Recent Work

2162 items

The Montana Senate this week stopped a bill to restructure the state's temporary tribal tax exemption program, making tribal governments the only sovereignties on which Montana levies a tax and making it more difficult for leaders to buy back illegally seized land. Still, the success of the bill in the House is troubling.

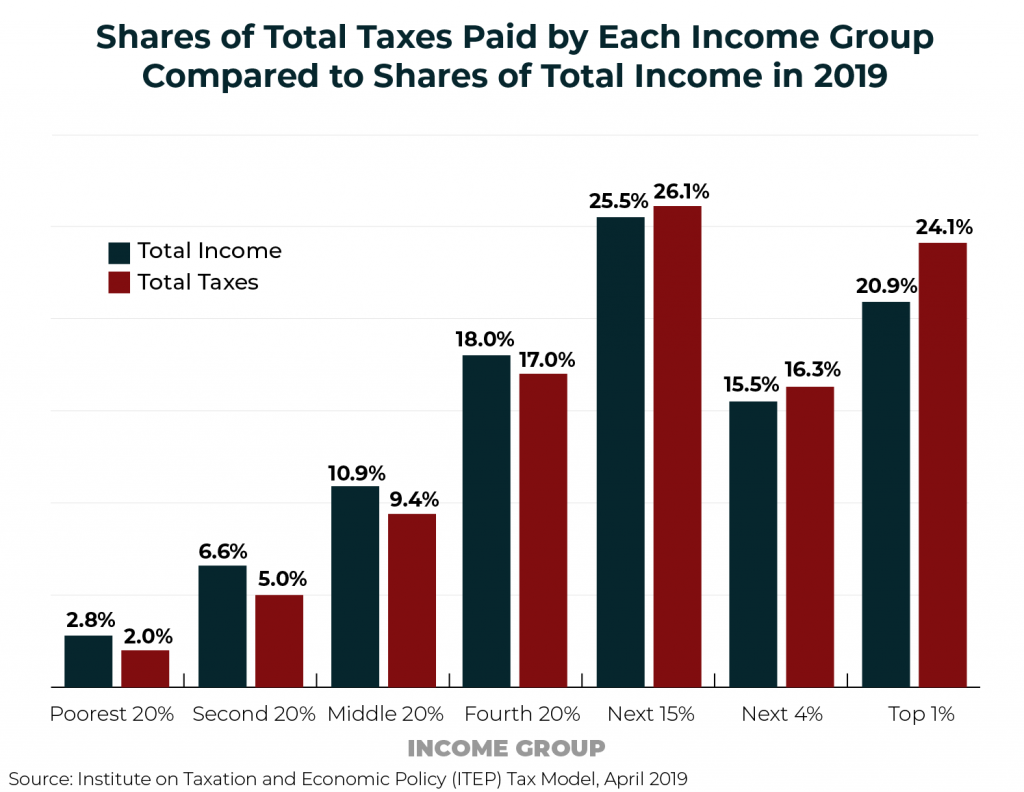

For years, Americans have been told that the rich are paying a highly disproportionate share of the nation’s taxes. Claims to that effect often focus on just one tax, the federal personal income tax, which is indeed progressive overall. But when the nation’s tax system is viewed in its entirety, it becomes clear that the reality is very different. Despite their enormous incomes and wealth, the nation’s richest taxpayers are paying a share of overall taxes that slightly exceeds their share of income.

State Rundown 4/11: An Estate Tax Win, Opioid Progress, and Teacher Uprising Updates

April 11, 2019 • By ITEP Staff

Hawaii made progress in pushing back against the increasing concentration of wealth and power by beefing up its estate tax. Delaware, New Jersey, and Rhode Island all took steps toward taxing opioid producers to raise funds to address the ongoing opioid crisis. Oregon lawmakers continue to try to address their chronic school underfunding with a $2 billion annual investment, in contrast to some of their counterparts in North Carolina who are responding to similar issues with the opposite approach, proposing to slash taxes in the face of their school funding issues – just as research highlighted in our What We’re…

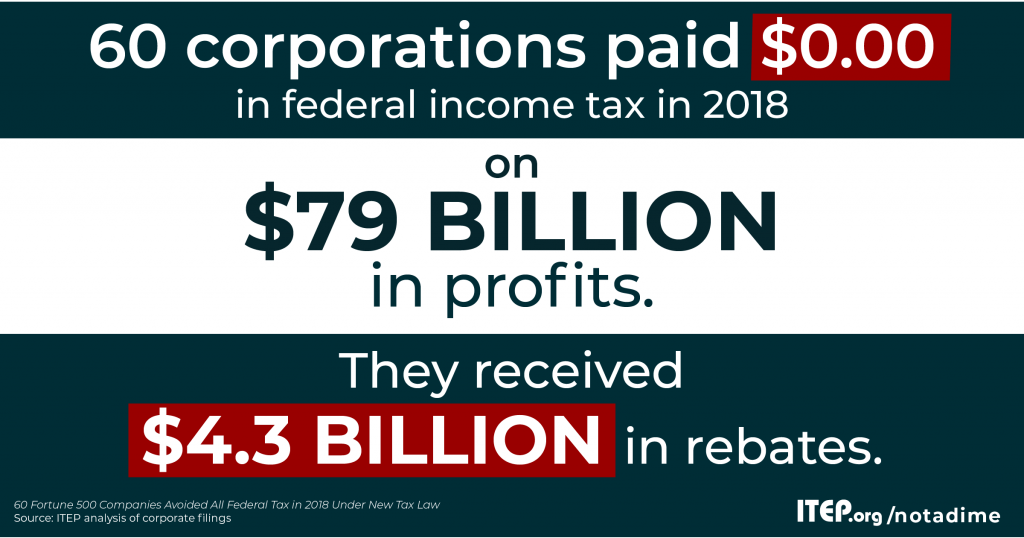

Corporate Tax Avoidance Remains Rampant Under New Tax Law

April 11, 2019 • By Lorena Roque, Matthew Gardner, Steve Wamhoff

For decades, profitable Fortune 500 companies have been able to manipulate the tax system to avoid paying even a dime in tax on billions of dollars in U.S. profits. This ITEP report provides the first comprehensive look at how the new corporate tax laws that took effect after the passage of the 2017 Tax Cuts and Jobs Act affects the scale of corporate tax avoidance.

The Working Families Tax Relief Act Would Boost Incomes and Economic Security for Workers and Children

April 10, 2019 • By Steve Wamhoff

Sens. Sherrod Brown, Michael Bennet, Richard Durbin, and Ron Wyden (along with the backing of most of the Democratic caucus in the Senate) today rolled out a new proposal to expand the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC). Called the Working Families Tax Relief Act (WFTRA), the proposal would provide a substantial benefit, especially to low-income working families.

State Rundown 4/4: Ohio Gas Tax and Maryland Minimum Wage Get Needed Updates

April 4, 2019 • By ITEP Staff

Transportation funding was a hot topic this week, as OHIO lawmakers responsibly voted to update their gas tax and offset some of its impact on lower-income families with an Earned Income Tax Credit (EITC) boost, while NEW YORK enacted the nation’s first “congestion pricing” charge, and LOUISIANA and VIRGINIA leaders looked at gas tax updates as well—a trend ITEP’s Carl Davis explored in depth today here. Broad tax packages are also being hashed out in LOUISIANA, NEBRASKA, OREGON, and TEXAS. And MARYLAND became the sixth state with a $15 minimum wage on the horizon.

A chorus is building and calling on our elected officials to tax the rich. And pundits and policymakers are seriously debating proposals calling for higher income taxes and a wealth tax instead of attempting to shut down the conversation by labeling such proposals as class warfare.

Sen. Ron Wyden of Oregon, the ranking Democrat on the Senate Finance Committee, announced that he would soon release a proposal to eliminate massive tax breaks enjoyed by the wealthy on their capital gains income. If successful, the proposal would ensure that income from wealth is taxed just like income from work.

What to Watch for When the IRS Releases Its SALT Workaround Regulations

April 1, 2019 • By Carl Davis

The Treasury Department and IRS last summer proposed regulations that would make it more difficult for taxpayers to avoid the $10,000 cap on deductions for state and local taxes (SALT). Now, likely days away from the unveiling of the final version of IRS regulations on SALT cap workarounds, Carl Davis recaps the finer points ITEP will be watching for when the regulations become public.

This month in tax policy news: Corporate profits soar while corporate tax collections plummet. Also inside: A look at regressive state tax policies and progressive remedies and the continued unpackaging of the Tax Cuts and Jobs Act. It's ITEP's March 2019 Monthly Digest.

The Trump Tax Law Further Tilted an Already Uneven Playing Field

March 27, 2019 • By Jessica Schieder

Proponents sold the Tax Cuts and Jobs Act (TCJA) as a way to spur new investment, increase workers’ paychecks, and reverse the off-shoring of jobs. Testimony presented during a House Ways and Means hearing held today reflected on how—more than a year after the law’s passage—each of those pitches ring hollow.

State Rundown 3/27: Spring Bringing Smart State Tax Policy So Far

March 27, 2019 • By ITEP Staff

Though a long winter and a rough start to spring weather have wreaked havoc in much of the country, lawmakers are off to a good start in the world of state fiscal policy so far. In the last week, a progressive revenue package was passed in the nick of time in NEW MEXICO, a service-sapping tax cut was vetoed in KANSAS, and a regressive and unsustainable tax shift was soundly defeated in NORTH DAKOTA. Meanwhile, gas tax updates are on the table in MAINE, MINNESOTA, and OHIO. And exemptions for feminine hygiene products and diapers were enacted in VIRGINIA and introduced in MISSOURI.

Data released Friday by the U.S. Treasury Department should give great pause to all who care about the federal government’s ability to raise revenue in a fair, sustainable way. In the wake of the 2017 corporate tax overhaul, corporate tax collections have fallen at a rate never seen during a period of economic growth.

A 2019 ITEP analysis found that Black and Latinx households are overrepresented in the lowest-income quintiles; while they represent about 22 percent of overall tax returns, they account for 30 percent of the poorest quintile of taxpayers.

Rep. Doggett and Sen. Whitehouse Reintroduce Bill to End Offshore Tax Avoidance

March 15, 2019 • By Lorena Roque

On Thursday, Representative Lloyd Doggett and Senator Sheldon Whitehouse announced that they are reintroducing the “No Tax Breaks for Outsourcing Act.” Our international corporate tax rules have been a mess for a long time, and Tax Cuts and Jobs Act (TCJA) failed to resolve the problems. The old rules and the new rules under TCJA both tax offshore corporate profits more lightly than domestic corporate profits, but in different ways. The No Tax Breaks for Outsourcing Act would create rules that tax domestic profits and foreign profits in the same way.