Recent Work

2146 items

State Rundown 7/27: State Legislative Debates Winding Down but Tax Talk Continues

July 27, 2017 • By ITEP Staff

While only a few states still remain mired in overtime budget debates, there is plenty of budget and tax news from around the country this week. Efforts are underway to repeal gas tax increases in California and challenge a local income tax in Seattle, Washington. And New Jersey legislators' law to modernize its tax code to tax Airbnb rentals has been vetoed for now.

GOP Leaders in Congress and the White House Set Out Goals for Tax Reform that Their Plans Fail to Meet

July 27, 2017 • By Alan Essig

Today Republican leaders in Congress and officials from the White House released a joint statement on tax reform, claiming that “the single most important action we can take to grow our economy and help the middle class get ahead is to fix our broken tax code for families, small business, and American job creators competing at home and around the globe.” Unfortunately, the proposals they have put forward so far do not address any such goals.

Reviving U.S. Manufacturing, One Cheesecake Factory at a Time

July 27, 2017 • By Matthew Gardner

In the latest example of how the tax code has been abused and distorted, the Cheesecake Factory is claiming the manufacturing tax deduction, apparently for manufacturing cheesecakes, burgers, and other treats.

Trump Touts Tax Cuts for the Wealthy as a Plan for Working People

July 26, 2017 • By Steve Wamhoff

Unless the administration takes a radically different direction on tax reform from what it has already proposed, its tax plan would be a monumental giveaway to the top 1 percent. The wealthiest one percent of households would receive 61 percent of all the Trump tax breaks, and would receive an average of $145,400 in 2018 alone.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

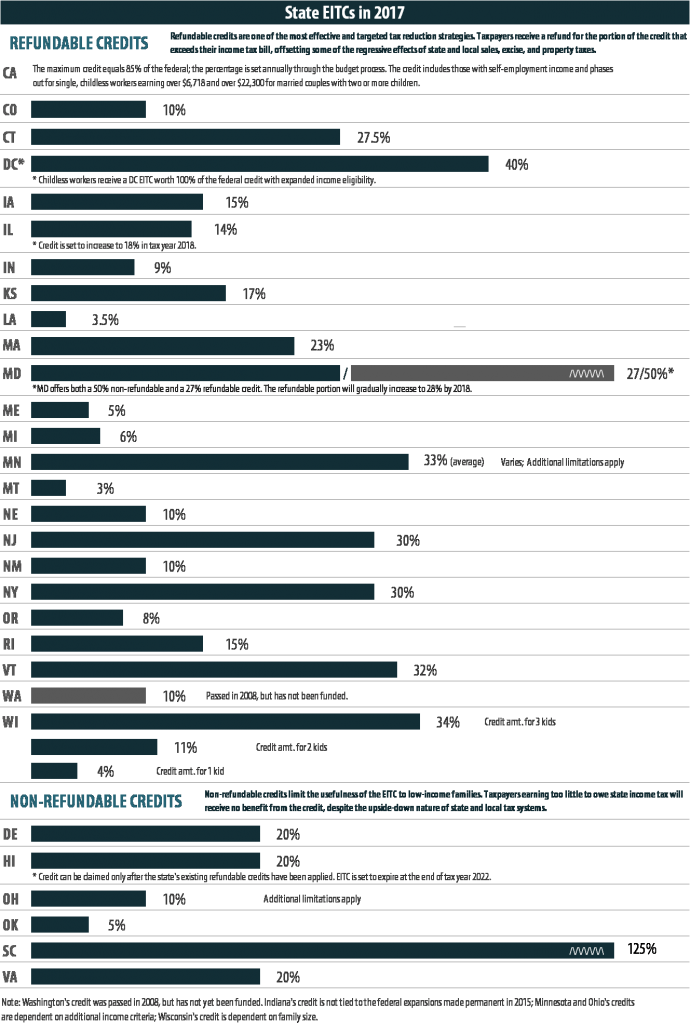

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

Tax Avoidance: Nike “Just Did It” Again, Moving $1.5 Billion Offshore Last Year

July 21, 2017 • By Matthew Gardner

The Nike Corporation’s annual financial disclosure of income tax payments is always notable for two recurring trends: the Oregon-based company’s steady shifting of profits into offshore tax havens, and Nike’s apparent effort to conceal how it’s achieving this tax avoidance. This year’s report, released earlier this week, is no exception.

States May Be Finally Learning Their Lesson on Back-To-School Sales Tax Holidays

July 21, 2017 • By Dylan Grundman O'Neill

State lawmakers face a dilemma when it comes to sales tax holidays, an attractive and popular policy that nonetheless proves to be a poor choice compared to developing thoughtful, targeted tax policies or investing in well-executed public services. Luckily, word seems to be getting out that the costs associated with these holidays far outweigh their purported benefits.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

State Rundown 7/19: Handful of States Still Have Their Hands Full with Tax and Budget Debates

July 19, 2017 • By ITEP Staff

Tax and budget debates drag on in several states this week, as lawmakers continue to work in Alaska, Connecticut, Rhode Island, Pennsylvania, Texas, and Wisconsin. And a showdown is brewing in Kentucky between a regressive tax shift effort and a progressive tax reform plan. Be sure to also check out our "What We're Reading" section for a historical perspective on federal tax reform, a podcast on lessons learned from Kansas and California, and more!

FedEx Pays Just 7.5% of Its Profits in Taxes While Pushing for a Lower Corporate Tax Rate

July 18, 2017 • By Matthew Gardner

The latest annual financial report released by shipping giant FedEx is yet another reminder that where you stand often depends on where you sit. The report shows that last year FedEx paid a 7.5 percent federal income tax rate on nearly $3.6 billion of U.S. pretax income and this low rate is due in part to accelerated depreciation, a provision in the tax code that allows the company to write off capital investments faster than they wear out. It’s not surprising, then, that FedEx’s leadership is currently promoting a tax plan that would drop the company’s statutory tax rate even…

This letter outlines ITEP’s two broad objectives for meaningful federal tax reform and discusses six recommendations that would achieve them.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2017 • By ITEP Staff

Sales taxes are an important revenue source, composing close to half of all state tax revenues. But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and services subject to the tax. Lawmakers in many states have enacted “sales tax holidays” (at least 16 states will hold them in 2017), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief…

State Rundown 7/11: Some Legislatures Get Long Holiday Weekends, Others Work Overtime

July 11, 2017 • By ITEP Staff

Illinois and New Jersey made national news earlier this month after resolving their contentious budget stalemates. But they weren’t the only states working through (and in some cases after) the holiday weekend to resolve budget issues.

What do terrorists, opioid and human traffickers, corrupt government officials and tax evaders have in common? They all depend on the secrecy provided by anonymous shell corporations to allow them to finance and profit from their crimes. Momentum is building in the House and Senate to pass legislation that would strike against illicit finance in the United States and around the world by bringing an end to the anonymity provided by U.S. incorporation.