Recent Work

2162 items

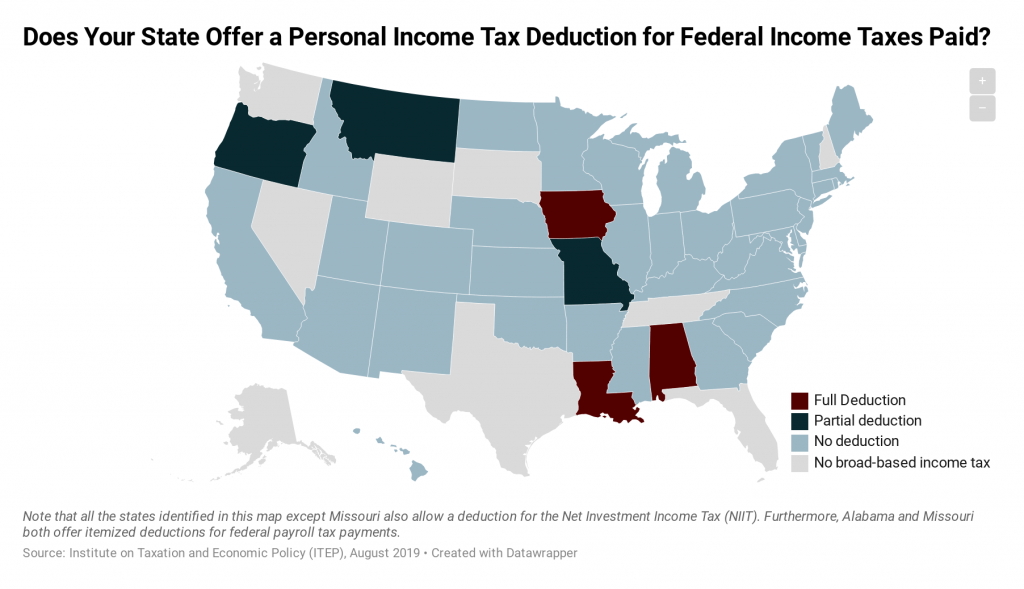

Six states allow an unusual income tax deduction for federal income taxes paid. These deductions are detrimental to state income tax systems on many fronts, as they offer large benefits to high-income earners and undercut the adequacy and stability of state income tax systems.

One Tax System for Most Americans, and a Second System for the Wealthiest

August 16, 2019 • By Matthew Gardner

Last year, the Walton family's fortune grew by $100 million a day. This level of wealth is particularly obscene in the context of the Walmart Corporation’s dark store strategy. The company works nationwide to reduce its property tax assessments, which, when successful, deprives local communities of revenue necessary to fund education, libraries, parks, public health and other services.

State Rundown 8/15: A Tax-Subsidy Cease-Fire in Kansas and Missouri

August 15, 2019 • By ITEP Staff

Over the last couple of weeks, leaders in Kansas and Missouri reached a historic agreement to stop giving away tax subsidies just to entice companies a couple of miles across their shared state line. Meanwhile, policymakers in Alaska resolved a stand-off over education funding...by cutting education funding slightly less. And California voters may be voting in 2020 on a stronger reform to the notoriously inequitable property tax effects of “Proposition 13.”

IRS’s SALT Workaround Regulations Should be Strengthened, Not Rejected

August 13, 2019 • By Carl Davis

Lawmakers are seeking to achieve a backdoor repeal of the $10,000 cap on deductions for state and local taxes paid (SALT) by invalidating recent IRS regulations that cracked down on schemes that let taxpayers dodge the cap. If successful, their efforts would drain tens of billions of dollars from federal coffers each year, with the vast majority of the benefits going to the nation’s wealthiest families.

Given how much more exclusively this deduction now benefits the highest-income households, its continued existence is hard to justify. Even when the credit was available to a larger swath of families, it was ineffective at promoting homeownership.

Taxing Offshore Profits and Domestic Profits Equally Could Curb Corporate Tax Dodging

August 9, 2019 • By Steve Wamhoff

In recent days, presidential candidates Sen. Kamala Harris and New York Mayor Bill DeBlasio have called for taxing corporate profits the same whether they are earned in the United States or abroad. These calls echo the position of Sen. Bernie Sanders, who has long had a proposal along these lines. As ITEP has explained, correcting […]

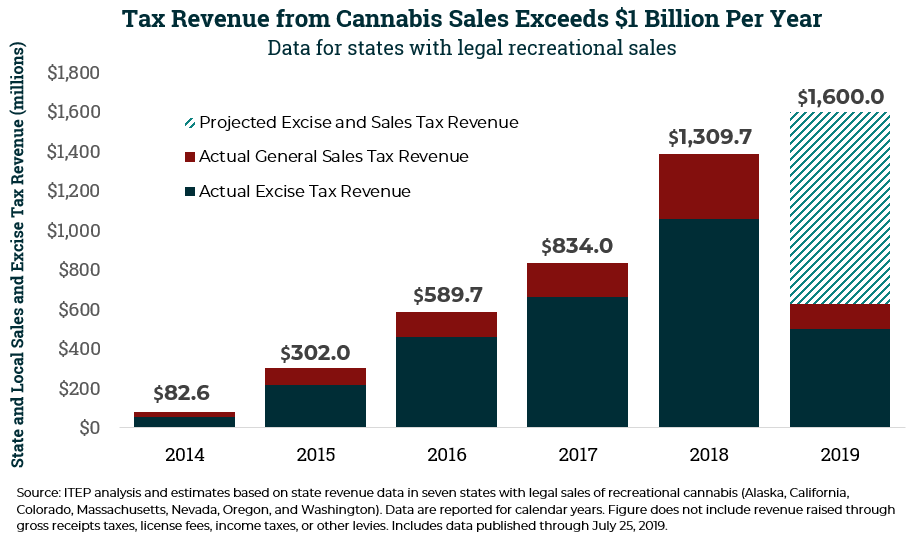

State and Local Cannabis Tax Revenue on Pace for $1.6 Billion in 2019

August 7, 2019 • By Carl Davis

Cannabis tax revenue is becoming more significant as legal sales grow. The tax is far from a budgetary panacea, but an ITEP analysis of revenue data reported by the seven states with legal cannabis sales underway suggests that excise and sales tax revenues from the sale of the drug could reach $1.6 billion this year.

In December 2017, federal lawmakers hastily enacted the Tax Cuts and Jobs Act. So rushed was its passage that provisions of the legislative text were scrawled in the margins. Scroll through this timeline for an in-depth look at the Tax Cuts and Jobs Act and the impact since its passage.

Opportunity Zones Have Nothing to Do with Reparations, Except …

August 2, 2019 • By Jenice Robinson

Among other things, this blog highlights how federal, state and local policies systematically work to reinforce the racial wealth gap by, for example, using the tax code to redistribute the nation’s wealth to billionaire developers and keeping low-income people of color in a perpetual cycle of debt through fines and fees to fund local governments. Opportunity zones and the top-heavy 2017 tax law are emblematic of a long history of policymaking that advantages wealthy white families.

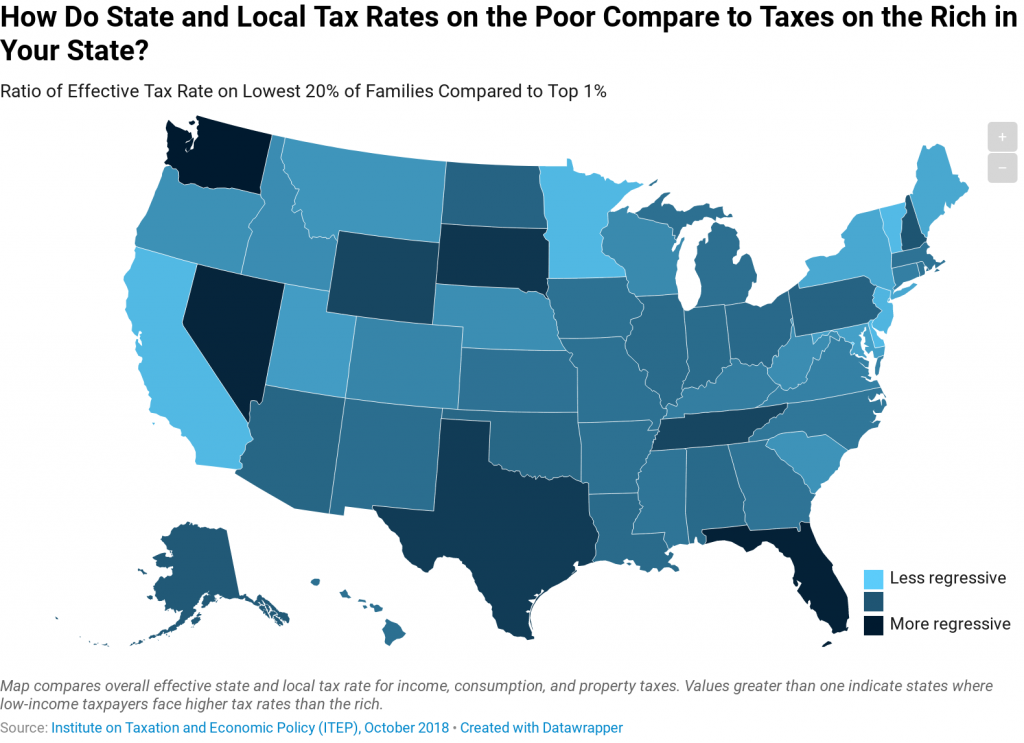

How Do Tax Rates on the Poor Compare to Taxes on the Rich in Your State?

August 1, 2019 • By ITEP Staff

No two state tax systems are the same, but 45 states have one thing in common: Low-income residents are taxed at a higher rate than the top 1 percent. Effective tax rates for the lowest 20 percent of families range from a high of 17.8 percent in Washington State to a low of 5.5 percent in Delaware.

A direct federal tax on wealth, as described in a January report from ITEP and proposed by Sen. Elizabeth Warren, could raise substantial revenue to make public investments, curb rising inequality, and is supported by a large majority of Americans. But would it work? Recent research highlighted in a new academic paper outlines approaches that would make it easier than you might think.

OHIO legislators passed a budget with unfortunate income tax cuts for high-income households. Other states turned their attention to unconventional ideas during their legislative off-seasons, for better and for worse. And there are many gems to be found in our “What We’re Reading” section below, including new research on the racial inequities that continue to pervade our communities and schools.

The nation’s tax policies and their role in economic inequality are front and center during this election cycle. For those interested in how the nation can move toward a fairer tax system and or more detailed information about progressive tax policy ideas, ITEP created this quick guide.

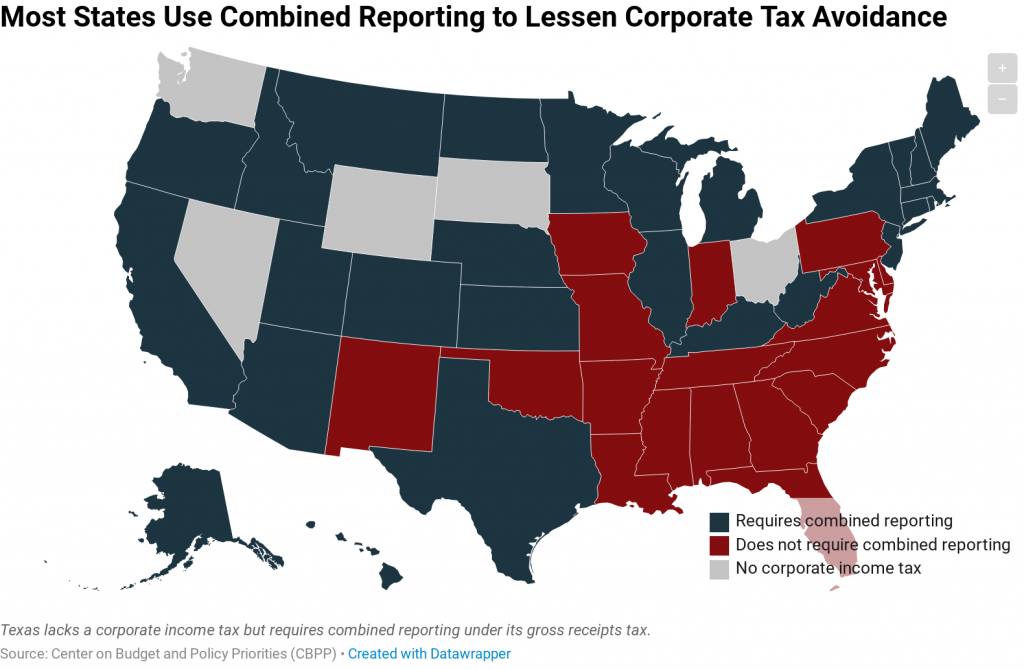

"Combined reporting" lessens the effectiveness of a tax avoidance scheme known as income shifting, in which large multi-state corporations dubiously claim that their income was earned in states with little or no corporate income tax.

If a future Congress and president enact a real tax reform, one that requires corporations to pay their fair share and ends TCJA’s various corporate breaks for offshore profits, then companies will use inversions and other tactics to dodge taxes once again—if lawmakers let them. That’s why any real tax reform will include something like the Stop Corporate Inversions Act, introduced last week by Sens. Dick Durbin and Jack Reed to block inversions.