Recent Work

2146 items

Our elected officials have to listen to we the people and change their approach. Going forward, corporate voices cannot continue to steer. Instead, families, communities and working individuals have to lead our policymaking so it better helps people struggling now.

State Rundown 4/9: Pandemic’s Fiscal Effects Slowly Coming into Focus

April 9, 2020 • By ITEP Staff

The COVID-19 pandemic continued this week to wreak havoc on lives and communities around the world. The fiscal fallout of the virus in the states is growing as well, and beginning this week to come into sharper focus. This week’s Rundown brings together what we know of that slowly clarifying picture and how states are responding so far.

Addressing the COVID-19 Economic Crisis: Advice for the Next Round

April 7, 2020 • By Steve Wamhoff

Americans need many things right now beyond tax cuts or cash payments. But for people whose incomes have declined or evaporated, money is the obvious, immediate need to prevent missed rent or mortgage payments, skipped hospital visits and other cascading catastrophes. So, what should Congress do next to get money to those who need it?

Last week, President Trump destroyed everyone’s coronavirus press conference bingo card by announcing that a conversation he had with celebrity chef Wolfgang Puck inspired him to propose restoring a corporate tax deduction for business entertainment expenses. Trump’s own signature tax plan repealed this break two years ago.

Returning to the Economic Status Quo After COVID-19 Crisis Should Not Be an Option

April 6, 2020 • By Jenice Robinson

It will take immense imagination, unyielding political will and a fundamental reordering of our policy priorities to adequately address the problems of this moment and unrig our economy.

State Rundown 4/3: States Welcome Federal Aid, Seek Further Solutions

April 3, 2020 • By ITEP Staff

States and families got good news this week as Congress came together to pass major aid to help during the COVID-19 coronavirus pandemic. But that bright spot came amid an onslaught of very difficult news about the public health crisis and the economic and fiscal fallout accompanying it. This week’s Rundown brings you the latest on these developments and state and local responses to them.

Federal Relief Bill Doesn’t Go Far Enough: Q&A with Meg Wiehe

April 2, 2020 • By ITEP Staff, Meg Wiehe, Stephanie Clegg

The final version of the Coronavirus Aid, Relief and Economic Security (CARES) Act enacted last week included rebate provisions that will reach most low-, moderate- and middle-income adults and children, but not everyone. Meg Wiehe sits down for a Q&A to discuss who benefits from the rebate provision, who is excluded and how states can respond to support communities.

Sales Taxes and Social Distancing: State and Local Governments May Face Their Steepest Sales Tax Decline Ever

April 2, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

One pressing question is what will an economic downturn in which consumers are anxious, facing job loss, or simply spending their time sheltering in place and not spending money in typical ways, mean for states’ ability to raise revenue?

Boeing “CARES” A Lot About its Shareholders—But What about the Rest of Us?

April 1, 2020 • By Matthew Gardner

The gigantic Coronavirus-related tax and spending bill enacted last week, the so-called “CARES Act,” sets aside $17 billion in loans for “businesses critical to maintaining national security.” It’s generally understood that the bill’s authors want much, if not all, of this $17 billion to go to a single company: Boeing. So it behooves us to ask whether Boeing benefits America and its economy in ways that merit this largesse.

Temporarily modifying the structure of the EITC to reflect the realities of our current economy could provide a vital lifeline to low-income workers who have seen their incomes disappear during this crisis. What follows are a few such ideas which could be implemented at either the federal or state levels, or both.

House Democrats’ Suggestion of Retroactively Repealing SALT Cap is a Poor Emergency Relief Measure

March 31, 2020 • By Steve Wamhoff

The House Democrats have plenty of ideas to help workers and families and boost the economy, but Speaker Nancy Pelosi’s recent idea to repeal the cap on deductions for state and local taxes (SALT) is not one of them. The 2017 Trump-GOP tax law includes many provisions that should be repealed. Unfortunately, Congressional Democrats have long made it clear that they want to start by repealing the $10,000 cap on SALT deductions, which is one of the law's few provisions that restrict tax breaks for the rich.

Congress “CARES” for Wealthy with COVID-19 Tax Policy Provisions

March 31, 2020 • By Matthew Gardner

At a time when record numbers of Americans are facing unemployment, state and local governments are facing a perfect storm of growing public investment needs and vanishing tax revenues, and small business owners are struggling to avoid even more layoffs, lavishing tax breaks on the top 1 percent in this way shouldn’t be in anyone’s top 20 list of needed tax changes.

State Rundown 3/26: Pandemic’s Health and Fiscal Fallout Continues to Grow

March 26, 2020 • By ITEP Staff

This week’s Rundown brings you the most useful reading and resources about how states are affected by and responding to the COVID-19 pandemic. These include: landing pages for the most up-to-date lists of state policy responses; ITEP’s own materials on state policy options and the federal response bills; insights on how a race-forward approach can improve these efforts at all levels; updates on state fiscal troubles and legislative postponements; and the developing picture of which states and communities could be affected more than others.

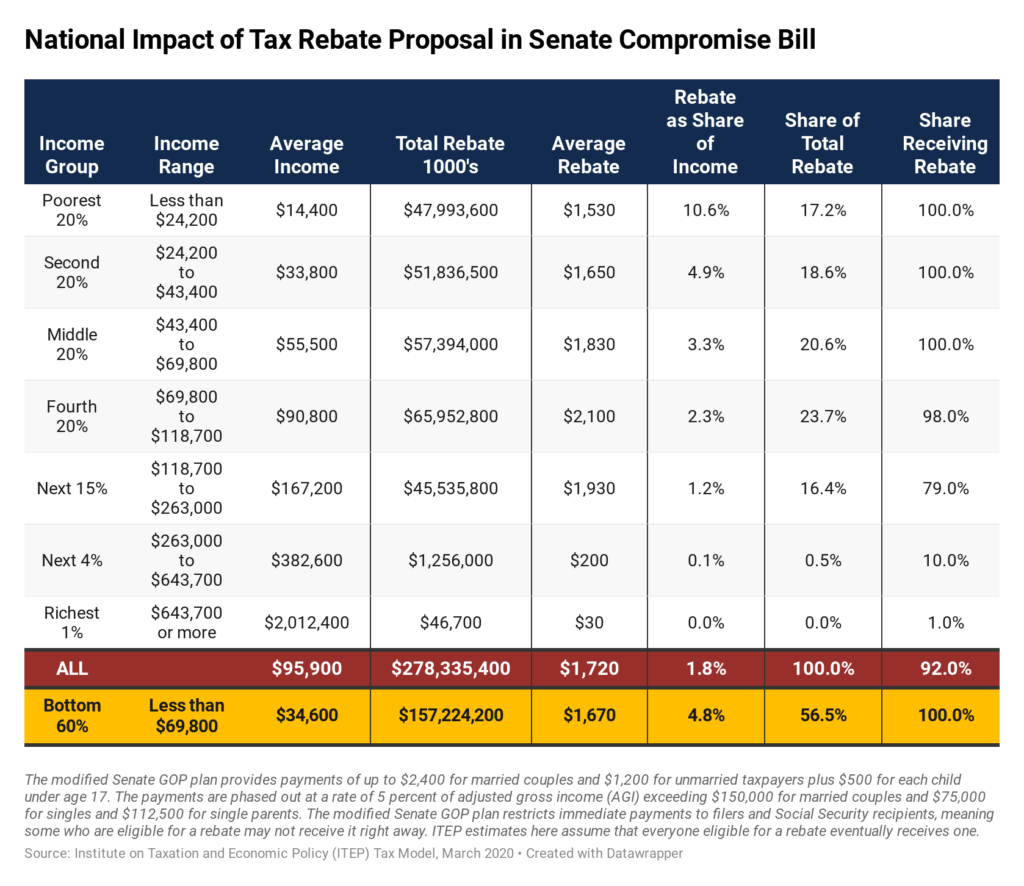

Data available for download Congress passed and the president signed a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. Though the bill improves on flaws in […]

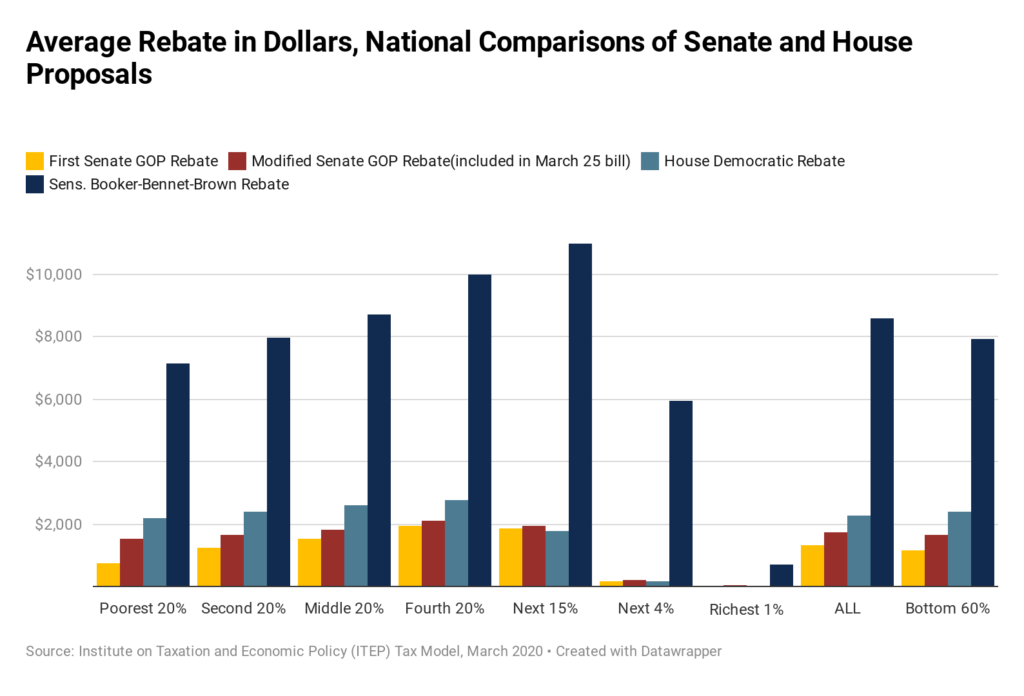

How the Tax Rebate in the Senate’s Bill Compares to Other Proposals

March 25, 2020 • By Steve Wamhoff

Congress is poised to pass a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. As the Senate votes on its stimulus/COVID19 bill, one provision ITEP has deeper insights on is the payments to households in the form of tax rebates. ITEP has provided several analyses over the past few days showing that the rebate in the current bill is an improvement over a previous GOP proposal but still falls short of…