Recent Work

2163 items

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Sales taxes are one of the most important revenue sources for state and local governments; however, they are also among the most unfair taxes, falling more heavily on low- and middle-income households. Therefore, it is important that policymakers nationwide find ways to make sales taxes more equitable while preserving this important source of funding for public services. This policy brief discusses two approaches to a less regressive sales tax: broad-based exemptions and targeted sales tax credits.

Reducing the Cost of Child Care Through State Tax Codes in 2019

September 26, 2019 • By Aidan Davis

The high cost of quality child care is a budget constraint for many working families and particularly daunting for parents who are working but earning low wages. Most families with children need one or more incomes to make ends meet which means child care expenses are an increasingly unavoidable and unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

State lawmakers seeking to make residential property taxes more affordable have two broad options: across-the-board tax cuts for taxpayers at all income levels, such as a homestead exemption or a tax cap, and targeted tax breaks that are given only to particular groups of low- and middle-income taxpayers. This policy brief surveys the advantages and disadvantages of the circuit breaker approach to reducing property taxes.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2019

September 26, 2019 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

Wealth Tax Proposals from Warren and Sanders: What You Should Know

September 25, 2019 • By Steve Wamhoff

Earlier this year, Sen. Elizabeth Warren proposed a federal wealth tax on a handful of U.S. households with the highest net worth. Sen. Bernie Sanders has just announced his own wealth tax proposal, which is similar to Warren’s. A few other presidential candidates say they support the concept although they have not provided any details. Here's what you need to know about the potential for a federal wealth tax.

Business Roundtable Members’ Social Responsibility Pledges are Easily Made, and Easily Broken

September 20, 2019 • By Matthew Gardner

It was this side of last month that the Business Roundtable made headlines by announcing its new vision of the purpose of a corporation. More than 180 corporate leaders signed the statement, which declared corporations will prioritize the communities in which they work—instead of shareholder value. But for some corporations, the Business Roundtable statement is yesterday’s news, and they are commencing with business as usual.

One of the most glaring sources of unfairness in the federal tax code are rules that tax capital gains, which mostly go to the rich, less than wages and other types of income that most of us depend on. The capital gains tax breaks have for decades been comfortably ensconced behind trenches filled with special interests who would defend them until the end. But the end is now conceivable.

Julián Castro Provides the Latest Proposal to Expand Refundable Tax Credits

September 17, 2019 • By Steve Wamhoff

New estimates from ITEP show that Julián Castro’s refundable tax credit proposal would mostly benefit the bottom 60 percent of households and would have a cost ($195 billion in 2020) that places it roughly in the middle of the different tax credit proposals that Democrats have offered over the past several months.

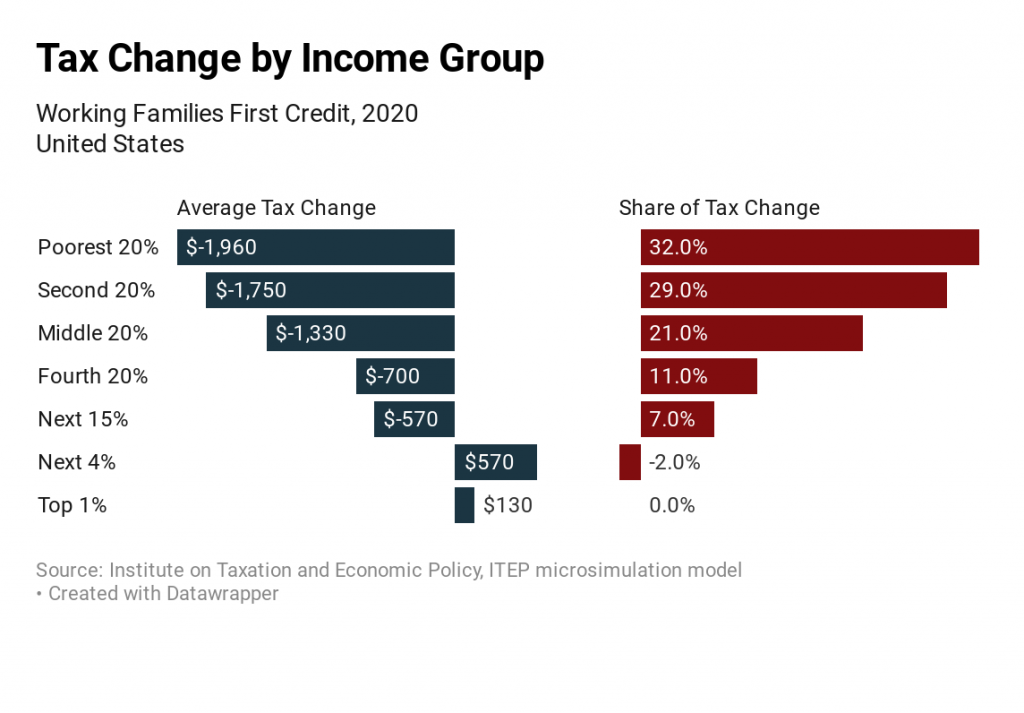

The Working Families First Credit proposal would increase the CTC from $2,000 to $3,000 and remove the limits on refundability that prevent many lower-income families from receiving the entire credit and expand the EITC by increasing the rate at which earnings are credited and it would provide a larger increase for childless workers. View the distributional analysis.

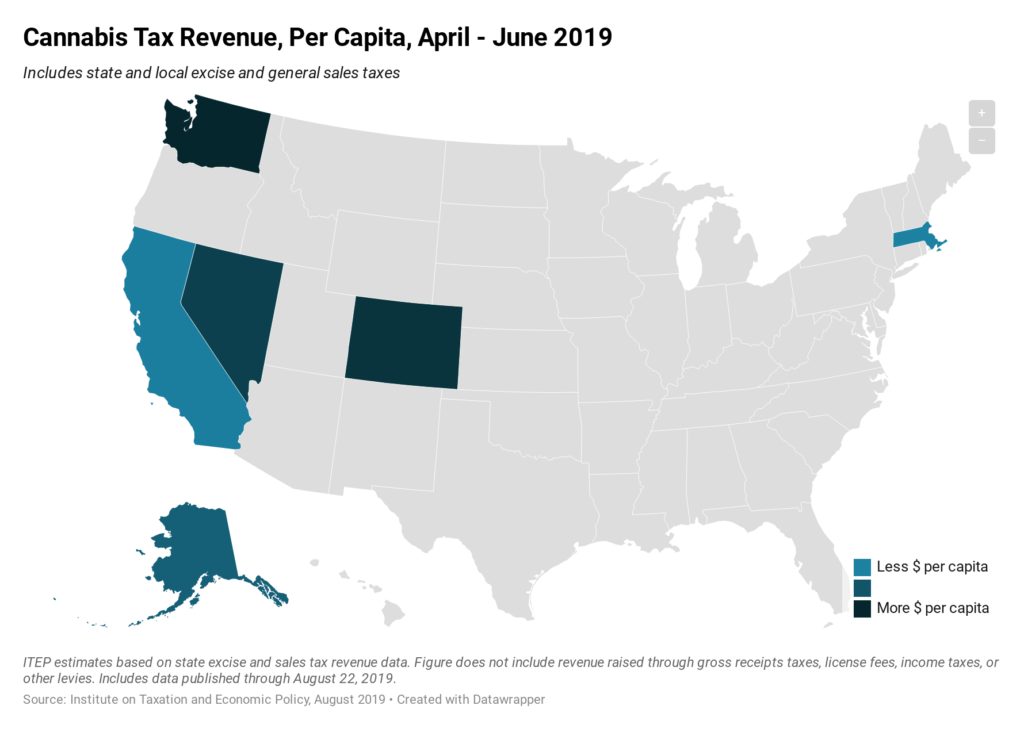

Seven states currently allow for the legal, taxable sale of recreational cannabis. The above map shows per capita revenue collections from excise and sales taxes on cannabis during the second quarter of 2019, the most recent period for which data are available in every state. The most lucrative cannabis market in the country, from a tax revenue perspective, is in Washington State where the 46 percent combined tax rate applied to cannabis is the highest in the country. Collections in California and Massachusetts, by contrast, remain low as these states are still in the early stages of establishing their legal…

A federal wealth tax on the richest 0.1 percent of Americans is a viable approach for Congress to raise revenue and address economic inequality. This new video from ITEP makes the case for a federal wealth tax.

Why Are Ideologues Trying to Downplay Poverty and Economic Inequality?

September 12, 2019 • By Jenice Robinson

Our elected officials should pause and check the pulse of the nation. The public is aware of the great income divide and likely isn’t keen on an agenda that would use sleight of hand to “reduce” poverty and spend less on domestic programs—particularly when that agenda is in tandem with using the tax code to further boost income for the wealthy.

State Rundown 9/12: Work Continues to Flip the Script on Backwards Tax Codes

September 12, 2019 • By ITEP Staff

Residents of several states are spending their palindrome week reading ballot initiatives forwards and backwards to decide whether or not to support them, including measures to improve education funding in California and Idaho, allow Alaska and Colorado to invest more in public services, and constitutionally prohibit income taxation in Texas. New Jersey lawmakers are giving the same thorough treatment to the state’s corporate tax subsidies. And advocates in Chicago, Illinois, have a bold proposal to flip the script on upside-down taxes there. But devotees of good policy and honest government in North Carolina won’t want to re-read yesterday’s news in…

Sen. Wyden’s Anti-Deferral Accounting Proposal Could Be a Game-Changer

September 12, 2019 • By Steve Wamhoff

Today, Sen. Ron Wyden, the ranking Democrat on the Senate Finance Committee, fulfilled a promise he made several months ago to release a proposal that could fundamentally transform how the U.S. taxes capital gains of the wealthy. The paper he released today proposes “anti-deferral accounting” to ensure that wealthy people are taxed on all of […]