Recent Work

2162 items

Effects of President Biden’s Proposal to Expand the Child Tax Credit

March 16, 2023 • By Joe Hughes

In his latest budget proposal, President Biden proposes enhancing the Child Tax Credit (CTC) based on the temporary credit that was in effect for 2021 as part of the American Rescue Plan Act. In this report we analyze how that proposal would help children and families.

It’s March and state lawmakers are showing why the Madness isn’t only reserved for the basketball court...

As one of the most prosperous countries in human history, we have enough resources for our collective needs. By better taxing corporations and the wealthiest, we can generate revenue to improve family security, strengthen our communities, and reduce the debt too.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2024 Budget Plan

March 10, 2023 • By Steve Wamhoff

President Biden’s latest budget proposal includes trillions of dollars of new revenue that would be paid by the richest Americans, both directly through increases in personal income, Medicare and estate taxes, and indirectly through increases in corporate income taxes.

Politifalse: A Fact-Checker Does Biden an Injustice on Taxes Paid by Billionaires

March 9, 2023 • By Michael Ettlinger

Most Americans pay more in Social Security and Medicare payroll taxes than they pay in federal personal income tax. So just looking at the personal income tax for comparison misses most of the taxes middle-income Americans pay. That is not true for billionaires because a much, much smaller proportion of their income is subject to the federal payroll taxes.

State Rundown 3/9: The Whirlwind 2023 Legislative Session Continues

March 9, 2023 • By ITEP Staff

State 2023 legislative sessions are proving to be eventful ones. With many states eager to make use of their budget surpluses, major tax changes are still being proposed and others signed into law. Michigan residents will soon see an increase to their state Earned Income Tax Credit (from 6 percent to 30 percent) after the […]

President’s Budget Would Strengthen Medicare Taxes Paid by the Wealthy

March 8, 2023 • By Joe Hughes

As part of his new budget plan, President Biden is asking the richest Americans to pay a little bit more to strengthen Medicare. The proposal includes raising taxes related to Medicare very slightly for the highest earners and closing a loophole that some wealthy individuals use to avoid Medicare taxes altogether.

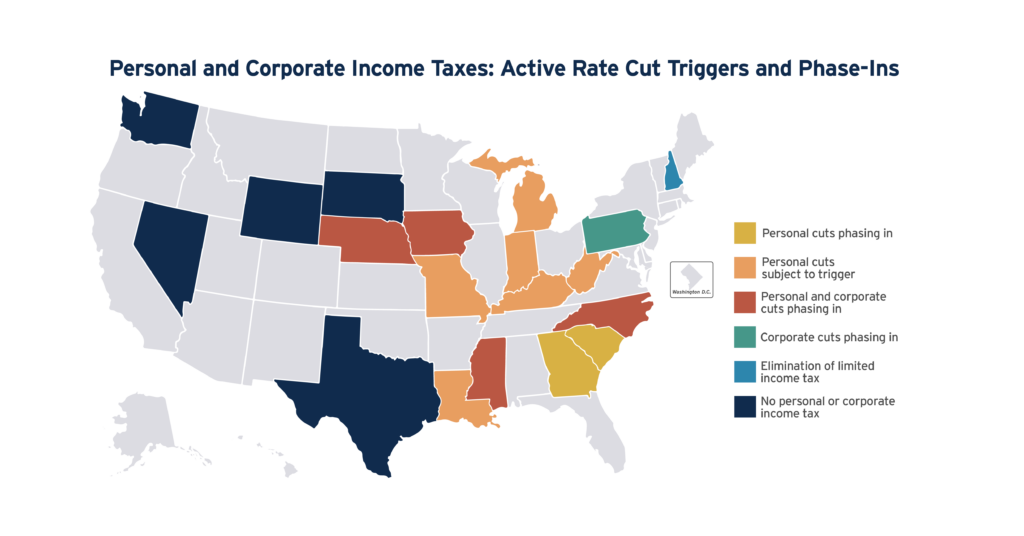

In recent years, lawmakers have been quick to push for phased-in tax cuts or cuts attached to trigger mechanisms. These policy tools push the implementation of tax cuts outside of the current budget window with a predetermined phase-in schedule or a mathematical formula tied to state revenue trends.

Wealthy families are overwhelmingly the ones using school voucher tax credits to opt out of paying for public education and other public services and to redirect their tax dollars to private and religious institutions instead. Most of these credits are being claimed by families with incomes over $200,000.

This week, several big tax proposals took strides on the march toward becoming law...

New Jersey, New York, and Connecticut Should Keep Corporate Taxes Strong, Extend Surcharges

February 28, 2023 • By Marco Guzman

At a time when corporations are seeing record profits while not paying their fair share of federal taxes, state corporate income taxes can and should play a role in raising sustainable revenue and adding progressivity to state tax codes. Right now, lawmakers in New Jersey, New York, and Connecticut have a unique opportunity to extend targeted tax changes that have raised billions of dollars from profitable corporations for meaningful public investments.

The flat tax plan and others being discussed that would cut even deeper would be windfalls for the wealthy, and expensive ones at that. Families with incomes over $300,000 per year, for example, could expect to gain, as a group, about a billion dollars annually under the flat tax plan. If you asked Ohio families about their top priorities for this legislative session, it’s a safe bet that very few of them would choose a billion-dollar tax cut for this group over funding for schools, parks, and infrastructure.

State Rundown 2/23: Tax Dominos Take Shape, Begin to Fall as Session Heats Up

February 23, 2023 • By ITEP Staff

The 2023 legislative session is in full swing, and dominos continue to be set up as others fall...

The word “tax” appears 97 times and counting in one recent summary of governors’ addresses to state legislators so far this year. The policy visions that governors are bringing, however, vary enormously. While there's good reason to worry about tax cuts for wealthy families and the flattening or elimination of income taxes, there are at least five great tax ideas coming directly out of governors’ offices this year.

This week, a fresh bouquet of tax proposals was delivered by state lawmakers, but not all of them have left us with that warm, fuzzy feeling in our stomachs...