Florida

State Rundown 2/13: What’s Trendy in State Tax Debates This Year

February 13, 2020 • By ITEP Staff

We wrote earlier this week about Trends We’re Watching in 2020, and this week’s Rundown includes news on several of those trends. Maine lawmakers are considering a refundable credit for caregivers. Efforts to tax high-income households made news in Maryland, Oregon, and Washington. Grocery taxes are receiving scrutiny in Alabama, Idaho, and Tennessee. Tax cuts or shifts are being discussed in Arizona, Nebraska, and West Virginia. And Arizona, Maryland, and Nevada continue to seek funding solutions for K-12 education as Alaska and Virginia do the same for transportation infrastructure.

State lawmakers have plenty to keep them busy on the tax policy front in 2020. Encouraging trends we’re watching this year include opportunities to enact and enhance refundable tax credits and increase the tax contributions of high-income households, each of which would improve tax equity and help to reduce income inequality.

Florida Policy Institute: Earned Income Tax Credit Crucial for Working Families

January 31, 2020

State EITCs are better targeted to people with low income than blanket tax exemptions, so they help to reduce the disproportionate impact of sales and excise taxes. According to new data from the Institute on Taxation and Economic Policy, a state EITC at 30 percent of the federal credit would reduce the share of income […]

This week as Americans celebrate Martin Luther King Jr.’s messages of resisting oppression and fighting for progress, state policymakers can look to some bright spots where tax and budget debates are bending toward justice. Among those highlights, Hawaii leaders are considering improvements to minimum wage policy, early childhood education, and affordable housing; Kansas Gov. Laura Kelly is seeking to reduce sales taxes applied to food and restore the state’s grocery tax credit; and advocates in Connecticut and Maryland are pushing for meaningful progressive tax reforms.

State Rundown 1/8: States Need Clear Tax and Budget Policy Vision in 2020

January 8, 2020 • By ITEP Staff

Happy New Year readers! The Rundown is back to our usual weekly schedule as state legislative sessions and governors’ budgets and State of the State Addresses begin in earnest. Here’s to clear-eyed 20-20 vision guiding state tax and budget decisions in 2020! So far this year, the harm of Colorado’s TABOR policy and Alaska’s lack of an income tax are coming into focus in big ways. Utah advocates are hoping the benefit of hindsight will help convince voters to overturn a recently enacted tax overhaul. Lawmakers in states including Iowa, Maryland, and Virginia can clearly see a need for revenues,…

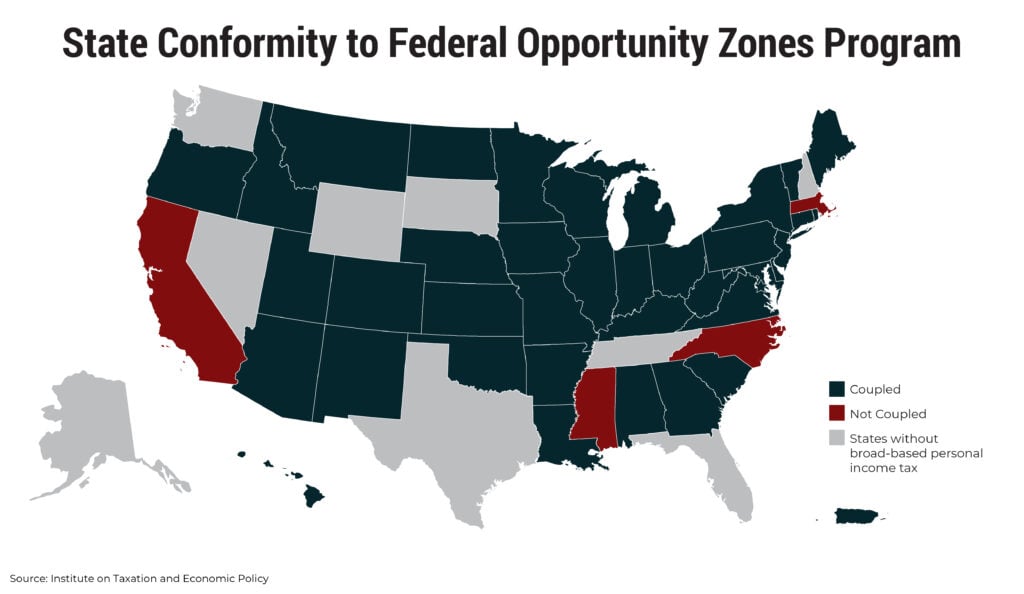

States Should Decouple from Costly Federal Opportunity Zones and Reject Look-Alike Programs

December 12, 2019 • By ITEP Staff

Post enactment of TCJA, lawmakers in most states needed to decide how to respond to the creation of this new program. Given the shortcomings of the federal Opportunity Zones program and its added potential costs to states, the most prudent course of action is three-pronged: States should move quickly to decouple; states should reject look-alike programs; and lawmakers should make investments directly into economically distressed areas.

In the last few weeks, Florida Gov. Ron DeSantis has served up his budget proposal, which advocates are eager to dig into and hoping to contribute to with a delectable Earned Income Tax Credit proposal of their own. Utah lawmakers have been cooking up tax ideas as well, but haven’t yet decided when to come to the table to debate them. And Maryland leaders finalized their menu of needed education reforms, now moving on to assigning responsibilities for funding them. With respect to dividing up the pie, our “What We’re Reading” section below includes reporting on evidence that corporate tax…

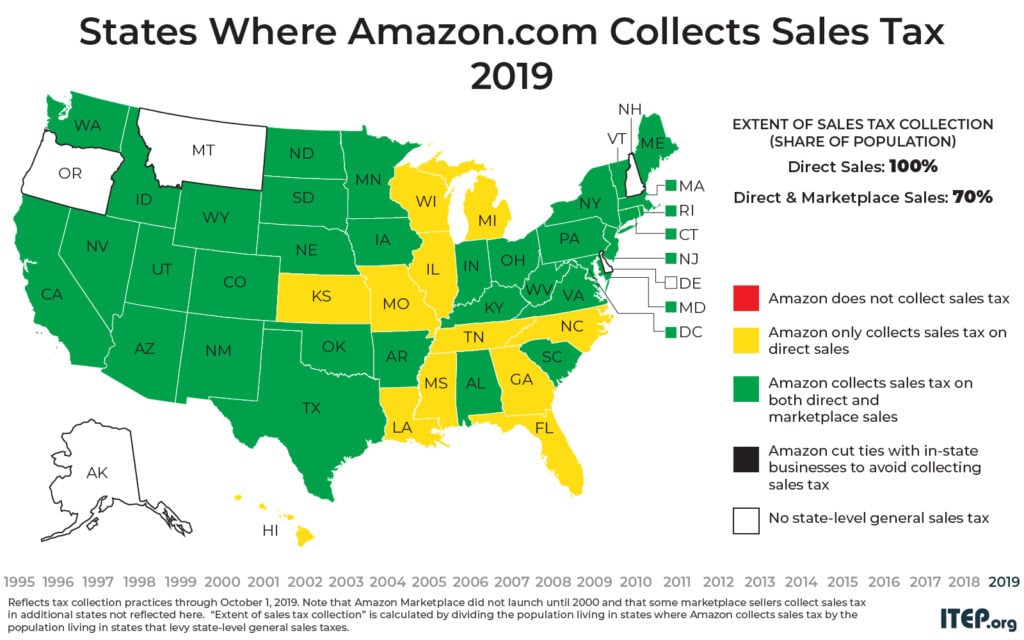

A Lump of Coal for 12 States Not Collecting Marketplace Sales Taxes this Holiday Season

November 25, 2019 • By Carl Davis

The last few years have brought major improvements in how states enforce their sales tax laws on purchases made over the Internet. Less than a decade ago, e-retailers almost never collected the sales taxes owed by their customers. The result was a multi-billion dollar drain on state coffers and a competitive disadvantage for local businesses. But this holiday season looks a bit different.

The Oracle: Big Corporate Tax Loopholes Strain Florida Budget

November 25, 2019

A 2019 report from the Institute on Taxation and Economic Policy, for instance, examined data from the IRS and Congressional Budget Office, estimating that Florida loses $1.1 billion annually from state corporate tax loopholes. $1.1 billion might seem small compared to the state’s $90 billion budget, but even small funding changes can have big impacts. The […]

Orlando Sentinel: As Florida Cuts Corporate Taxes, Your Tax Burden Rises … and Schools, Mental Health, Roads Suffer

November 15, 2019

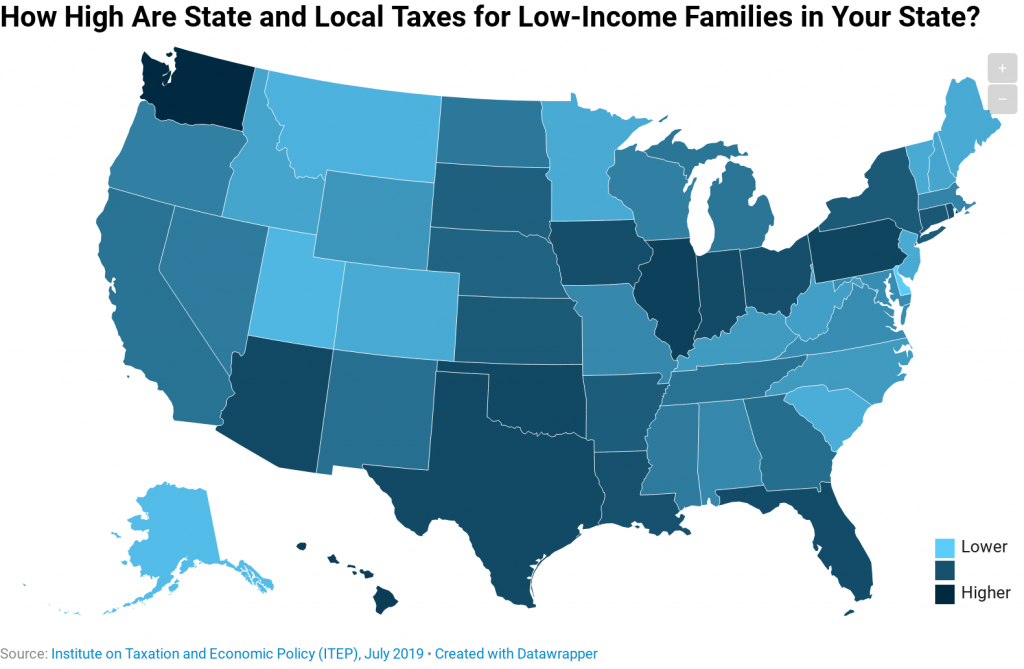

Families that make less than $50,000 a year pay between 8.1% and 12.7% of their income in local and state taxes, according to the Institute on Taxation and Economic Policy, while families that make $200,000 or more pay between 2.3% and 4.5%. Read more

Orlando Sentinel: In Florida, 99% of Companies Pay No Corporate Income Tax — with Lawmakers’ Blessing

November 13, 2019

A leaky corporate income tax ultimately shifts more of the cost of Florida government from corporations onto others, including low- and middle-income families, said Matt Gardner, a senior fellow at ITEP. “Every million dollars you’re not collecting that way is a million dollars that local governments are trying to collect through speed traps or dog-catcher […]

State Rundown 10/24: State Tax Talk Makes Like a Tree and Gets Colorful

October 24, 2019 • By ITEP Staff

As autumn brings a colorful display of foliage to many states, so too are tax proposals taking on interesting hues as states move from the summer off-season toward 2020 legislative sessions. Ohio lawmakers are blue in the face from debating and re-debating tax and budget issues there. Maryland residents again showed they can’t be called yellow-bellied when it comes to footing the bill for needed education improvements, showing their broad support for higher taxes to fund those needs even despite a hefty price tag. Alaska, Michigan, and other states are giving the green light to laws implementing their new ability…

House Passes Landmark Bipartisan Bill to Crack Down on Shell Companies Used for Tax Evasion and Other Crimes

October 24, 2019 • By Steve Wamhoff

On Tuesday night, 25 Republicans joined nearly all the chamber’s Democrats to approve the Corporate Transparency Act, a bill that would require those creating a company to report its owners to the federal government. The White House expressed support but called for the House and Senate to work on certain details, creating the possibility that the measure could be enacted.

State Rundown 10/10: Always Something Old, Something New in State Tax Debates

October 10, 2019 • By ITEP Staff

Creative thinking from Pennsylvania lawmakers has helped them discover that the Wayfair ruling allowing states to collect sales tax from online retailers can also help them identify and tax corporate profits earned in their borders. Similarly, New York leaders had the vision to put bold environmental goals in place and identify a carbon price as a potential pay-for. Gubernatorial candidates in Mississippi and Kentucky showed less ingenuity, proposing tax cuts even though Mississippi is still phasing in a massive tax cut from a few years ago and Kentucky’s next election isn’t until 2020. Meanwhile, the old idea of eliminating income…

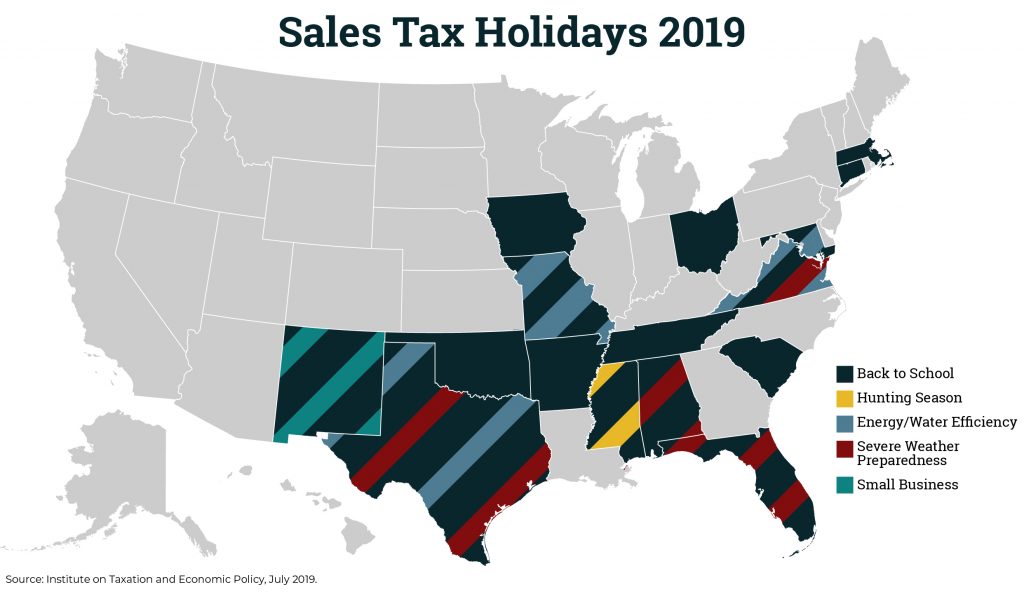

Orlando Sentinel: Florida’s Back-to-School Sales Tax Holiday – a Costly Gimmick

July 31, 2019

And an analyst with the Institute on Taxation and Economic Policy said one of the alleged benefits — that the tax holidays stimulate spending — is bogus. Why? Because if your kid needs a backpack, your kid needs a backpack. Maybe you buy it this weekend. Maybe you buy it next weekend. Either way, you […]

WPEC: Retailers Ready for Back-to-School Tax ‘Holiday’

July 31, 2019

But not everyone is sold on the value of sales-tax holidays. The Washington, D.C.-based Institute on Taxation and Economic Policy, a non-profit liberal think tank, calls such holidays an “outdated gimmick.” Dylan Grundman, a senior policy analyst for the institute, argued in a news release that the brief holiday periods don’t reduce taxes for low- […]

The Daytona Beach News-Journal: Sales Tax Holiday, Here’s What You Need To Know

July 30, 2019

The Washington, D.C.-based Institute on Taxation and Economic Policy, a non-profit liberal think tank, calls such holidays an “outdated gimmick.” Dylan Grundman, a senior policy analyst for the institute, argued in a news release that the brief holiday periods don’t reduce taxes for low- and moderate-income families the rest of the year. He pointed to […]

New York Times: State and Local Taxes Are Worsening Inequality

July 21, 2019

Low-income households in Illinois pay about 14 cents in state and local taxes from every dollar of income, while the state’s most affluent households pay about 7 cents per dollar. That gap between the poor and the wealthy in Illinois is one of the largest in any state, but the poor pay taxes at higher […]

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 17, 2019 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2019), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief looks at sales tax holidays as a tax reduction device.

Sales Tax Holidays Are Outdated Gimmicks That Have Run Their Course

July 17, 2019 • By ITEP Staff

Just as the very first sales tax holiday for car sales did not fix the auto industry’s challenges, providing consumers a temporary reprieve on sales tax will not address families’ pocketbook concerns.

No two state tax systems are the same, but 45 states have one thing in common: Low-income residents are taxed at a higher rate than the top 1 percent. This map shows the effective tax rates for the lowest-income 20 percent in each state--ranging from a high of 17.8 percent in Washington to a low of 5.5 percent in Delaware.

Mercury is rising, presidential primary debates are underway and most state legislative sessions have adjourned for summer. Whether you’re curling up with a good book (or your favorite e-Reader) or looking for a new television show to binge-watch, check out these recommendations on ITEP’s Summer Reading (and Watching) List.

States are putting evidence into practice with multiple efforts to improve services and tax codes through more progressive taxes on the wealthy. Clear evidence has spread widely this year, informing a national conversation about progressive taxation and leading lawmakers in multiple states to eschew supply-side superstition and act on real evidence instead. Taxing the rich works, and in this Just Taxes blog we review state-level efforts to put these proven findings into effect.

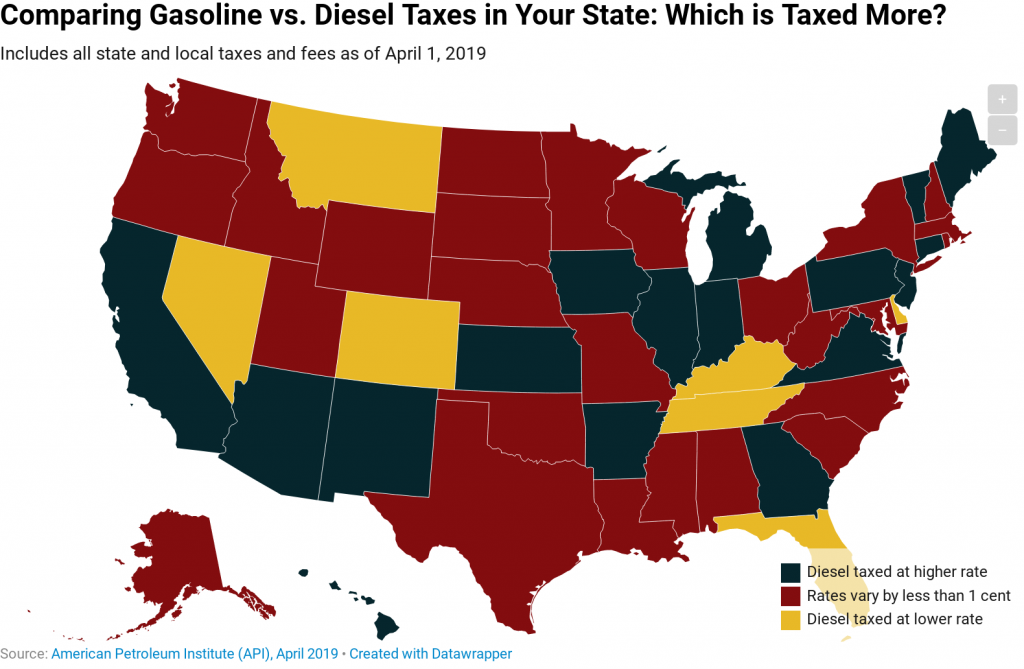

Twenty-six states and the District of Columbia tax these two fuel types at the same rate or very similar rates, as of April 2019, according to data from the American Petroleum Institute.

State Rundown 5/9: Illinois Moves Closer to a Progressive Income Tax

May 9, 2019 • By ITEP Staff

Lawmakers in Illinois and Ohio have advanced major tax proposals but cannot rest just yet, as they must still get past the other legislative chamber. Their counterparts in Michigan, Minnesota, Nebraska, and Oregon, meanwhile, are all at impasses over education funding, as those in Texas left their school funding disagreement unresolved at least until they reconvene...in 2021. And in an era of many states pre-empting smaller jurisdictions by revoking local decision-making powers, leaders in Colorado and Delaware made moves in the opposite direction, entrusting cities and school districts with more local control.