Recent Work

2162 items

Although the weather is beginning to cool down in parts of the country, the same cannot be said for many state economies, which are still running hot. That, however, doesn’t mean that the good times are guaranteed to last...

While the Inflation Reduction Act's corporate minimum tax is a huge improvement in our tax system, implementing the global corporate minimum tax would improve it much more. And if other governments implement the global minimum tax, the United States will have an even stronger interest in joining them to ensure that new revenue collected from American corporations flows to the U.S. rather than to other countries.

Congress Should Not Leave Children Out of Possible Year-End Tax Deal

October 3, 2022 • By Steve Wamhoff

If lawmakers believe it’s worthwhile to extend corporate tax breaks, then it would be entirely unreasonable for them to not conclude the same about tax provisions that help low-income children.

Do you remember/the big tax news innn September? Well, if not, we at ITEP got you covered...

How the Inflation Reduction Act’s Tax Reforms Can Help Close the Racial Wealth Gap

September 20, 2022 • By Brakeyshia Samms, Joe Hughes

Lawmakers have many opportunities to pass reforms that will make our tax code fairer and further reduce racial inequity in our economy. The Inflation Reduction Act is a great step forward; better taxing wealth and income from wealth and expanding targeted refundable tax credits would build on this progress.

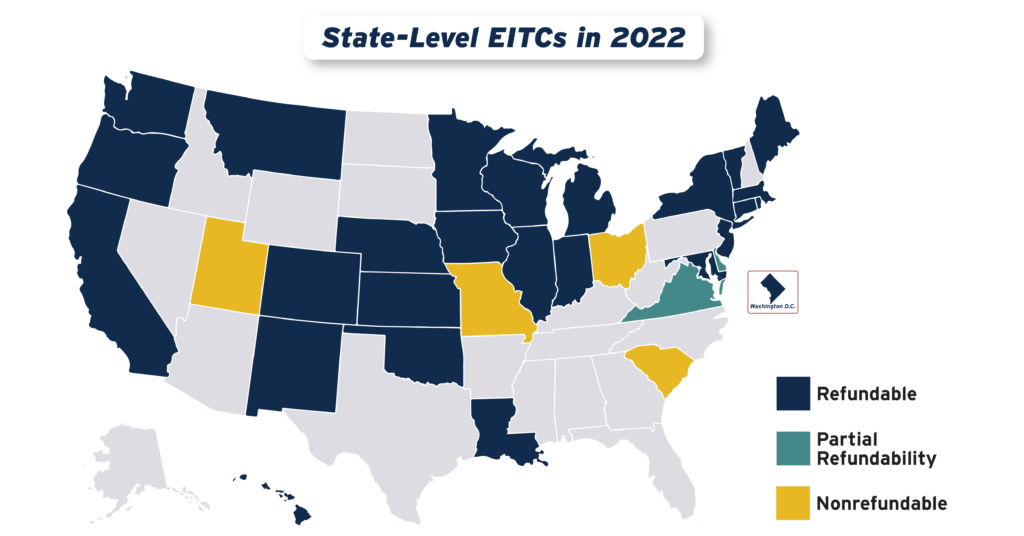

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.

Census Data Shows Need to Make 2021 Child Tax Credit Expansion Permanent

September 14, 2022 • By Joe Hughes

The Child Tax Credit expansion led to a 46 percent decline in childhood poverty. That it could be accomplished during the largest economic disruption in most of our lifetimes underscores a basic fact: thoughtful, decisive government action to combat poverty works.

Billionaires Should Pay Taxes on Their Income Every Year Like the Rest of Us

September 13, 2022 • By Steve Wamhoff

The Inflation Reduction Act signed by President Biden last month will crack down on corporate tax dodgers and strengthen enforcement of tax laws already on the books, raising hundreds of billions of dollars to be spent on climate, health and other priorities. But these reforms will not directly raise taxes on even the wealthiest individuals. […]

State Rundown 9/7: Labor Day Week Provides Sobering Reminder of Steps Forward, Back

September 7, 2022 • By ITEP Staff

Though Labor Day has passed, advocates on the ground in states across the country are continuing to uphold the spirit of the labor movement...

Romney Child Tax Credit Plan Would Leave Millions of Children Worse Off and Raise Taxes for the Average Black Family

September 7, 2022 • By Steve Wamhoff

Sen. Romney’s plan would expand the Child Tax Credit and offset the costs by scaling back other tax benefits. All told, it would raise taxes on a fourth of all kids in the U.S. This includes about a fourth of the children among the poorest fifth of U.S. families.

National and State-by-State Estimates of Two Approaches to Expanding the Child Tax Credit

September 7, 2022 • By Emma Sifre, Joe Hughes, Steve Wamhoff

The Romney Child Tax Credit plan would leave a quarter of children worse off compared to current law and help half as many low-income children as the 2021 expansion of the credit.

Four Tax Policy Wins in the Inflation Reduction Act and Four More That Can Build on This Progress

August 22, 2022 • By Joe Hughes, Jon Whiten

With four major tax policy provisions, the IRA takes a huge step toward a fairer tax code and a more equitable economy. But as always, there are more steps lawmakers should take to build on this progress.

Putting Cleveland and the Nation on a Path Toward Tax and Climate Justice

August 22, 2022 • By Amy Hanauer

Editor’s note: This originally ran as an opinion piece in the Cleveland Plain Dealer. When I left Cleveland to work on federal tax policy after 20 years running Policy Matters Ohio, I knew Ohio would stay in my heart and fuel my work. Accustomed to an America that often ignores our toughest problems, I understood […]

Editor’s note: This originally ran as an opinion piece in The Hill. Though the Inflation Reduction Act is enormously popular, some politicians and pundits are trying to generate hysteria about one feature: Funding for the IRS. All the false claims are distracting us from two important things: how necessary the funding increase is to reverse […]