Child Tax Credit

Sometimes a good idea takes a while. Alvin Schorr, who would have turned 100 this month, helped draft a 1972 bill “to provide for a system of children’s allowances.” He continued to push (in a 1977 congressional testimony and in a 1983 New York Times op-ed) for a refundable tax credit for all families and a children’s allowance, among other laudable ideas. A half-century later, these ideas—which many others have championed—are becoming reality.

What to Expect from Biden and Congressional Democrats on Tax Increases for Individuals

April 8, 2021 • By Steve Wamhoff

The Biden administration has already provided details on its corporate tax proposals and in the next couple of weeks is expected to propose tax changes for individuals. Meanwhile, congressional Democrats have some ideas of their own. What should we expect?

President Biden’s Child Tax Credit Proposal Could Right a Historical Wrong

February 2, 2021 • By ITEP Staff, Jenice Robinson, Meg Wiehe

Many 1990s policies were grounded in harmful, erroneous ideas such as financial struggles are due to personal shortcomings and less government is better. Lawmakers didn’t apply these ideas consistently, however. For example, there was no drive to reduce corporate welfare even as policymakers slashed the safety net and disinvested in lower-income communities. So, it’s not surprising that a bipartisan group of lawmakers concluded during that era that the CTC was an appropriate vehicle to give higher-income households a tax break while leaving out poor children.

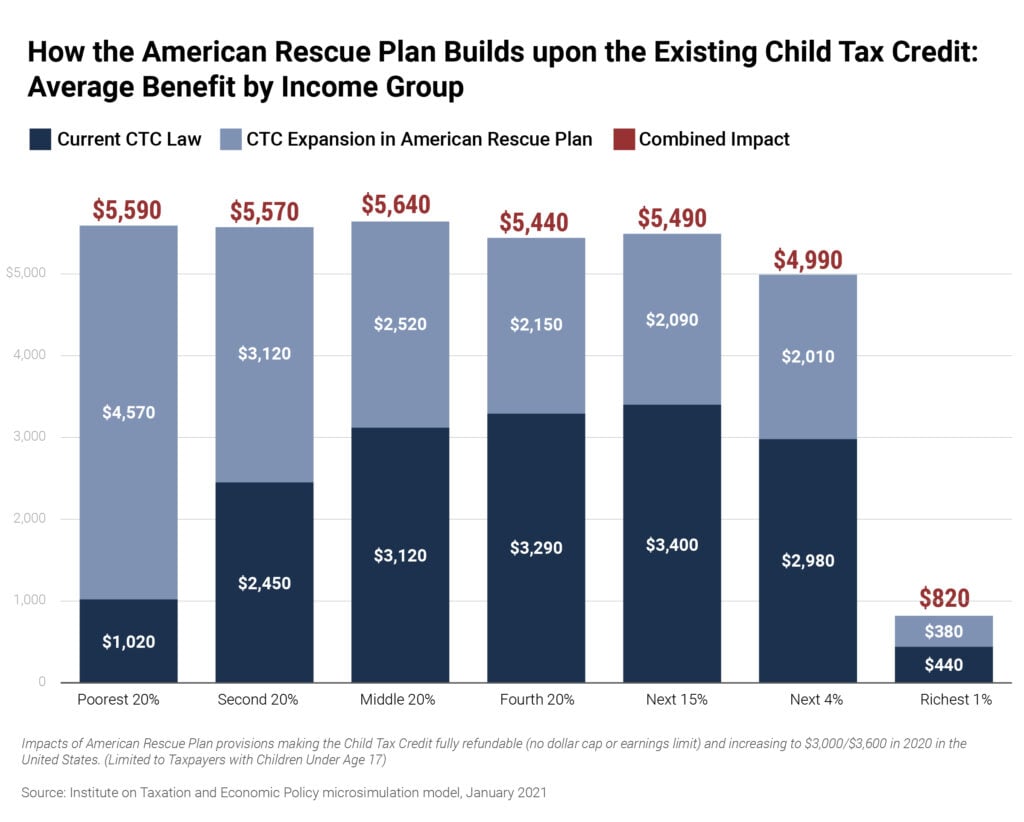

Child Tax Credit Enhancements Under the American Rescue Plan

January 26, 2021 • By Aidan Davis, Jessica Schieder

President Joe Biden’s coronavirus relief package, the American Rescue Plan, includes a significant expansion of the Child Tax Credit (CTC). The president’s proposal provides a $125 billion boost in funding for the program, which would essentially double the size of the existing federal credit for households with children. Combined with existing law, the CTC provisions in Biden's plan would provide a 37.4 percent income boost to the poorest 20 percent of families with children who make $21,300 or less a year.

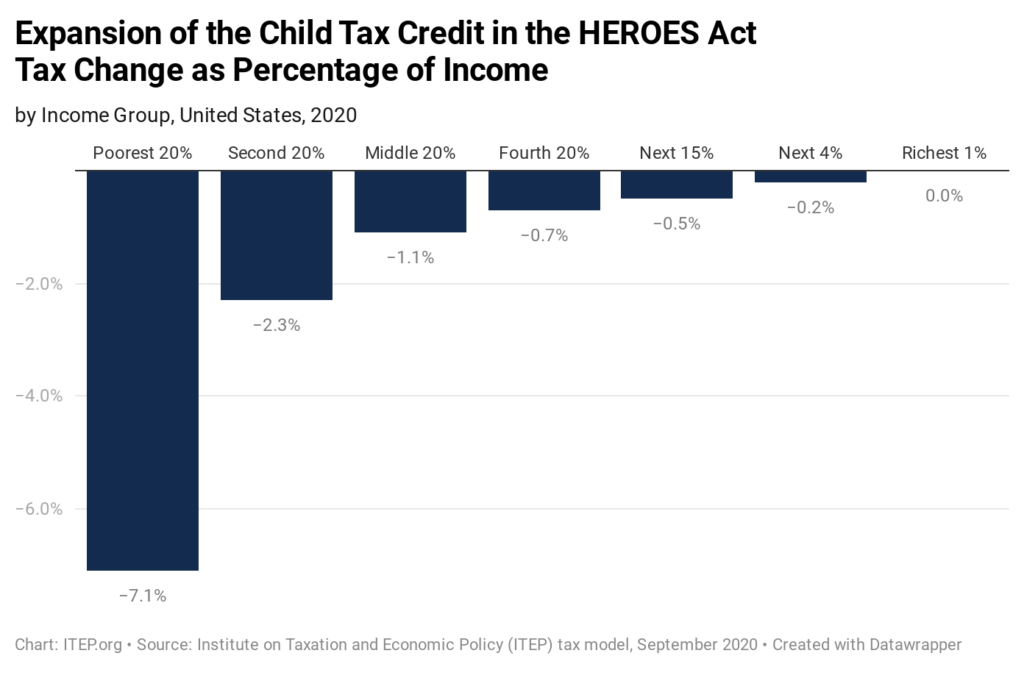

New ITEP Estimates on Biden’s Proposal to Expand the Child Tax Credit

September 18, 2020 • By Steve Wamhoff

On Thursday, former Vice President Joe Biden announced that his tax plan would include a provision passed by House Democrats to temporarily expand the Child Tax Credit (CTC), potentially lifting millions of children out of poverty. Estimates from ITEP show that this change would benefit most families with children—more than 83 million children live in households that would benefit if this was in effect in 2020—but the most dramatic boost would go to low-income families.