District of Columbia

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

How the Revised Senate Tax Bill Would Affect District of Columbia Residents’ Federal Taxes

November 13, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In District of Columbia, 74 percent of the federal tax cuts would go to the richest 5 percent of residents, and 25 percent of households would face a tax increase, once the bill is fully implemented.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

How the House Tax Proposal Would Affect District of Columbia Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

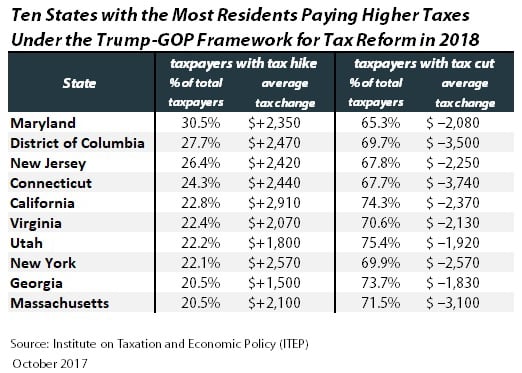

As our report on the Trump-GOP tax framework explained, in nine states plus the District of Columbia, more than a fifth of households would pay higher taxes under the framework.

CNN: How Trump’s Policies Could Hurt the Rust Belt

October 25, 2017

Rust Belt states Ohio, Michigan and Indiana are not home to large populations of $1 million household income earners. Rather, they’re in the middle or bottom of the pack, according a summary from the Institute on Taxation and Economic Policy. States with a higher percentage of millionaire earners voted for Hillary Clinton in the 2016 […]

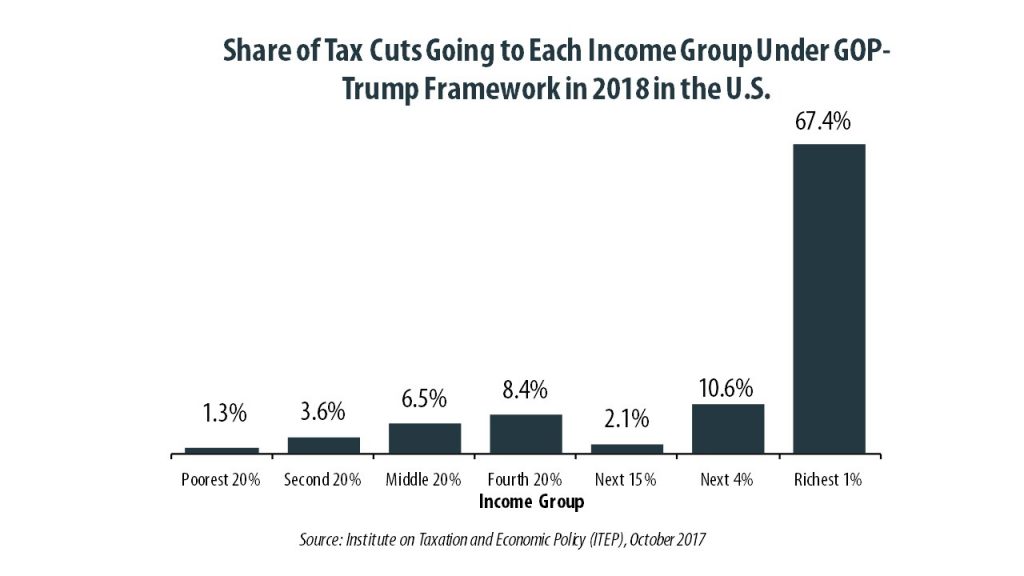

50-State Analysis: GOP-Trump Tax Proposal Would Give the Store Away to the Wealthy, Exacerbate the Income Divide

October 4, 2017 • By Alan Essig

A 50-state analysis of the GOP tax framework reveals the top 1 percent of taxpayers would receive a substantial tax cut while middle- and upper-middle-income taxpayers in many states would pay more, the Institute on Taxation and Economic Policy said today. The GOP continues to tout its tax plan as “beneficial to the middle class.” […]

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

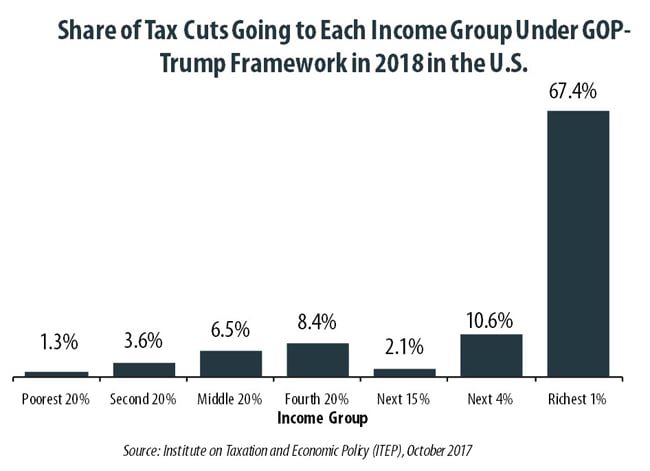

GOP-Trump Tax Framework Would Provide Richest One Percent in The District of Columbia with 83.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in the District equally. The richest one percent of District of Columbia residents would receive 83.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $1,022,000 next year. The framework would provide them an average tax cut of $147,500 in 2018, which would increase their income by an average of 4.9 percent.

State Rundown 9/25: No Rest for the Weary as State Tax and Budget Debates Wind Down, Ramp Up

September 25, 2017 • By ITEP Staff

Last week, Wisconsin leaders finally came to agreement on a state budget, while their peers in Connecticut appear to be close behind them. Iowa lawmakers avoided a special session with a short-term fix and will have to return to their structural deficit issues next session, as will those in Louisiana who will face a $1 billion shortfall. Meanwhile, District of Columbia leaders have already resumed meeting and discussing tax and budget issues there.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

Reducing the Cost of Child Care Through State Tax Codes in 2017

September 11, 2017 • By ITEP Staff

Low- and middle-income working parents spend a significant portion of their income on child care. As the number of parents working outside of the home continues to rise, child care expenses have become an unavoidable and increasingly unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

Sales taxes are one of the most important revenue sources for state and local governments; however, they are also among the most unfair taxes, falling more heavily on low- and middle-income households. Therefore, it is important that policymakers nationwide find ways to make sales taxes more equitable while preserving this important source of funding for public services. This policy brief discusses two approaches to a less regressive sales tax: broad-based exemptions and targeted sales tax credits.

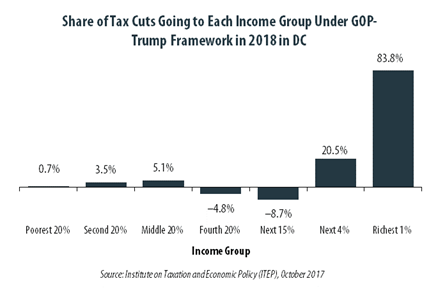

Rewarding Work Through State Earned Income Tax Credits in 2017

September 11, 2017 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

State Rundown 8/31: Modernizing Taxes is Sometimes a Sprint, Sometimes a Marathon

August 31, 2017 • By ITEP Staff

Tax and budget debates are progressing at different paces in different parts of the country this week. In Connecticut and Wisconsin, lawmakers hope to finally settle their budget and tax differences soon. In South Dakota, a court case that could finally enable states to enforce their sales taxes on online retailers inches slowly closer to the U.S. Supreme Court.

Washington Post: Ahead of regional summit, left-leaning policy groups say ‘No’ to a sales tax for Metro

August 28, 2017

A regionwide one-cent sales tax to fund Metro would have a disproportionate impact on poor families, taking five times the share of income from the bottom 20 percent of earners when compared with those in the top 1 percent, according to a new analysis from a trio of left-leaning think tanks representing the District, Maryland and Virginia.

DC Fiscal Policy Institute, Maryland Center on Economic Policy, and The Commonwealth Institute: Triple Whammy: A Regional Sales Tax for Metro, Like Fare Hikes and Service Cuts, Would Fall Hardest on Struggling Families

August 28, 2017

A strong Metro system is important to all of us in the Washington region. And everyone agrees that the Metro system needs new resources to rebuild its health. But a regional sales tax—a widely discussed option—would be an unfair way to pay for it.

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

In the District 62.9 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the the District population (0.9 percent) earns more than $1 million annually. But this elite group would receive 62.9 percent of the tax cuts that go to the District residents under the tax proposals from the Trump administration. A much larger group, 39.5 percent of the state, earns less than $45,000, but would receive just 3.4 percent of the tax cuts.

Comment Letter to Treasury on Earnings Stripping Regulations

August 4, 2017 • By ITEP Staff

The following letter was submitted to U.S. Treasury as per their request for comment in Notice 2017–38 on Section 385 regulations.

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

50-State Analysis of Trump’s Tax Outline: Poorer Taxpayers and Poorer States are Disadvantaged

July 20, 2017 • By Alan Essig

Not only would President Trump’s proposed tax plan fail to deliver on its promise of largely helping middle-class taxpayers, it also would shower a disproportionate share of the total tax cut on taxpayers in some of the richest states while southern and a few other states would receive a smaller share of the tax cut […]

Trump Tax Proposals Would Provide Richest One Percent in the District of Columbia with 69.5 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Washginton, D.C., would not benefit equally from these proposals. The richest one percent of the District’s taxpayers are projected to make an average income of $2,998,900 in 2018. They would receive 69.5 percent of the tax cuts that go to D.C. residents and would enjoy an average cut of $245,770 in 2018 alone.

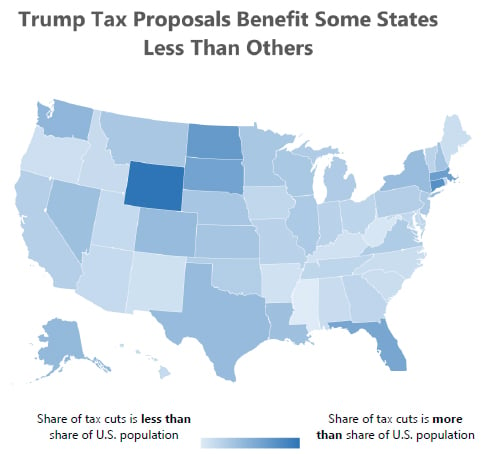

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

This letter outlines ITEP’s two broad objectives for meaningful federal tax reform and discusses six recommendations that would achieve them.