New Mexico

New Mexico Voices for Children: The Trump Tax Plan Isn’t ‘Reform.’ Here’s Why:

September 1, 2017

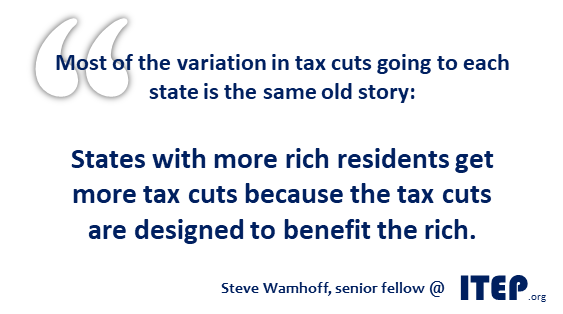

In April the Trump administration released a sketchy outline of their half-baked ideas for tax changes. An analysis by the Washington, D.C.-based Institute for Taxation and Economic Policy (ITEP) of that back-of-the-envelope ‘plan’ found that nearly half (48 percent) of Trump’s proposed tax cuts would go to millionaires. Millionaires make up only 0.5 percent of the U.S. population.

New Mexico Voices for Children: Trump Tax Plan Does Little for NM’s Middle Class

August 31, 2017

Average New Mexicans would not benefit much from President Trump’s tax reform proposal, which would give the biggest tax breaks to New Mexico’s millionaires. That’s according to a report released recently by the Institute on Taxation and Economic Policy (ITEP).

State Rundown 8/31: Modernizing Taxes is Sometimes a Sprint, Sometimes a Marathon

August 31, 2017 • By ITEP Staff

Tax and budget debates are progressing at different paces in different parts of the country this week. In Connecticut and Wisconsin, lawmakers hope to finally settle their budget and tax differences soon. In South Dakota, a court case that could finally enable states to enforce their sales taxes on online retailers inches slowly closer to the U.S. Supreme Court.

In New Mexico 35.3 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the New Mexico population (0.3 percent) earns more than $1 million annually. But this elite group would receive 35.3 percent of the tax cuts that go to New Mexico residents under the tax proposals from the Trump administration. A much larger group, 47.5 percent of the state, earns less than $45,000, but would receive just 5.8 percent of the tax cuts.

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

State Rundown 7/27: State Legislative Debates Winding Down but Tax Talk Continues

July 27, 2017 • By ITEP Staff

While only a few states still remain mired in overtime budget debates, there is plenty of budget and tax news from around the country this week. Efforts are underway to repeal gas tax increases in California and challenge a local income tax in Seattle, Washington. And New Jersey legislators' law to modernize its tax code to tax Airbnb rentals has been vetoed for now.

Trump Touts Tax Cuts for the Wealthy as a Plan for Working People

July 26, 2017 • By Steve Wamhoff

Unless the administration takes a radically different direction on tax reform from what it has already proposed, its tax plan would be a monumental giveaway to the top 1 percent. The wealthiest one percent of households would receive 61 percent of all the Trump tax breaks, and would receive an average of $145,400 in 2018 alone.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

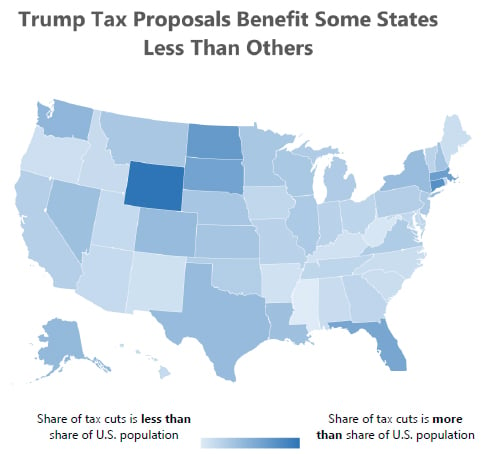

50-State Analysis of Trump’s Tax Outline: Poorer Taxpayers and Poorer States are Disadvantaged

July 20, 2017 • By Alan Essig

Not only would President Trump’s proposed tax plan fail to deliver on its promise of largely helping middle-class taxpayers, it also would shower a disproportionate share of the total tax cut on taxpayers in some of the richest states while southern and a few other states would receive a smaller share of the tax cut […]

Trump Tax Proposals Would Provide Richest One Percent in New Mexico with 42 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in New Mexico would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,264,600 in 2018. They would receive 42 percent of the tax cuts that go to New Mexico’s residents and would enjoy an average cut of $73,070 in 2018 alone.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

This week, we celebrate a victory in Kansas where lawmakers rolled back Brownback's tax cuts for the richest taxpayers. Governors in West Virginia and Alaska promote compromise tax plans. Texas heads into special session and Vermont faces another budget veto, while Louisiana and New Mexico are on the verge of wrapping up. Voters in Massachusetts may soon be able to weigh in on a millionaire's tax, the California Senate passed single-payer health care, and more!

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

23 Million Uninsured Americans Is Too Great a Cost to Finance Tax Cuts for the Rich

May 24, 2017 • By Richard Phillips

The cost to give $1 trillion in tax cuts to the wealthy and corporations is 23 million uninsured Americans by 2026. This is the bottom-line take away from the much-awaited Congressional Budget Office (CBO) score of the American Health Care Act, which House Republicans rushed through the chamber and narrowly passed (217-213) in early May.

This week, Kansas lawmakers continued work on fixing the fiscal mess created by tax cuts in recent years, as legislators in Louisiana, Minnesota, Oklahoma, and West Virginia attempted to wrap up difficult budget negotiations before their sessions come to an end, and Delaware lawmakers advanced a corporate tax increase as one piece of a plan to close that state's budget shortfall. Our "what we're reading" section this week is also packed with articles about state and local effects of the Trump budget, new 50-state research on property taxes, and more.

This week saw tax debates heat up in many states. Late-session discovered revenue shortfalls, for example, are creating friction in Delaware, New Jersey, and Oklahoma, while special sessions featuring tax debates continue in Louisiana, New Mexico, and West Virginia. Meanwhile the effort to revive Alaska's personal income tax has cooled off.

State Rundown 5/10: Spring Tax Debates at Different Stages in Different States

May 10, 2017 • By Meg Wiehe

This week saw a springtime mix of state tax debates in all stages of life. In West Virginia and Louisiana, debates over income tax reductions and comprehensive tax reform are full of vigor. Other debates that bloomed earlier are now settled, such as Florida‘s now-complete budget debate and the more florid debates over gas taxes […]

State Rundown 5/3: Lawmakers See Value in State EITCs, Danger in Tax Cut Triggers

May 3, 2017 • By ITEP Staff

This week, Kansas lawmakers found that they’ll have to roll back Gov. Brownback’s tax cuts and then some to adequately fund state needs. Nebraska legislators took notice of their southern neighbors’ predicament and rejected a major tax cut. Both Hawaii and Montana‘s legislatures sent new state EITCs to their governors, and West Virginia began an […]

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

States are experiencing a rapid decline in state corporate income tax revenue, and the downward trend has become increasingly pronounced in recent years. Despite rebounding bottom lines for many corporations, a new ITEP report, 3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015,finds that effective tax rates paid by […]

This week in state tax news we saw a destructive tax cut effort defeated in Georgia, a state shutdown avoided in New York, and lawmakers hone in on major tax debates in Massachusetts, Nebraska, South Carolina, and WestVirginia. State efforts to collect taxes owed on online purchases continue to heat up as well. — Meg […]

For decades, Amazon.com helped its customers dodge the sales taxes they owed to gain an advantage over its competitors. But as the company’s business strategy has changed, so has its tax collection. As recently as 2011, the nation’s largest e-retailer was collecting sales tax in just 5 states, home to 11 percent of the country’s […]

A growing number of Americans are getting rides or booking short-term accommodations through online platforms such as Uber and Airbnb. This is nothing new in concept; brokers have operated for hundreds of years as go-betweens for producers and consumers. The ease with which this can be done through the Internet, however, has led to millions of people using these services, and to some of the nation's fastest-growing, high-profile businesses. The rise of this on-demand sector, sometimes referred to as the "gig economy" or, by its promoters, the "sharing economy," has raised a host of questions. For state and local governments,…

This week brings more news of states considering reforms to their consumption taxes, on everything from gasoline in South Carolina and Tennessee, to marijuana in Pennsylvania, to groceries in Idaho and Utah, and to practically everything in West Virginia. Meanwhile, the fiscal fallout of Kansas’s failed ‘tax experiment’ has new consequences as the state’s Supreme […]

Undocumented Immigrants’ State & Local Tax Contributions

March 1, 2017 • By Lisa Christensen Gee, Meg Wiehe, Misha Hill

Public debates over federal immigration reform, specifically around undocumented immigrants, often suffer from insufficient and inaccurate information about the tax contributions of undocumented immigrants, particularly at the state level. The truth is that undocumented immigrants living in the United States paybillions of dollars each year in state and local taxes. Further, these tax contributions would increase significantly if all undocumented immigrants currently living in the United States were granted a pathway to citizenship as part of comprehensive immigration reform. Or put in the reverse, if undocumented immigrants are deported in high numbers, state and local revenues could take a substantial…