North Carolina

Lottery, Casino and other Gambling Revenue: A Fiscal Game of Chance

June 12, 2018 • By ITEP Staff

Cash-strapped, tax-averse state lawmakers continue to seek unconventional revenue-raising alternatives to the income, sales, and property taxes that form the backbone of most state tax systems. However, gambling revenues are rarely as lucrative, or as long-lasting, as supporters claim.

State Rundown 6/1: Time Is Ripe for Closer Look at Intergovernmental Relations

June 1, 2018 • By ITEP Staff

This week, Virginia lawmakers overcame their budget impasse and approved an expansion of Medicaid, North Carolina's behind closed doors budget debate appears to be wrapping up, and Vermont's special session continues in the wake of the governor's vetoes of the state budget and accompanying tax bills. New research highlighted in our What We're Reading section shows that both corporate income tax cuts and business tax subsidies contribute to wider economic inequality. And the possible reconstitution of a federal commission on intergovernmental relations could not come soon enough, as other headlines this week include a state-to-local shift in school funding, governments…

NC Budget and Tax Center: Corporations over Carolinians?

May 31, 2018

Big corporations and wealthy executive have been on quite a run. Corporate profits are at historic levels,[1] stock prices are through the roof, and plush executive pay has become the norm. At the same time, corporate taxes have been slashed both here in North Carolina starting in 2013 and last December at the federal level. […]

NC Budget and Tax Center: Revenue Options to Support Children’s Educational Success

May 30, 2018

The General Assembly legislative session begins on May 16, the same day teachers plan a day of action to highlight the unmet needs their students face in the classroom and their communities. While the evidence is quite clear that supporting children’s educational success can generate lifelong benefits for families and the broader economy[1], the NC […]

State Rundown 5/23: Special Sessions Abound Amid Budget Vetoes, Stalemates, Federal Tax Bill

May 23, 2018 • By ITEP Staff

This week the governors of Louisiana and Minnesota both vetoed budget bills, leading to another special session in Louisiana and unanswered questions in Minnesota, and Missouri legislators managed to push through a tax shift bill just before adjourning their regular session and heading right into a special session to impeach their governor. Wisconsin and Wyoming localities are both looking at ways to raise revenues as state funding drops. And our What We're Reading section contains helpful pieces on changing demographics, the effects of wealth inequality on families with children, and the impacts of the Supreme Court sports gambling and online…

NC Policy Watch: Governor Cooper recognizes North Carolina is in a hole, stops digging

May 22, 2018

Holding off on another round of tax cuts for the richest taxpayers and profitable corporations and keeping the increased standard deduction and lower rate for the majority of taxpayers will reduce the tax cuts given to the top 5 percent of taxpayers since 2013. Read more here

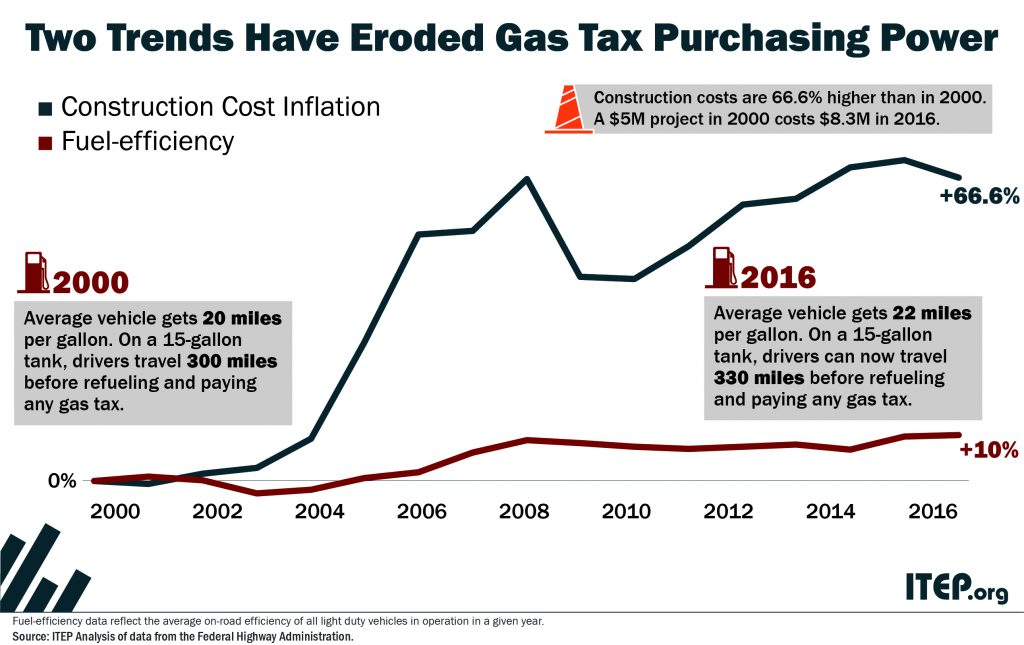

An updated version of this blog was published in April 2019. State tax policy can be a contentious topic, but in recent years there has been a remarkable level of agreement on one tax in particular: the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies.

North Carolina Justice Center: New Report Looks at How Corporate Tax Cuts Have Hurt North Carolina

May 21, 2018

A new report on corporate income taxes looks at how corporate taxes have been slashed at the state and federal levels, provides evidence that wealthy shareholders are the prime beneficiaries of corporate tax cuts, and shows that corporate tax cuts have not solved North Carolina’s most pressing economic problems. Unless leaders in Raleigh change course, corporations could be in line for yet another tax cut next year if a rate cut to the corporate income tax moves ahead as currently scheduled.

State Rundown 5/17: Don’t Bet on Legal Sports Betting Solving State Budget Woes

May 17, 2018 • By ITEP Staff

This week the U.S. Supreme Court opened the door to legal sports gambling in the states (see our What We're Reading section), which will surely be a hot topic in state legislative chambers, but most states currently have more pressing matters before them. The teacher pay crisis made news in North Carolina, Alabama, and nationally. Louisiana, Oregon, and Vermont lawmakers are headed for special sessions over tax and budget issues. And several other states have recently reached or are very near the end of their legislative sessions.

CNN: North Carolina teachers want better pay and they’re marching to fight for it

May 16, 2018

Mark Jewell, president of the North Carolina Association of Educators, has said the state could be spending a lot more on schools if it hadn’t shrunk revenues by lowering corporate and personal income tax rates in the past few years. He points to a 2017 report by the nonpartisan Institute on Taxation and Economic Policy, […]

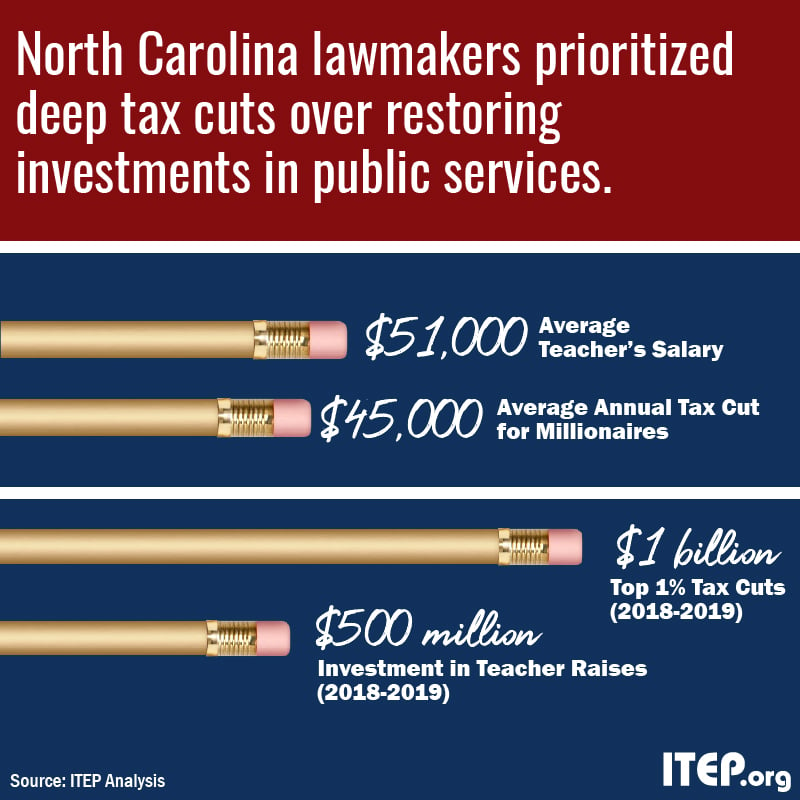

NC Teachers’ March on Raleigh and the Tax Cuts that Led Them There

May 15, 2018 • By Aidan Davis

Once again, public school teachers are taking a stand for education and against irresponsible, top-heavy tax cuts that deprive states of the revenue they need to sufficiently fund public services, including education.

Millionaires Average Annual Tax Cut in North Carolina Is Comparable to Average Teacher’s Salary

May 11, 2018 • By Meg Wiehe

North Carolina lawmakers' misplaced priorities are evident: The recent rounds of tax cuts will provide the state’s millionaires with an average annual tax break of more than $45,000, which is nearly as much as the average teacher’s annual salary of about $50,000.

State Rundown 5/9: Iowa Digs a New Hole as Other States Try to Avoid or Climb Out of Theirs

May 9, 2018 • By ITEP Staff

This week we have news of a destructive tax cut plan finally approved in Iowa just as one was narrowly avoided in Kansas. Tax debates in Minnesota and Missouri will go down to the wire. And residents of Arizona and Colorado are considering progressive revenue solutions to their states' education funding crises.

CNN: North Carolina teachers will be the next to walk out. Here’s what they want

May 8, 2018

An analysis by the Institute on Taxation and Economic Policy finds North Carolina would have $3.5 billion more in annual revenue if lawmakers had not changed the tax system that was in place in 2013. Read more

State Rundown 5/3: Progressive Revenue Solutions to Fiscal Woes Gaining Traction

May 3, 2018 • By ITEP Staff

This week, Arizona teachers continued to strike over pay issues and advocates unveiled a progressive revenue solution they hope to put before voters, while a progressive income tax also gained support as part of a resolution to Illinois's budget troubles. Iowa and Missouri legislators continued to try to push through unsustainable tax cuts before their sessions end. And Minnesota and South Carolina focused on responding to the federal tax-cut bill.

Bloomberg BNA: Higher Gas Prices May Mean Paying States More in Taxes

May 1, 2018

As a result, a few states will see revenue gains from higher prices because their tax rates are tied to the price of fuel, rather than its volume, Carl Davis, research director for the left-leaning Institute on Taxation and Economic Policy, told Bloomberg Tax. Those states include California, Connecticut, Kentucky, Maryland, Nebraska, New Jersey, New […]

NC Budget and Tax Center: North Carolina’s Upside Down Tax Code

April 16, 2018

Tax season comes to a close this week, and Tax Day serves as a good time to reflect on who pays taxes in North Carolina. The income tax is, naturally, at the foremost of our minds, but often ignored as one of the best tools to align our tax code with taxpayers’ ability to contribute […]

Washington Post: Behind Oklahoma’s Teacher Strike: Years of Tax Cuts and an Energy Slump

April 12, 2018

Some states that have also recently pushed through big income tax cuts, including North Carolina and Ohio, did so while also broadening their tax base, according to Meg Wiehe of the Institute on Taxation and Economic Policy. But until this year, Oklahoma did very little to balance rate reductions with increases in the tax base. Oklahoma raised […]

Trends We’re Watching in 2018, Part 2: State Revenue Shortfalls and the Impact on Education and Other Services

March 12, 2018 • By Aidan Davis

Many states struggle with a need for revenue, yet their lawmakers show little will to raise taxes to fund public services. Revenue shortfalls can prove to be a moving target. Some states with expected shortfalls are now seeing rosier forecasts. But as estimates come in above or below projections, states continue to grapple with how and whether to raise the revenue necessary to adequately fund key programs. Here are a few trends that are leading to less than cushy state coffers this year.

CBPP: North Carolina Tax Cuts Have Worsened Racial Wealth Inequities

February 27, 2018

The top 1 percent of North Carolinians are getting about $21,780 in average tax breaks per year — 59 times the average break for people in the middle fifth of the income scale and 1,361 times the average break for people in the lowest fifth, the Institute on Taxation and Economic Policy found in its analysis of the 2013 tax changes.

Preventing State Tax Subsidies for Private K-12 Education in the Wake of the New Federal 529 Law

February 23, 2018 • By Ronald Mak

This policy brief explains the federal and various state-level breaks for 529 plans and explores the potential impact that the change in federal treatment of 529 plans will have on state revenues.

What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options

January 26, 2018 • By ITEP Staff

The recently enacted Tax Cuts and Jobs Act (TCJA) has major implications for budgets and taxes in every state, ranging from immediate to long-term, from automatic to optional, from straightforward to indirect, from certain to unknown, and from revenue positive to negative. And every state can expect reduced federal investments in shared public priorities like health care, education, public safety, and basic infrastructure, as well as a reduced federal commitment to reducing economic inequality and slowing the concentration of wealth. This report provides detail that state residents and lawmakers can use to better understand the implications of the TCJA for…

NC Policy Watch: Devastating consequences if Congress fails to replace DACA in three months

December 20, 2017

State and local government coffers would also take a hit if Congress fails to pass the Dream Act, or another effective solution. The Institute for Taxation and Economic Policy estimates that current DACA recipients pay almost $58 million in state and local taxes, contributions which could grow to $78 million if the Dream Act were […]

How the Final GOP-Trump Tax Bill Would Affect North Carolina Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.