Recent Work

2146 items

Lawmakers Must Choose Between Funding the IRS or Protecting Wealthy Tax Cheaters

August 12, 2022 • By Steve Wamhoff

Grasping for some way to criticize the popular Inflation Reduction Act as it approaches final passage, Congressional Republicans have decided to attack its provisions that will reverse a decade of budget cuts to the IRS and instruct the agency to crack down on tax evasion by big corporations and individuals making more than $400,000. Of […]

State Rundown 8/10: States Still Talking Taxes as IRA Dominates Headlines

August 10, 2022 • By ITEP Staff

While federal tax policy has dominated the headlines with the Senate’s recent approval of the Inflation Reduction Act, lawmakers in statehouses across the country...

What Tax Provisions are in the Senate-Passed Inflation Reduction Act?

August 9, 2022 • By Steve Wamhoff

The Inflation Reduction Act approved by the Senate on Aug. 7 would raise more than $700 billion in new revenue over a decade by closing corporate tax loopholes, empowering the IRS to enforce the tax laws on the books, taxing stock buybacks, and extending a limitation on deductions for business losses. The IRA – if […]

They Might Really Do It: The Senate Is About to Reform Our Tax Code

August 5, 2022 • By Steve Wamhoff

For now, the Senate is poised to reverse cuts to the IRS enforcement against wealthy tax evaders for the first time in a decade, crack down on tax-dodging by huge corporations for the first time since 1986, and finally address the method increasingly used by corporations to transfer income to shareholders to avoid federal taxes. The multi-decade winning streak of corporate lobbyists and special interests who have practically written many of our tax laws in recent years is about to come to an end.

Corporations are Shifting Profits to Wealthy Investors Tax-Free—Stock Buyback Tax Would Change That

August 5, 2022 • By Joe Hughes

Senate Democrats have announced an agreement on the Inflation Reduction Act that, among other changes to a previous version of the bill, would apply a 1 percent tax on corporations repurchasing their own stock. This proposal was included in the House-passed Build Back Better Act last year and was estimated at that time to raise $124 billion over 10 years. This measure would ensure that income transferred from corporations to wealthy shareholders does not continue to escape taxation.

Corporate Minimum Tax Examples: Apple Would Likely Pay More, 3M Would Not

August 5, 2022 • By Matthew Gardner

Apple, one of the largest corporations in the United States despite manufacturing most of its physical products offshore, would likely pay the corporate minimum tax that is included in the Inflation Reduction Act that the Senate is debating this week. 3M, a manufacturer that has about 40 percent of its workforce in the United States, likely would not pay the corporate minimum tax if current trends in the company’s profits and taxes continue, because it is already paying above 15 percent of its profits in taxes.

Opponents of Inflation Reduction Act Call for Continued Tax Avoidance by Large Manufacturers

August 2, 2022 • By Steve Wamhoff

The biggest revenue-raising provision in the Inflation Reduction Act, the 15 percent minimum tax for corporations that have more than a billion dollars in profits, is under attack from members of Congress who argue that manufacturing companies should not be required to pay any minimum amount of tax. Sen. Mike Crapo, the top Republican on […]

Top Republican Tax-Writer Falsely Claims that Minimum Tax for Huge Corporations Is a Tax Hike on Middle-Class

August 2, 2022 • By Steve Wamhoff

Opponents of requiring corporations to pay even a minimum amount of taxes hold an unpopular position. But Sen. Mike Crapo, the top Republican on the Senate Finance Committee and a leader of that opposition, is using a one-sided and incomplete analysis to claim that the corporate minimum tax would raise taxes on low- and middle-income people.

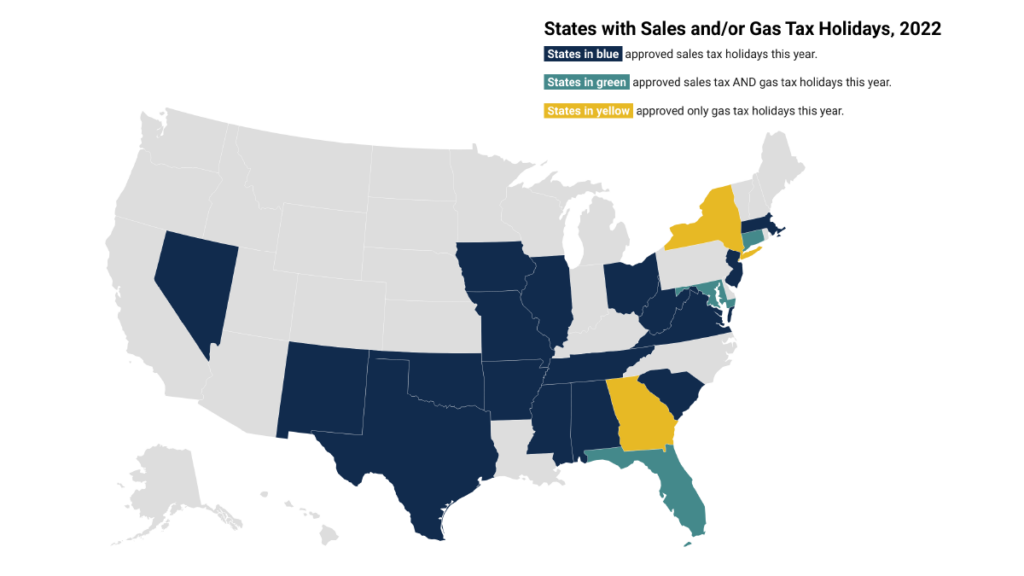

State Rundown 7/27: It’s (Sales Tax) Holiday Season, But Who’s Really Celebrating?

July 27, 2022 • By ITEP Staff

It’s the holiday season – well, the sales tax holiday season, that is. But after taking a closer look, you may notice that there is little to celebrate...

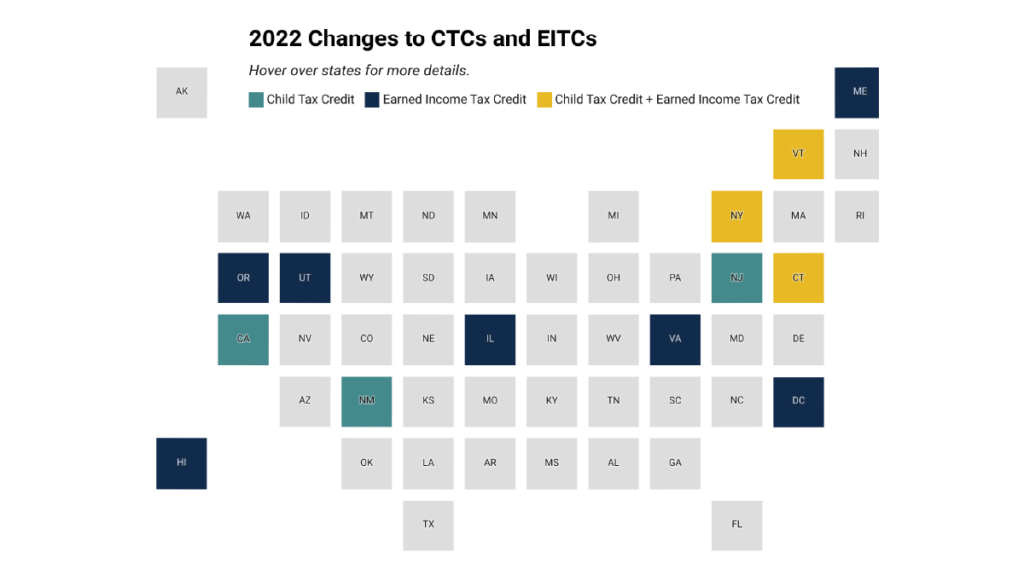

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

Most States Used Surpluses to Reduce Taxes But Not in Sustainable or Progressive Ways

July 22, 2022 • By Kamolika Das

The average person on the street would have no idea that many states experienced unprecedented budget surpluses this year. Iowa, for instance, has the most structurally deficient bridges of any state with nearly 1 in 5 falling apart. The Iowa Board of Regents proposed a 4.25 percent tuition increase for all three state universities and […]

New ITEP Brief Shows How State Sales Tax Holidays Fail to Live Up to the Hype

July 20, 2022 • By Marco Guzman

Twenty states this year have decided to go so far as to forgo a combined $1 billion in vital tax revenue in favor of conveniently popular yet ultimately ineffective sales tax holidays. Whether it’s a state looking for a way to help families manage the rising cost of goods or to celebrate back-to-school shopping season, these policy options are poorly targeted and an inadequate use of state tax revenue that could be doing more to make childcare more affordable, health care more accessible and high-quality education available to everyone.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 20, 2022 • By Marco Guzman

Lawmakers in many states have enacted “sales tax holidays” (20 states will hold them in 2022) to temporarily suspend the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or arbitrarily reward people with specific hobbies or in certain professions. This policy brief looks at sales tax holidays as a tax reduction device.

The Tax Legislation Debated in Congress Would Reduce Inflation and Help Americans Deal with Rising Costs

July 19, 2022 • By Steve Wamhoff

Opposing a fully paid-for spending bill because of inflation concerns does not make any sense. Opposing a deficit-reducing bill because of inflation is absurd.

From the Bay State to the Golden State, lawmakers across the nation are making deals and negotiating budgets with major tax implications...