Recent Work

2146 items

The American Family Act would expand the Child Tax Credit (CTC) for low- and middle-income families. The CTC would increase from $2,000 under current law to $3,000 for each child age six and older and to $3,600 for each child younger than age six. The proposal removes limits on the refundable part of the credit so that low- and moderate-income families with children could receive the entire credit.

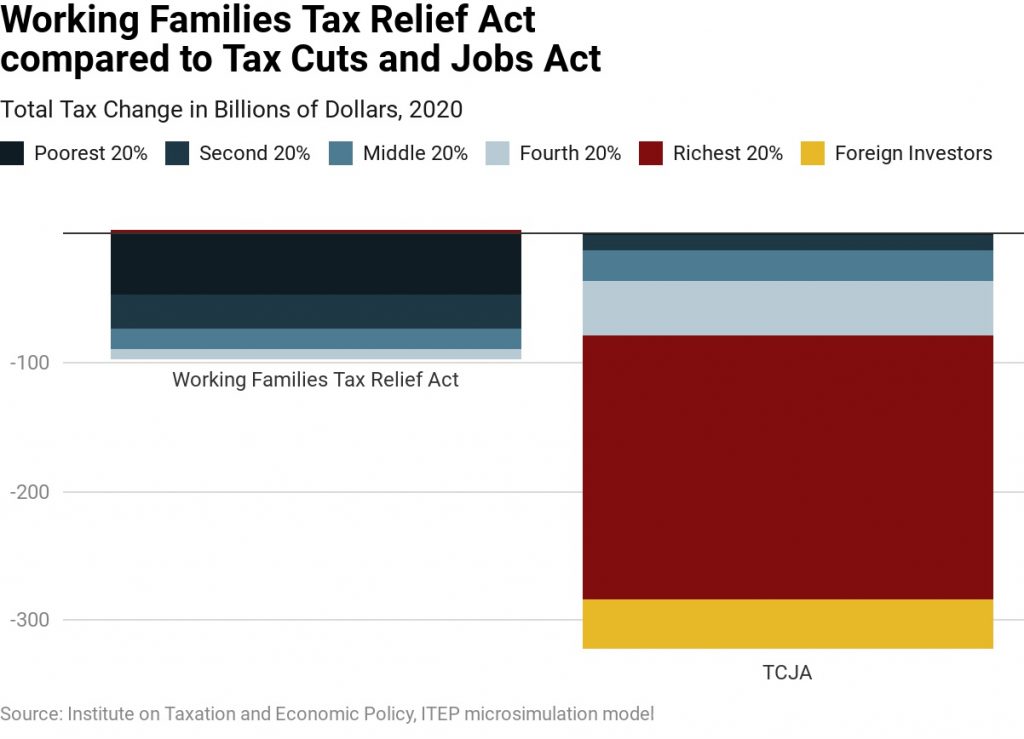

The Working Families Tax Relief Act would expand the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) for low- and middle-income families.

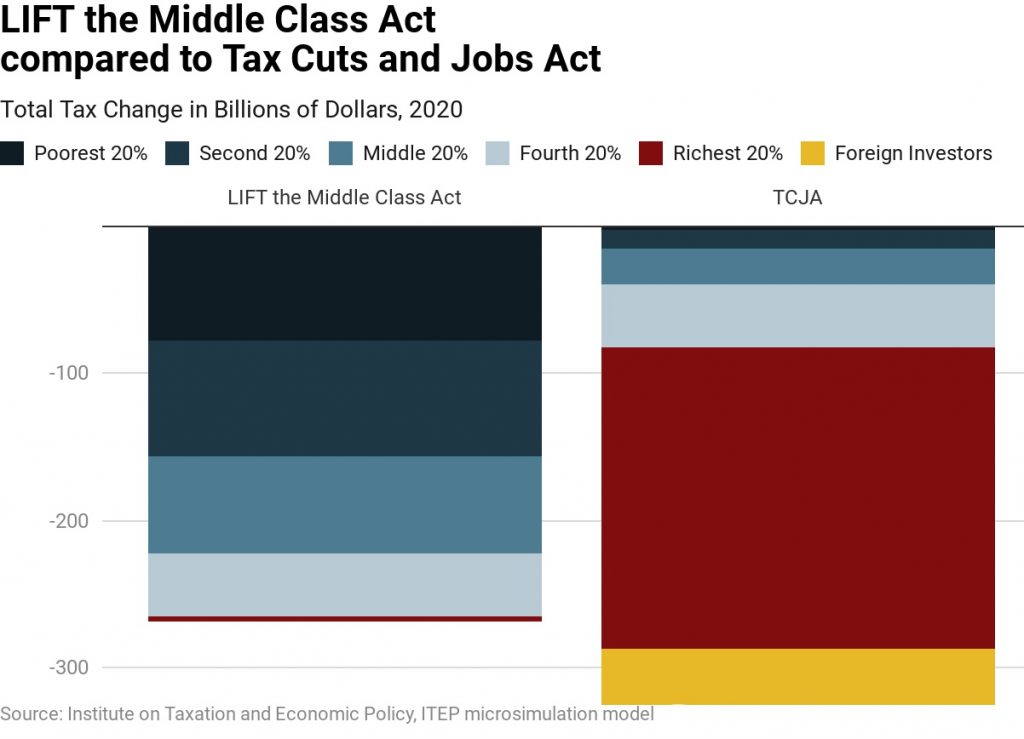

The LIFT (Livable Incomes for Families Today) the Middle Class Act would create a new tax credit of up to $3,000 for single people and up to $6,000 for married couples, which would be an addition to existing tax credits. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less. Income limits would prevent well-off households from receiving the credit.

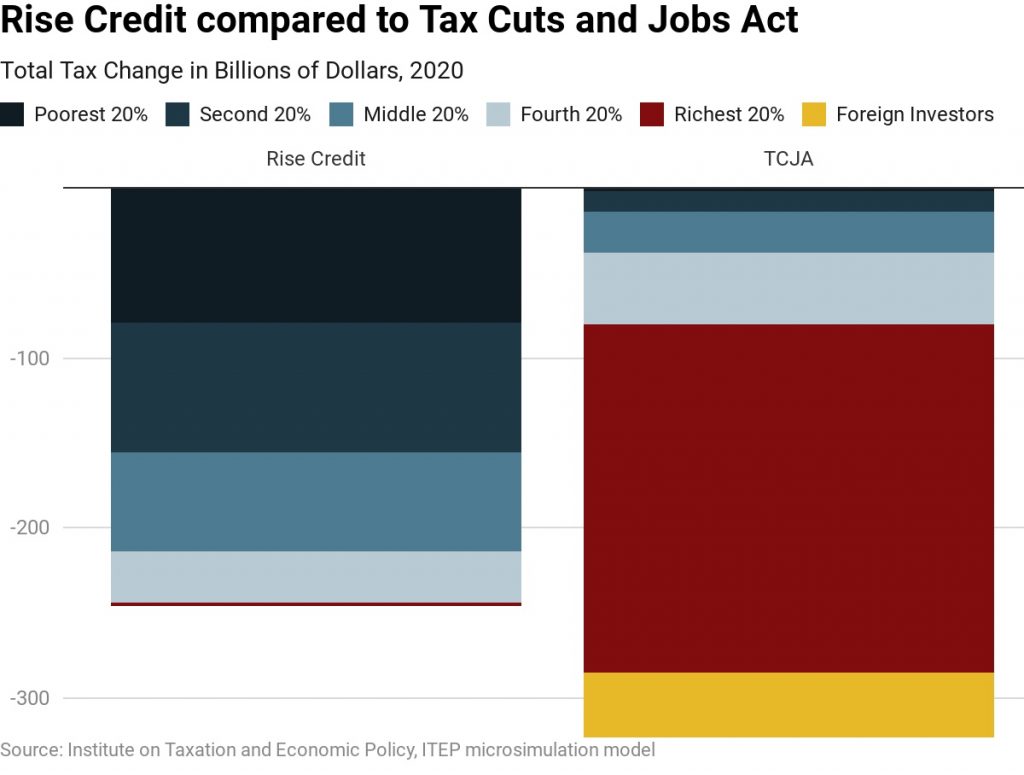

The Rise Credit would replace the existing EITC. In most cases, the Rise Credit would be $4,000 for single people and $8,000 for married couples. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less.

Gas Taxes Have Gone Up in Most States, but Decades-Long Procrastinators Remain

May 21, 2019 • By Carl Davis

The upcoming Memorial Day weekend marks the start of the traditional summer driving season. In most states, summer road-trippers are paying more gas tax than they did a few years ago and are benefiting from smoother and safer roads as a result. In total, 30 states have raised or reformed their gas taxes in the last six years.

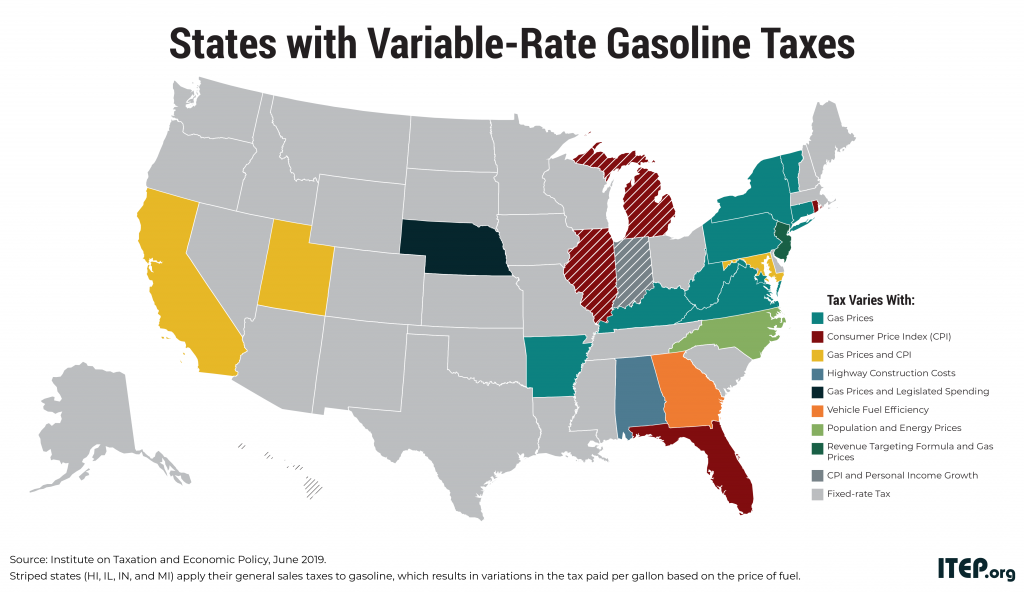

These States Abandoned Old Gas Tax Structures in Favor of More Sustainable Variable-Rate Gas Taxes

May 20, 2019 • By ITEP Staff

Because of these reforms, more than 193 million people (or 59 percent of the U.S. population) now live in places where the state gas tax rate automatically varies over time.

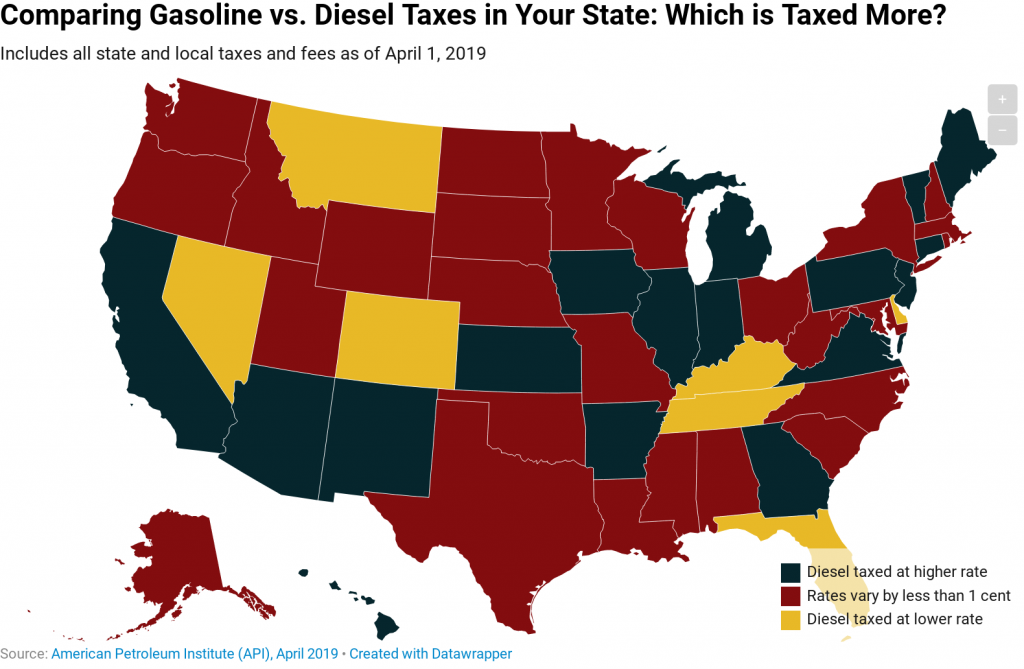

Twenty-six states and the District of Columbia tax these two fuel types at the same rate or very similar rates, as of April 2019, according to data from the American Petroleum Institute.

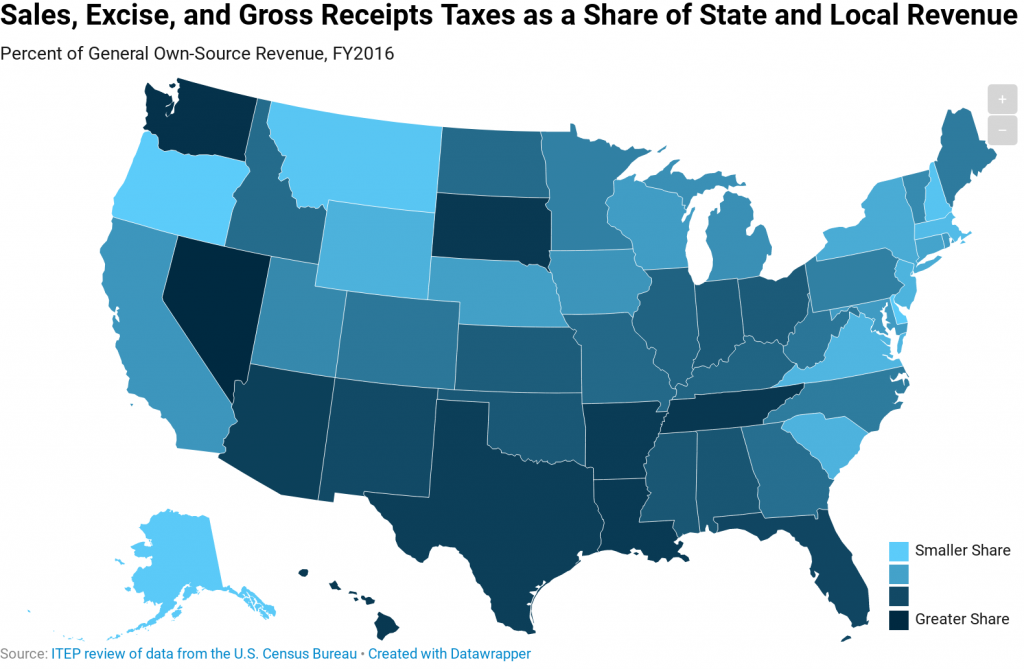

Consumption taxes (including general sales taxes, excise taxes on specific products, and gross receipts taxes) are an important revenue source for state and local governments. While five states lack state-level general sales taxes (Alaska, Delaware, Montana, New Hampshire, and Oregon), every state levies taxes on some types of consumption.

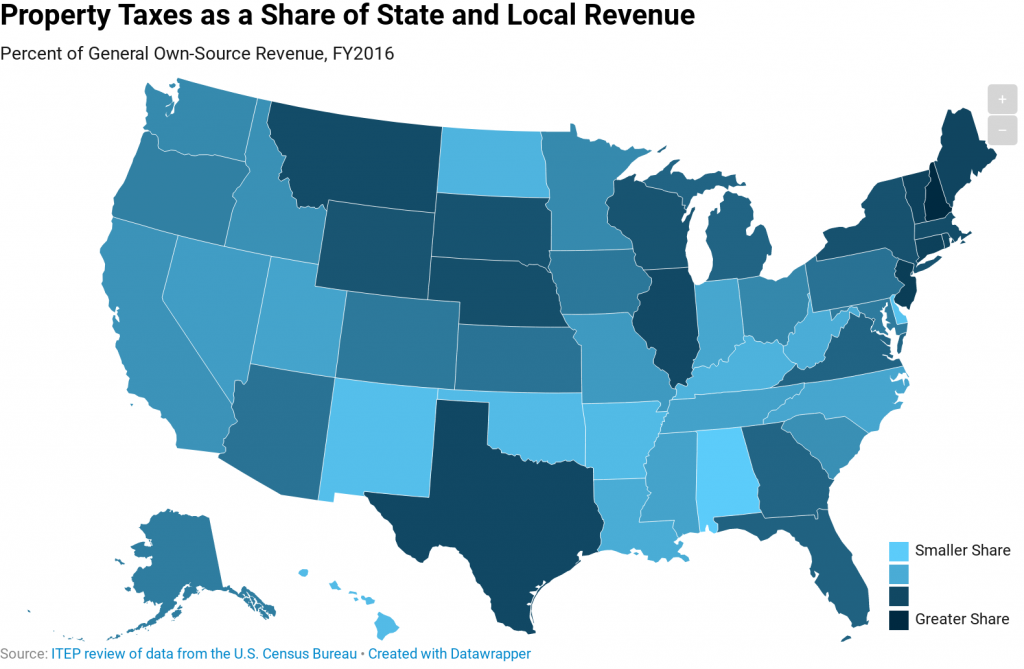

The property tax is the oldest major revenue source for state and local governments and remains an important mechanism for funding education and other local services. This map shows the share of state and local general revenue in each state that is raised through property taxes.

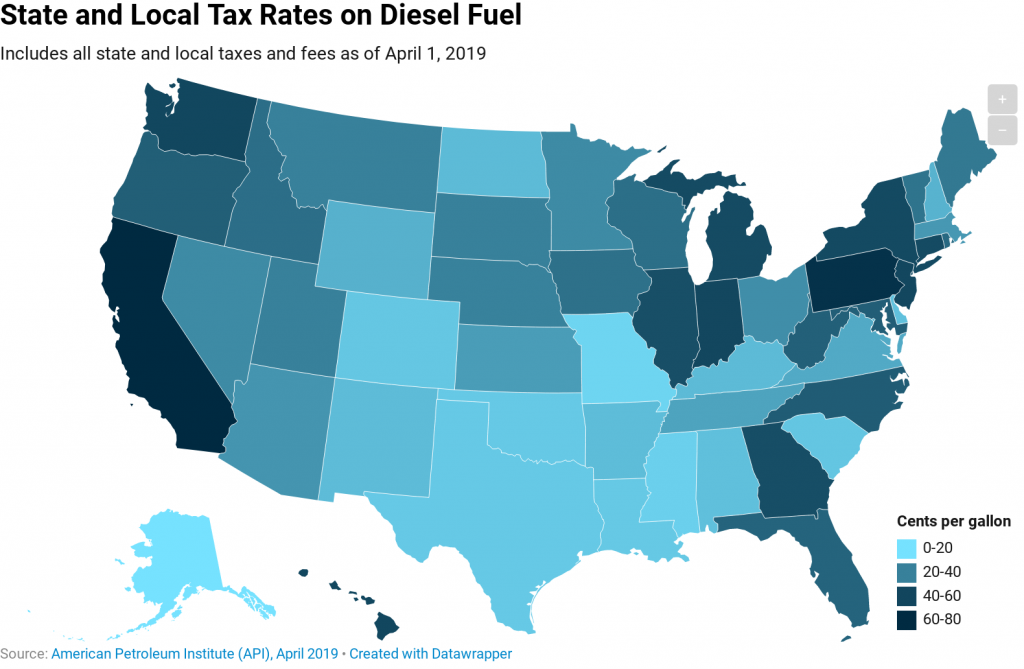

The tax rates identified in this map include state and local excise and sales taxes on diesel fuel, as well as various fees, as calculated by the American Petroleum Institute (API). These taxes are levied in addition to the federal government’s 24.4-cent-per-gallon diesel tax.

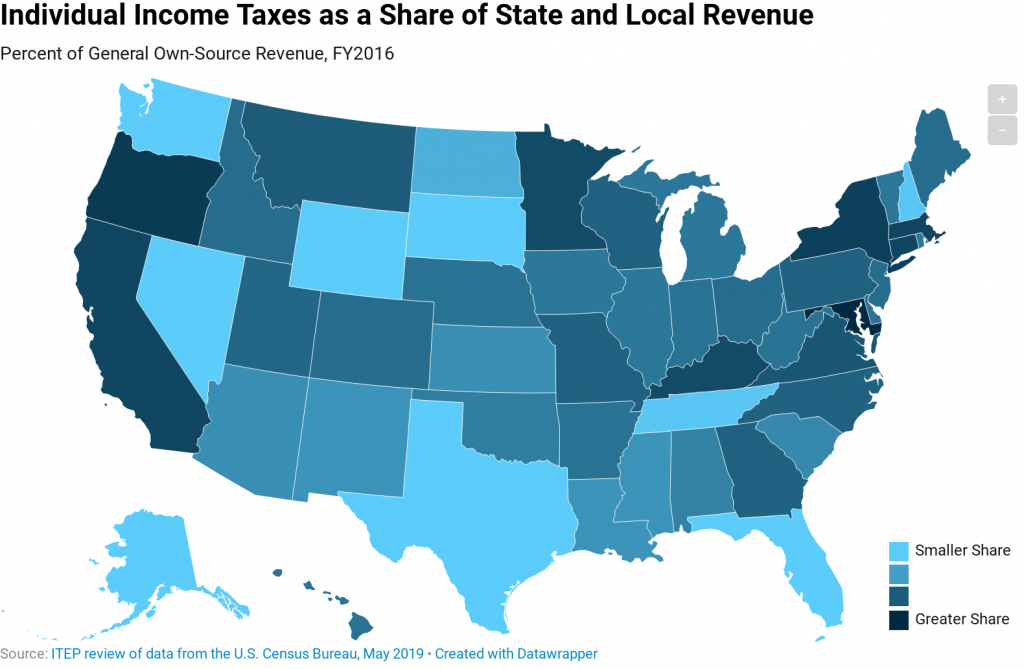

Income taxes vary considerably in their structure across states, though the best taxes are fine-tuned to taxpayers’ ability-to-pay.

Policymakers and the public widely agree that economic inequality is the social policy problem of our age. It threatens the livelihoods of millions of children and adults, and it even threatens our democracy. Although some say Americans could fix it themselves by simply rolling up their sleeves, as a sub-headline in a March U.S. News and World Report column implied, the reality is different.

State Rundown 5/16: Tensions Remain High Over Budgets and School Finances in Several States

May 16, 2019 • By ITEP Staff

Tax and budget negotiations remain at standstills in Louisiana and Minnesota, as school funding debates and teacher protests again captured headlines in several states. Oregon lawmakers, for example, finally passed a mixed-bag tax package that won’t improve tax equity but will raise much-needed revenue for education. Meanwhile their counterparts in Nebraska continue to debate highly […]

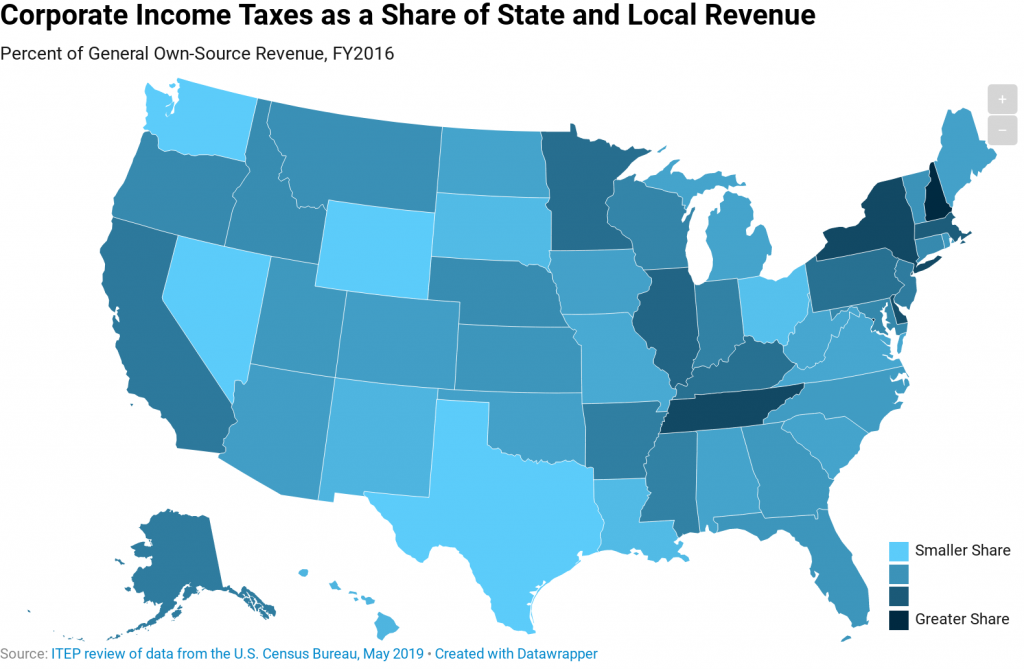

Corporate income taxes are an important source of revenue for state governments and ensure that profitable corporations benefiting from public services pay toward the maintenance of those services.

Presentation: NCSL Task Force on State and Local Taxation, Taxing Cannabis

May 10, 2019 • By Carl Davis

ITEP Research Director Carl Davis presented to the National Conference of State Legislatures (NCSL) Task Force on State and Local Taxation on approaches to cannabis taxation and the recent report Taxing Cannabis.