South Dakota

While record state revenue surpluses have led to big pushes in red states to make unnecessary permanent income and corporate tax cuts, Democrats are also getting in on the tax-cut mania...

State Rundown 1/13: The Tax Cuts Cometh, But There Is a Better Way

January 13, 2022 • By ITEP Staff

As expected, with the start of many new legislative sessions around the country, lawmakers have introduced a slew of tax cut plans following better-than-expected budget outlooks that have, so far, weathered the impact of the pandemic...

The new year often brings with it a reinvigorated commitment to new goals and a fresh perspective on how to accomplish them, but it seems like lawmakers in states around the country are giving up already...

State Rundown 11/10: It’s Beginning to Look a Lot Like…Election Season?!

November 10, 2021 • By ITEP Staff

If the leaves are turning colors and you find yourself walking out of the office into pitch-black darkness, it only means that time of the year is upon us—and no, I'm not talking about the holiday season. Before that, it’s the equally important election season...

The release of the ‘Pandora Papers’ showed once again that states and their tax systems play an important role in wealth inequality, and in this case, worsening it...

Jacobin: In Washington State, the Left Won a Major Victory for Taxing the Rich

May 14, 2021

Last week, Washington State passed a capital gains tax aimed at the state’s ultra-wealthy. The tax is historic because Washington, despite its progressive reputation, until now had the worst tax code in the nation when it comes to fairness, behind Texas, Florida, and South Dakota. A landmark 2018 report by the Institute on Taxation and […]

North Carolina lawmakers may have approved a massive tax subsidy giveaway to Apple, but we won’t let that news spoil our barrel this week. Nor will we be discouraged by Connecticut Gov. Ned Lamont’s threats to upset the apple cart full of positive progressive tax reforms state lawmakers recently came together to approve...Why all the optimism? Because the apple of our eye this week is Washington State, where advocates and lawmakers succeeded in a decade-long fight...

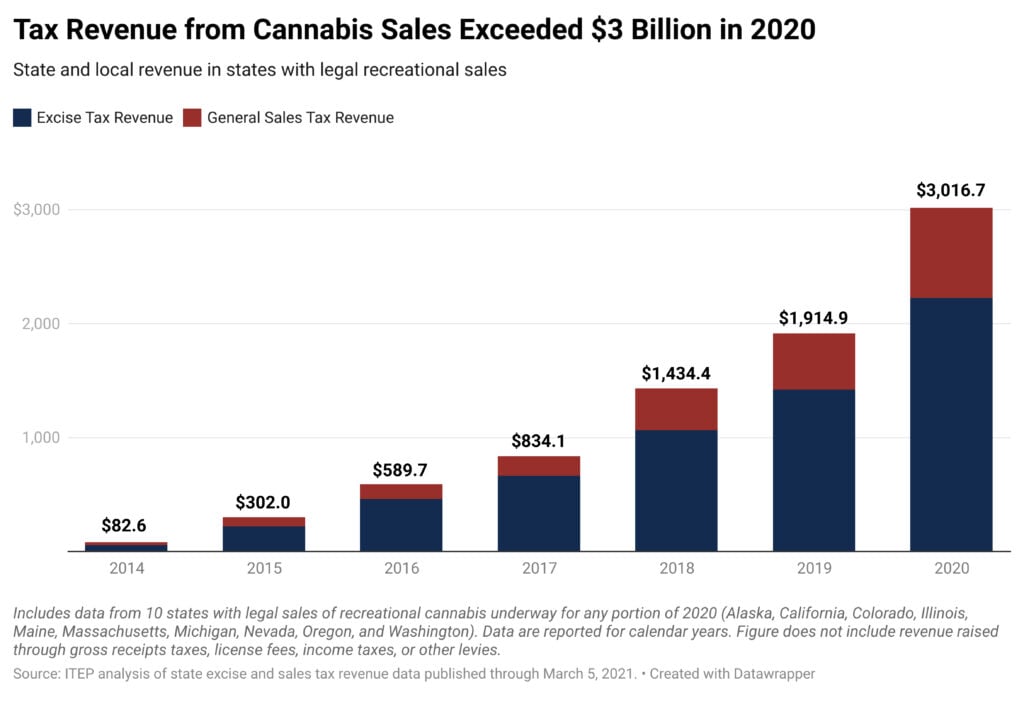

State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

March 15, 2021 • By Carl Davis

Cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales. But they’re also one of states’ fastest-growing revenue sources. Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on […]

Marketplace: High-income taxpayers help some states stay above water

March 1, 2021

However, in 22 states, tax revenue actually increased, with revenue in four states — Idaho, Utah, South Dakota and Colorado — up more than 5%. Revenue fell in the remaining states, with seven down more than 10% —Texas, Oregon, Florida, Nevada, North Dakota, Hawaii and Alaska. This disparity has a lot to do with the […]

State Rundown 2/24: State Tax Debates Quickly Thaw Out with Warmer Weather

February 24, 2021 • By ITEP Staff

Warming temperatures in many parts of the country this week seem to be thawing out state fiscal debates as well. Multiple states including California, Colorado, Maryland, and New Jersey saw movement on efforts to improve tax credits for low- and middle-income families. Mississippi House lawmakers suddenly rushed through a dangerous bill to eliminate the state’s income tax and shift those taxes onto lower-income households. Montana senators also approved regressive income tax cuts and South Dakota legislators advanced an anti-tax constitutional amendment, while lawmakers in Hawaii, Rhode Island, and Washington made progress on improving the progressivity of their tax codes. Gas…

State Rundown 2/11: Legalizing and Taxing Cannabis Becoming Increasingly Mainstream

February 11, 2021 • By ITEP Staff

This week, the governors of New Hampshire and West Virginia proposed to eliminate their states’ most progressive revenue sources and shift taxes even more heavily onto the middle- and low-income families who already pay the highest rates in both states. It was also a big week for proponents of legalizing recreational cannabis, as that movement made progress in Hawaii, Virginia, and Wisconsin.

As states kick off their 2021 legislative sessions, it’s clear that many governors and lawmakers are attempting to “take a mulligan” on the last year and recycle tax-slashing ideas that were already bad in 2020 and are even worse now as states try to recover from the Covid-19 pandemic and accompanying downturn...On a brighter note, Illinois leaders showed they did learn from the events of 2020, passing a major criminal justice reform bill and payday loan protections intended to reduce racial inequities.

After the Dust Has Settled: How Progressive Tax Policy Fared in the General Election

November 30, 2020 • By Marco Guzman

While the results of the 2020 presidential election are all but set in stone—and a sign of life for progressive policy—the results of state tax ballot initiatives are more of a mixed bag. However, the overall fight for tax equity and raising more revenue to invest in people and communities is trending in the right direction.

State Rundown 11/13: States Can Find Inspiration in Arizona Ballot Success; Must Look to Congress for More Immediate Help

November 13, 2020 • By ITEP Staff

Although progressive tax policy doesn’t always succeed in in statehouses or voting booths, Arizona voters showed once again that when offered a clear choice, most people resoundingly support requiring fairer tax contributions from rich individuals and highly profitable corporations over allowing their schools and other shared priorities to wither and decay. Still, a similar effort in Illinois and a more complicated measure in California were defeated, and anti-tax zealots in West Virginia and many other states will continue to push for tax cuts for the rich and defunding public investments, leaving much work to be done to advance tax justice.

Voters Have the Chance in 2020 to Increase Tax Equity in Arizona, Illinois, and California, And They Should

October 22, 2020 • By Marco Guzman

There’s a lot at stake in this election cycle: the nation and our economy are reeling from the effects brought on by the coronavirus pandemic and states remain in limbo as they weigh deep budget cuts and rush to address projected revenue shortfalls.

Temperatures and tensions are high right now across the country as Congress debates its next pandemic response and states continue to sweat through difficult decisions. Nevada lawmakers, for example, just wrapped up a special session during which they came within one vote of a proposed tax increase but ultimately chose to balance their shortfall through only funding cuts. But advocates in many states, including California, New Jersey, New York, and Rhode Island are trying to light a fire under lawmakers to encourage them to enact progressive tax increases on their wealthiest households.

A bipartisan group of governors and senators from Louisiana to Maryland to Ohio have called for at least $500 billion in state and local fiscal relief. They also need specific help with testing, protective equipment, unemployment costs, Medicaid costs, social services, education and infrastructure. States can’t be on their own as they address the double whammy of plunging revenue and skyrocketing needs.

State Options to Shore up Revenues and Improve Tax Codes amid Pandemic

April 15, 2020 • By Dylan Grundman O'Neill, Meg Wiehe

The COVID-19 pandemic is an extraordinarily challenging time, as we see harm and struggle affecting the vast majority of our families, businesses, public services, and economic sectors. No one will be unaffected by the crisis, and everyone has a stake in the recovery and faces tough decisions. In the world of state fiscal policy, where revenue shortfalls are likely to be far bigger than can be filled by the initial $150 billion in federal aid or absorbed through funding cuts without causing major harm, tax increases must be among those decisions. Even with more federal support, states will need home-grown…

State Rundown 4/9: Pandemic’s Fiscal Effects Slowly Coming into Focus

April 9, 2020 • By ITEP Staff

The COVID-19 pandemic continued this week to wreak havoc on lives and communities around the world. The fiscal fallout of the virus in the states is growing as well, and beginning this week to come into sharper focus. This week’s Rundown brings together what we know of that slowly clarifying picture and how states are responding so far.

State Rundown 4/3: States Welcome Federal Aid, Seek Further Solutions

April 3, 2020 • By ITEP Staff

States and families got good news this week as Congress came together to pass major aid to help during the COVID-19 coronavirus pandemic. But that bright spot came amid an onslaught of very difficult news about the public health crisis and the economic and fiscal fallout accompanying it. This week’s Rundown brings you the latest on these developments and state and local responses to them.

Sales Taxes and Social Distancing: State and Local Governments May Face Their Steepest Sales Tax Decline Ever

April 2, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

One pressing question is what will an economic downturn in which consumers are anxious, facing job loss, or simply spending their time sheltering in place and not spending money in typical ways, mean for states’ ability to raise revenue?

State Rundown 2/20: Property Taxes and School Finance Take Center Stage

February 20, 2020 • By ITEP Staff

Property taxes and education funding are a major focus in state fiscal debates this week. California voters will soon vote on borrowing billions of dollars to fill just part of the funding hole created in large part by 1978’s anti-property-tax Proposition 13. Nebraska lawmakers are debating major school finance changes that some fear will create similar long-term fiscal issues. And Idaho and South Dakota leaders are looking to avoid that fate by reducing property taxes in ways that will target the families who most need the help. Meanwhile, Arkansas, Nevada, and New Hampshire are taking close looks at their transportation…

This week as Americans celebrate Martin Luther King Jr.’s messages of resisting oppression and fighting for progress, state policymakers can look to some bright spots where tax and budget debates are bending toward justice. Among those highlights, Hawaii leaders are considering improvements to minimum wage policy, early childhood education, and affordable housing; Kansas Gov. Laura Kelly is seeking to reduce sales taxes applied to food and restore the state’s grocery tax credit; and advocates in Connecticut and Maryland are pushing for meaningful progressive tax reforms.

State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug […]

State Rundown 12/18: Utah’s Tax Fight Wraps Up As Other States’ Ramp Up

December 18, 2019 • By ITEP Staff

With the new year and many state legislative sessions just around the corner, most state tax and budget debates are just getting started. Arkansas will be among the states working to improve their roads and other infrastructure. Massachusetts will have to deal with revenue losses due to a misguided tax-cut trigger put in place in prior years. Maryland and South Dakota will be two of many states facing teacher pay shortages and other education funding needs. And debates over the legalization and taxation of cannabis will likely continue in California, Kentucky, New Jersey, and beyond. Utah lawmakers, on the other…