Recent Work

2162 items

Gov. Sam Brownback’s tax experiment in Kansas was a failure. His radical tax cuts for the rich eventually had to be partly paid for through tax hikes on low- and middle-income families and also failed to deliver on promises of economic growth. Meanwhile, the tax cuts decimated the state’s budget, diminished its credit rating, and compromised its ability to meet the state’s constitutional standard of adequacy for public education.

One of the supposed selling points of the House GOP’s “Better Way” tax plan is that it will make the tax system so simple that you could do your taxes on a postcard. The reality, however, is that their promised postcard is a deception that would require numerous additional pages of worksheets to fill out. A better solution to making tax preparation simpler is called “return-free filing.” It does not just reduce your work to filling out a postcard, it could eliminate it altogether.

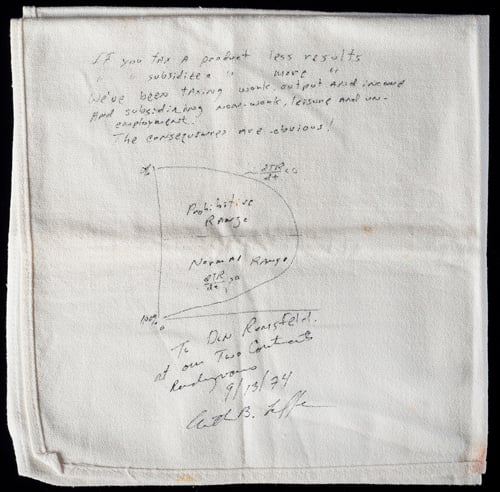

Sitting in the National Museum of American History in Washington, DC, hidden in the jumble of Americana like Thomas Jefferson’s desk, Michelle Obama’s inaugural gown and the ruby slippers worn in the Wizard of Oz, is a napkin with a drawing on it. Probably one of the least known exhibits in the museum, this napkin, quietly hiding behind glass lest some child wandering from a school group wipe his nose on it, has on several occasions destroyed the finances of the federal government and several state governments, most recently in Kansas.

This week, we celebrate a victory in Kansas where lawmakers rolled back Brownback's tax cuts for the richest taxpayers. Governors in West Virginia and Alaska promote compromise tax plans. Texas heads into special session and Vermont faces another budget veto, while Louisiana and New Mexico are on the verge of wrapping up. Voters in Massachusetts may soon be able to weigh in on a millionaire's tax, the California Senate passed single-payer health care, and more!

Oklahoma’s Budget Signed by Governor, but Long-Run Challenges Remain

June 2, 2017 • By Aidan Davis

On the last day of their legislative session, Oklahoma lawmakers finalized a $6.8 billion budget bill that was later signed by Gov. Mary Fallin. In the governor's statement on the bill, she noted that state agencies will be hard hit by the agreement--"it leaves many agencies facing cuts for the sixth year in a row"--and that while it does include some recurring revenue, it does not address the state's long-run structural budget challenges.

A truly populist budget would seek to ensure that middle- and low-income families have the resources that they need to get ahead, that the wealthy and corporations are paying their fair share in taxes, and that our country is making the public investments we need to ensure full employment and improve productivity over the long term. The Congressional Progressive Caucus’s (CPC) 2018 budget proposal would make real progress on all of these fronts.

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

Avocado Toast, iPhones, Billionairesplaining and the Trump Budget

May 30, 2017 • By Jenice Robinson

A couple weeks ago, a billionaire set the Internet ablaze when on 60 Minutes Australia he chided millennials to stop buying avocado toast and fancy coffee if they wanted to buy a home. The backlash was swift and deserved. Twenty- and early thirty-something people rightly took offense to the suggestion that they haven’t purchased homes […]

Besides Eviscerating the Safety Net, Trump Budget Would Put States in a Fiscal Bind

May 26, 2017 • By Misha Hill

There has been considerable discussion about the human impact of the Trump budget’s draconian cuts to what remains of the social safety net. A long-standing conservative talking point in response to such criticism is that states can pick up the tab when federal dollars disappear. But at a time when many states are facing budget shortfalls and the effect of federal tax reform is yet to be determined, it is outlandish to suggest that states are flush with cash to make up for federal spending reductions.

The Cost Of Trickle-Down Economics For North Carolina

May 26, 2017 • By ITEP Staff

Since 2013, state lawmakers have passed significant income tax cuts that largely benefit the state’s highest income earners and profitable corporations. These costly tax cuts have made the state’s tax system more upside-down by delivering the greatest income tax cuts to the state’s highest income taxpayers, while maintaining a heavier tax load on low- and […]

Congressional Hearing Highlights Problems with the Border Adjustment Tax

May 25, 2017 • By Richard Phillips

The debate over the so-called border adjustment tax (or BAT) took center stage this week when the House Ways and Means Committee held its first hearing on the topic. Despite strong support by the House Republican leadership and the Chairman of the Ways and Means Committee, Rep. Kevin Brady, the proposal faced an onslaught of criticism during the hearing from invited witnesses and members of both parties.

23 Million Uninsured Americans Is Too Great a Cost to Finance Tax Cuts for the Rich

May 24, 2017 • By Richard Phillips

The cost to give $1 trillion in tax cuts to the wealthy and corporations is 23 million uninsured Americans by 2026. This is the bottom-line take away from the much-awaited Congressional Budget Office (CBO) score of the American Health Care Act, which House Republicans rushed through the chamber and narrowly passed (217-213) in early May.

This week, Kansas lawmakers continued work on fixing the fiscal mess created by tax cuts in recent years, as legislators in Louisiana, Minnesota, Oklahoma, and West Virginia attempted to wrap up difficult budget negotiations before their sessions come to an end, and Delaware lawmakers advanced a corporate tax increase as one piece of a plan to close that state's budget shortfall. Our "what we're reading" section this week is also packed with articles about state and local effects of the Trump budget, new 50-state research on property taxes, and more.

Trump Budget Plan Would Eliminate Child Tax Credits for Working Families Due to Parents’ Immigration Status

May 23, 2017 • By Misha Hill

As ITEP has detailed, undocumented immigrants are taxpayers, contributing close to $12 billion a year in state and local taxes while also paying federal payroll, income, and excise taxes. In spite of these facts, Mick Mulvaney, President Trump’s budget director, has spread erroneous information to validate the administration’s cruel proposal to strip a proven anti-poverty benefit from undocumented immigrants and their children.

ITEP’s Commitment to Being a Voice for Low-, Moderate- and Middle-Income People in Tax Policy Debates

May 22, 2017 • By Alan Essig

A strong voice for working people in federal and state tax policy debates is absolutely critical. Sound, progressive tax policies make all the difference between high-quality educational systems or crowded classrooms with limited resources. They account for the difference between structurally sound roads and bridges or potholes and other crumbling infrastructure. At the federal level, good tax policy means raising enough revenue so the nation can adequately fund child care and early education, health care, food inspection, national parks, and a clean, safe environment among other things.