California

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2019

September 26, 2019 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

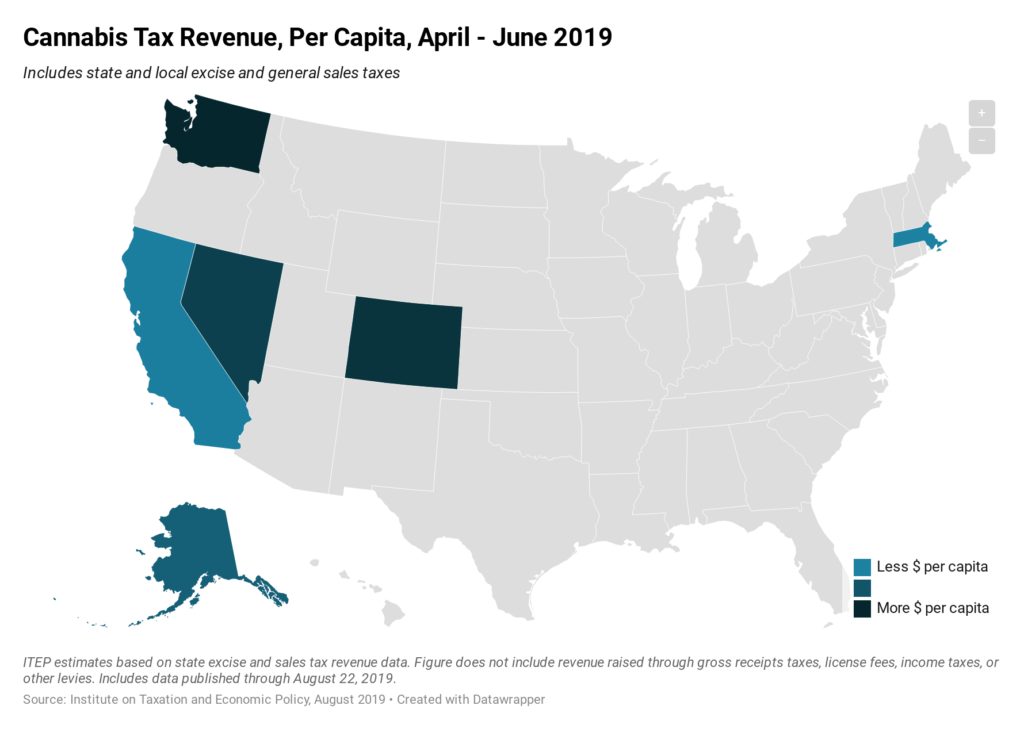

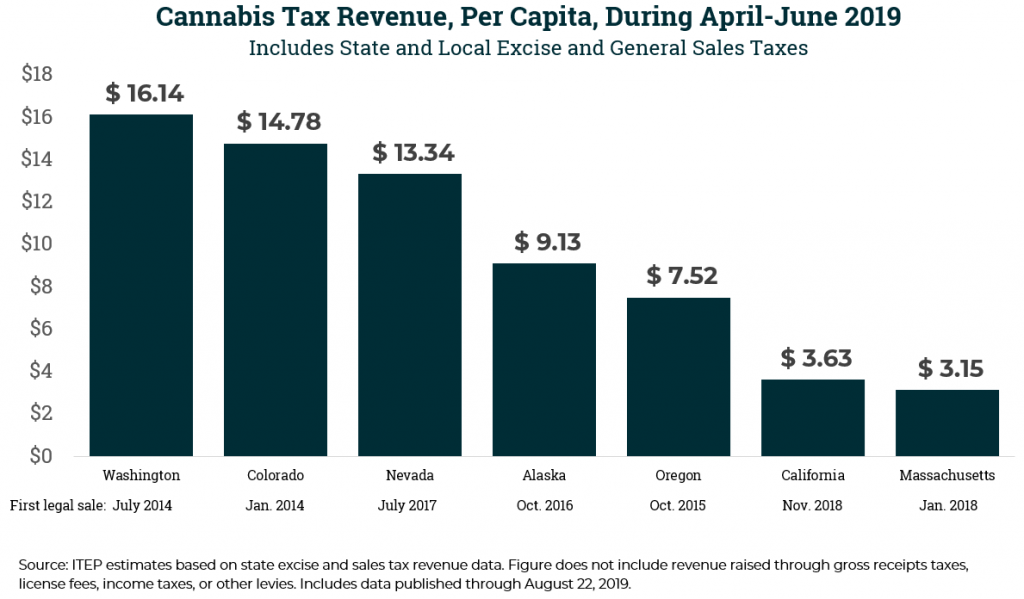

Seven states currently allow for the legal, taxable sale of recreational cannabis. The above map shows per capita revenue collections from excise and sales taxes on cannabis during the second quarter of 2019, the most recent period for which data are available in every state. The most lucrative cannabis market in the country, from a tax revenue perspective, is in Washington State where the 46 percent combined tax rate applied to cannabis is the highest in the country. Collections in California and Massachusetts, by contrast, remain low as these states are still in the early stages of establishing their legal…

State Rundown 9/12: Work Continues to Flip the Script on Backwards Tax Codes

September 12, 2019 • By ITEP Staff

Residents of several states are spending their palindrome week reading ballot initiatives forwards and backwards to decide whether or not to support them, including measures to improve education funding in California and Idaho, allow Alaska and Colorado to invest more in public services, and constitutionally prohibit income taxation in Texas. New Jersey lawmakers are giving the same thorough treatment to the state’s corporate tax subsidies. And advocates in Chicago, Illinois, have a bold proposal to flip the script on upside-down taxes there. But devotees of good policy and honest government in North Carolina won’t want to re-read yesterday’s news in…

Promoting Greater Economic Security Through A Chicago Earned Income Tax Credit: Analyses of Six Policy Design Options

September 12, 2019 • By Lisa Christensen Gee

A new report reveals that a city-level, Chicago Earned Income Tax Credit would boost the economic security of 546,000 to 1 million of the city’s working families. ITEP produced a cost and distributional analysis of six EITC policy designs, which outlines the average after-tax income boost for families at varying income levels. The most generous policy option would increase after-tax income for more than 1 million working families with an average benefit, depending on income, ranging from $898 to $1,426 per year.

OpEd News: Another Cruel–Irony The Homeless Pay for their Homelessness

September 7, 2019

A cursory look at the tax numbers blow the conservative’s tax mythmaking apart. A 2017 study by the Institute on Taxation and Economic Policy found that the poorest of the poor, that’s those with annual income under $19,000 plop in more that 10 percent of the federal tax dollars. Toss in millions more to that […]

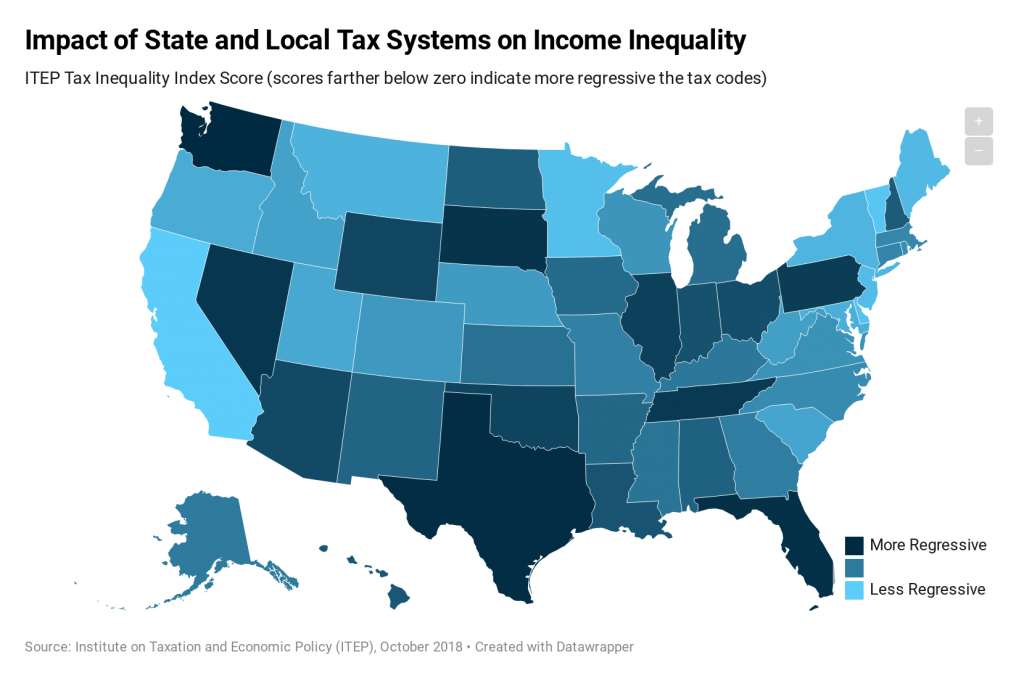

The vast majority of state and local tax systems exacerbate the economic divide by taxing low- and middle-income families at higher rates than the wealthy. This map distills an exhaustive analysis of state and local tax codes into one key number, the ITEP Tax Inequality Index, to show the degree to which each state’s tax […]

DESPITE CONTRARY CLAIMS, NUMBERS SHOW TRUMP TAX LAW STILL FAVORS THE WEALTHY GOP leaders continue to misrepresent who benefits from the 2017 Trump-GOP tax law, most recently claiming most “of the tax overhaul went into the pockets of working families and Main Street businesses who need it most, not Wall Street.” But the numbers prove […]

The hottest, stickiest month of the year has left a grimy feeling on several state tax debates, as Idaho lawmakers find themselves unable to fund the state’s priorities after years of cutting taxes, Alaskans express their support for public investments to their governor’s polling office and then watch the governor slash them anyway, New Jersey lawmakers go to bat for ineffective and corrupt business tax subsidies, and residents of North Carolina watch their representatives pursue cheap political points over sound investments and thoughtful policy. Nonetheless, residents and advocates on the other side of these and other debates have fought long…

NPR: California Says Its Cannabis Revenue Has Fallen Short Of Estimates, Despite Gains

August 23, 2019

“After adjusting for population, the Golden State raised the second-least amount of revenue from cannabis taxes during the second quarter among states with legal sales, ahead of only Massachusetts,” according to the Institute on Taxation and Economic Policy. The result was a departure from the spikes seen in states such as Colorado, Washington and Oregon […]

Why California’s Cannabis Market May Not Tell You Much about Legalization in Your State

August 22, 2019 • By Carl Davis

New tax data out of California, the world’s largest market for legal cannabis, tell a complicated story about the cannabis industry and its tax revenue potential. Legal cannabis markets take time to establish, and depending on local market conditions, the revenue states raise can vary significantly.

State Rundown 8/15: A Tax-Subsidy Cease-Fire in Kansas and Missouri

August 15, 2019 • By ITEP Staff

Over the last couple of weeks, leaders in Kansas and Missouri reached a historic agreement to stop giving away tax subsidies just to entice companies a couple of miles across their shared state line. Meanwhile, policymakers in Alaska resolved a stand-off over education funding...by cutting education funding slightly less. And California voters may be voting in 2020 on a stronger reform to the notoriously inequitable property tax effects of “Proposition 13.”

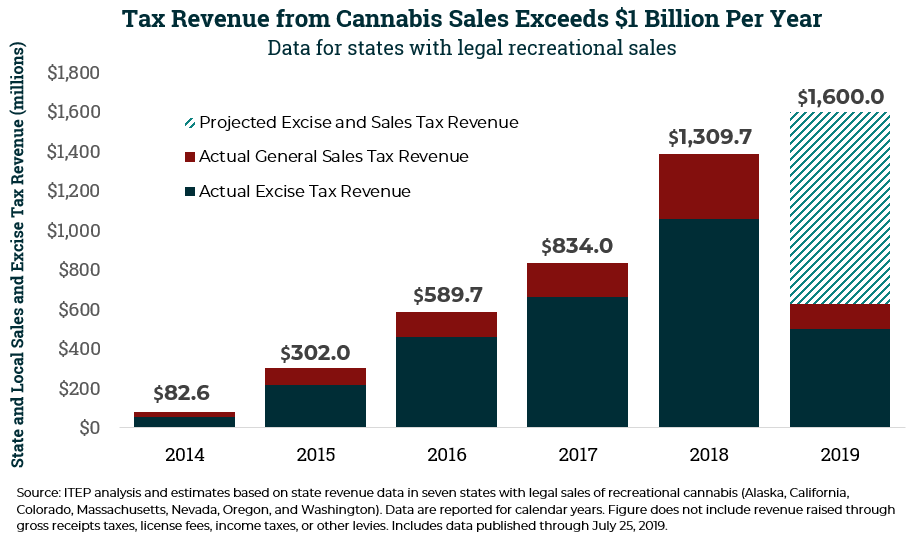

State and Local Cannabis Tax Revenue on Pace for $1.6 Billion in 2019

August 7, 2019 • By Carl Davis

Cannabis tax revenue is becoming more significant as legal sales grow. The tax is far from a budgetary panacea, but an ITEP analysis of revenue data reported by the seven states with legal cannabis sales underway suggests that excise and sales tax revenues from the sale of the drug could reach $1.6 billion this year.

Newsweek: Alexandria Ocasio-Cortez Reminds America Undocumented Immigrants Pay Taxes: ‘They Pay Your Kids’ Schooling’

July 31, 2019

While it is difficult to say exactly how much undocumented immigrants contribute in taxes today, a 2013 report from the Institute On Taxation and Economic Policy highlighted how “the 11.2 million undocumented immigrants living in the United States” at the time were “already paying a significant share of their income in state and local taxes.” […]

OHIO legislators passed a budget with unfortunate income tax cuts for high-income households. Other states turned their attention to unconventional ideas during their legislative off-seasons, for better and for worse. And there are many gems to be found in our “What We’re Reading” section below, including new research on the racial inequities that continue to pervade our communities and schools.

Reno News Review: Another Portrait of Ripped-off Nevadans

July 25, 2019

But wait, there’s more bad news for Nevada. The New York Times editorialized last Sunday on the growing trend toward inequality caused by how state and local taxes are assessed. According to a 2018 study by the Institute on Taxation and Economic Policy, (ITEP) “the poor pay taxes at higher rates in 45 of the […]

KCBS: Kamala Harris’ Pot Proposal Would Reduce Tax Revenue, Expert Predicts

July 23, 2019

Harris’ proposal would impose a 5% federal tax on pot to pay for new social justice program. Her legislation would also extend significant income tax deductions that have been unavailable to business people in the cannabis industry, because of federal prohibitions on the drug. “There’s actually a really big income tax cut in here,” said Carl […]

Many States Move Toward Higher Taxes on the Rich; Lower Taxes on Poor People

July 18, 2019 • By Meg Wiehe

Several states this year proposed or enacted tax policies that would require high-income households and/or businesses to pay more in taxes. After years of policymaking that slashed taxes for wealthy households and deprived states of revenue to adequately fund public services, this is a necessary and welcome reversal.

We've said it before, and we'll say it again: states don't have to wait for federal lawmakers to make moves toward progressive tax policy. And so far, 2019 has been a good year for equitable and sustainable tax policy in the states. With July 1 marking the start of a new fiscal year for most states, this special edition of the Rundown looks at how discussions in 2019 have been dominated by plans to raise revenue for vital investments, tax the rich and corporations fairly, use the tax code to help workers and families and advance racial equity, and shore…

The Wall Street Journal: From Gas Taxes to Vaping Rules, New State Laws Take Effect Across U.S.

July 2, 2019

Drivers in a number of states will now pay higher taxes on gas as part of a broader push to fund infrastructure improvements. In Illinois, the gas tax has doubled to 38 cents from 19 cents, making it the largest increase for any of these states, according to the Institute on Taxation and Economic Policy, […]

State Rundown 6/27: States Look at Raising Incomes at the Bottom, Taxes at the Top

June 27, 2019 • By ITEP Staff

Low-income working families got good news and bad news this week, as Earned Income Tax Credit (EITC) enhancements passed in California and advanced in Oregon, while minimum wage increases failed in Pennsylvania, Rhode Island, and Wisconsin. Meanwhile, the momentum for taxing wealth and the very rich continued to grow, as more one-percenters called for enacting progressive taxes, and Inequality.org held a star-studded conference on why and how to do so.

Travelers in 12 States Will Pay More in Gas Taxes Beginning Monday

June 27, 2019 • By Carl Davis

Drivers in 12 states who hit the road during this summer driving season will be paying more in gas tax beginning Monday, July 1. While the federal gas tax has remained stagnant for nearly 26 years, many states have stepped up and increased their taxes so they can raise revenue to fund infrastructure and other projects. California, Indiana, Maryland, Michigan, Montana, Nebraska, Ohio, Rhode Island, South Carolina, Tennessee and Vermont all will raise their gas taxes.

Gas Taxes Rise in a Dozen States, Including an Historic Increase in Illinois

June 27, 2019 • By Carl Davis

On July 1, 12 states will boost their gasoline taxes and 11 will boost their diesel taxes. The reasons for these increases vary, but they’re generally intended to fund maintenance and improvement of our nation’s transportation infrastructure–a job at which Congress has not excelled in recent years.

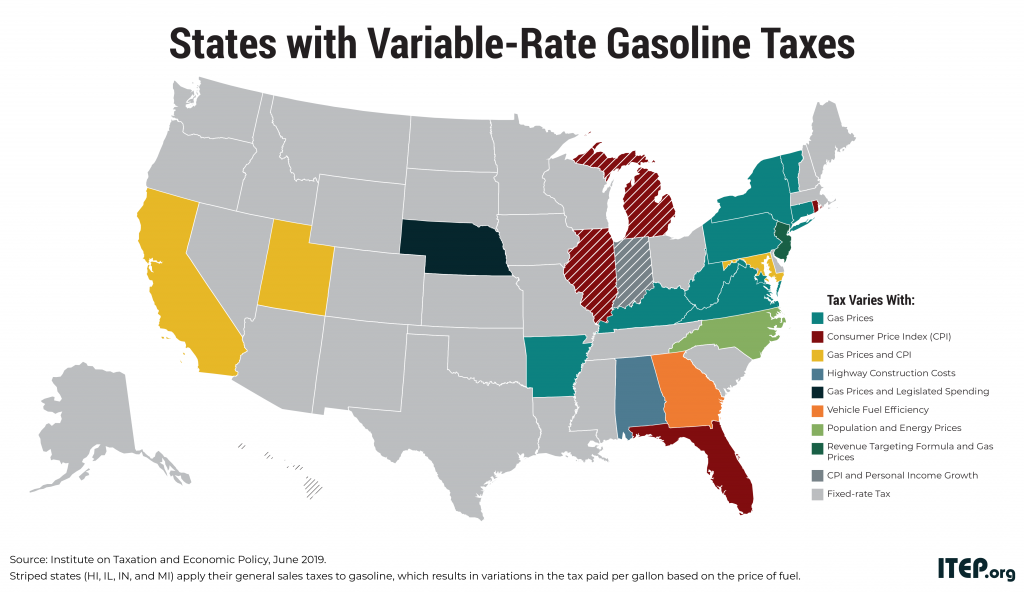

Ohio now enjoys the distinction of being the 30th state to raise or reform its gas tax this decade, and the third state to do so this year, under a bill signed into law by Gov. Mike DeWine. While state tax policy can be a contentious topic, there has been a remarkable level of agreement on the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies. These actions are helping reverse losses in gas tax purchasing power caused by rising construction costs…

The flawed design of federal and state gasoline taxes has made it exceedingly difficult to raise adequate funds to maintain the nation’s transportation infrastructure. Twenty-eight states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers purchase more fuel-efficient vehicles and pay less in gas tax. The federal government’s 18.4-cent gas tax, for example, has not increased in over 25 years. Many states have waited a decade or more since last raising their own gas tax rates.

State Rundown 6/19: Juneteenth Highlights Role of State Policy in Racial Equity Fight

June 19, 2019 • By ITEP Staff

As Americans observe Juneteenth today–the day two years after the Emancipation Proclamation on which news of the end of the Civil War and slavery reached some of the last slaves in Texas—most people’s attention should be on celebrating victories, remembering losses, gathering strength to continue the fight for racial justice, and the accompanying Congressional reparations hearings. In comparison, state tax debates over matters such as reluctance to invest in infrastructure in Michigan and Missouri, approval of income tax cuts in Wisconsin, and a budget standoff in New Jersey may seem unimportant and irrelevant. But we encourage our readers to think about how state policies often serve to enrich and empower white and wealthy households, and…