Corporate Tax Watch

Understanding and Fixing the New International Corporate Tax System

July 17, 2018 • By Richard Phillips

The Tax Cuts and Jobs Act (TCJA) radically changed the international tax system. It slashed taxes on corporate income, both domestic and foreign. It encouraged U.S. multinational corporations to shift jobs, profits, and tangible property abroad, and keep intangibles home. This report describes the new international tax system—and its many gaps—and also provides a road map for how to fix these gaps and surveys recent legislative approaches.

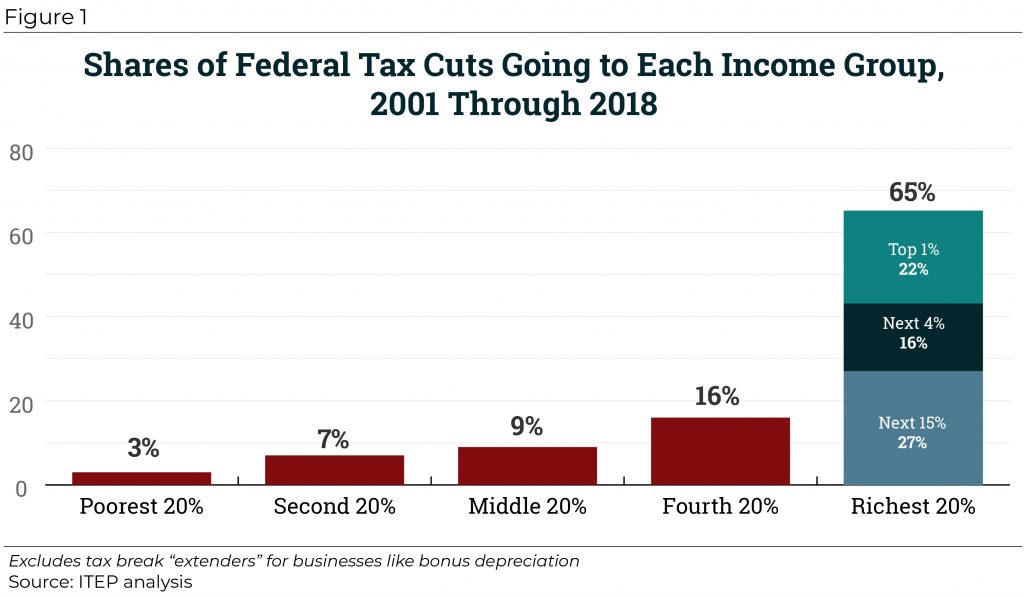

Since 2000, tax cuts have reduced federal revenue by trillions of dollars and disproportionately benefited well-off households. From 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans.

Rigging the System and Poor Shaming (Rightly) Are Incompatible Political Strategies

June 27, 2018 • By Jenice Robinson

The absurdity of blaming poor and moderate-income people for their circumstances is close to running its course as an effective political tool, particularly as some elected officials more boldly assert their intent to cater to the whims of the wealthy. Take last year’s GOP-led drive to eliminate the Affordable Care Act (ACA), for example. House […]

ITEP’s Senior Policy Analyst Richard Phillips Remarks at Facebook Shareholders Meeting in Favor of Tax Principles Resolution

May 31, 2018 • By Richard Phillips

Read the Remarks in PDF Listen to Webcast of Shareholders Meeting (Richard’s remarks begin at 21:20) My name is Richard Phillips and I am here to present Item 8 on behalf of the AFL-CIO Office of Investments. This proposal requests that the board articulate a set of responsible global tax principles that ensure the company […]

Facebook Facing Shareholder Scrutiny for Its Offshore Tax Avoidance

May 30, 2018 • By Richard Phillips

In advance of its annual shareholders meeting on May 31, Facebook was confronted with a shareholder resolution asking it to endorse a set of principles to guide its tax policy and to ensure that such principles consider the impact of its tax strategies on local economies and public services. The resolution is a signal from a group of concerned shareholders that Facebook’s tax avoidance hurts its reputation, the communities in which it operates, and creates financial risks to the company’s shareholders.

Why Proponents of the Trump-GOP Tax Law Can’t Get their Story Straight

May 16, 2018 • By Steve Wamhoff

If you listened closely to today’s House Ways and Means Committee hearing on the Tax Cuts and Jobs Act (TCJA), you could sense that the witnesses speaking in favor of the new tax law were not 100 percent on the same page. This has been apparent ever since the law was enacted at the end of last year. The economists who speak in favor of the law (including Douglas Holtz-Eakin at today’s hearing) tend to focus on other indicators of its success. They know that the talk of bonuses and raises is nothing more than a desperate corporate PR campaign…

Apple’s Three-Month Tax Savings under President Trump’s New Tax Law: $1.68 Billion

May 2, 2018 • By Matthew Gardner

By now, it should come as no shock that profitable Fortune 500 corporations are reaping huge benefits from the corporate tax cuts enacted last December. But as first quarter earnings reports are released, we’re learning just how big.

15 Companies Report Tax Savings of $6.2 Billion in First Three Months of 2018

April 26, 2018 • By Matthew Gardner

In reports released over the past week, covering the first three months of 2018, a few of the biggest and most profitable Fortune 500 corporations acknowledge receiving billions in tax cuts in the first quarter of 2018 alone. Fifteen of these companies collectively disclosed reducing their effective tax rates by $6.2 billion compared to the rates they faced in the first quarter of last year.

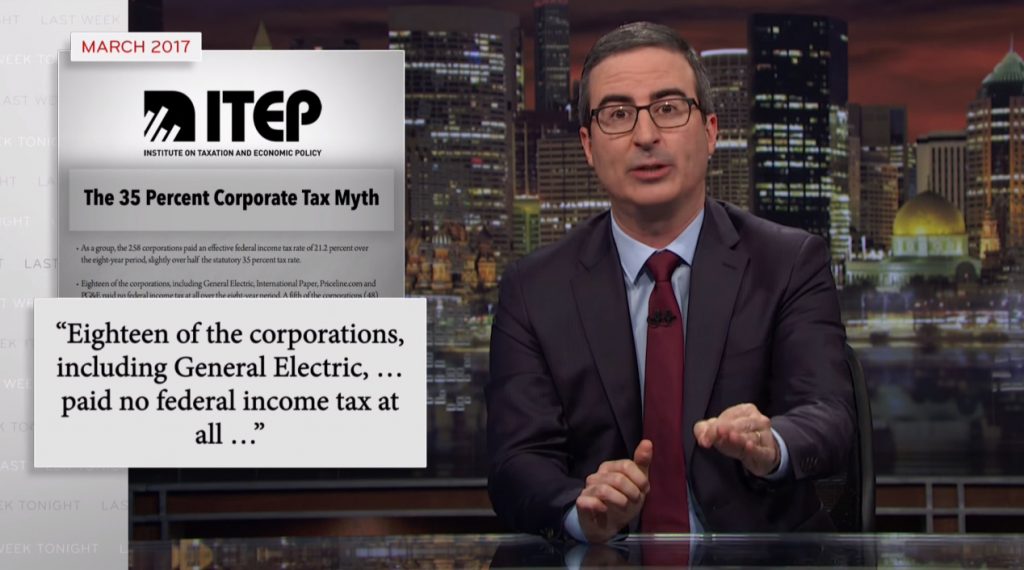

Key Takeaways from John Oliver’s Segment on Corporate Tax Avoidance

April 16, 2018 • By Richard Phillips

The HBO television show Last Week Tonight with John Oliver has become known for its longer segments that examine important issues facing the country. In its latest segment on Sunday, the show took a deep dive into corporate taxes and how many companies manage to avoid paying their fair share. Between its hilarious interludes, the segment painted a striking portrait of problems in our corporate tax code and how the Tax Cuts and Jobs Act (TCJA) failed to address them.

Everyone pays taxes, including those who earn the least. Our collective federal, state, and local tax system includes income taxes, payroll taxes (Social Security, Medicare), property taxes, sales and other excise taxes. The total share of taxes (federal, state, and local) that Americans across the economic spectrum will pay in 2018 is roughly equal to their total share of income.

Many Large Corporations Reporting Tax Cut-Inspired Employee Bonuses Were Paying Low Tax Rates to Begin With

April 12, 2018 • By Matthew Gardner

Since the corporate tax cut took effect at the beginning of 2018, a number of large corporations have announced plans to give bonuses or pay raises to some of their employees. Some of these companies have explicitly said that the new tax law, which sharply reduced the federal corporate income tax rate from 35 to 21 percent, made these moves possible. But an examination of the tax-paying habits of these corporations found that many of them used various tax breaks and accounting maneuvers to reduce their tax rates to below 21 percent year after year before the new tax law…

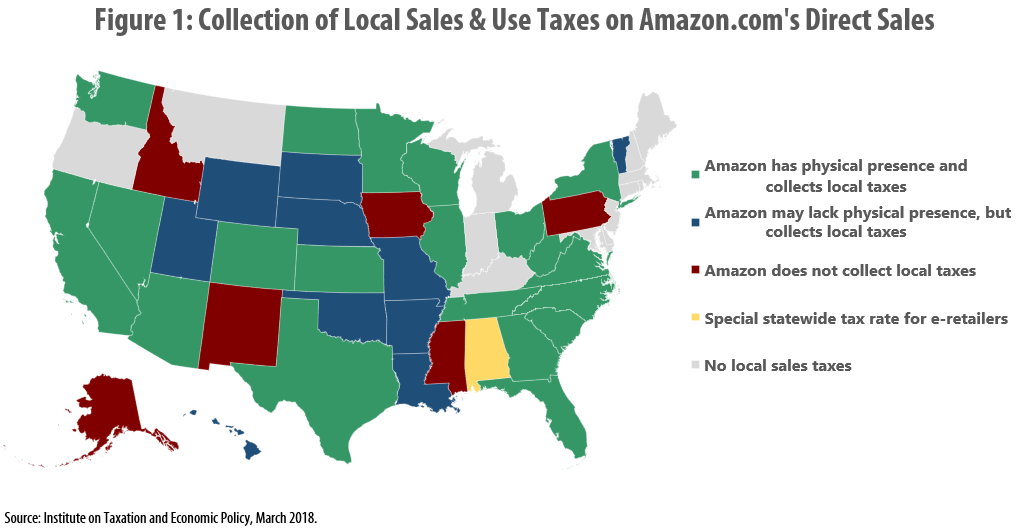

The U.S. Supreme Court is scheduled to consider a case next week (South Dakota v. Wayfair, Inc.) that has the potential to significantly improve states and localities’ ability to enforce their sales tax laws on Internet purchases.

Fifteen (of Many) Reasons We Need Real Corporate Tax Reform

April 11, 2018 • By Matthew Gardner

This ITEP report examines a diverse group of 15 corporations’ federal income tax disclosures for tax year 2017, the last year before the recently enacted tax law took effect, to shed light on the widespread nature of corporate tax avoidance. As a group, these companies paid no federal income tax on $24 billion in profits in 2017, and they paid almost no federal income tax on $120 billion in profits over the past five years. All but one received federal tax rebates in 2017, and almost all paid exceedingly low rates over five years.

Is the Trump Organization’s Sales Tax Avoidance More Aggressive Than Amazon’s?

April 6, 2018 • By Carl Davis

In recent weeks, President Trump has been raking Amazon over the coals for failing to collect state and local sales taxes on many of the company’s sales—a criticism that has some merit. But a new story first reported by James Kosur at RedStateDisaster, and then picked up today by the Wall Street Journal, provides fascinating insight into the sales tax collection habits of the Trump Organization’s “official retail website,” TrumpStore.com.

Cities Fail to Disclose Tax Incentives in Bids for Amazon’s HQ2

April 3, 2018 • By Guest Blogger

The Amazon HQ2 project would be the biggest in U.S. history as measured in projected jobs, yet little is known about the incentives cities have offered Amazon to lure its second headquarters. This lack of disclosure prevents public participation in the deal, including raising important questions about whether tax incentives that cities are offering are in the best short- and long-term interest of their residents. This is the main finding of Public Auction, Private Dealings: Will Amazon’s HQ2 Veer to Secrecy Create A Missed Opportunity for Inclusive, Accountable Development?, a Good Jobs First study released today.

President Trump’s latest Twitter target, the Amazon Corporation, is now under the microscope for its state and local tax avoidance. In a Thursday tweet, the President claimed that “[u]nlike others, they pay little or no taxes to state & local governments.” Such a statement is a startling reversal for a president who previously said his own ability to avoid paying income taxes “makes me smart.”

Amazon Maintains Sales Tax Advantage over Local Businesses

March 26, 2018 • By ITEP Staff

This report concludes that lack of consistent sales tax collection is contributing to an unlevel playing field for local businesses “because millions of shoppers are able to pay less tax if they choose to buy from out-of-state companies over the Internet rather than at local stores.” It recommends that states explore reforms to bring their sales tax policies into the digital age.

Many Localities Are Unprepared to Collect Taxes on Online Purchases: Amazon.com and other E-Retailers Receive Tax Advantage Over Local Businesses

March 26, 2018 • By Carl Davis

Online retailer Amazon.com made headlines last year when it began collecting every state-level sales tax on its direct sales. Savvy observers quickly noted that this change did not affect the company’s large and growing “marketplace” business, where it conducts sales in partnership with third-parties and rarely collects tax. But far fewer have noticed that even on its direct sales, Amazon is still not collecting some local-level taxes.

Boeing Paid Tax Rate of 8.4% in Previous Decade, But Trump to Speak About Why It Needed His Corporate Tax Cut

March 14, 2018 • By Matthew Gardner

For the second time in seven months, President Trump will visit a Boeing factory to hype corporate tax cuts. He’s chosen the wrong poster child. If there was something preventing the aerospace giant from expanding its business before the Trump-GOP tax law, it certainly wasn’t taxes. Boeing made headlines in 2016 only because after years of paying zero in federal taxes, it finally paid something. Over 10 years (2008 to 2017), the company paid an effective federal tax rate of 8.4 percent on $54.7 billion of U.S. profits.

The tobacco company Reynolds American announced this week that its full-time employees will receive a one-time bonus of $1,000 in the wake of a sharp reduction in its British parent company’s tax bill.

Five Ways States Can Recoup Corporations’ Massive Federal Tax Giveaway

March 2, 2018 • By Aidan Davis

Corporate America is doing alright. Corporate profits soared last year, and 2018 has already brought a major windfall in the form of the Trump-GOP tax law, which dramatically cut the federal corporate tax rate from 35 percent to 21 percent and shifted to a territorial tax system, giving income earned offshore by U.S. companies a free pass by no longer making it subject to U.S. taxes.

Amazon Inc. Paid Zero in Federal Taxes in 2017, Gets $789 Million Windfall from New Tax Law

February 13, 2018 • By Matthew Gardner

The online retail giant has built its business model on tax avoidance, and its latest financial filing makes it clear that Amazon continues to be insulated from the nation’s tax system. In 2017, Amazon reported $5.6 billion of U.S. profits and didn’t pay a dime of federal income taxes on it. The company’s financial statement suggests that various tax credits and tax breaks for executive stock options are responsible for zeroing out the company’s tax this year.

The More Things Change: PG&E Records a Tenth Straight Year of No Federal Income Taxes

February 9, 2018 • By Matthew Gardner

In the runup to last fall’s tax debate, it was commonly observed that corporate tax reform is both easy and hard: the easy part is cutting the rate, and the hard part is paying for it by closing loopholes. The real test of Congress’ determination to achieve tax reform would be whether they would stand up to corporate lobbyists and shut down loopholes like accelerated depreciation that allow profitable companies to pay little or no income tax. As is now widely known, Congress was not especially determined: lawmakers aggressively cut the corporate rate from 35 to 21 percent, but then…

How Exxon’s Empty $50 Billion Promise Made Its Way into Trump’s SOTU

January 31, 2018 • By Matthew Gardner

Never one to let the truth get in the way of a good story, House Speaker Paul Ryan immediately published a press release with the headline, “ExxonMobil to Invest an Additional $50 Billion in the U.S. Due to Tax Reform.” The statement was completely faithful to ExxonMobil’s statement, except for the words “additional” and “due to tax reform.” Not to be outdone, President Trump implied during his State of the Union address that the company was investing $50 billion in response to the new tax law. But a closer examination of ExxonMobil’s recent history of domestic spending finds that the…

Moody’s and Conservative Economists Agree: The Trump Corporate Tax Cut Is Not Helping Workers

January 26, 2018 • By Steve Wamhoff

Moody’s does not believe that corporate tax cuts are trickling down to working people as bonuses and pay raises. The real problem with the corporate PR campaign is that even those economists who supported Trump’s corporate tax cut and claimed it would help workers do not believe that it works this way.