Child Tax Credit

Proposed Tax Deal Would Help Millions of Kids with Child Tax Credit Expansion While Extending Damaging Corporate Tax Breaks

January 16, 2024 • By Joe Hughes

On January 16, Congressional tax writers officially announced the details of a tax policy agreement. The deal includes expansions of the Child Tax Credit (CTC) to improve access for low- and middle-income families as well as expansions of the 2017 Trump tax cuts for businesses. The agreement also includes bipartisan tax priorities tax provisions for […]

States differ dramatically in how much they allow families to make choices about whether and when to have children and how much support they provide when families do. But there is a clear pattern: the states that compel childbirth spend less to help children once they are born.

Year-End Tax Package Must Prioritize Children and Families Over Corporations and Private Equity

November 8, 2023 • By Joe Hughes

While Congress considers extending expired tax provisions, it should first and foremost focus on expanding the Child Tax Credit, a policy with a proven track record of helping families and children.

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

States are Boosting Economic Security with Child Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Fourteen states now provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states created new Child Tax Credits while lawmakers in seven states expanded existing credits. To maximize impact, lawmakers should consider making their credits fully refundable, not including an earnings requirement, setting a maximum amount per child instead of per household, setting state-specific phase-out ranges that target low- and middle-income families, indexing to inflation, and offering the option of advanced payments.

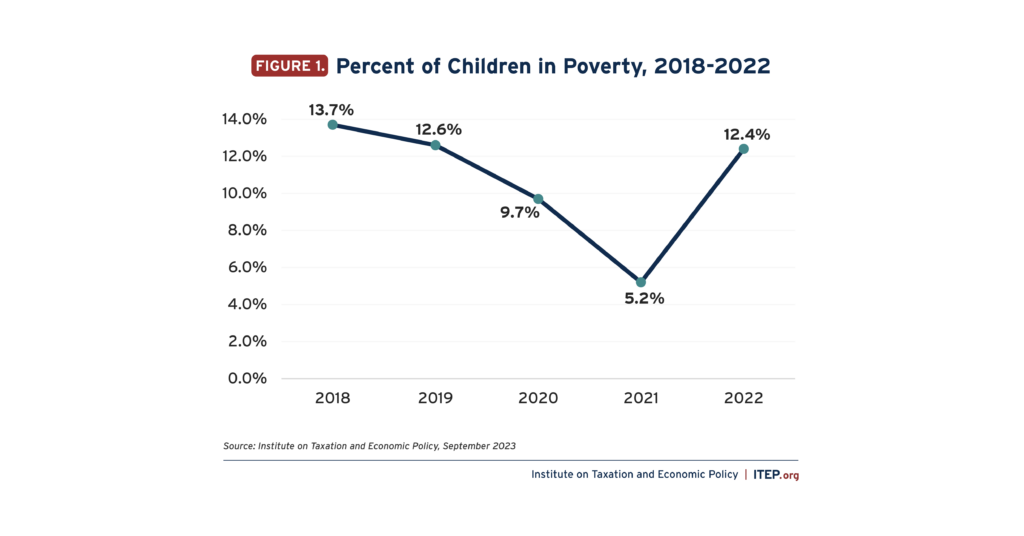

Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in Child Poverty

September 12, 2023 • By Joe Hughes

The new Census data should provide both concern and optimism for lawmakers. The steep rise in child poverty is an inexcusable tragedy. But it shows that child poverty is avoidable when Congress makes the decision to make tax policy for those who need the hand up rather than for the rich and powerful.

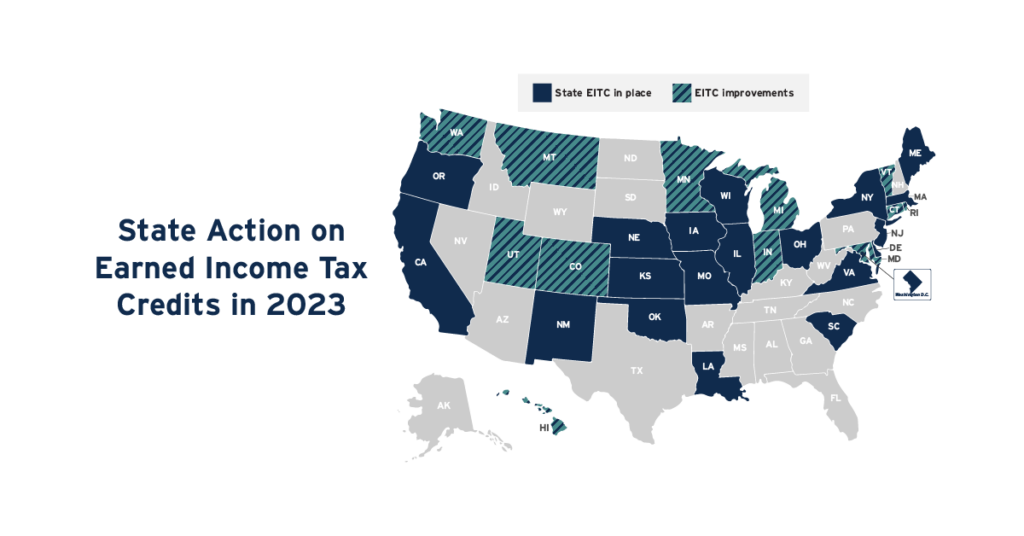

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

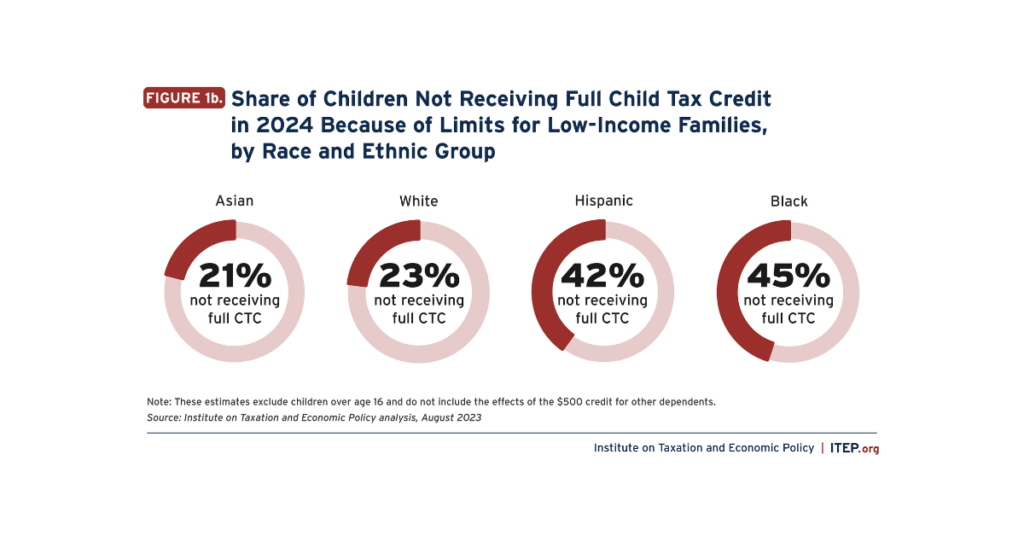

Expanding the Child Tax Credit Would Advance Racial Equity in the Tax Code

August 29, 2023 • By Emma Sifre, Joe Hughes

Expanding the federal Child Tax Credit to 2021 levels would help nearly 60 million children next year. It would help the lowest-income children the most and would particularly help children and families of color.

State lawmakers continue to make groundbreaking progress on state tax credits, with 17 states creating or enhancing Child Tax Credits or Earned Income Tax Credits so far this year. These policies have the potential to boost family economic security and dramatically reduce the number of children living below the poverty line.

State Action on Child Tax Credits and Earned Income Tax Credits in 2023

June 28, 2023 • By ITEP Staff

In 2023 so far, 17 states have either adopted or expanded a Child Tax Credit or Earned Income Tax Credit. Both these policies can help bolster the economic security of low- and middle-income families and position the next generation for success.

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids, Especially Those in Families with Low Incomes

June 13, 2023 • By Joe Hughes

Restoring the federal Child Tax Credit to 2021 levels would benefit nearly 60 million children. Three-quarters of the benefit would go to families in the bottom three quintiles, consisting of households with less than $86,600 in income.

ITEP Statement: American Family Act Prioritizes Tax Credits for Low- and Middle-Income Families

June 7, 2023 • By ITEP Staff

Restoring the more robust CTC should be a top priority of all lawmakers from both sides of the aisle. But unfortunately, this bill stands in stark contrast to other tax bills taking shape that would deeply cut taxes for profitable corporations and wealthy families.

Minnesota’s House, Senate and Governor’s office have each proposed their own vision as to how the state should maximize its $17.5 billion surplus and raise new revenue, and these tax plans make one thing clear: Minnesota lawmakers are serious about using tax policy to advance tax equity and improve the lives of Minnesotans.

Why is My Refund So Much Smaller This Year? Only the Good (Tax Credits) Die Young.

April 18, 2023 • By Joe Hughes

This year millions of American families are finding that their refunds are much smaller than last year—or that they even owe taxes back to the government—because of the expiration of the expanded Child Tax Credit and Earned Income Tax Credit that were in effect in 2021. The lapse of the expanded credits affects a majority of the middle class, but lower-income households are particularly likely to feel the sting.

Effects of President Biden’s Proposal to Expand the Child Tax Credit

March 16, 2023 • By Joe Hughes

In his latest budget proposal, President Biden proposes enhancing the Child Tax Credit (CTC) based on the temporary credit that was in effect for 2021 as part of the American Rescue Plan Act. In this report we analyze how that proposal would help children and families.

ITEP Statement: President Biden Lays Out a Bold Vision for Tax Justice in Proposed Budget

March 9, 2023 • By ITEP Staff

President Biden’s budget proposal presents a bold vision for what tax justice should look like in America. The provisions would raise substantial revenue, fund important priorities and increase tax fairness.

The word “tax” appears 97 times and counting in one recent summary of governors’ addresses to state legislators so far this year. The policy visions that governors are bringing, however, vary enormously. While there's good reason to worry about tax cuts for wealthy families and the flattening or elimination of income taxes, there are at least five great tax ideas coming directly out of governors’ offices this year.

State of the Union Likely to Continue Progress on Tax Justice

February 7, 2023 • By Amy Hanauer

After decades of Presidents who ran away from taxes, it’s a sea change to have a chief executive who understands that the rich should pay their fair share, extremely profitable corporations should pay their fair share, and the public sector should have revenue to invest in problems – like climate change and healthcare – that will only be solved with pathbreaking public action.

Momentum Behind State Tax Credits for Workers and Families Continues in 2023

January 18, 2023 • By Miles Trinidad

Refundable tax credits are an important tool for improving family economic security and advancing racial equity, and there is incredible momentum heading into 2023 to boost two key state credits: the Child Tax Credit and the Earned Income Tax Credit.

The Tax Deal That Wasn’t: Congress Decides Corporate Tax Cuts Are Too Expensive if it Means Also Helping Children

December 20, 2022 • By Joe Hughes

Congressional leaders announced their long-awaited omnibus spending package which will fund the government through September 2023. The good news: the bill does not include needless corporate tax giveaways. The bad news: it also leaves out any expansion of the child tax credit.

Covering federal, state, and corporate tax work, here are our top 5 charts of 2022. It’s worth noting that the biggest tax news of 2022 – the adoption of a federal 15 percent corporate minimum tax in the Inflation Reduction Act – should make some of these charts look much better after the new law is implemented.

Child Tax Credit Expansion Would Shrink the Racial Wealth Gap

November 21, 2022 • By ITEP Staff

Extending the expanded Child Tax Credit would benefit nearly every child in low- and middle-income families. Under current rules, 24% of white children, 45% of Black children, and 42% of Hispanic children will not receive the full credit in 2023 because their families make too little. These figures would drop to zero if the provisions were extended, helping families of all races and disproportionately helping families of color.

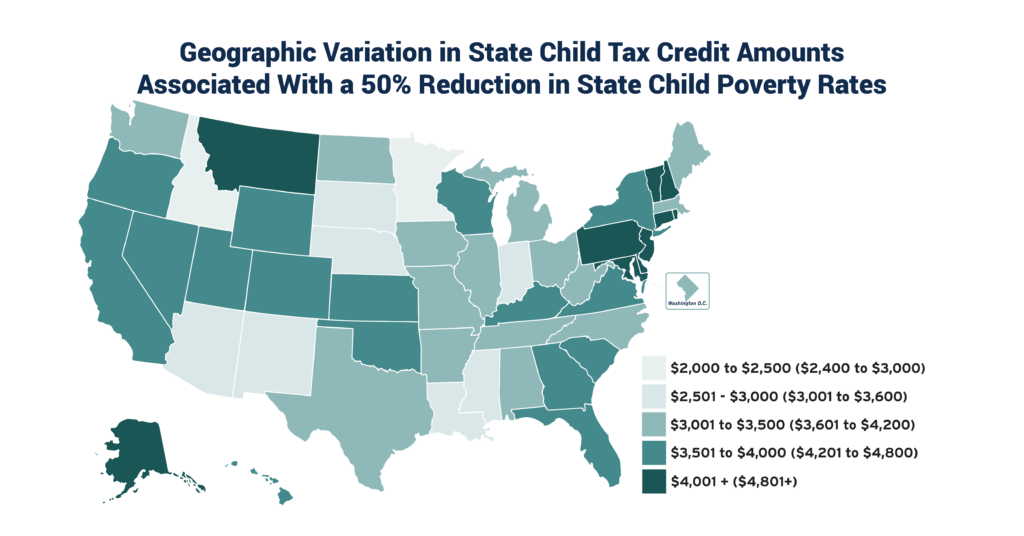

State policymakers have the tools they need to drastically reduce child poverty within their borders. A new ITEP report, coauthored with Columbia University’s Center on Poverty and Social Policy, explores state Child Tax Credit (CTC) options that would reduce child poverty by up to 50 percent. Temporary expansion of the federal CTC in 2021 reduced […]

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

Key Republicans Say Negligible Decline in Economic Growth Outweighs Enormous Drop in Child Poverty

November 3, 2022 • By Joe Hughes

The expanded Child Tax Credit reduced child poverty dramatically and immediately. There is no debate or murkiness on this. Some lawmakers have decided that cutting child poverty in half is not worth the cost if it means an ambiguous and negligible decline in GDP growth. This view is not just cruel, it is bad economics.