018, which would increase their income by an average of 3.3 percent.

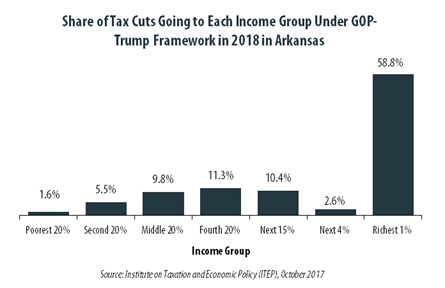

GOP-Trump Tax Framework Would Provide Richest One Percent in Arkansas with 58.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Arkansas equally. The richest one percent of Arkansas residents would receive 58.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $490,000 next year. The framework would provide them an average tax cut of $51,370 in 2018, which would increase their income by an average of 3.8 percent.

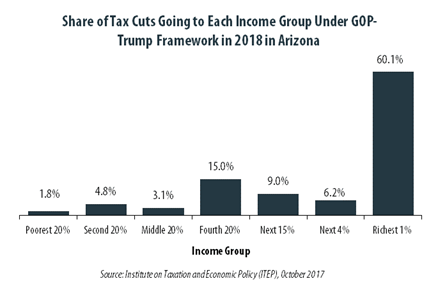

GOP-Trump Tax Framework Would Provide Richest One Percent in Arizona with 60.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Arizona equally. The richest one percent of Arizona residents would receive 60.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $470,200 next year. The framework would provide them an average tax cut of $59,210 in 2018, which would increase their income by an average of 4.4 percent.

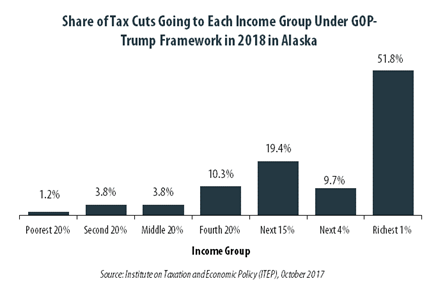

GOP-Trump Tax Framework Would Provide Richest One Percent in Alaska with 51.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Alaska equally. The richest one percent of Alaska residents would receive 51.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $615,800 next year. The framework would provide them an average tax cut of $77,880 in 2018, which would increase their income by an average of 5.5 percent.

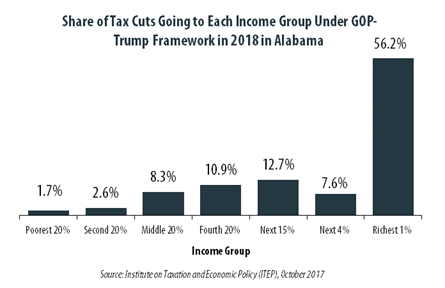

GOP-Trump Tax Framework Would Provide Richest One Percent in Alabama with 56.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Alabama equally. The richest one percent of Alabama residents would receive 56.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $501,800 next year. The framework would provide them an average tax cut of $49,830 in 2018, which would increase their income by an average of 3.5 percent.

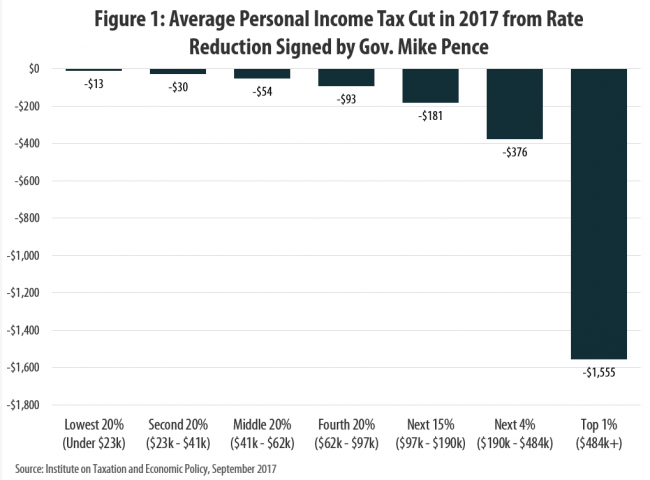

Indiana’s Tax Cuts Under Mike Pence Are Not a Model for the Nation

September 29, 2017 • By Carl Davis

In announcing a new tax cut framework this week in Indianapolis that was negotiated with House and Senate leaders, President Trump claimed that “Indiana is a tremendous example of the prosperity that is unleashed when we cut taxes and set free the dreams of our citizens …. In Indiana, you have seen firsthand that cutting taxes on businesses makes your state more competitive and leads to more jobs and higher paychecks for your workers.”

State Rundown 9/28: Wisconsin Budget Finalized, Oklahoma Special Session Underway

September 28, 2017 • By ITEP Staff

This week, Wisconsin's leaders finalized the state budget at last, while those in Oklahoma began a special session to close their state's revenue shortfall. Soda tax fights made news in Illinois and Pennsylvania. And New Jersey offered Amazon $5 billion in tax subsidies.

State Rundown 9/25: No Rest for the Weary as State Tax and Budget Debates Wind Down, Ramp Up

September 25, 2017 • By ITEP Staff

Last week, Wisconsin leaders finally came to agreement on a state budget, while their peers in Connecticut appear to be close behind them. Iowa lawmakers avoided a special session with a short-term fix and will have to return to their structural deficit issues next session, as will those in Louisiana who will face a $1 billion shortfall. Meanwhile, District of Columbia leaders have already resumed meeting and discussing tax and budget issues there.

Fact Sheet: The Consequences of Adopting a Territorial Tax System

September 18, 2017 • By Steve Wamhoff

President Trump and Republican leaders in Congress have proposed a “territorial” tax system, which would allow American corporations to pay no U.S. taxes on most profits they book offshore. This would worsen the already substantial problem of corporate tax avoidance and result in more jobs and investment leaving the U.S. Lawmakers should know some key facts about the territorial approach.

Poverty is Down, But State Tax Codes Could Bring It Even Lower

September 15, 2017 • By Misha Hill

The U.S. Census Bureau released its annual data on income, poverty and health insurance coverage this week. For the second consecutive year, the national poverty rate declined and the well-being of America’s most economically vulnerable has generally improved. In 2016, the year of the latest available data, 40.6 million (or nearly 1 in 8) Americans were living in poverty.