Kentucky

Louisville Courier-Journal: Fix Kentucky’s Upside Down Tax Code

July 19, 2017

And among other things, the legislation would raise Kentucky’s tax on cigarettes and other tobacco products, including e-cigarettes. This would initially generate about $155 million in revenue, but – more importantly – it would discourage tobacco use and reduce associated costs. Kentucky has one of the highest smoking rates and highest rates of lung cancer […]

State Rundown 7/19: Handful of States Still Have Their Hands Full with Tax and Budget Debates

July 19, 2017 • By ITEP Staff

Tax and budget debates drag on in several states this week, as lawmakers continue to work in Alaska, Connecticut, Rhode Island, Pennsylvania, Texas, and Wisconsin. And a showdown is brewing in Kentucky between a regressive tax shift effort and a progressive tax reform plan. Be sure to also check out our "What We're Reading" section for a historical perspective on federal tax reform, a podcast on lessons learned from Kansas and California, and more!

State Rundown 6/28: States Scramble to Finish Budgets Before July Deadlines

June 28, 2017 • By ITEP Staff

This week, several states attempt to wrap up their budget debates before new fiscal years (and holiday vacations) begin in July. Lawmakers reached at least short-term agreement on budgets in Alaska, New Hampshire, Rhode Island, and Vermont, but such resolution remains elusive in Connecticut, Delaware, Illinois, Maine, Pennsylvania, Washington, and Wisconsin.

State Rundown 6/14: Some States Wrapping Up Tax Debates, Others Looking Ahead to Next Round

June 14, 2017 • By ITEP Staff

This week lawmakers in California and Nevada resolved significant tax debates, while budget and tax wrangling continued in West Virginia, and structural revenue shortfalls were revealed in Iowa and Pennsylvania. Airbnb increased the number of states in which it collects state-level taxes to 21. We also share interesting reads on state fiscal uncertainty, the tax experiences of Alaska and Wyoming, the future of taxing robots, and more!

Kentucky Center for Economic Policy: Troubling Hints About Direction for Tax Reform

June 8, 2017

The corporate tax cuts described above mean profitable businesses chip in less for the public services that help them succeed. And the result of less reliance on income and inheritance taxes is clear (see graph below): those at the top in Tennessee and Indiana pay an even smaller share of their income in state and local taxes than the wealthiest Kentuckians do, and their lowest-income residents pay an even higher share than the poorest Kentuckians.

This week, we celebrate a victory in Kansas where lawmakers rolled back Brownback's tax cuts for the richest taxpayers. Governors in West Virginia and Alaska promote compromise tax plans. Texas heads into special session and Vermont faces another budget veto, while Louisiana and New Mexico are on the verge of wrapping up. Voters in Massachusetts may soon be able to weigh in on a millionaire's tax, the California Senate passed single-payer health care, and more!

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

Kentucky Center for Economic Policy: Any Way You Slice It, A Shift To Consumption Taxes Will Hurt Kentucky

May 22, 2017

According to ITEP, replacing all of Kentucky’s income tax revenue with sales tax revenue would require an increase in our sales tax rate to 13.3 percent – more than double the current 6 percent rate and by far the highest state sales tax rate in the country (next highest is California at 7.5 percent). But […]

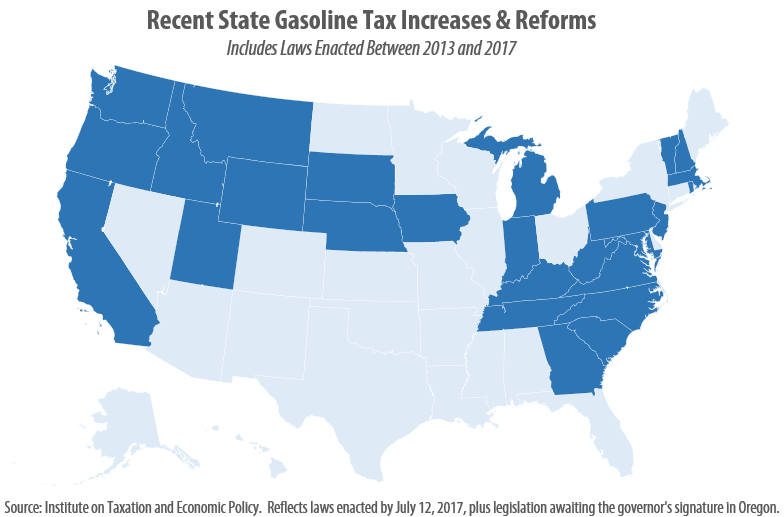

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.

State Rundown 4/27: States Finally Reaching Resolution on Gas Taxes

April 27, 2017 • By ITEP Staff

This week, transportation funding debates finally concluded with gas tax updates in Indiana, Montana, and Tennessee, and appear to be nearing an end in South Carolina. Meanwhile, Louisiana and Oregon lawmakers debated new Gross Receipts Taxes, and Texas legislators considered eliminating the state’s franchise tax. — Meg Wiehe, ITEP Deputy Director, @megwiehe Louisiana Gov. Bel Edward’s Commercial Activities Tax (CAT) was pulled from committee early this week without a vote due to opposition, […]

Kentucky Center for Economic Policy: What Good Tax Reform Looks Like

April 17, 2017

In contrast, HB 263 would ask more of those at the top and less of low- and middle-income people who currently pay a larger share of their income in taxes. To further help with inequities, the bill would create a state level Earned Income Tax Credit (EITC) – an effective poverty-fighting tool that supports work […]

Kentucky Center for Economic Policy: Taxing Groceries in Kentucky Would Hurt Low-Income Families, Weaken Revenue Growth

April 12, 2017

Lower-income families therefore receive the most benefit from the exemption for groceries. Repealing it would disproportionately increase the share of income they pay in taxes, making Kentucky’s tax system more regressive than it already is.

Kentucky Center for Economic Policy: Undocumented Immigrants Contribute $37 Million Toward Investments in Kentucky Each Year

April 3, 2017

Undocumented immigrants living in Kentucky pay $36.6 million in state and local taxes each year, according to a new report from the Institute on Taxation and Economic Policy. These substantial tax contributions should be acknowledged as lawmakers consider the economic and social impact of immigration policy and enforcement in the U.S. – including a recent […]

Kentucky Center for Economic Policy: Tiny Fraction of Wealthiest Kentuckians Gain from Tax Cuts in Health Repeal

March 23, 2017

The House plan to repeal healthcare reform, known as the American Health Care Act (AHCA), provides a tax cut to the wealthiest people while reducing the number of Americans with health coverage by an estimated 24 million, according to the Congressional Budget Office. Because Kentucky has relatively few high earners, we benefit even less from the […]

Kentucky New Era: State gets $36M from immigrants here illegally

March 8, 2017

The report, released Thursday by the Washington, D.C.-based Institute on Taxation and Economic Policy, comes as President Donald Trump works to ramp up immigration enforcement across the nation in part through an executive order expanding the groups of immigrants prioritized for removal and as Trump suggests he may push for broader immigration reform. The Kentucky […]

State Rundown 3/1: Will Tax Cut Proposals Be “In Like a Lion, Out Like A Lamb”?

March 1, 2017 • By ITEP Staff

Tax cuts have been proposed in many states already this year, but amid so much uncertainty, it remains to be seen how successful those efforts will be. This week saw one dangerous, largely regressive tax cut proposal move in Georgia, new budget proposals in Louisiana and New Jersey, a new plan to close West Virginia‘s […]

Kentucky Center for Economic Policy: The Math Behind Ed Choice Tax Credit Fails Many Tests

February 21, 2017

Today in the House Education Committee legislators are hearing discussion of House Bill 162, a proposal to create a so-called Education Choice tax credit in Kentucky. This proposal does not target low- and moderate-income students as suggested; is expensive, taking resources away from public schools and other investments; and provides an excessively large credit under […]

This week we are following a number of significant proposals being debated or introduced including reinstating the income tax in Alaska and eliminating the tax in West Virginia, establishing a regressive tax-cut trigger in Nebraska, restructuring the Illinois sales tax, moving New Mexico to a flat income tax and broader gross receipts tax, and updating […]

State Rundown 2/8: Lessons of Kansas Tax-Cut Disaster Taking Hold in Kansas, Still Lost on Some in Other States

February 8, 2017 • By ITEP Staff

This week we bring news of Kansas lawmakers attempting to fix ill-advised tax cuts that have wreaked havoc on the state’s budget and schools, while their counterparts in Nebraska and Idaho debate bills that would create similar problems for their own states, as well as tax cuts in Arkansas that were proven unaffordable within one […]

What to Watch in the States: Further Attempts to Weaken or Eliminate Progressive Taxes

February 2, 2017 • By Aidan Davis

This is the third installment of our six-part series on 2017 state tax trends. The introduction to this series is available here. As we described last week, many states are gearing up for challenging budget debates this year. But the need to address revenue shortfalls has not stopped lawmakers in many states from pursuing harmful […]

This week’s Rundown brings news of tax cuts passed in Arkansas and advanced in Idaho, proposals to exempt feminine hygiene products from sales taxes in Nevada and Michigan, revenue shortfalls forcing tough choices in Louisiana and Maine, and more governors’ state of the state addresses and budget proposals setting the stage for yet more tax […]

Kentucky Center for Economic Policy: Refugees, Immigrants Important to Kentucky and the Economy: An Overview of the Research

February 1, 2017

From the promise to build a wall paid for by tariffs on Mexican imports and uncertainty about what will happen to DACA (which allows undocumented immigrants whose parents brought them to the U.S. as children to apply for a renewable reprieve from deportation), to a 120-day ban on refugee admissions and an indefinite ban for […]

Below is a list of notable resources for information on state taxes and revenues: Alabama Alabama Department of Revenue Alabama Department of Finance – Executive Budget Office Alabama Department of Revenue – Tax Incentives for Industry Alabama Legislative Fiscal Office Alaska Alaska Department of Revenue – Tax Division Alaska Office of Management & Budget Alaska […]

Since the 2007-2009 economic crisis, rising income inequality and the role our public policies play in aiding or easing this trend have been an ongoing part of the public discourse. In spite of what we know about the growing gap between the rich and the rest of us, federal and state policymakers continue to sell […]

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

January 26, 2017 • By Carl Davis, Meg Wiehe

When states shy away from personal income taxes in favor of higher sales and excise taxes, high-income taxpayers benefit at the expense of low- and moderate-income families who often face above-average tax rates to pick up the slack. This chart book demonstrates this basic reality by examining the distribution of taxes in states that have pursued these types of policies. Given the detrimental impact that regressive tax policies have on economic opportunity, income inequality, revenue adequacy, and long-run revenue sustainability, tax reform proponents should look to the least regressive, rather than most regressive, states in crafting their proposals.