North Carolina

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

State Rundown 9/12: Work Continues to Flip the Script on Backwards Tax Codes

September 12, 2019 • By ITEP Staff

Residents of several states are spending their palindrome week reading ballot initiatives forwards and backwards to decide whether or not to support them, including measures to improve education funding in California and Idaho, allow Alaska and Colorado to invest more in public services, and constitutionally prohibit income taxation in Texas. New Jersey lawmakers are giving the same thorough treatment to the state’s corporate tax subsidies. And advocates in Chicago, Illinois, have a bold proposal to flip the script on upside-down taxes there. But devotees of good policy and honest government in North Carolina won’t want to re-read yesterday’s news in…

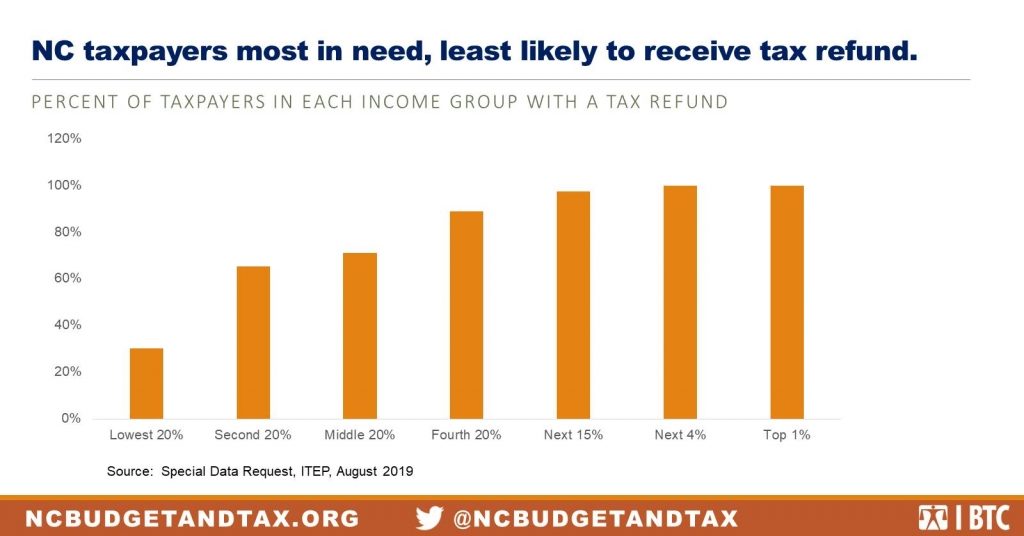

New Analysis: A Third of NC Taxpayers Won’t Benefit from Proposed Tax Refund Plan

August 29, 2019 • By Guest Blogger

North Carolina Senate and House leaders are moving forward with a flawed proposal to spend the majority of the state’s revenue over collections, more than $600 million, to issue tax refund checks of $125 per taxpayer ($250 for married couples).

The hottest, stickiest month of the year has left a grimy feeling on several state tax debates, as Idaho lawmakers find themselves unable to fund the state’s priorities after years of cutting taxes, Alaskans express their support for public investments to their governor’s polling office and then watch the governor slash them anyway, New Jersey lawmakers go to bat for ineffective and corrupt business tax subsidies, and residents of North Carolina watch their representatives pursue cheap political points over sound investments and thoughtful policy. Nonetheless, residents and advocates on the other side of these and other debates have fought long…

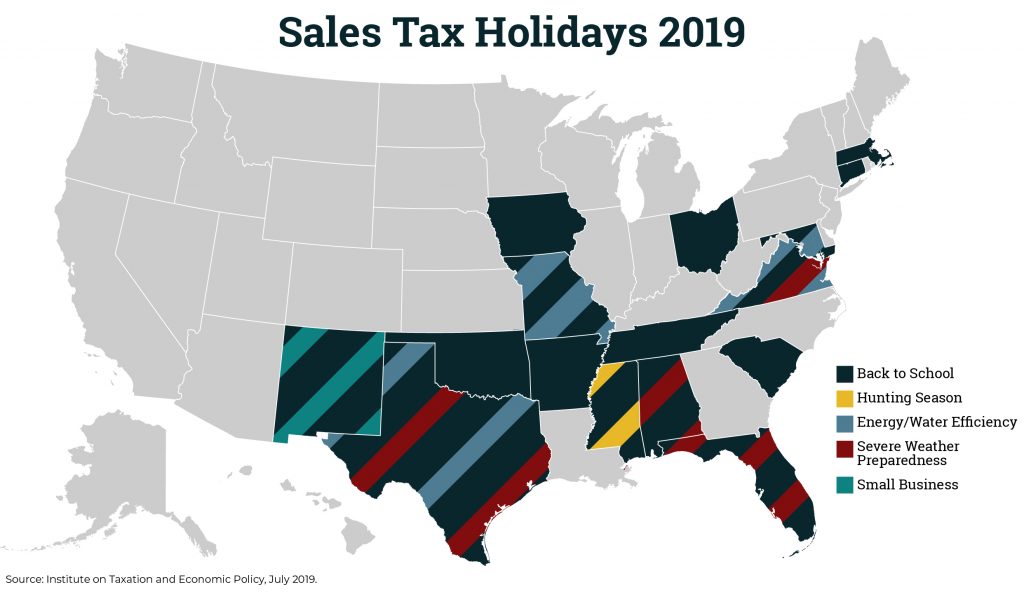

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 17, 2019 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2019), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief looks at sales tax holidays as a tax reduction device.

We've said it before, and we'll say it again: states don't have to wait for federal lawmakers to make moves toward progressive tax policy. And so far, 2019 has been a good year for equitable and sustainable tax policy in the states. With July 1 marking the start of a new fiscal year for most states, this special edition of the Rundown looks at how discussions in 2019 have been dominated by plans to raise revenue for vital investments, tax the rich and corporations fairly, use the tax code to help workers and families and advance racial equity, and shore…

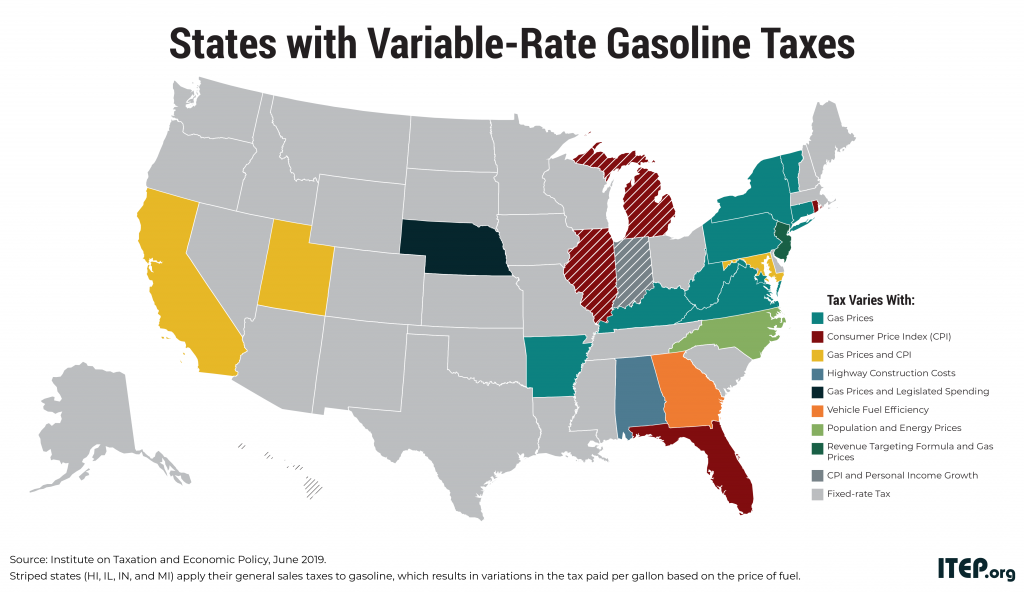

Ohio now enjoys the distinction of being the 30th state to raise or reform its gas tax this decade, and the third state to do so this year, under a bill signed into law by Gov. Mike DeWine. While state tax policy can be a contentious topic, there has been a remarkable level of agreement on the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies. These actions are helping reverse losses in gas tax purchasing power caused by rising construction costs…

The flawed design of federal and state gasoline taxes has made it exceedingly difficult to raise adequate funds to maintain the nation’s transportation infrastructure. Twenty-eight states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers purchase more fuel-efficient vehicles and pay less in gas tax. The federal government’s 18.4-cent gas tax, for example, has not increased in over 25 years. Many states have waited a decade or more since last raising their own gas tax rates.

Illinois made big news in several tax and budget areas recently, including sending a graduated income tax amendment to voters in 2020, as well as legalizing and taxing cannabis and updating gas and cigarette taxes for infrastructure improvements. Connecticut made smaller waves with sales tax reforms, a plastic bag tax, and a progressive mansion tax. Property tax credits were proposed in both Maine and New Jersey. And Nevada extended a business tax to give teachers a raise. And our What We’re Reading section is brimming with good reads on how states are doing with recovering from the Great Recession, funding…

Winston Salem-Journal: Five Basic Truths About the State Budget

May 28, 2019

The budget is unfair and unjust: North Carolina has always relied upon a regressive tax structure that takes more from the incomes of the poor and middle-class than from the wealthy. But this pattern has grown significantly worse and more unfair in recent years as the personal income tax was flattened and cut and corporate […]

State Rundown 5/22: (Some) State Lawmakers Can (Partly) Relax This Weekend

May 22, 2019 • By ITEP Staff

Lawmakers and advocates can enjoy their barbeques with only one eye on their work email this weekend in states that have essentially finished their budget debates such as Alaska, Minnesota, Nebraska, and Oklahoma, though both Alaska and Minnesota require special sessions to wrap things up. Getting to those barbeques may be a bumpy ride in Louisiana, Michigan, and other states still working to modernize outdated and inadequate gas taxes.

These States Abandoned Old Gas Tax Structures in Favor of More Sustainable Variable-Rate Gas Taxes

May 20, 2019 • By ITEP Staff

Because of these reforms, more than 193 million people (or 59 percent of the U.S. population) now live in places where the state gas tax rate automatically varies over time.

State Rundown 5/9: Illinois Moves Closer to a Progressive Income Tax

May 9, 2019 • By ITEP Staff

Lawmakers in Illinois and Ohio have advanced major tax proposals but cannot rest just yet, as they must still get past the other legislative chamber. Their counterparts in Michigan, Minnesota, Nebraska, and Oregon, meanwhile, are all at impasses over education funding, as those in Texas left their school funding disagreement unresolved at least until they reconvene...in 2021. And in an era of many states pre-empting smaller jurisdictions by revoking local decision-making powers, leaders in Colorado and Delaware made moves in the opposite direction, entrusting cities and school districts with more local control.

Teachers in North Carolina and South Carolina are walking out and rallying this week for increased education funding, teacher and staff pay, and other improvements to benefit students—if you’re unsure why be sure to check out research on the teacher shortage and pay gap under “What We’re Reading” below. Meanwhile, budget debates have recently wrapped up in Indiana, Iowa, Massachusetts, New Hampshire, and Washington. And major tax debates are kicking into high gear in both Louisiana and Nebraska.

State Rundown 4/26: Capital Gains Taxes Make Gains and Regressive Proposals Regress

April 26, 2019 • By ITEP Staff

Progressive capital gains tax proposals made news this week in Connecticut and Massachusetts, while Nebraskans came out in force to oppose a regressive tax shift, and North Carolina teachers prepare to rally over their legislature’s proclivity to cut taxes on wealthy households while underfunding schools.

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

State Rundown 4/11: An Estate Tax Win, Opioid Progress, and Teacher Uprising Updates

April 11, 2019 • By ITEP Staff

Hawaii made progress in pushing back against the increasing concentration of wealth and power by beefing up its estate tax. Delaware, New Jersey, and Rhode Island all took steps toward taxing opioid producers to raise funds to address the ongoing opioid crisis. Oregon lawmakers continue to try to address their chronic school underfunding with a $2 billion annual investment, in contrast to some of their counterparts in North Carolina who are responding to similar issues with the opposite approach, proposing to slash taxes in the face of their school funding issues – just as research highlighted in our What We’re…

State Rundown 3/27: Spring Bringing Smart State Tax Policy So Far

March 27, 2019 • By ITEP Staff

Though a long winter and a rough start to spring weather have wreaked havoc in much of the country, lawmakers are off to a good start in the world of state fiscal policy so far. In the last week, a progressive revenue package was passed in the nick of time in NEW MEXICO, a service-sapping tax cut was vetoed in KANSAS, and a regressive and unsustainable tax shift was soundly defeated in NORTH DAKOTA. Meanwhile, gas tax updates are on the table in MAINE, MINNESOTA, and OHIO. And exemptions for feminine hygiene products and diapers were enacted in VIRGINIA and introduced in MISSOURI.

North Carolina Justice Center: Higher Rates on Higher Income: Why a Graduated Income Tax is Good Policy for North Carolina

March 20, 2019

At the same time, a graduated rate structure — in contrast with the state’s current flat tax rate on income — can make more revenue available for key public investments, generating broad-based benefits to many people and communities. It is also better able to keep up with the needs of a growing state. That is […]

More than three billion dollars could be raised under a major progressive tax plan proposed by Illinois Gov. J.B. Pritzker this week, the point being to simultaneously improve the state’s upside-down tax code and address its notorious budget gap issues. One state, Utah, may already be looking at a special session to revisit the sales tax reform debate that ended this week without resolution, in contrast to Alabama and Arkansas, where leaders finally resolved years-long debates over gas taxes and infrastructure funding. And lawmakers in four states – California, Florida, Minnesota, and North Carolina – introduced legislation to expand or…

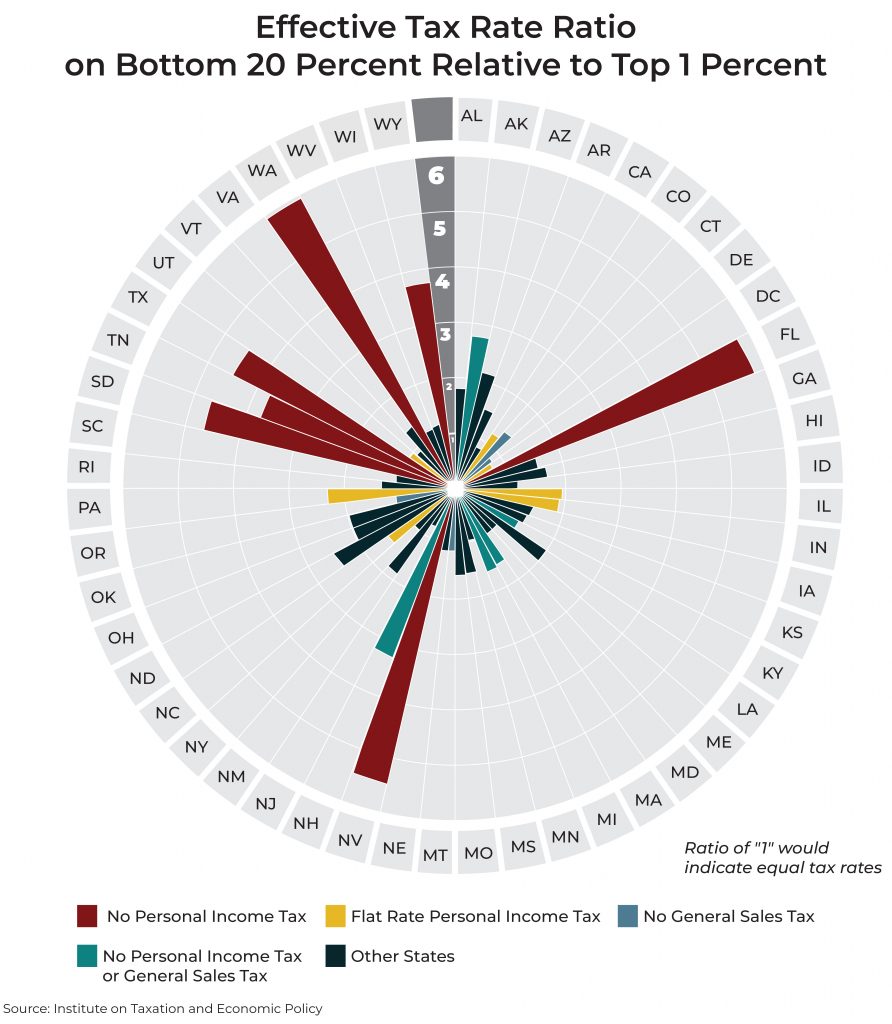

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

March 6, 2019 • By ITEP Staff

There is significant room for improvement in state and local tax codes. State tax codes are filled with top-heavy exemptions and deductions and often fail to tax higher incomes at higher rates. States and localities have come to rely too heavily on regressive sales taxes that fail to reflect the modern economy. And overall tax collections are often inadequate in the short-run and unsustainable in the long-run. These types of shortcomings provide compelling reason to pursue state and local tax reforms to make these systems more equitable, adequate, and sustainable.

State Rundown 2/27: Temperatures and Tax Fights Continue to Polarize

February 27, 2019 • By ITEP Staff

As another polar vortex heads for large swaths of the country, state tax debates this week were highly polarized in another way. Lawmakers and advocates in MICHIGAN, OHIO, OREGON, UTAH, and elsewhere fought to enact or improve state Earned Income Tax Credits to give a boost to low- and middle-income working families. But the opposite extreme was heavily represented as well, as others pushed for regressive tax cuts for wealthy individuals and corporations, including in KANSAS, NEBRASKA, NORTH DAKOTA, OHIO, UTAH, and WEST VIRGINIA. Even our “What We’re Reading” section has informative reading on how education funding policy continues to…

NC Policy Watch: Report: Corporations Are Stiffing North Carolina on $373 Million in State Taxes

January 23, 2019

It turns out that state leaders can ensure that companies pay the proper amount of taxes on income generated from business conducted in their jurisdictions, but existing tax codes at the state level often allow loopholes for smart corporate tax lawyers to exploit. Corporations often use accounting sleights of hand to move income around within […]

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.

Who Pays and Why It Matters | MECEP Policy Insights Conference Keynote Address

January 16, 2019 • By Aidan Davis

States have broad discretion in how they secure the resources to fund education, health care, infrastructure, and other priorities important to communities and families. Aidan Davis with the Institute on Taxation and Economic Policy will offer a national perspective on state-level approaches to funding public investments and the implications of those approaches on tax fairness and revenue adequacy, and their economic outcomes. She’ll also provide insight on what’s in store for 2019 among the states.